-

A bullish formula for the stock market is on the verge of happening as the economy continues to grow.

-

“Positive GDP growth plus improving earnings and a paused Fed is the formula to be bullish stocks,” JPMorgan said.

-

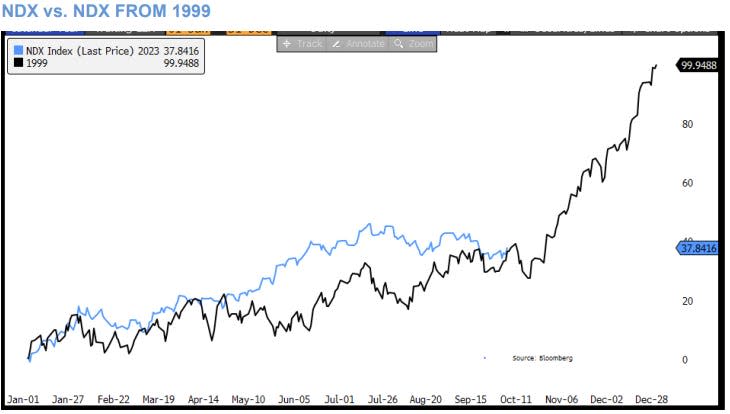

The bullish set up for stocks comes as the Nasdaq 100 follows a similar playbook from 1999.

Our Chart of the Day is from JPMorgan, which highlights that the Nasdaq 100 Index is closely tracking its trading playbook from 1999.

The chart plots the 2023 year-to-date performance of the tech-heavy index and compares it to its performance in 1999, during the late stages of the dot-com bubble.

The Nasdaq 100 is up about 38% year-to-date. The index was up just over 100% in 1999.

To be clear, JPMorgan is not making a call that the Nasdaq is going to stage a mind boggling year-end rally that rivals its 1999 performance, but it does offer the chart as an observation and highlights that there is a bullish formula brewing for stocks.

“Positive GDP growth plus improving earnings and a paused Fed is the formula to be bullish stocks,” JPMorgan’s Ellen Wang and Andrew Tyler said in a Monday note. “Positioning is more favorable and our Delta One team flags the elevated risk for an upside squeeze.”

Investors currently see little chance of another interest rate hike from the Federal Reserve this year or next. In fact, according to the CME’s Fed Watch Tool, the Fed could pause interest rate hikes for its next four FOMC meetings before it cuts interest rates in May 2024.

Meanwhile, GDP growth is expected to come in strong in the third-quarter, with the Atlanta Fed’s GDPNow cast suggesting the economy will grow nearly 5%.

The strong September jobs report, which doubled economists’ estimates at nearly 336,000 jobs added, echoes that possibility.

“This is positive for the economy and the trend of outsized economic growth appears likely to continue, which will pull earnings higher. Another outcome is that yields move higher, subject to Thursday’s CPI print. If so, that is not a negative. Positive GDP growth with increasing real yields typically expands the S&P 500’s price-to-earnings ratio and not contracts it,” the note said.

Earnings estimates on Wall Street have consistently trended higher over the past few weeks, suggesting that corporate earnings troughed during the second or third-quarter of this year.

Read the original article on Business Insider