PapaBear/iStock via Getty Images

Introduction

It’s time to talk about my favorite North American steel stock. Cleveland-Cliffs (NYSE:CLF) is off to a terrific start of the year as its stock price is flying at a time of weakening economic growth. In addition to its impressive business turnaround, the company benefits from…

- Chinese economic reopening, triggering buying in iron ore, steel, and related commodities.

- A weakening dollar in anticipation of a more dovish Federal Reserve.

- The ongoing energy crisis in Europe, lowering competing supply.

- The energy transition, resulting in accelerated steel demand growth.

This article will discuss all of this and assess the risk/reward as the CLF ticker is on the verge of breaking out to my price target of $33.

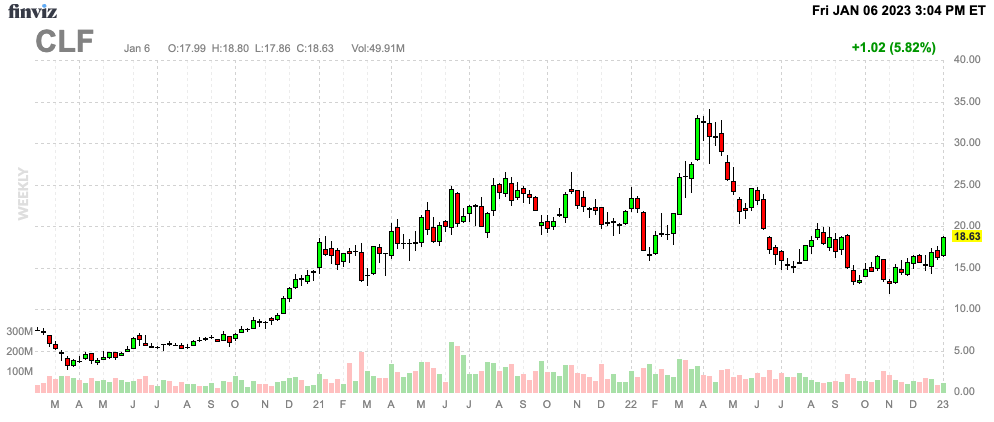

FINVIZ

So, let’s get to it!

The New And Improved CLF

I mention this in almost all of my CLF articles, but the company is simply one of the most fascinating companies on my radar. This steel giant and its many long-term investors have been through a lot over the past few decades – both good and bad things.

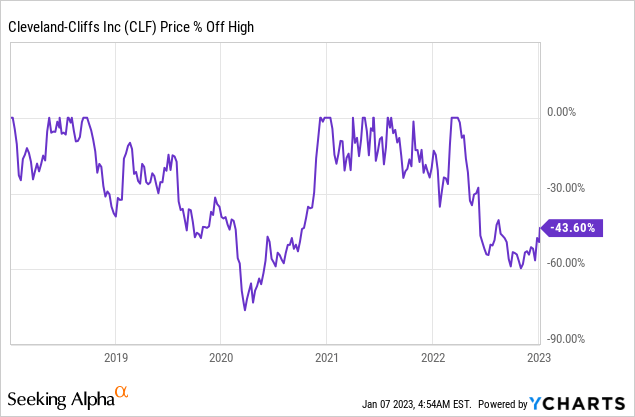

In the past two decades, the stock has been through a 3,900% stock price surge before the Great Financial Crisis, two stock price surges close to 600%, and one of almost 900% after the pandemic bottom of 2020. However, the company has also sold off roughly 99% between the Great Financial Peak and the 2016 commodity bottom.

In the past five years alone, the stock has been through two 60% drawdowns. The most recent happened last year.

Now, the stock is surging again after going nowhere since early 2021. Essentially, the company has gotten rid of most of the panic buyers who bought too late in 2020 and 2021 after being convinced that CLF is the biggest investment opportunity on the market.

Don’t get me wrong, CLF is awesome, but the sentiment was way too good back in late 2020/early 2021.

