Darren415/iStock via Getty Images

How to Find Cheap Small-Cap Stocks to Invest in

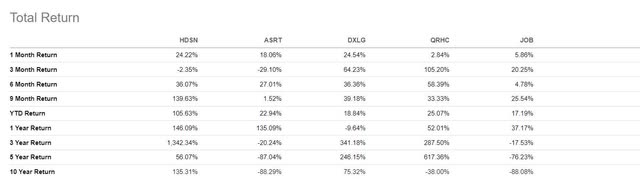

One year ago, Seeking Alpha’s quant screener contained 53 stocks under $10 rated Strong Buys. The average performance of those 53 stocks is up 2.55% compared to the S&P 500 performance, -16.04%, and Small Cap Russell Index, down 19.61%. The market pullback has concerned investors whose sentiment has leaned towards fear for most of the year. But we’re beginning to see a change in sentiment towards greed.

The small-cap rut this year has given way to significant losses, especially in September. October began a turnaround, which is why considering some Strong Buy small-cap stocks for a portfolio may prove beneficial. As I referenced in previous articles, Goldman Sachs analysts “believe small cap stocks can continue to outperform in 2022. The expectation for earnings growth of Russell 2000 companies in 2022 is 30%, well above the 9% forecast for the S&P 500.” Although there is still a lot of volatility in the markets, historically, November and December are the best months for investing in terms of frequency of growth, giving way to the phenomenon known as the “Santa Clause Rally.” Although my stock picks are cheap, they are micro- and small-caps found by way of Top Stocks Under $10 through my proprietary quantitative system.

My Top 5 U.S. Stocks Under $5

My Top 5 U.S. Stocks’ Total Return (Seeking Alpha Premium)

I take the emotion out of investing to make an objective, unemotional evaluation of each stock based upon data that includes a company’s financials and analyst estimates so that only the stocks possessing the strongest fundamentals have strong buy ratings.

5 Best Small-Cap Stocks Under $10

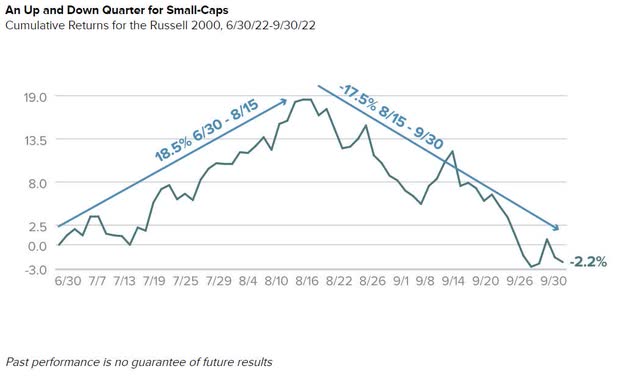

With a market capitalization between $300 million and $2 billion, small-cap stocks can offer excellent opportunities for long-term growth. Historically, they have outperformed large-cap stocks, but this year, they have taken a big hit. Will they see a turnaround from the up and down third quarter when the Russell 2000 Index gained +18%, only to fall and continue to trade -18% YTD? Only time – and investment – will tell.

The Up and Down of Small-Caps (Royce Invest)

As the riskiest of U.S. equity asset classes, small caps can have whipsawing price swings, especially amid rising rates that can affect the outlook of individual stocks. Where the markets reacted well initially to the latest 75-basis point hike, cheap stocks with a lot of leverage can quickly sell off sharply when rising interest rates are threatened, and emotions dictate the markets. But over long periods, small-caps have paid out handsomely, especially those based on our Quant System. And where past performance is not a guarantee of future results, a focus on stocks with attractive collective financial traits like valuation, strong growth, EPS revisions, profitability, and momentum, can offer upside for a portfolio. These characteristics are currently found in the below five stocks under $10.

1. Hudson Technologies (HDSN)

-

Market Capitalization: $414.64M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/1): 10 out of 619

-

Quant Industry Ranking (as of 11/1): 2 out of 42

Hudson Technologies is a U.S.-based refrigerant services company focused on supporting the transition to climate-friendly heating, ventilation, air conditioning, and refrigeration (HVACR) needs. By promoting sustainability through energy efficiency, reclamation, reuse, and several other environmentally friendly solutions, Hudson is on a mission for future generations to inherit a healthy planet.

