Scott Olson

Introduction

I believe that Cboe Global Markets (BATS:CBOE) is one of the most fascinating stocks in finance right now. The stock is a bit comparable to owning a casino in Las Vegas. Instead of gambling with options, investors are better off buying this financial data and stock exchange powerhouse.

While Cboe doesn’t come with a high dividend yield (1.4%), it has turned into an outperformer in the financial sector. Not only is it able to avoid the issues facing banks, but it actively benefits from stock market volatility and a wide range of new services launched to fuel organic growth.

Currently, I own its peer CME Group (CME), which is focused on futures. However, if the opportunity presents itself, I’m looking to add the CBOE ticker to my dividend growth portfolio as well.

In this article, I’ll tell you why.

So, let’s get to it!

A Financial Powerhouse

With a market cap of $15 billion, Chicago-based Cboe Global Markets is one of the largest providers of stock exchange services in the world.

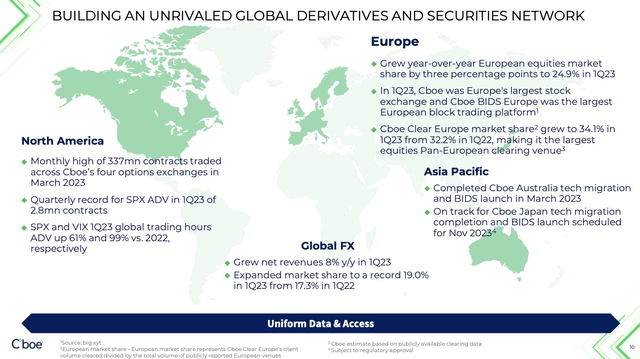

Operating across North America, Europe, and Asia Pacific, CBOE serves various asset classes, including equities, derivatives, FX, and digital assets.

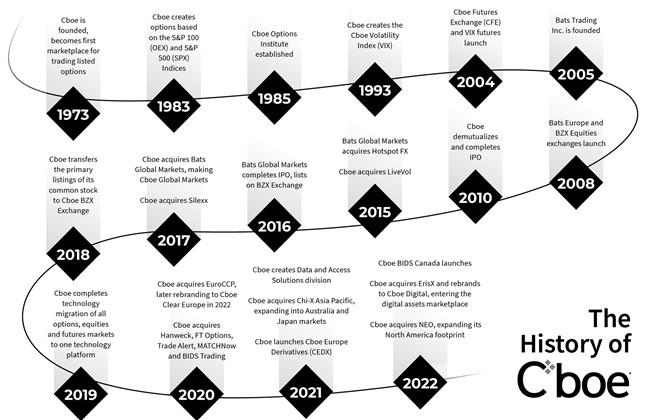

Founded in 1973, the company has become a well-diversified operator through organic growth and a number of major acquisitions to enlarge its (global) footprint.

Cboe Global Markets

The company’s operations are divided into six business segments.

- Options: This segment includes options on market indices and individual stocks, including options on exchange-traded funds (ETFs) and exchange-traded notes (ETNs). Market data revenue and access services also fall under this segment.

- North American Equities: This segment covers US equities transaction services, including electronic exchanges like BZX, BYX, EDGX, and EDGA, as well as Canadian equities and transaction services through MATCHNow ATS and NEO.

- Europe and Asia Pacific: This segment covers pan-European listed equities and derivatives services, ETPs, exchange-traded commodities, and depository receipts, along with equities transaction services in Australia and Japan.

- Futures: This segment involves transaction services on CFE, an electronic futures exchange offering VIX futures and other futures products.

- Global FX: Global FX provides institutional FX trading services through Cboe FX and non-deliverable forward FX transactions on Cboe SEF and Cboe Swiss.

- Digital: This segment includes Cboe Digital, operating a US-based digital asset spot market and regulated futures exchange, along with Cboe Clear Digital, a regulated clearinghouse.

Proprietary products include SPX options and VIX options and futures. Bear in mind that the full name of the VIX is CBOE Volatility Index.