I also don’t blame people for being overly excited back in 2020/2021 as the CLF transformation is nothing short of stunning. When I started covering the stock roughly eight years ago, it was an iron ore-focused company with oil exposure. The company had high leverage and was highly dependent on commodity prices – even more than it is today. Also, I think that most of you will remember that CLF was named Cliffs Natural Resources back then.

When CEO Lourenco Goncalves took over, he had a clear vision of where he wanted to take CLF. He knew North America needed a strong steel industry for national security and trade reasons. He also knew that China’s growth miracle was slowly fading. There was no way that Chinese cities could keep up with the steel boom that started in the 1980s. Pollution wasn’t a problem the government could ignore anymore as health risks were just too high. The same goes for China’s position as a low-wage factory of the world’s cheapest steel products.

I’m not going to spend too much time discussing this, as most of you are aware of this transformation. However, it’s truly impressive what the Brazilian-born CEO has done with CLF.

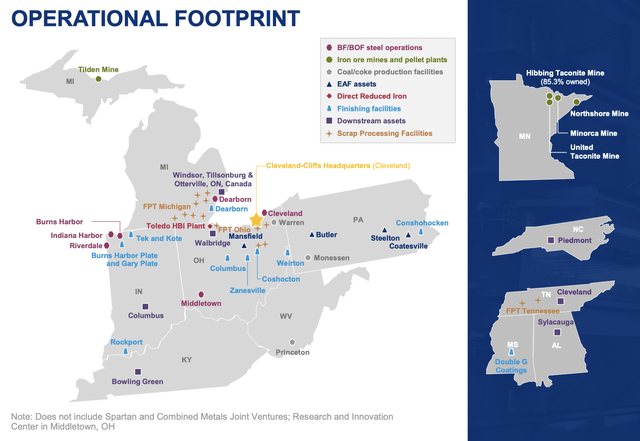

In 2019, CLF produced no steel. Now, it is North America’s largest flat-rolled steel producer after buying both AK Steel and ArcelorMittal USA in 2020.

Here are some of the benefits of the new CLF that set it apart from traditional low-margin steel producers:

- CLF’s products are highly value-added, meaning they go very far up the value chain.

- The company has industry-leading automotive exposure, selling 31% of its products directly to automotive customers.

- The company has very short and secure (low-risk) supply chains in North America, sourcing its own pellets, HBI, and prime scrap. This reduces a wide number of supply chain risks and dependence on (sometimes unreliable) foreign suppliers.

- CLF has 1.9 million tons of annual HBI capacity, used in blast furnaces, EAFs, and BOFs. CLF produces up to 27 million tons of pellets with an 85% lower carbon intensity than traditional sinter. It has long-term scrap deals with OEMs.

Cleveland-Cliffs

With that said, equally important is that this transition also comes with important financial improvements. Cleveland-Cliffs isn’t a high-risk commodity play anymore.

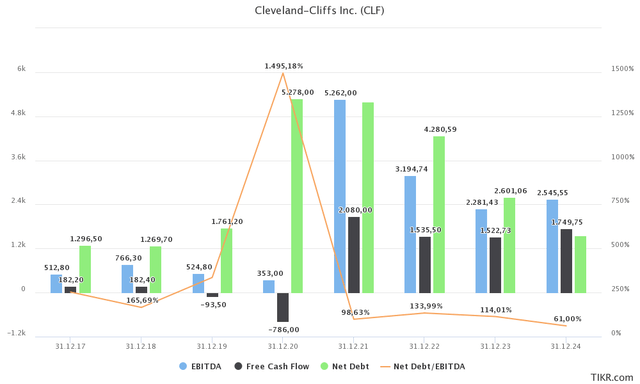

While net debt jumped from $1.8 billion in 2019 to $5.3 billion in 2020, as a result of acquisitions, the company is now in better shape than “ever” before. After all, the company paid a very fair price for both AK Steel and ArcelorMittal’s USA assets. It also resulted in high free cash flow used to buy back shares and reduce debt. The company is expected to end the 2022 calendar year with roughly $3.2 billion in net debt. That is just 1.3x EBITDA. This net leverage ratio is expected to fall to less than 1.0x EBITDA in 2024.