Hudson Technologies Valuation & Momentum

Trading under $10/share, HDSN has been on a longer-term uptrend, with many analysts calling the stock overbought. YTD and over the last year, HDSN shares are up more than 100%, with valuation multiples at extremely low levels and indicating room for future growth.

Hudson’s forward P/E ratio is 5.15x compared to the sector median of 16.67x, trading nearly 70% below the sector median; the forward PEG ratio is strong at 0.19x, an -87% difference to the sector.

HDSN Valuation (Seeking Alpha Premium)

With bullish momentum, the stock’s one-year price performance is up 165.58%. As we look to its future and factors that may affect its business, we see continued growth prospects involving supply shortage tailwinds that can help its growth and profitability.

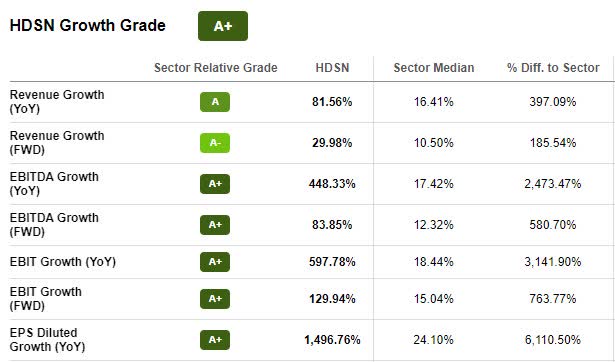

HDSN Growth & Profitability

Like commodities that have benefited companies in their respective industries, elevated refrigerant prices benefit Hudson Technologies. Governments around the globe are limiting the production and use of refrigerants and hydrofluorocarbons (HFCs). In a rare bipartisan agreement signed by Biden, a global political consensus of nearly 200 nations has agreed to reduce HFCs, considered a highly potent greenhouse gas and driver of global warming. As Horizon Capital writes:

“When there is global political consensus that the supply of a widely used refrigerant should be curtailed significantly, there is less risk that the supply induced upward pressure on the price of refrigerants will be short-lived…For a company like Hudson that operates primarily in the U.S. and only deals with refrigerants, this press release is a reason to be bullish.”

The cut in production and supplies serves as a tailwind for Hudson Technologies, which not only capitalizes on the increasing price of refrigerants but has already positioned itself for growth by developing the next generation of refrigerants. HDSN is gaining market share through reclamation.

HDSN Growth Grade (Seeking Alpha Premium)

Hudson has consecutively beaten top- and bottom-line earnings, with the most recent showcasing continued strength and momentum for record revenues. Q2 EPS of $0.84 beat by $0.45, and revenue of $103.94M beat by $7.92M (71.67% YoY). Gross margins increased by 55%, and the firm maintained higher-than-average selling prices. In addition to increasing cash flow and profitability, margins continue to be enhanced. Hudson CEO Brian Coleman commented on Hudson’s long-term value during the Q2 Earnings Call:

“We remain focused on developing strategic working relationships with customers who recognize the long-term value in Hudson’s ability to provide them with sustainable refrigerant products and services as the industry transitions to cleaner equipment and refrigerants. We believe a shared vision for the circular economy of refrigerants is an important component of our customer relationships.”

The company’s raised guidance and unique industry allow Hudson to play a crucial role in supply chains and the environment, providing this stock a solid moat, substantiating its Strong Buy rating.

2. Assertio Holdings, Inc. (ASRT)

-

Market Capitalization: $124.30M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/1): 10 out of 1191

-

Quant Industry Ranking (as of 11/1): 6 out of 229

I recently wrote about Assertio Holdings, Inc. as a top Small-Cap Pharma Stock for a 2023 Melt-Up. Quant-rated a Strong Buy, this micro-cap specialty pharmaceutical company trades for less than $3 per share. Although Assertio experienced a few hurdles, including a fall in price after news of a $60M convertible senior note offering, which resulted in a share price fall of 20%, this stock continues to persevere.

