By Jeff Prestridge, Financial Mail on Sunday

21:51 27 May 2023, updated 21:59 27 May 2023

While Japan may be fretting about China’s intentions towards its south western neighbour Taiwan, its economy is in good health.

Unlike the UK, both inflation and wage growth are currently under control, helping create an air of optimism about both the economy and the direction of corporate earnings.

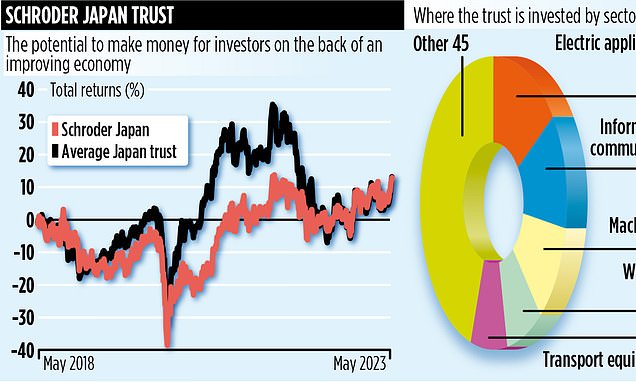

It is a backdrop that Masaki Taketsume, fund manager of investment trust Schroder Japan, believes is conducive to making money from the stock market.

‘The Japanese economy is in good shape,’ he says, ‘thanks to pent-up demand from consumers as the country has come out of lockdown. With higher wages giving people more spending power and wider inflation enabling Japanese companies to push up their prices, there are some strong tailwinds driving corporate earnings higher.’

He adds: ‘The political backdrop is stable and while geopolitical issues are always in our minds, we don’t let them influence the portfolio we have put together.’

Taketsume, who has just relocated to Tokyo after a long stint working at Schroders in London, is also enthused by the steps that many Japanese companies are taking to become more shareholder friendly. This is resulting in a greater focus on earnings growth – and dividend payments to shareholders as companies reduce the amount of cash that is sitting on their balance sheets.

He says that key trust holdings such as conglomerate Hitachi and retailer Seven & I are altogether different businesses than they were in the past.

Related Articles

HOW THIS IS MONEY CAN HELP

‘Hitachi is unrecognisable from the company it was ten to 15 years ago,’ adds Taketsume. ‘It has moved into new exciting business areas such as green energy and infrastructure. As profits and earnings rise, its share price will at some stage be re-evaluated upwards by the wider market. Seven & I has benefited from a boardroom that now engages with shareholders.’

The trust, listed on the UK stock market, has assets of £267 million and currently holds 64 stocks, including names familiar to UK investors – the likes of drinks company Asahi and car giant Toyota.

The performance numbers are better when viewed relatively rather than in absolute terms. Over the past three years, it has delivered returns of 44 per cent, results better than any of its Japanese peer group. Over the past year, it has delivered total returns of 12 per cent – a figure only beaten by Abrdn Japan.

Reflecting the propensity of Japanese companies to pay a dividend, the trust paid income of 4.9pence a share in its last financial year – with the shares now trading at around £2.20. Taketsume says key to the trust’s continued success is the input from Schroders’ in-house analysts who are constantly looking for new investment opportunities. ‘Their research provides us with a competitive advantage,’ he adds. ‘They are vital in identifying management change which might impact on a business’s prospects.’ Annual charges on the fund total 0.92 per cent and the stock market ID code is 0802284. The market ticker is SJG.

Greater confidence in the Japanese stock market has prompted London-based investment boutique Zennor Asset Management to launch a Japan Equity Income fund. James Salter, joint fund manager, says: ‘Companies in Japan are under pressure to shrink their balance sheets. This is providing a powerful tailwind for dividends.’

Investment house Hawksmoor is also bullish about the market – both from a valuation point of view (it’s cheap) and the improvement in governance. Fund manager Ben Mackie says: ‘After a number of false dawns, the sun seems to be rising on a new age for corporate Japan.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.