TIKR.com

Between 1Q21 and 3Q22, the company reduced net debt from $5.6 billion to $4.4 billion, as the number one free cash flow spending priority is debt reduction. This includes the redemption of its most expensive tranche of debt during 2Q22 when $607 million worth of 9.9% senior secured notes due in 2025 were repaid.

The company also lowered net pension and related liabilities by 63% between 4Q21 and 3Q21 and negotiated lower healthcare premiums (economies of scale).

CLF’s credit is currently rated with a BB- by Fitch. I expect that to be hiked to BBB at some point in the 2-3 years ahead (maybe earlier) to reflect structural improvements.

Valuation

Usually, this is the last part of the article. However, in this case, it’s not. It makes sense to discuss the valuation before we dive into the next part of this article.

In this case, CLF has a $13.5 billion enterprise value. This number consists of its $9.6 billion market cap, $2.6 billion in 2023E net debt, $1.0 billion in pension liabilities, and $260 million in minority interest.

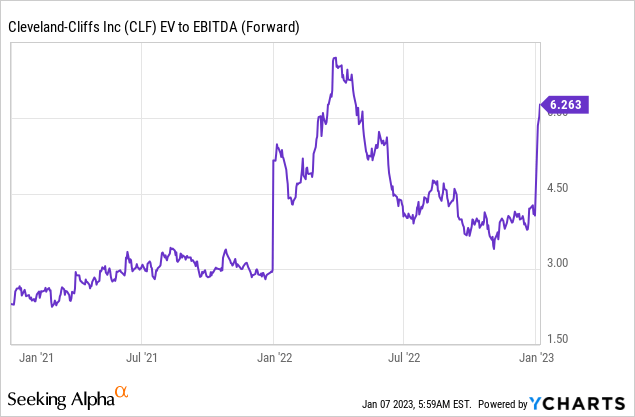

Using 2023E EBTIDA of $2.3 billion, we’re dealing with a 5.9x forward multiple. When I wrote my most recent article in October, 2023E EBITDA was $2.6 billion. That number already came down from $2.8 billion. This is the result of investors expecting the (global) economy to enter a recession this year.

Regardless of that, I believe that CLF should not trade anywhere below 7x NMT EBITDA. This would imply a $12.2 billion market cap, using current EBITDA estimates.

This implies roughly 28% upside potential from current levels. Note that the stock has also advanced more than 20% since my October article.

If we look further into the future, we can assume that the next economic upswing takes EBITDA back to $2.8 billion, while high free cash flow reduces net debt to less than $1.5 billion. In such a scenario, CLF would be valued at $33 per share, which is my longer-term target.

With that said, the reason I brought up the valuation this early in the article is that the market is allowing CLF to surge, despite weakening economic indicators.

Factors That Could Indicate A Bottom

Business Cycle Risk/Reward

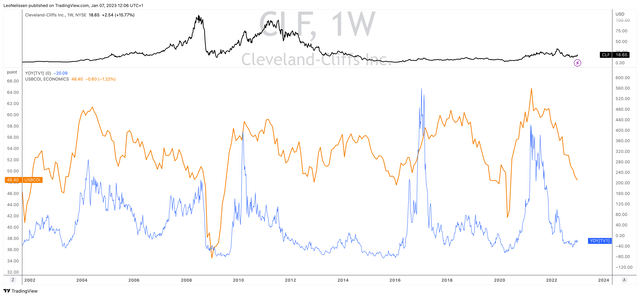

Let’s start this segment by looking at the chart below. The upper part of the chart shows the weekly CLF stock price. I made that box small as it’s not important. The lower part is more important. What we see is a comparison between the year-on-year performance of the CLF stock price and the outright ISM manufacturing index. This leading indicator has done a tremendous job indicating bottoms and peaks in cyclical investments like CLF. The only reason why the chart isn’t a perfect overlay is that CLF tends to sell off so hard during downturns and rally so much during upswings. That really messes with my layout. So, apologies for that.