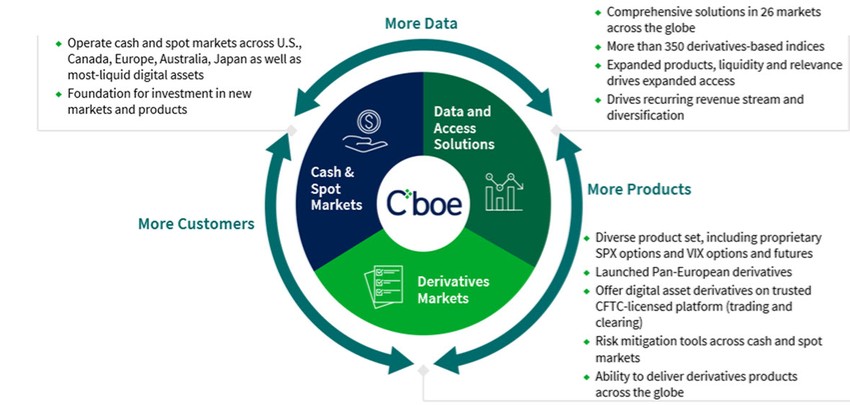

Having said that, the company focuses on long-term growth through three key (strategic) initiatives.

-

Innovation: Meeting the growing demand for trading products and data services globally through new product launches and expansions, including ESG-focused indices and products. In other words, this includes a lot of organic growth by levering existing capabilities. We’ll discuss this a lot in this article.

-

Integration: Enhancing efficiency and customer service by seamless integration across ecosystems, leveraging what it believes to be cutting-edge technology.

-

Market Expansion: Accessing untapped addressable markets through organic investments and strategic acquisitions, expanding into Canada and the digital asset space. This is similar to integration, except that market expansions are mainly done through M&A.

Cboe Global Markets

CBOE also holds long-term business relationships with key index providers like S&P Global (SPGI), FTSE Russell, and MSCI (MSCI). These relationships enable exclusive offerings of listed options contracts and proprietary indices, contributing to the company’s (organic) revenue growth.

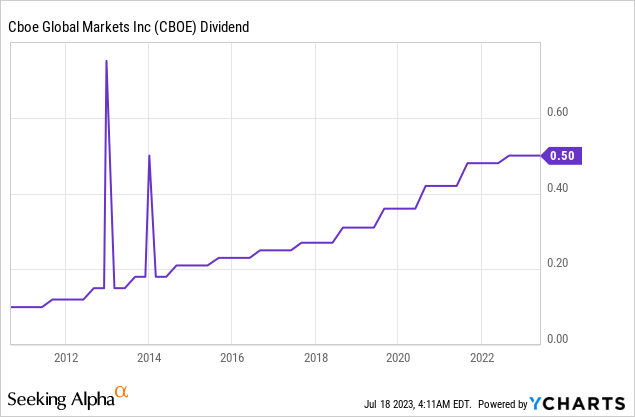

Thanks to these qualities, the company is able to pay a 1.4% dividend yield backed by a 28% payout ratio and 13.1% average annual dividend growth over the past five years.

Since initiating its dividend 12 years ago, the company has hiked its dividend every single year and paid two special dividends, which are visible in the chart below.

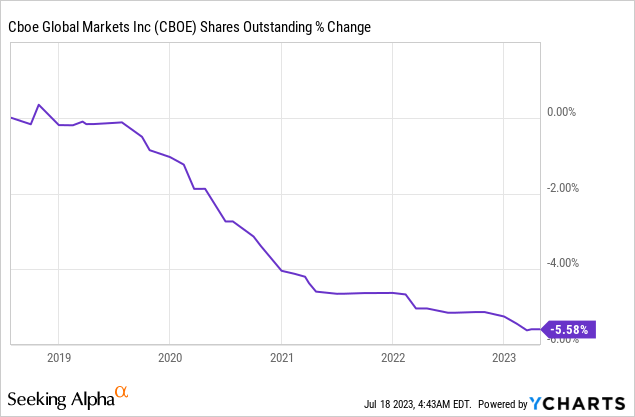

When it comes to capital spending priorities, Cboe maintains an opportunistic approach to share buybacks, considering trading metrics, expected cash flows, and sustainability. The company prioritizes funding organic activities, growing dividends annually, and ensuring capital allocation aligns with capital priorities.

Over the past five years, CBOE has bought back 6% of its shares.

