Bearish investors are ‘trapped’ after stocks just flashed another sign a new bull market has begun, Fundstrat says

-

Stocks just flashed yet another signal that suggests a new bull market has begun, according to Fundstrat.

-

The S&P 500’s near-20% rise since its mid-October low has trapped bearish investors that expect a hawkish Fed.

-

“If inflation falls as quickly as we expect, the Fed will tolerate easing financial conditions,” Fundstrat’s Tom Lee said.

The stock market has flashed yet another signal that suggests a new bull market has arrived, and bearish investors are “trapped,” according to Fundstrat’s Tom Lee.

Lee highlighted that a growing chorus of warnings about a hard landing and imminent recession is falling flat as inflation shows signs of easing and the job market remains resilient — hinting at the possibility an actual recession could have already come and gone.

“The issue is this has become the most widely anticipated recession ever, which raises the question whether a ‘rolling recession’ has already passed,” Lee said in a Friday note.

And that sets the stock market up for more gains following the S&P 500’s near-20% rally from its mid-October low, with yet another bullish technical signal suggesting that the year-long bear market has flipped to a brand new bull market.

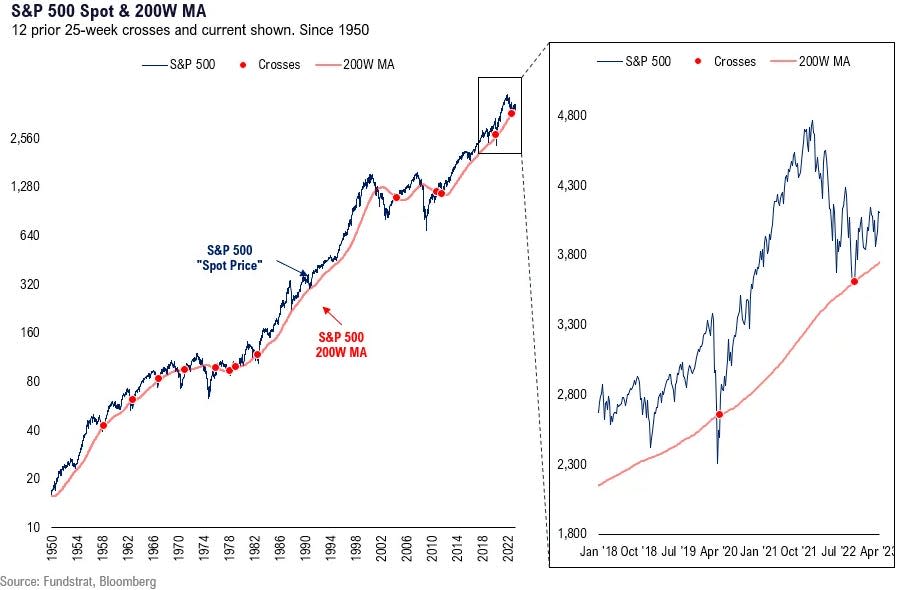

“The S&P 500 has now spent more than 25 weeks above its 200-week moving average. Since 1950, there are zero instances of the S&P 500 making a new low once it has recovered above the 200-week moving average and spent at least 15 weeks there,” he explained.

The signal has a 100% win ratio, according to Lee, with one-, three-, six-, and 12-month returns being positive every single time the S&P 500 passed the milestone of remaining above its 200-week moving average for 25 consecutive weeks.

“October 12, 2022 is the low for this cycle,” he said, adding that his views have been strengthened by other bullish signals like the “rule of 1st five trading days” and two consecutive quarters of stock market gains during a bear market, among others.

The rising stock market amid a barrage of negative economic headlines has trapped a lot of bearish investors who are positioned for more downside in stocks, not upside.

In fact, hedge funds have built the largest short exposure against the S&P 500 since 2011. And those bears could be the fuel that drives a sustainable bull market as they slowly capitulate and flip their exposure from bearish to bullish.

“Equities are in a bull market, even if consensus is ‘trapped bears,” Lee said. “We believe if inflation falls as quickly as we expect, the Fed will tolerate easing financial conditions. Hence, bears are trapped, in our view.”

He reiterated his view that the S&P 500 will surge another 15% from current levels to 4,750 by year-end.

Read the original article on Business Insider