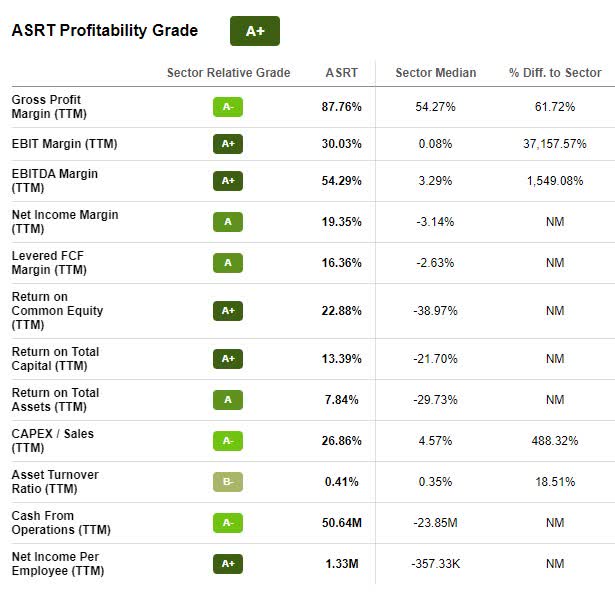

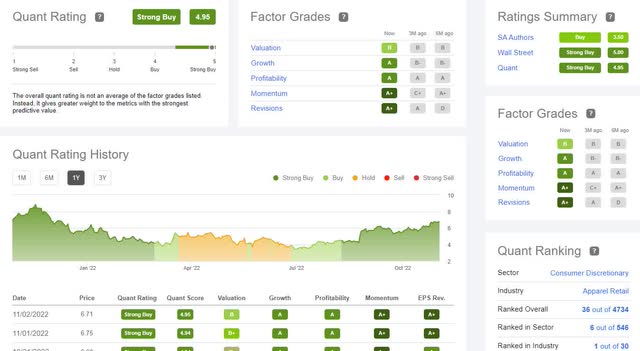

ASRT Factor Grades (Seeking Alpha Premium)

A review of Assertio’s Factor Grades, which rate investment characteristics on a sector-relative basis, is excellent. Each A+ Grade indicates that ASRT has excellent potential and is fundamentally sound compared to the sector. With a current A+ Profitability grade and an A+ Earnings Revision (which was upgraded since my recent writing of the stock), ASRT is one of the most profitable companies in its sector. ASRT continues to trend higher and is severely undervalued.

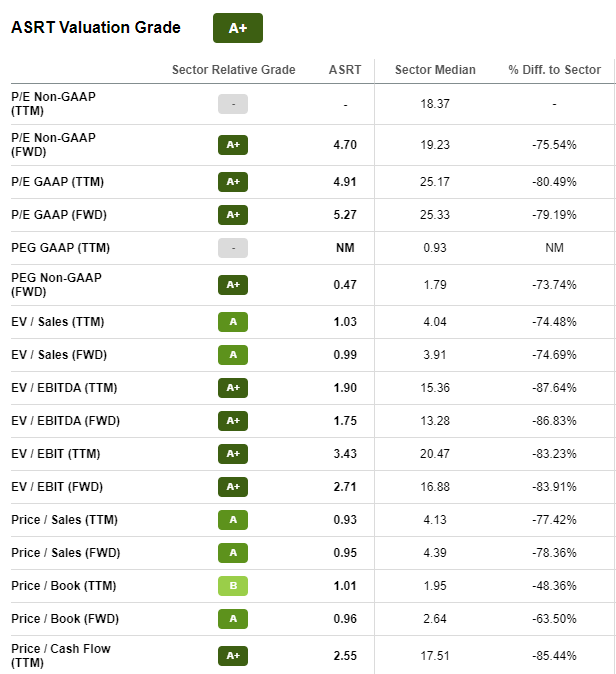

ASRT Valuation

ASRT’s valuation grade is an A+ with a one-year price increase of 135%. Trading nearly 80% below its sector peers, ASRT has a 5.27x forward P/E ratio. In addition, its forward PEG of 0.47x versus the sector’s 1.79x, as evidenced by the below figures, also showcases it is undervalued.

ASRT Valuation (Seeking Alpha Premium)

At this price point and with continued bullish momentum, ASRT is a strong buy to consider.