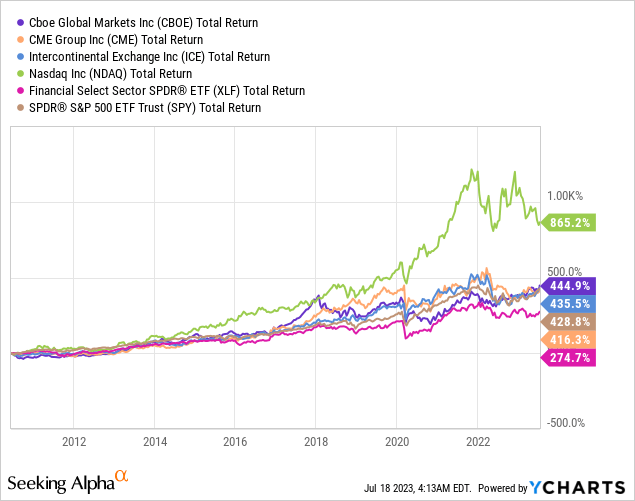

This consistent performance has also led to outperformance. Since the end of the Great Financial Crisis, CBOE shares have returned 445%, which beats the S&P 500 and the financial sector (XLF). It also beats all of its major peers except for Nasdaq Inc. (NDAQ), which benefitted from the success of the index with the same name and investments in its product/services portfolio.

Speaking of investments in a product/services portfolio, CBOE is making tremendous progress, which has led to a new all-time high in its stock price. It’s also the main reason I’m writing this article.

CBOE Is Making Tremendous Progress

During this year’s Morgan Stanley (MS) US Financials, Payment, and CRE Conference, the company started by making the case that traders love options.

While factors like the debt ceiling debate, interest rate uncertainty, and weakening economic growth are all leading to investors trying to use options in their strategies, the company found that strategies such as put-call spreads, defined outcome trades, yield harvesting through selling spreads, and expressing directional views through single-leg puts or calls have shown consistency.

According to the company, its ecosystem is expanding, with market makers finding more economical ways to hedge risks by shifting from e-minis to SPX.

Furthermore, CBOE believes that the interest and participation of various clients, including institutions and market makers, contribute to the overall growth in index options. In other words, it’s not just retail traders using options to try to get rich quickly.

On a side note, the company mentioned a shift from e-minis to SPX. That’s something to keep an eye on. E-minis are owned by CME Group, which is the future of the S&P 500. During the next CME earnings call, I’ll try to find confirmation of this trend.

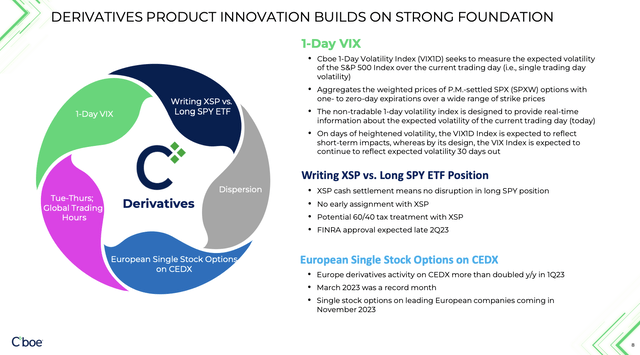

That said, the company is further expanding its capabilities. This includes XSP options, which enable trading on SPY for smaller notional sizes. CBOE believes in the importance of margin treatment and risk control in supporting the use of XSP options for covered positions.

Cboe Global Markets

The SEC has already approved the treatment, and Cboe is awaiting FINRA approval. Once approved, XSP options would provide margin compression, capacity leverage, and an improved profitability profile.

Furthermore, as visible in the overview above, ongoing initiatives include the development of tradable products based on the 1-day VIX Index, dispersion index, variance futures, and exploring opportunities in digital asset tokenization.

