22 Mins Ago

Lego sales increase while other toy makers struggle

While other toy companies struggle with an inflation-fueled sales slump, Lego is building positive results brick by brick.

The privately held Danish toymaker saw revenue rise 1% during the first six months of this year, reaching 27.4 billion Danish krone, or about $4 billion.

Meanwhile, publicly traded rivals such as Mattel, Hasbro, Funko and Jakks Pacific have all reported double-digit revenue and sales declines so far this year.

The full story is available here.

— Sarah Whitten

28 Mins Ago

Spanish inflation figures still ‘a tough pill to swallow for consumers’: Verisk Maplecroft

Jimena Blanco, senior research director and chief analyst and Verisk Maplecroft, discusses Spanish inflation figures and the latest on the Spanish general elections.

An Hour Ago

Germany import prices show steepest drop since 1987

German import prices were down 13.2% in July 2023 from the same period last year — the largest annual decrease since January 1987, Germany’s federal statistics office reported.

The decline was slightly more than the 13.1% forecast by analysts polled by Reuters.

Import prices are down mostly because of the big drop in energy prices after costs skyrocketed in 2022 following Russia’s full-scale invasion of Ukraine.

— Hannah Ward-Glenton

An Hour Ago

Spanish flash inflation meets expectations with 2.6% uptick

Consumer prices in Spain rose 2.6% year on year for August, according to the country’s National Statistic Institute.

The annual figure was higher than 2.3% in July, and was in line with forecasts made by analysts polled by Reuters.

Fuel prices are largely responsible for the increase since August 2022, the institute said, while electricity prices have risen month on month but at a slower rate than this time last year.

— Hannah Ward-Glenton

An Hour Ago

Offshore wind company Orsted drops more than 17% on delay forecasts

Shares of Danish offshore wind company Orsted slumped more than 17% in early trading after the developer said it expected impairments on its U.S. portfolio in a statement released late Tuesday.

See Chart…

Orsted share price.

Orsted listed projects affected by supplier delays and said there is a “continuously increasing risk” in suppliers’ ability to deliver in line with their contracts. The delays would total an impairment of 5 billion Danish krona ($729 million) if there are “no further adverse developments” in supply chains, the company said.

Discussions with senior federal stakeholders are also not progressing as expected, Orsted said, and if efforts to qualify for additional tax credits prove unsuccessful, the company could lose around 6 billion krona.

— Hannah Ward-Glenton

2 Hours Ago

European equity markets open higher

European stock markets opened higher Wednesday, reflecting moves on Wall Street overnight.

The pan-European Stoxx 600 index was up 0.2%, with most sectors trading in cautiously positive territory. Mining stocks made the biggest gains, with a 0.9% uptick, followed by insurance, which was up 0.6%. Utilities stocks shed 0.4% in early trade.

— Hannah Ward-Glenton

9 Hours Ago

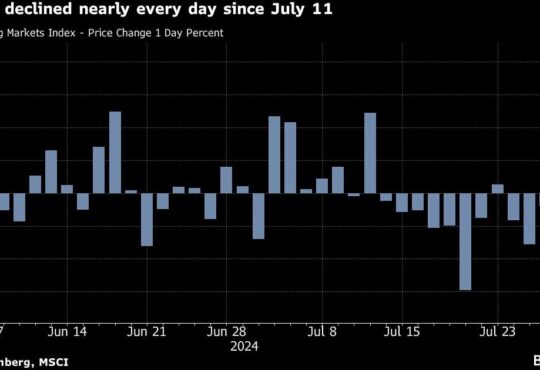

CNBC Pro: ‘Pain trade’: UBS CIO warns of bear trap as Chinese stocks rise

The recent rally in Chinese stocks could catch investors out, according to a UBS chief investment officer, who warned of a “pain trade.”

Adrian Zuercher, a chief investment officer at UBS in the Asia-Pacific region, said this could lead to a “bear trap” — when traders open short positions, believing markets will fall, but are forced to close out these positions when markets rise.

Pro subscribers can read more here.

— Lucy Handley

Tue, Aug 29 2023 4:38 AM EDT

U.S. Treasury yields fall as investors look ahead to key economic data

U.S. Treasury yields declined on Tuesday as investors braced themselves for a series of key economic data releases due this week that will shed light on the latest developments around inflation and the labor market, and could inform the Federal Reserve’s next monetary policy moves.

At 4:30 am ET, the yield on the 10-year Treasury was down by more than two basis points to 4.1922%. The 2-year Treasury yield was last trading at 4.9979% after falling by over one basis point.

Yields and prices move in opposite directions and one basis point is equal to 0.01%.

Treasurys

| TICKER | COMPANY | YIELD | CHANGE | %CHANGE |

|---|---|---|---|---|

| US1M | U.S. 1 Month Treasury | 5.44% | +0.058 | 0.00% |

| US3M | U.S. 3 Month Treasury | 5.509% | +0.021 | 0.00% |

| US6M | U.S. 6 Month Treasury | 5.572% | +0.022 | 0.00% |

| US1Y | U.S. 1 Year Treasury | 5.421% | +0.024 | 0.00% |

| US2Y | U.S. 2 Year Treasury | 4.909% | +0.019 | 0.00% |

| US10Y | U.S. 10 Year Treasury | 4.143% | +0.021 | 0.00% |

| US30Y | U.S. 30 Year Treasury | 4.255% | +0.018 | 0.00% |

9 Hours Ago

CNBC Pro: Morgan Stanley’s Slimmon says the S&P 500 will near 5,000 by year-end — and names 3 stocks to buy

Morgan Stanley Investment Management’s Andrew Slimmon said he believes markets are set for a “strong rally” by the end of the year.

The managing director and senior portfolio manager at the firm told CNBC’s “Street Signs Asia” on Tuesday that he believes the S&P 500 will be “closer” to 5,000 by then. If it reaches 5,000, that’s an upside of nearly 13% from Monday’s close of 4,433.

He named three stocks to buy.

CNBC Pro subscribers can read more here.

— Weizhen Tan

4 Hours Ago

European markets: Here are the opening calls

European markets are poised to open higher Wednesday, according to IG data. Britain’s FTSE will move to 7,497.0 points, up 21.2, Germany’s DAX is seen 53.5 points higher at 15,994.0, France’s CAC is set for a 26.1-point uptick to 7,398.9, and Italy’s FTSE MIB is forecast to jump 22 points to 28,672.

— Hannah Ward-Glenton