The Cayman Islands Stock Exchange (CSX) added 402 new securities in 2022, making it the fourth best year for new listings since the CSX’s inception in 1996, Maples and Calder reported.

The Maples Group’s law firm said it remained the top listing agent, having advised on 49% of all CSX listings in 2022. There are 15 listing agents in Cayman.

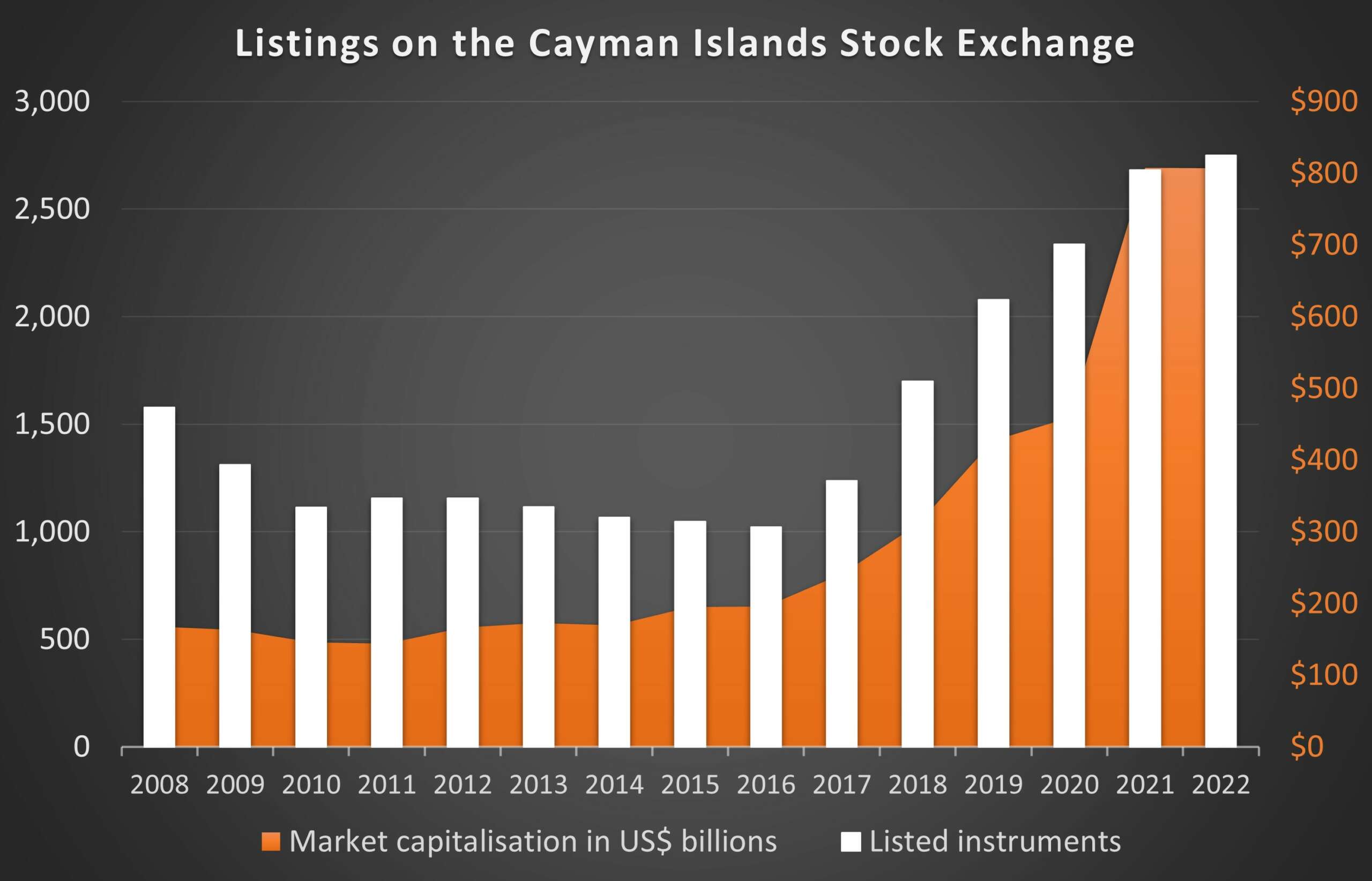

At the end of last year, the total number of listed instruments on the CSX was 2,750, amounting to a market capitalisation of US$807 billion. This represented an increase in total listings of 2.5%, while market capitalisation stayed flat.

Over the past 15 years, listings of mutual funds on the exchange have declined considerably, whereas specialist debt securities have increased fourfold and made up 84.5% of all listed instruments and almost 80% of total market capitalisation in 2021.

In the same year, sovereign debt securities were the second largest category, representing 9.8% of the volume and 18.2% of the value of stock market listings.

The CSX continued to reinforce its position as a leader for collateralised loan obligations (CLOs) with a recorded total of 146 CLO securities listed last year.

The CSX continued to reinforce its position as a leader for collateralised loan obligations (CLOs) with a recorded total of 146 CLO securities listed last year.

This comprised a significant percentage of US launches, refinancing and resets in the market, Maples and Calder said.

However, Cayman has lost some market share in the CLO space, after the Financial Action Task Force included the islands on its grey list of jurisdictions whose anti-money laundering (AML) regime is under increased monitoring.

The European Union, as a result, automatically added Cayman to its own AML list in March 2022.

Because the EU Securitisation Regulation prevents the creation of Securitisation Special Purpose Entities (SSPE) in AML-listed countries, US issuers who want to attract European investors have to choose a domicile other than Cayman.

In its October 2022 publication, “CLOser”, Maples noted that the EU Securitisation Regulation did not require EU investors who were already holding securities issued by an existing Cayman Islands SSPE to sell or transfer such securities.

At the same time, the refinancing or reset of an existing Cayman Islands SSPE is not strictly considered a new establishment.

However, “EU investors adopted a cautious stance from the outset, particularly with regard to a reset, requiring the Cayman Islands SSPE issuer to be migrated to an alternative jurisdiction not featuring on the EU AML List,” Maples said.

With both Bermuda and Jersey vying for the business, “the market relatively quickly coalesced on Jersey as the preferred alternative to the Cayman Islands”, the law firm added.

This was in part because Bermuda was included in the EU’s Annex II of non-cooperative jurisdictions for tax from February to October 2022, which required European investors to notify their tax authorities of any investments in a Bermuda special purpose vehicle.