In the realm of insider trading, the actions of company directors and significant shareholders can provide valuable insights into a company’s financial health and future prospects. Recently, EIG VETERAN EQUITY AGGREGATOR, L.P., a director and 10% owner of USA Compression Partners LP (NYSE:USAC), sold a substantial number of shares, prompting a closer examination of the transaction and its implications.EIG VETERAN EQUITY AGGREGATOR, L.P. is a significant investor in USA Compression Partners LP, a firm that specializes in providing natural gas compression services. This entity is affiliated with EIG Global Energy Partners, a leading institutional investor to the global energy sector. The insider’s recent transaction involved the sale of 38,617 shares on November 20, 2023, which is a notable move given their position within the company.USA Compression Partners LP operates in the energy sector, offering compression services for natural gas and crude oil production, gathering, artificial lift, transmission, processing, and storage. Their services are critical for maintaining the flow and marketability of natural gas and oil, which are essential components of the energy infrastructure.Analyzing the insider’s buy/sell activities over the past year reveals that EIG VETERAN EQUITY AGGREGATOR, L.P. has sold a total of 38,617 shares and has not made any purchases. This one-sided activity could be interpreted in various ways, but it often suggests that the insider may perceive the current stock price as being on the higher side or may have other reasons for reducing their stake in the company.

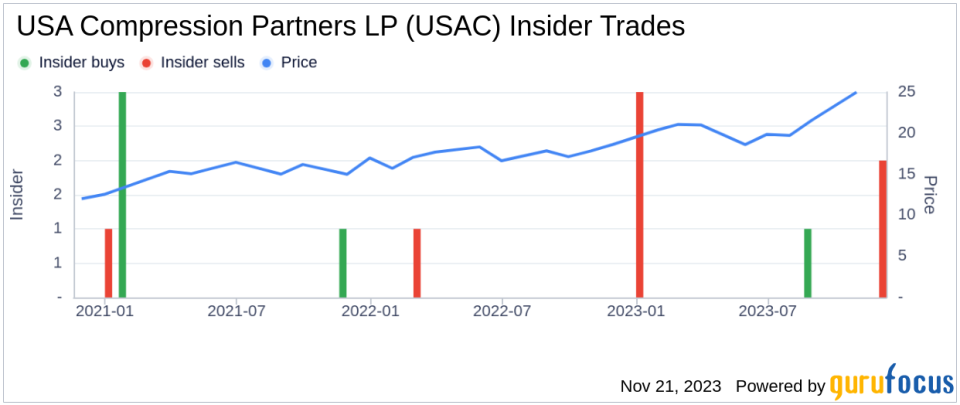

The insider trend image above illustrates the pattern of insider transactions over the past year. With only 1 insider buy and 6 insider sells, the trend seems to lean towards more selling activity among insiders, which could be a signal to investors to proceed with caution.When it comes to valuation, USA Compression Partners LP’s shares were trading at $25.65 on the day of the insider’s recent sale, giving the company a market cap of $2.508 billion. This valuation places the stock’s price-earnings ratio at 170.13, significantly higher than both the industry median of 9.28 and the company’s historical median price-earnings ratio. Such a high P/E ratio could indicate that the stock is overvalued compared to its peers and historical performance, potentially justifying the insider’s decision to sell.

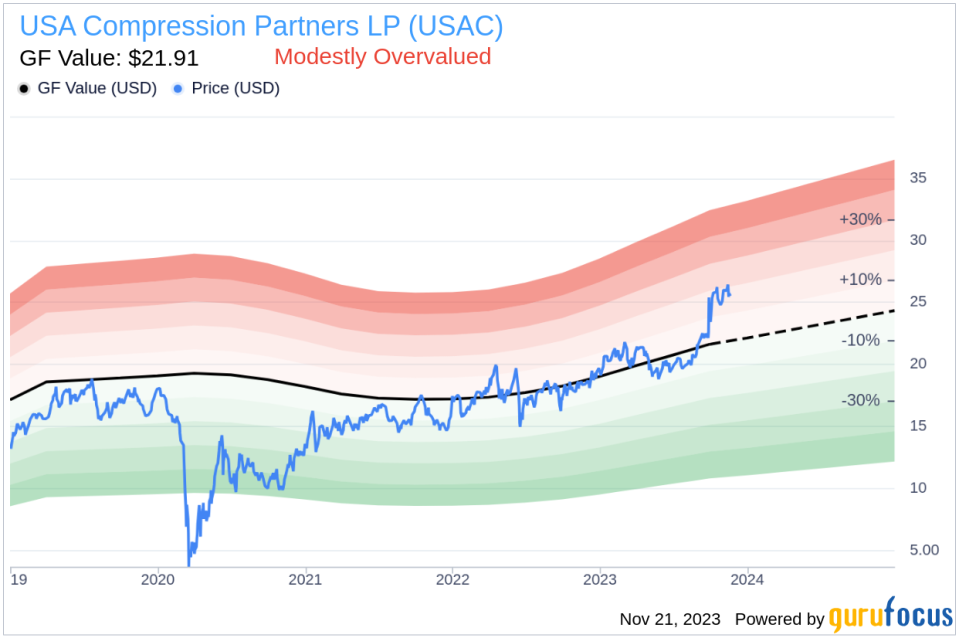

The GF Value image above provides further context for the stock’s valuation. With a price of $25.65 and a GuruFocus Value of $21.91, the price-to-GF-Value ratio stands at 1.17, suggesting that USA Compression Partners LP is modestly overvalued. The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.The relationship between insider trading activity and stock price can be complex. While insider selling does not always indicate a lack of confidence in the company, it can sometimes precede a downturn in the stock price, especially when multiple insiders are selling and no buying activity is observed. Investors often monitor such transactions to gauge insider sentiment and consider it alongside other fundamental and technical analysis before making investment decisions.In conclusion, the recent insider sell by EIG VETERAN EQUITY AGGREGATOR, L.P. at USA Compression Partners LP, coupled with the company’s high P/E ratio and modest overvaluation according to the GF Value, may raise questions among investors. While insider activity is just one piece of the puzzle, it is an important factor that should be considered as part of a broader investment strategy. As always, investors are encouraged to conduct their own due diligence and consider the full spectrum of financial data and market trends before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.