Twin Tree Management LP purchased a new position in shares of Murphy USA Inc. (NYSE:MUSA – Get Rating) in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor purchased 4,409 shares of the specialty retailer’s stock, valued at approximately $1,212,000.

Twin Tree Management LP purchased a new position in shares of Murphy USA Inc. (NYSE:MUSA – Get Rating) in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor purchased 4,409 shares of the specialty retailer’s stock, valued at approximately $1,212,000.

→ See this “Next-Gen” Stock yet? (From Technology Markets Today )

A number of other large investors have also recently bought and sold shares of MUSA. BlackRock Inc. lifted its stake in shares of Murphy USA by 1.4% in the 1st quarter. BlackRock Inc. now owns 2,670,297 shares of the specialty retailer’s stock worth $533,953,000 after acquiring an additional 35,610 shares during the period. Renaissance Technologies LLC lifted its stake in shares of Murphy USA by 6.5% in the 2nd quarter. Renaissance Technologies LLC now owns 557,500 shares of the specialty retailer’s stock worth $129,825,000 after acquiring an additional 34,100 shares during the period. Goldman Sachs Group Inc. lifted its stake in shares of Murphy USA by 20.6% in the 2nd quarter. Goldman Sachs Group Inc. now owns 332,877 shares of the specialty retailer’s stock worth $77,518,000 after acquiring an additional 56,905 shares during the period. Price T Rowe Associates Inc. MD lifted its stake in shares of Murphy USA by 10.5% in the 2nd quarter. Price T Rowe Associates Inc. MD now owns 238,500 shares of the specialty retailer’s stock worth $55,539,000 after acquiring an additional 22,704 shares during the period. Finally, Charles Schwab Investment Management Inc. lifted its stake in shares of Murphy USA by 0.3% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 210,538 shares of the specialty retailer’s stock worth $42,100,000 after acquiring an additional 586 shares during the period. Institutional investors and hedge funds own 85.30% of the company’s stock.

Analysts Set New Price Targets

Several research firms have recently commented on MUSA. StockNews.com cut shares of Murphy USA from a “strong-buy” rating to a “buy” rating in a research note on Wednesday, February 8th. Wells Fargo & Company cut their price target on shares of Murphy USA from $350.00 to $325.00 and set an “overweight” rating for the company in a report on Friday, February 3rd. The Goldman Sachs Group increased their price target on shares of Murphy USA from $200.00 to $228.00 and gave the company a “sell” rating in a report on Wednesday, October 19th. Raymond James cut their price target on shares of Murphy USA from $335.00 to $305.00 and set an “outperform” rating for the company in a report on Friday, February 3rd. Finally, Stephens increased their price target on shares of Murphy USA from $315.00 to $355.00 and gave the company an “overweight” rating in a report on Friday, October 28th. One analyst has rated the stock with a sell rating, one has given a hold rating and four have given a buy rating to the company. Based on data from MarketBeat, Murphy USA presently has a consensus rating of “Moderate Buy” and a consensus price target of $314.60.

Murphy USA Stock Performance

NYSE:MUSA opened at $266.37 on Wednesday. The company has a current ratio of 0.85, a quick ratio of 0.48 and a debt-to-equity ratio of 2.80. The firm has a 50-day moving average price of $273.20 and a two-hundred day moving average price of $283.40. Murphy USA Inc. has a twelve month low of $164.30 and a twelve month high of $323.00. The company has a market capitalization of $6.02 billion, a P/E ratio of 9.48 and a beta of 0.83.

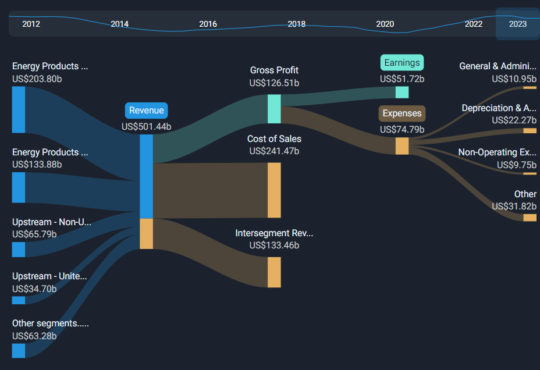

Murphy USA (NYSE:MUSA – Get Rating) last posted its earnings results on Wednesday, February 1st. The specialty retailer reported $5.21 earnings per share for the quarter, missing the consensus estimate of $6.16 by ($0.95). Murphy USA had a net margin of 2.87% and a return on equity of 90.90%. The business had revenue of $5.37 billion for the quarter, compared to analysts’ expectations of $5.40 billion. During the same quarter last year, the business posted $4.23 earnings per share. The business’s revenue was up 12.6% compared to the same quarter last year. As a group, research analysts expect that Murphy USA Inc. will post 18.85 earnings per share for the current fiscal year.

Murphy USA Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, March 1st. Shareholders of record on Tuesday, February 21st will be issued a dividend of $0.37 per share. This is an increase from Murphy USA’s previous quarterly dividend of $0.35. This represents a $1.48 annualized dividend and a yield of 0.56%. The ex-dividend date is Friday, February 17th. Murphy USA’s dividend payout ratio (DPR) is 4.98%.

About Murphy USA

Murphy USA, Inc engages in marketing motor fuel products and convenience merchandise through retail stores, namely Murphy USA and Murphy Express. It collaborates with Walmart to offer customers discounted and free items based on purchases of qualifying fuel and merchandise. The company was founded on March 1, 2013 and is headquartered in El Dorado, AR.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Murphy USA, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Murphy USA wasn’t on the list.

While Murphy USA currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.