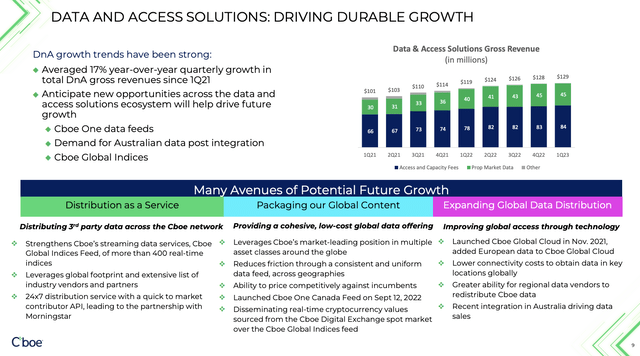

On top of that, CBOE is expanding its Data and Access Solutions. The company believes that the most valuable data is unique and usable for efficient trading. The US data, especially around proprietary products, is considered highly valuable and a significant driver of future growth.

Cboe Global Markets

Cboe expects demand for this valuable US data to extend beyond domestic markets and attract interest from non-domestic entities.

Essentially, this is what I like about companies like CBOE which can use their existing platform (which comes with a lot of data, to put it bluntly) to offer new value-adding products. I expect to see a lot more of this in the industry.

Internationally, the company is focused on two major projects:

- Cboe has expanded its footprint in Europe and plans to offer market structure enhancements in the European Derivatives market. Their goal is not to take market share from existing players, but to grow the overall market by providing screen-based liquidity and a centralized clearing solution. By offering unique indices and single stock options, Cboe aims to create a more accessible and competitive trading environment.

- CBOE is expanding in APAC, with a focus on Australia. The company expects incremental growth in data, market share, and execution consulting services. They aim to leverage their technology capabilities to provide trading venues with improved execution costs and analysis of trading data. Positive regulatory developments in Australia encourage competition, further supporting Cboe’s growth prospects in the region.

Cboe Global Markets

Having said that, here’s how the company is currently doing.

Recent Events & Outlook

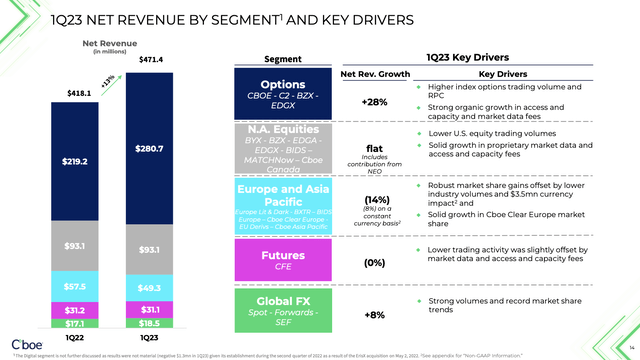

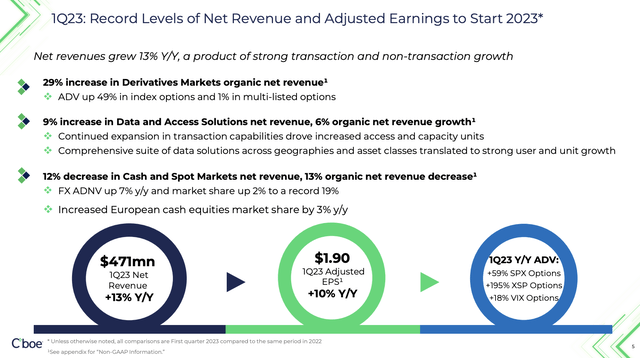

In the first quarter, CBOE reported record-breaking earnings, with net revenue growing by 13% year-over-year to $471 million and adjusted EPS increasing by 10% to $1.90. The strong performance was driven by the aforementioned initiatives like the Derivatives franchise, particularly proprietary index options products, and the continued global expansion of the Data and Access Solutions business.

Cboe Global Markets

- In the Derivatives business, total net revenue increased by 29% due to the strength of index options and volatility products and solid volumes in multi-list options trading.

- The Data and Access Solutions business saw a 9% increase in total net revenue.

- Cboe Digital, the digital asset platform, continued to onboard new clients and achieved significant trading volumes, with February being the best month to date, with an average daily volume (“ADV”) of over $100 million.

- With regard to its APAC expansion, the equities market share in Japan grew to 4.8% in the first quarter, and Cboe is on track for the planned technology migration of Cboe Japan and the launch of Cboe BIDS Japan in the fourth quarter of this year, which is subject to regulatory approval.

