Winter may still be raging, but it looks like there may be some hints of green shoots … in the global economy, if not the soil. Yes, Tuesday’s batch of S&P Global’s February flash purchasing managers’ indexes (PMIs) showed service sectors in the US, UK and eurozone accelerating enough to pull the composite PMIs, which combine services and manufacturing, into expansion territory for the first time in months.[i] For some time, we have suspected that global stocks’ rally since mid-June was the market pricing in the high likelihood the global economy would perform better than many analysts we follow projected as 2023 unfolded.[ii] We think it is still too early to say with certainty that a bull market (a long period of generally rising equity prices) is indeed underway following last year’s decline, but PMIs are one more piece of evidence supporting the rally, in our view.[iii]

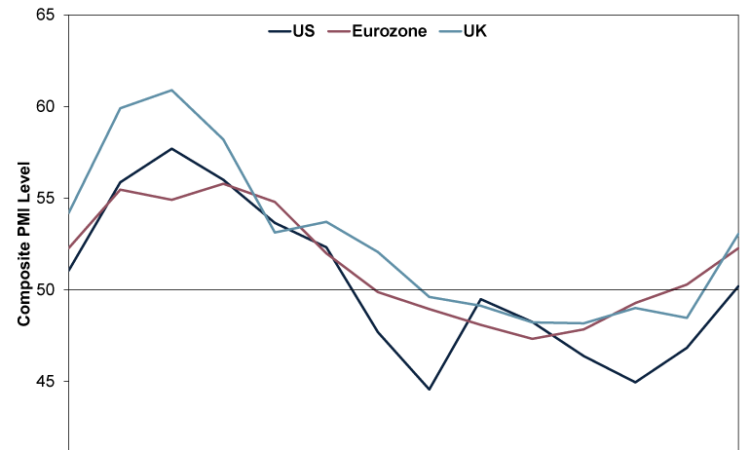

Exhibit 1 shows composite PMIs for the US, UK and eurozone over the past year. All had a grim second half of 2022, in our view, with both services and manufacturing indicating contraction the majority of the time. Last month, however, the eurozone flipped above 50, the dividing line separating growth from contraction.[iv] Now the US and UK have mirrored the move.

Exhibit 1: PMIs Are Back in Expansion

Source: FactSet, as of 21/2/2023.

Or rather, their service sectors are expanding, registering 50.5 in the US, 53.3 in the UK and 53.0 in the eurozone—with Germany at 51.3 and France at 52.8.[v] Manufacturing contracted in all of these, although its declines were less broad-based in the UK and US.[vi] As for the eurozone, S&P reported that whilst manufacturing contractions worsened in France and Germany, the rest of the eurozone enjoyed “broad-based growth” in both services and manufacturing, with the composite PMI for those nations combined rising from 51.4 to 53.9, a 9-month high.[vii] Our research suggests the eurozone always has pockets of strength and weakness, and for now we think it looks like growth outside the two largest economies is doing the heavy lifting. That isn’t surprising, given Germany and France appeared to have the largest power challenges this winter—Germany with natural gas potentially in short supply and France with its nuclear power plants repeatedly going offline.[viii] But both seem to have pulled through better than commentators we follow expected, basically giving the eurozone economy some bonus points.

With all that said, composite PMIs measure output only, meaning they don’t amalgamate the various subindexes that the surveys also include—so we see them as coincident economic indicators, not forward-looking. In our view, PMIs’ new orders subindexes are the real forward-looking components, as today’s orders are tomorrow’s production. Those were overall not bad, in our view. In the eurozone, new orders expanded for the first time since May 2022, with services orders rising and manufacturing orders shrinking at the slowest pace since May.[ix] UK new orders rose for the first time in seven months, with services orders “solid” and manufacturing’s decline “marginal,” according to S&P’s commentary.[x] US orders declined, but by the narrowest margin since October. Services’ decline was “slight,” though manufacturing orders endured what S&P described as a “sharp downturn” as customers focussed on running down inventories.[xi] That could point to restocking driving demand later, but only time will tell.

Based on our research of stock market recoveries and the accompanying economic conditions, we think these PMIs are emblematic of economic data early in a bull market. Based on our interpretation of recent economic data, the US, UK and eurozone aren’t yet in recession (a period of contracting economic output). Nor have the US’s National Bureau of Economic Research or the eurozone’s Euro Area Business Cycle Dating Committee—official recession arbiters for these two large economic blocs—declared one for their respective regions. That is despite numerous forecasts to the contrary from supranational organisations, think tanks and economists we follow—forecasts that suggest to us expectations are very, very low. In our view, that makes it easy for nice headline results with mixed underlying data to qualify as a positive surprise. We find stocks’ moving ahead of this is normal, as our research suggests markets are forward-looking. In our view, last year’s decline precipitated weakening economic data and all those recession forecasts, not to mention the contracting PMIs.[xii] Now, stocks appear to be turning up ahead of PMIs, which are moving back into the black—with new orders mostly hinting at more growth to come, in our view.

Yes, both could turn down again. And yes, PMIs aren’t GDP (gross domestic product, a government-produced measure of economic output). In 2022’s second half, contractionary PMIs paired with growing GDP for the most part.[xiii] Maybe that flips in early 2023. Or maybe it doesn’t. Either way, we find stocks typically don’t dwell on what is happening right this minute. Our research suggests they look 3 – 30 months out, and they now appear to us to be pricing in continued improvement within that window. The latest PMIs suggest that isn’t irrational, in our view.

[i] Source: S&P Global, as of 21/2/2023. PMIs are monthly surveys that track the breadth of economic activity; readings above 50 indicate expansion, below 50, contraction.

[ii] Source: FactSet, as of 21/2/2023. Statement based on MSCI World Index returns with net dividends in GBP, 16/6/2022 – 21/2/2023.

[iii] Ibid. Statement based on MSCI World Index returns with net dividends in GBP, 31/12/2021 – 16/6/2022.

[vi] Source: FactSet, as of 21/2/2023.

[viii] “Germany Has Three Months to Save Itself From a Winter Gas Crisis,” Vanessa Dezem, William Wilkes and Arne Delfs, Bloomberg, 31/7/2022 and “France to Tap Power Company Windfalls to Help Ailing Firms,” Francois de Beaupuy and William Horobin, Bloomberg, 5/10/2022. Accessed via Yahoo Finance and Financial Post.

[xii] Source: FactSet, as of 21/2/2023. Statement based on MSCI World index returns with net dividends in GBP, 31/12/2021 – 30/12/2022.

[xiii] Ibid. Statement based on US, UK and eurozone GDP, July 2022 – December 2022.