The new tax refunds.

The new tax refunds.People who continue to work past their retirement age will have 40% of their pension income not calculated for tax purposes, up from 20% this year, the finance minister said in the Budget speech on Monday.

Clyde Caruana said this was part of a plan, first announced last year, for all pension income to be excluded for tax purposes for active pensioners within five years.

Tex refund cheques

The new tax refunds.

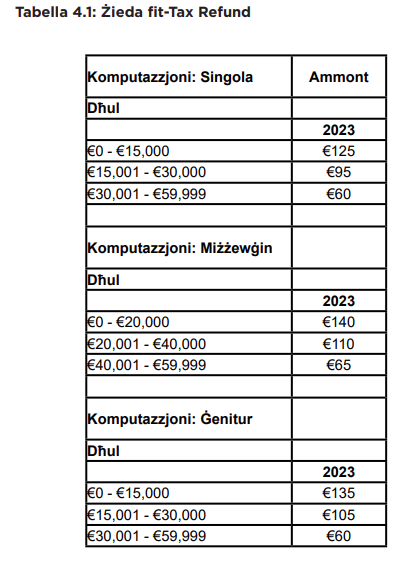

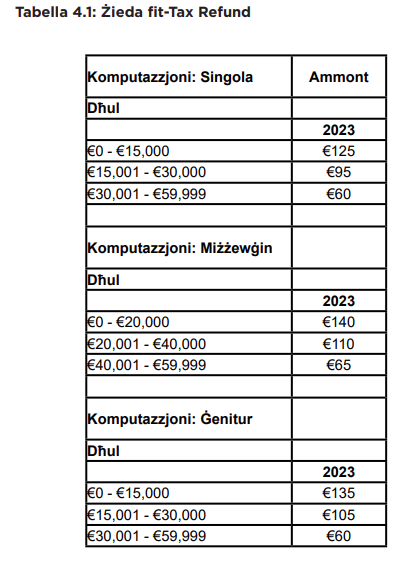

The new tax refunds.Caruana also announced that tax refunds given by the government every year will next year be between €60 and €140, with those with the lowest income receiving the highest amount.

A total of 250,000 persons will benefit from the measure, which will cost the government €26 million.

Benefit for those who work unsocial hours

The government will also improve the work benefit for workers working unsocial hours, to €150.

Lower tax on writers’ royalties

Tax on royalties received by authors and co-authors is to be halved to 7.5% to further boost this sector, the minister said,

Existing scholarship and tax credit schemes for students who wish to further their studies at masters and doctorate levels will be improved through funds from the European Social Fund.

Tax cuts for parents who send children for sports, culture events

A tax rebate for parents who send their children to sport, art or cultural activities will be increased to €300 from the current €100.

Carers’ Allowance

An allowance for parents who opt not to go to work so as to care for their adult, severely disabled children will rise from the current €500 to €4,500, which is half the minimum wage.

Parents of persons with disability will also be given a tax credit of €200 per year, per child on their expenditure on therapy.

Those who buy a vehicle modified for wheelchair users will get a 20% subsidy on the purchase price.

Independent journalism costs money. Support Times of Malta for the price of a coffee.