ASRT Growth & Profitability

With consistent growth and profitability, it’s no wonder Assertio Holdings has consecutively beaten earnings expectations and raised guidance yet again after Q2 reports. ASRT continues to reduce its debt. In the latest news and as part of Assertio’s growth plan, the specialty pharmaceutical company is exclusively licensing an anti-seizure therapy from Aquestive Therapeutics, Inc. (AQST). “Sympazan fits perfectly with our non-personal digital platform and growth plans, further diversifies our portfolio, and brings with it opportunities to significantly extend patent life,” said Dan Peisert, President and Chief Executive Officer of Assertio.

ASRT Profitability Grade (Seeking Alpha Premium)

Although ASRT fell 20% in share price following an announcement for a convertible note offering, the stock still possesses tremendous fundamentals, anticipates saving $4.5M in annual payments, and continues to deliver results.

ASRT delivered another strong earnings beat, with an EPS of $0.16 that beat by $0.08 and revenue of $35.13M that beat nearly 40% year-over-year. ASRT’s new digital strategy is helping restructure and focus the business, gross margins, operating expenses, cash flows, and overall strategy for improvement. Sympazan will serve as a great replacement for the loss of exclusivity for CAMBIA, which treats adult migraines. Forecasting net product sales for FY 2022 to increase from $126M to $136M to $129M to $137M, during the earnings report, CEO Dan Peisert said, “…our base business continues to perform well such that we anticipate 2023 revenues will exceed $120 million despite the loss of exclusivity for CAMBIA, and even in the absence of any additional acquisitions.” ASRT’s new digital strategy is helping restructure and focus the business, gross margins, operating expenses, cash flows, and overall strategies for improvement. Sympazan will serve as a great replacement for the loss of exclusivity for CAMBIA, which treats adult migraines.

Focusing on debt reduction and sales, Assertio anticipates a jump in EBITDA from $73M to $79M versus the previous outlook of $66M to $74M. These lofty goals and bullish momentum have resulted in investors actively purchasing shares to drive the stock price higher. Consider this strong buy stock pick for your portfolio.

3. Destination XL Group, Inc. (DXLG)

-

Market Capitalization: $412.53M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/1): 6 out of 546

-

Quant Industry Ranking (as of 11/1): 1 out of 30

Specialty retailer Destination XL Group, Inc. operates big and tall men’s clothing stores designed and built for those unable to find the clothes they want and need for their proportions. Rated a strong buy according to our quant ratings, DXLG possesses a strong ratings and factor grades history that showcases its YTD uptrend (+18.84%).

DXLG Quant Ratings & Factor Grades (Seeking Alpha Premium)

Above, you can see the Seeking Alpha factor grades, which rate investment characteristics on a sector-relative basis. Each of DXLG’s grades is a B or better, indicating that destination XL is on the move with excellent potential and is fundamentally sound compared to the sector. With a current A Profitability grade, A+ Momentum, and A+ Earnings Revision, DXLG is a fast-growing company in its sector. It is fast-growing, and the stock comes at a discounted price.

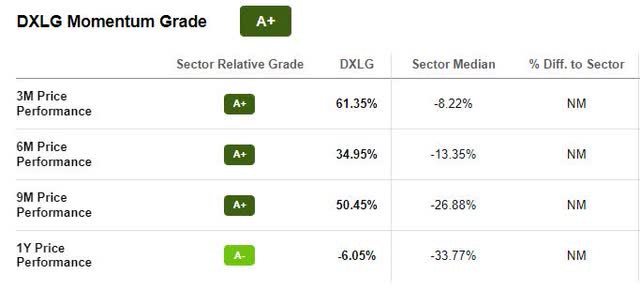

DXLG Valuation & Momentum

On an upward trend, DXLG’s shares are being actively purchased, driving the stock price higher. Although this stock is trading for less than $7, the underlying valuation metrics still indicate that price is undervalued.

DXLG Momentum (Seeking Alpha Premium)

DXLG’s forward P/E ratio of 5.44x compared to the sector’s 13.82x is a -60.62% difference to the sector. Its trailing PEG of 0.02x is more than a 92.37% difference to the sector. At this discounted price and price-performance that is outpacing its sector peers quarterly, it may be a great time to get in on this clothing trend.

