Image source: Getty Images

Passenger numbers for easyJet (LSE: EZJ) are on the cusp of recovering to pre-pandemic levels soon. Meanwhile, its share price remains 70% off its pre-pandemic levels of £12.70. So, here’s why I think the airline stock could be undervalued.

Flying higher

In its latest full-year report, the FTSE 250 firm’s passenger numbers saw a healthy boost. Nonetheless, these figures were already expected given positive updates from its peers earlier. As such, the easyJet share price hasn’t moved much.

| Metrics | FY22 | FY21 | FY19 | Change vs FY19 |

|---|---|---|---|---|

| Passengers | 69.7m | 20.4m | 96.1m | -27% |

| Load factor | 85.5% | 72.5% | 91.5% | -6% |

| Capacity | 81.5m | 28.2m | 105.0m | -22% |

Be that as it may, there are still a number of achievements to celebrate from the report, which could bring long-term benefits to the company.

For one, the group’s operational performance has improved. On-the-day cancellations have seen a healthy reduction due to structural improvements being implemented. Second, the budget airline expects capacity to continue improving, and sees a return to pre-pandemic levels by the summer.

Additionally, early bookings are trending positive and Easter ticket yields are showing strength. Moreover, the firm’s holidays segment continues to grow rapidly and is on target to hit £100m in profit next year.

Hard times bring easy money

easyJet has also seen a modest improvement in its financial figures. Yet while these metrics are significantly better compared to last year’s, they’re still lagging behind pre-pandemic levels by quite some margin.

| Metrics | FY22 | FY21 | FY19 | Change vs FY19 |

|---|---|---|---|---|

| Revenue | £5.77bn | £1.46bn | £6.39bn | -10% |

| Revenue per seat (RPS) | £66.23 | £50.54 | £60.81 | 9% |

| Headline EBITDAR | £0.57bn | -£0.55bn | £0.97bn | -41% |

| Profit before tax (PBT) | -£0.21bn | -£1.04bn | £0.43bn | -149% |

| Diluted earnings per share (EPS) | -22.4p | -159.0p | 87.8p | -126% |

Nevertheless, the firm has continued its recovery through every quarter. For instance, in Q4 alone, headline EBITDAR hit a record £674m. And RPS has recovered beyond pre-pandemic levels. Therefore, the board remains positive about the airline’s recovery.

For the quarter ahead, CEO Johan Lundgren forecasts RPS to come in 20% higher compared to last year, at approximately £17.81. Furthermore, he’s anticipating load factor to grow above 87%, citing easyJet’s robust performance during tough times.

Trading on a budget

All this leads me to look at the stock’s valuation multipliers to determine whether it’s undervalued. The airline remains unprofitable, so figures such as price-to-earnings (P/E) ratio can’t be collated. However, its price-to-sales (P/S) ratio currently stands at 0.5, which indicates good value.

More importantly, investment banks such as Liberium Capital are rather upbeat about the stock. Analysts are expecting the Luton-based airline to return to profitability once capacity returns to pre-pandemic levels.

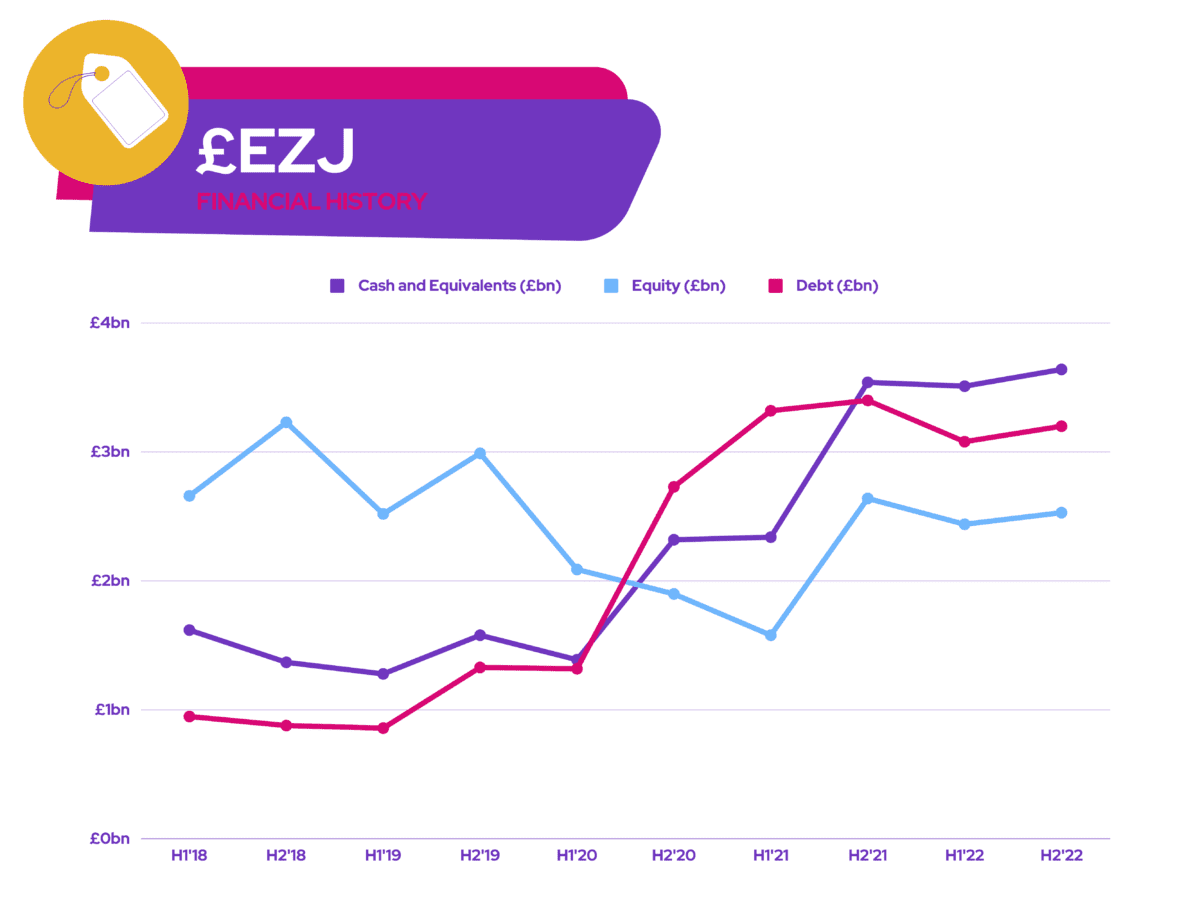

Having said that, this will be reliant on continued strong demand and lower jet fuel prices. Either way, easyJet has one of the strongest balance sheets in Europe, which should shield it from taking on further debt or having to raise capital.

If oil prices continue to decline, the low-cost operator could return to profitability by 2024. And it’s hedged 63% of its fuel for the year ahead, which should help if there are any spikes in oil prices. As a result, Peel Hunt rates the stock a ‘buy’ with a price target of £5.50, presenting it with a 45% potential upside.

That being said, the risk of a recession can’t be ignored and could slow its path to full recovery. But given strong consumer spending in services, particularly in travel, I don’t see a slowdown any time soon. For that reason, I think easyJet shares are massively undervalued, and that’s why I’ll be investing when I’ve got more spare cash on hand.