TradingView (CLF, CLF Y/Y vs. ISM Index)

Anyway, the ISM index is now at 48.4, which indicates manufacturing contraction. New orders are at 45.0%, indicating a high probability of a manufacturing recession.

Wells Fargo

As the CLF versus ISM comparison chart shows, cyclical stocks become attractive once economic indicators indicate contraction. That makes sense as the risk/reward is simply better at that point. At high prices in times of high sentiment, a lot of good news has been priced in. Hence, “smart” money starts to sell to retail traders. These large investors start buying once the crowd starts to worry about a recession.

Now, don’t get me wrong, this isn’t a call to put all of your money in CLF. After all, uncertainty is still sky-high. We’re now in a situation where the Fed is unlikely to rescue the economy as it is still fighting inflation. Especially sticky labor inflation is hard to combat, which means that no monetary stimulus should be expected as we head into the next phase of this economic slowing cycle.

It’s also the reason why I have not yet deployed my larger-than-usual cash reserves to buy cyclical stocks.

That said, the risk/reward is getting better.

Weakening Dollar

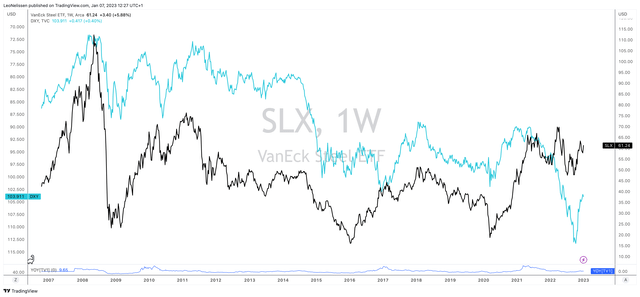

After all, the market is starting to price in that the Federal Reserve will be forced to pivot later this year. The chart below shows the inverted dollar index (blue line) and the VanEck Vectors Steel ETF (SLX). Essentially, the market is betting that the Fed will reduce the pace at which it is draining dollars from the system. That is bearish for the dollar. Also, warm weather is easing the pressure from rising gas prices on the European and Asian economies, which is causing investors to re-assess global risks a bit.

As the graph below displays, a weakening dollar is good news as it eases pressure on commodity buyers like emerging markets, who often have dollar debt. A weakening dollar also makes dollar-denominated commodities relatively cheaper. Moreover, a weakening dollar makes it less attractive to dump cheap steel in the United States, that’s great news for domestic players!

TradingView (Inverted DXY, SLX)

But wait, there’s more good news.

China Reopening

China, the world’s largest steel producer is always key when it comes to global commodity prices. As most know by now, China is easing its draconian zero-COVID measures, which it has applied since the outbreak in 2020.