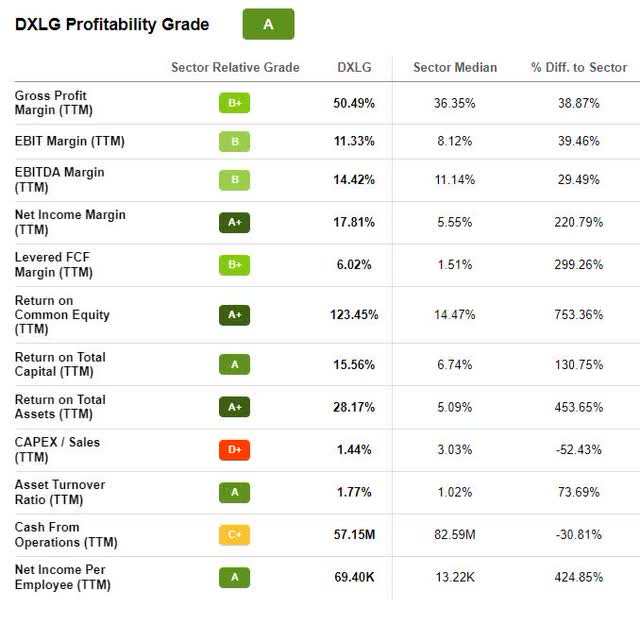

DXLG Growth & Profitability

Focused on a better path for investors after paying off all debt earlier this year after generating over $70M of free cash flow, Destination XL has restructured, recently hired a new Chief Marketing Officer who will join DXLG this month, and continues to improve its digital presence. With its new and improved online presence, DXLG has experienced record profitability, with hopes of its digital commerce reaching 35% to 40% over the next few years.

DXLG Profitability (Seeking Alpha Premium)

Destination XL Group, like many retailers during the pandemic, experienced difficulties amid lockdowns with little focus on eCommerce and its online presence. After revamping that aspect and coming out of the pandemic, DXLG experienced a surge in business in 2021 that has led to abnormally high margins that are now normalizing. Following excellent second-quarter results, including an EPS of $0.85, beating by $0.67, and revenue of $144.63M, beating by $7.79M, DXLG has raised its sales guidance.

“This quarter, we were at a 17.9% margin. Last quarter, it was 13.5%. So for the rest of the year, we are still being cautiously optimistic for where the rest of the year is going to lie. And the change to guidance that we’re announcing today is an increase in the sales range taking that to $520 million to $540 million. With regard to EBITDA margin, we’ve said historically that we want to be able to build sustainable margins in excess of 10%.” Peter Stratton, Destination XL Group CFO.

With raised sales guidance and a new Chief Marketing Officer to help move the company and its e-commerce forward, if you’re looking for a cheap retail stock to buy, consider this DXLG for a portfolio.

4. Quest Resource Holding Corporation (QRHC)

-

Market Capitalization: $169.38M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/1): 2 out of 619

-

Quant Industry Ranking (as of 11/1): 1 out of 25

Offering waste solutions to companies like grocers, restaurants, and commercial and multi-family complexes, Quest Resource Holding Corporation operates more than 100 waste streams in locations throughout the U.S., Canada, and Puerto Rico. Rated a Strong Buy according to Seeking Alpha’s quant rating system, Quest is a diversified play for a portfolio wanting a focus on sustainability.

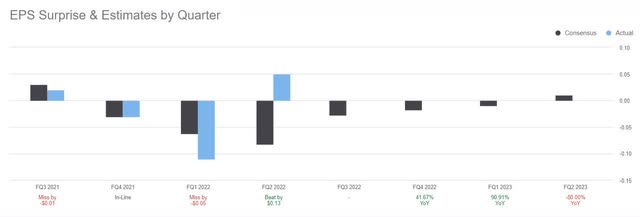

QRHC EPS Estimates by Quarter

QRHC EPS Estimates by Quarter (Seeking Alpha Premium)

Like many stocks that fell from June to July, Quest experienced a decline after missing Q1 earnings. Since then, the stock has been on an uptrend, focusing on differentiated services and accounts that have increased gross margins and profits.