Cboe Global Markets

The company also maintained a healthy balance sheet with a leverage ratio of 1.5x (EBITDA). Thanks to its stable operations and healthy balance sheet, the company has an A-/A3 credit rating.

Having said that, CBOE reaffirmed its 2023 guidance, which includes an expected D&A (Data and Access Solutions) organic net revenue growth rate in the range of 7-10%.

Additionally, acquisitions held for less than a year are expected to contribute around 0.5 percentage points to the total net revenue growth in 2023.

The company also reaffirmed its organic total revenue growth range of 7-9% for the year, which is above the medium-term guidance of 5-7% introduced at the Investor Day 1.5 years ago.

Valuation

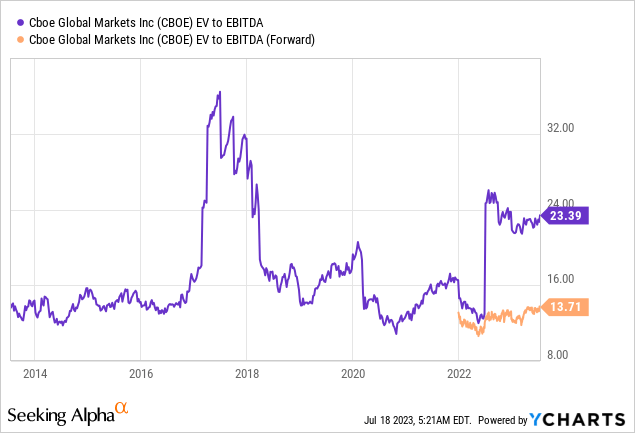

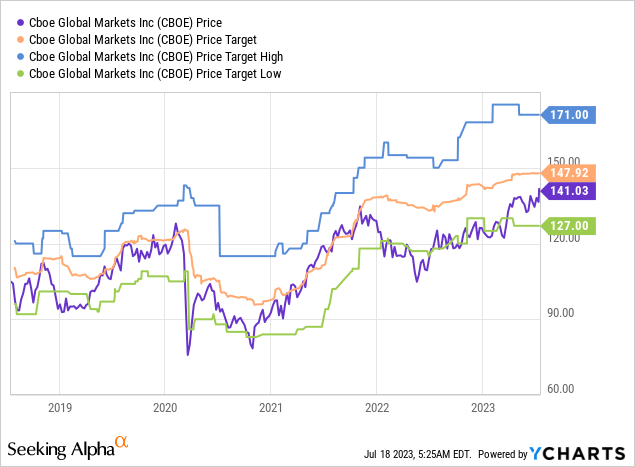

Despite rising by 13% year-to-date and rallying roughly 25% from its 52-week low, the stock is far from overvalued. CBOE is currently trading at 13.7x NTM EBITDA, which is a very fair valuation. The same goes for its free cash flow estimates. The company is expected to grow free cash flow by 27% this year, followed by an expected increase of 11% in 2024. This could result in more than $830 million in free cash flow, which implies a 5.6% 2024E free cash flow yield. While I cannot show you the historical price/FCF chart because of many outliers that ruin the chart, I believe this is a fair deal.

Analysts seem to agree. The current consensus price target is $148, which is roughly 5% above the current stock price.

If I were in the market for CBOE shares, I would watch the stock closely to buy potential corrections in its stock price. Given its strong performance, I would not start a full position at current prices. However, that is mainly a personal opinion based on the recent stock market performance and my belief that investors have priced in a perfect soft landing and decline in rates. I do not believe that macroeconomic developments will be that smooth.

Takeaway

Cboe Global Markets is an interesting dividend growth stock and a financial powerhouse in the stock exchange services sector. Despite its modest 1.4% dividend yield, CBOE has outperformed the financial sector due to its ability to thrive in stock market volatility and its diverse range of services.

The company’s focus on innovation, integration, and market expansion through organic growth and strategic acquisitions promises long-term growth prospects.

The recent surge in its stock price is a testament to its ongoing progress. I’m excited to see CBOE’s expanding capabilities and the introduction of new value-adding products.

Keeping an eye on potential corrections and considering a position in CBOE shares could be a smart move to capitalize on its growth as a dividend growth stock.