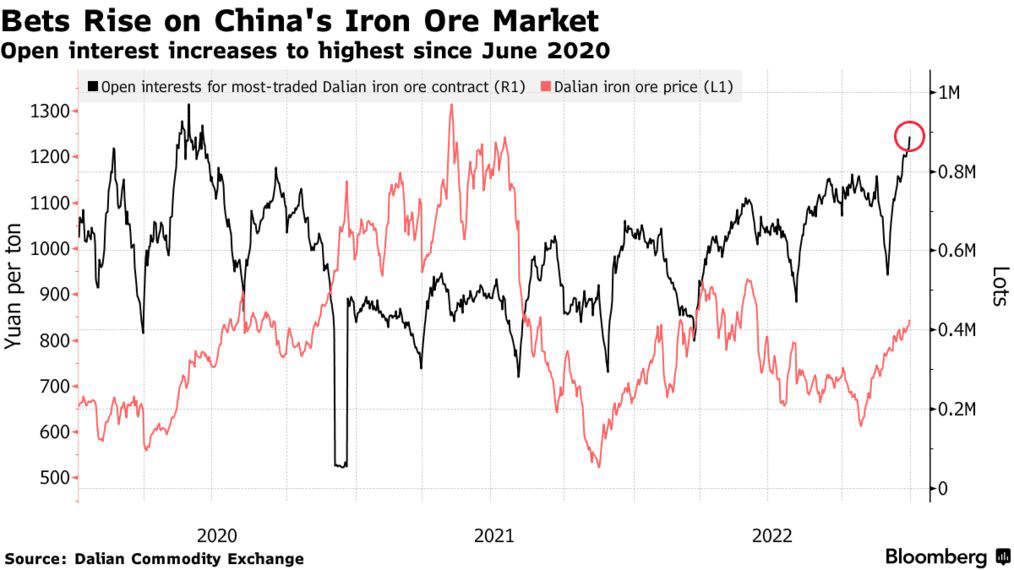

This has put a tremendous focus on the steel input product iron ore. China accounts for more than 70% of the world’s imports of that mineral.

According to commodity expert Javier Blas:

Iron ore prices reflect the health of the Chinese economy — or at least, the perception of it among international traders and local steel producers. At times, they have been ahead of the curve, as in September and October when prices fell sharply before a series of Covid-19 outbreaks hit the country.

Moreover (from the same article):

“Iron ore has been — and will likely continue to be — the China reopening trade,” says Max Layton, a commodity analyst at Citigroup Inc. in London.

The only reason why key commodities like oil haven’t rallied yet is that reopening an economy is a longer-term process.

Nonetheless, Dalian iron ore prices advanced 17% last month, hitting the highest levels since 2021. Moreover, open interest for iron ore contracts on the Dalian market is at a multi-year high.

Bloomberg

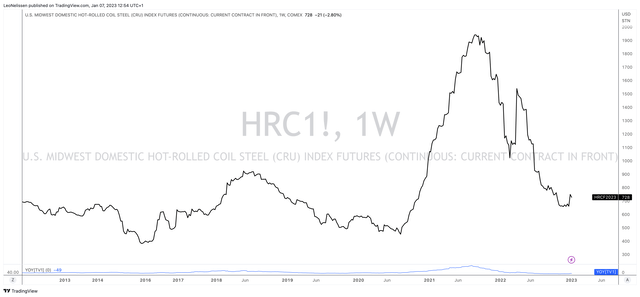

In the United States, we see that COMEX hot-rolled coil steel futures have jumped a bit to $728 per ton. $728 is still well below its peak, yet high enough to provide producers with strong revenues.

TradingView (COMEX HRC Futures)

That said, I think the recovery will be bumpy. The reopening comes with a massive wave of COVID cases as China has never achieved herd immunity. Now, it will have to prioritize spending elsewhere before it can aggressively spend on construction.

Also, I am not sure what is going on behind closed doors. Last year, China wasn’t boosting its economy to keep inflation subdued. Insiders have told me that the US and China agreed on refraining from massive stimulus to allow central banks to lower inflation. Unless that deal is off the table, I cannot imagine that China is going full ham on stimulus at a time when the Fed is struggling to control inflation.

Or, as Bloomberg put it:

“I think we will see a bumpy and gradual recovery,” said Michal Meidan, director of the China Energy Research Programme at the Oxford Institute for Energy Studies. Officials may prioritize health and social spending over infrastructure, and economic uncertainty means consumer and household spending will take time to materialize, she said.

Accelerating stimulus is something I expect to happen later this year.