QRHC Growth & Profitability

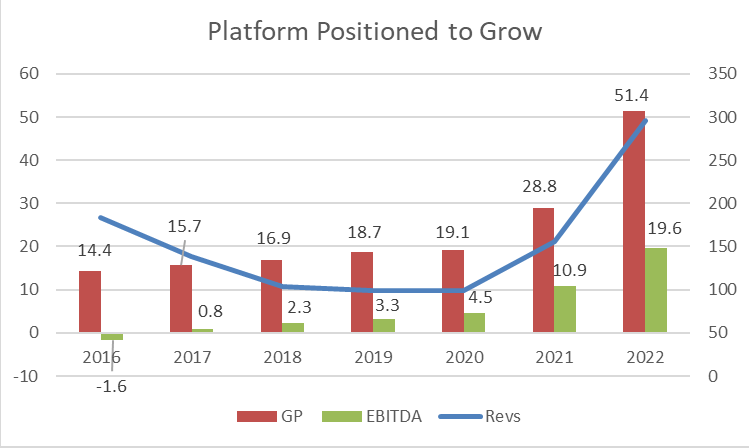

Since 2016, Quest has been on a mission to grow steadily. Its gross margins have increased from 7.8% in 2016 to 17.5% this year, according to Quest’s investor presentation. As Pinnacle Fund writes and showcases below:

“Investors that believed in Quest’s operational turnaround during the 2016-2020 transition period have been rewarded. Quest began growing organically in Q4’20, grew ~25% organically in 2021, and continues to grow organically. Quest embarked on an acquisition strategy that has driven further growth and resulted in operational synergies that started to meaningfully contribute to profitability in Q2’22.”

Quest Growth (Pinnacle Fund)

Quest has transformed its go-to-market strategy by focusing on organic growth by capitalizing on M&A opportunities with current Quest clients with robust networks, systems, and IT and data capabilities in place. Adjusted EBITDA increased by 100%, doubling the company’s size while improving profitability. Expenses did see an increase on the heels of acquisitions that reflect overhead and labor cost increases. Still, the company brought in solid cash flow and reinvested into working capital and acquisitions.

With a second-quarter EPS of $0.05 that beat by $0.13 and revenue of $76.91M that beat by $5.59M, a 108.65% YoY increase, it should come as no surprise that four analysts provided FY1 Up revisions in the last 90 days. The positive figures and outlook led Quest’s new Chief Financial Officer, Laurie Latham to say:

“We made a lot of progress this past quarter incorporating our best practices to these acquired businesses. And it is beginning to show up in our financial results. We continue to use gross profit dollars as a key metric to measure the success of our initiatives. And during the second quarter, gross profit dollars increased to $14.7 million, which is 115% increase year-over-year and a 30% sequential increase from the first quarter…Looking forward to the second half of the year, we expect gross profit dollars to benefit from continued momentum in our organic growth and continued improvements from our integration efforts.”

Not only is the company making improvements to grow, it trades at a relative discount and has A+ momentum.

QRHC Valuation & Momentum

Trading under $10 per share and at a relative discount, Quest’s forward P/E ratio is 19.29x, and its forward PEG of 1.29x compared to the sector median of 1.49x is -13.51% difference to the sector. Continuing to trend higher, investors don’t want to waste this strong buy opportunity, as they’ve been actively purchasing shares to drive the stock higher. Consider this quant-rated strong buy pick for your portfolio, along with my last pick.

5. GEE Group Inc. (JOB)

-

Market Capitalization: $71.91M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/1): 5 out of 619

-

Quant Industry Ranking (as of 11/1): 1 out of 26

Despite economic data showing strength in the labor market, skilled workers are scarce, causing labor shortages around the nation. High inflation, slowing growth, and the demand for workers in fields outpacing the hiring have prompted companies like GEE Group Inc. to offer professional and industrial staffing placements to rise. Offering strong financials and a low valuation, what better opportunity than a penny stock to consider putting our quant system to work for your portfolio!

