Semiconductor companies are those involved in the design, manufacturing, and distribution of semiconductor devices and related technology.

Semiconductors — or chips — are essential to the functioning of electronic devices and have seen particular interest in 2023 given the rise of the AI sector. Without semiconductors, there would be no computers, smartphones, gaming, film CGI, or a hundred other applications, all of which are essential to 21st century living.

OpenAI’s revolutionary ChatGPT chatbot, the US ban on some semiconductor exports to China, and Nvidia’s dizzying rally are all testament to the importance of the sector. With significant growth in AI interest expected through the next decade and beyond, investing in semiconductor stocks within a diversified portfolio could be an attractive proposition.

For context, giants including Intel and ASML consider that annual global spending on semiconductors will rise to $1 trillion by 2030, up from just $570 billion in 2022.

But remember, past performance is not an indicator of future returns.

Best semiconductor stocks to watch

Before delving into some of the most popular individual semiconductor shares, it’s worth highlighting that there are many popular, diversified ETFs which offer exposure into multiple companies on a low cost basis.

For example, the Vaneck Semiconductor UCITS ETF holds 25 of the world’s largest semiconductor companies and is a common choice for investors who want broad exposure to the sector without the need to conduct additional research.

In addition, the ARM IPO could see the tech giant become one of the most valuable semiconductor stocks in the world when it relaunches to the public later this year.

Of course, some companies will do better than others, and this is not an exhaustive list. No returns can be guaranteed.

1. Oxford Instruments

While the largest semiconductor stocks are dominated by non-UK entities, London-listed Oxford Instruments is a £1.3 billion established leader and the largest semiconductor company in the country. It serves multiple markets across the sector, but the key focus is currently on its semiconductor and communications division.

In recent full-year results, the company saw orders grow by 20.9% to £511.6 million, while adjusted operating profit rose by 21.4% to £80.5 million.

CEO Ian Barkshire enthuses that the company ‘delivered growth in orders, revenue and profit, as well as maintaining margin, with performance strengthened in the second half as we converted our order book and realised the benefits of new pricing structures…our strong balance sheet positions us well to invest in people, infrastructure and innovation, and to make synergistic acquisitions to augment our organic growth.’

However, the company is much smaller than its stateside competitors.

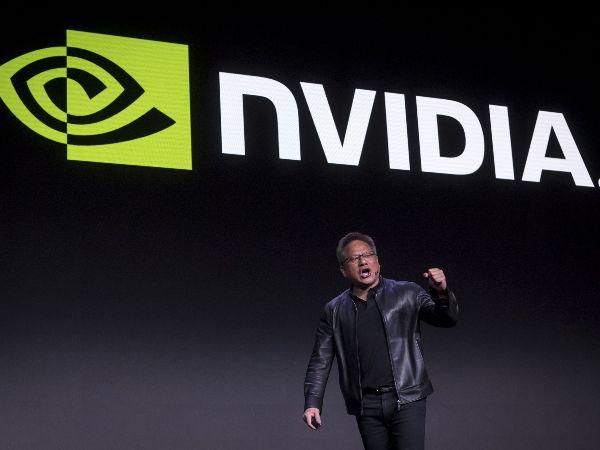

2. Nvidia

Nvidia shares have been on a dizzying rally this year to a $1.2 trillion valuation. The semiconductor champion is clearly the most popular semiconductor stock of 2023 — though of course, popularity does not mean it is the best investment available.

However, the company once again delivered analyst-beating results in Q2 2023, with revenue up by 88% quarter-on-quarter to $13.51 billion, and its critical Record Data Center revenue up by 171% compared to Q2 2022.

CEO and co-founder Jensen Huang believes that ‘a new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI… (our) leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry.’

Of course, Nvidia now has a huge price-to-earnings ratio, and perhaps too much exposure to a faltering Chinese economy.

3. Taiwan Semiconductor Manufacturing Co

While Nvidia is touted as the ‘picks and shovels’ semiconductor stock for 2023, this crown could arguably belong to TSMC. Most chip producers — including Nvidia — outsource actual production to the Taiwanese company, with the country responsible for making circa 90% of the world’s most advanced chips.

TSMC shares have done well in 2023 given the AI-driven demand, its colossal manufacturing capacity and the wide economic moat surrounding starting up any sizeable competitor.

However, Taiwan’s complex political status, including its relationship with China remains a long-term risk.

4. Qualcomm

Qualcomm shares may be largely flat in 2023, but this could change soon. The NASDAQ titan returned $1.3 billion to stockholders in Q3 2023, including $893 million in dividends and $400 million through share buybacks.

The company has struggled in 2023 due to low consumer demand for smartphones through the cost-of-living crisis, but it’s now pivoting towards the AI business.

CEO Cristiano Amon is ‘pleased with our technology leadership, product roadmap and design-win execution, which position us well for growth and diversification in the long term. As AI use cases proliferate to the edge, on-device AI has the potential to drive an inflection point across all our products. Qualcomm remains best positioned to lead this transition given the unmatched accelerated computing performance with the power efficiency of our platforms.’

5. Advanced Micro Devices

Advanced Micro Devices — commonly abbreviated to AMD — is a distant second to Nvidia, but it has several near-term catalysts to consider. For example, in mid-June 2023, AMD rolled out its new Instinct MI300 series chips, which should become popular for customers looking to accelerate their generative artificial intelligence chip processing.

While Nvidia may control circa 80% of the AI market, this new AMD chip could be a gamechanger — and its shares have climbed sharply this year as a result.

Chair and CEO Dr Lisa Su notes that the company ‘delivered strong results in the second quarter as 4th Gen EPYC and Ryzen 7000 processors ramped significantly…we made strong progress meeting key hardware and software milestones to address the growing customer pull for our data center AI solutions and are on-track to launch and ramp production of MI300 accelerators in the fourth quarter.’