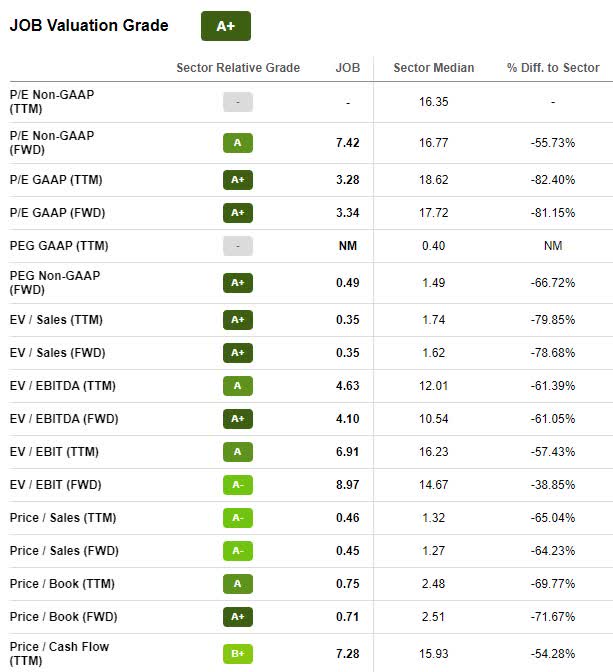

GEE Group Valuation & Momentum

Extremely undervalued, GEE is trading for less than $1, with a low valuation on several metrics. Forward P/E of 3.34x is more than an 80% difference to the sector, and JOB’s forward PEG of 0.49x is a -66.72% difference. As you can see by the A’s throughout its valuation, the stock comes at an extreme discount.

JOB Valuation (Seeking Alpha Premium)

In addition to an attractive valuation, GEE’s momentum is solid. Investors are paying higher prices for shares, as the stock is strongly bullish, with steady price performance, outperforming its peers. Year-to-date, the stock is +8.33% and, over the last year, is up more than 30%.

JOB Growth & Profitability

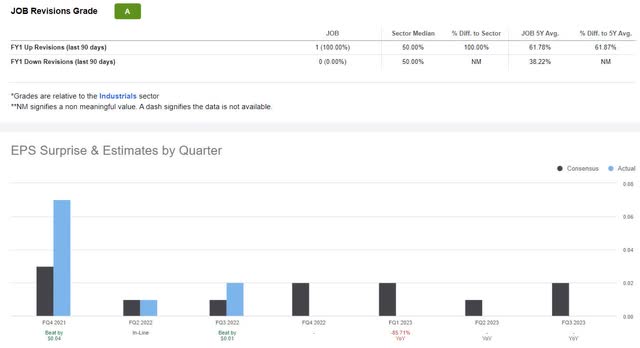

Focused on organic growth, the stock reached its 52-week high of $0.78 per share following third-quarter earnings. Since the pandemic, GEE has been focused on the rebound, expanding its client-base, implementing cost controls, and expanding margins.

JOB EPS Revisions (Seeking Alpha Premium)

Debt-free with a strong liquidity position, the GEE Group’s Q3 EPS of $0.02 beat by $0.01, and revenue of $41.11M beat by $761K, an increase of 8% YoY. For a consecutive nine months, GEE’s consolidated gross margins have been above 36%. Contract staffing services revenue increased by $8.7M over nine months, and industrial staffing increased, providing opportunities for acquisition add-on growth. As fellow SA author David Zanoni writes:

“One good aspect of an economic downturn is that it increases the opportunities to find potential acquisitions at low valuations. The good news is that GEE Group has a goal of paying for an acquisition without overleveraging the company. So, this would include using available cash, financing, and seller financing. The company hinted that they would probably not do a stock offering which could be dilutive to the stock. As a result of the long-term positive trend for GEE Group, consensus estimates show that earnings are expected to grow at an average pace of 15% per year over the next 3 – 5 years. This pace of growth can drive the stock to outperform the broader market over the long-term.”

With the positive factors in mind and the company’s tremendous fundamentals, consider this Strong Buy for a portfolio, along with the other stocks referenced above.

Consider 5 Cheap Stocks Under $10

Stocks trading under $10 with discounted valuations and strong growth can offer portfolios upside. Risk can bring reward, but stocks with strong investment fundamentals can take a bite out of the risk to help make well-informed investment decisions. Historically, small-cap stocks tend to outperform large-cap stocks in the long run. Although small-caps tend to be more volatile (as we saw with the September price swings), the stock picks mentioned here were selected by identifying low-cost stocks with strong fundamentals using our Quant System.

Hudson Technologies, Assertio Holdings, Destination XL Group, Quest Resource Holdings, and Gee Group are a diversified bunch that may help to diversify your portfolio. We have many more Top Stocks Under $10 for you to choose from, offering the best resources to make informed investment decisions.