Natural Gas

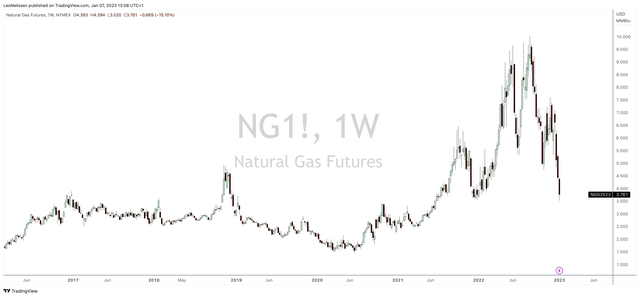

Natural gas is both a headwind and a tailwind. It’s a tailwind because lower natural gas prices lower steel production costs. NYMEX Henry Hub natural gas futures have tanked to the 2021 lows as lower economic growth and very warm weather in Europe have taken tremendous pressure off inventories overseas. Gas demand in Europe is much lower than expected, which is reducing gas prices.

TradingView (NYMEX NG)

On a side note, CLF had 50% of its production hedged in 3Q22.

This is also because it’s somewhat of a headwind as high energy prices in Europe make it harder for European steel companies to compete with the Americans. It also supports moving production to North America.

However, as I wrote in a recent Substack, I do not expect the energy situation to ease until at least 2026, which means North American producers like CLF remain in a terrific position to benefit from lost supply in Europe (and Asia), even if Henry Hub prices increase again – which I also expect to happen.

Moreover, Mr. Goncalves made the case that decarbonization efforts in Europe won’t have a major impact as the Europeans need to focus on securing basic supply first. I completely agree with that and would add that the Inflation Reduction Act in the US is another reason why production from Europe could move to North America. Here’s the Goncalves quote:

In Europe, there’s a lot of talk about decarbonization. But I think that the problem in Europe right now is currency, heating homes, find a way around the lack of gas from Russia. I think Europe right now has a lot more important fish to fry. Decarbonization will be left for the oil that can do it. At United States, we are doing and we’ll continue to do our own way.

Automotive Backlog & Energy Transition

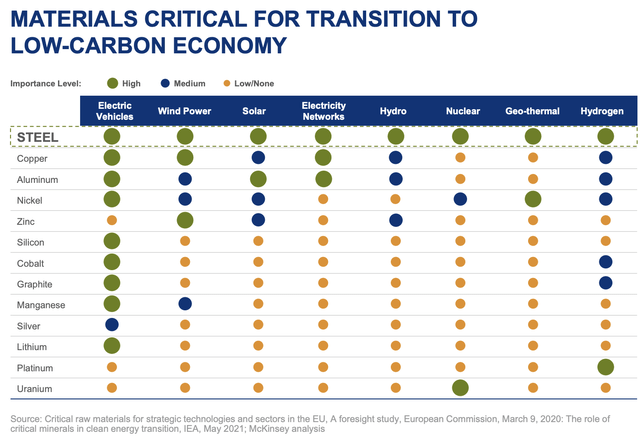

Speaking of the Inflation Reduction Act, and related efforts to push the green agenda, steel will be the center of any transition technology, as I wrote in a bullish CLF article in August.

With regard to the aforementioned transition to net-zero, steel is much more important than one might think. While there are many great ways to benefit from higher metal demand related to new energies, steel is key in every single new energy technology. To give you one example, between 66% and 80% of the weight of a wind turbine comes from steel.

Cleveland-Cliffs

This bull case also includes a wild card, which I already briefly mentioned: pollution in China.

Allow me to quote myself again (August article):

[…] the Chinese steel industry emits 2.5 billion tons of CO2 per year. The US steel industry emits 90 million tons. None of these sentences include a typo. While I am not going to bet any money on China enforcing strict environmental rules, we only need a very small shift in its willingness (or ability) to dump cheap steel overseas to get a much bigger bull case for American steel companies.

What To Make Of All of This (Takeaway)

We’re living in very strange times. A lot of macroeconomic developments make it tricky to predict where we’re headed. After all, this isn’t a “regular” economic growth slowing trend, as it’s impacted by supply issues, energy prices, politics, the war in Ukraine, and many other factors.

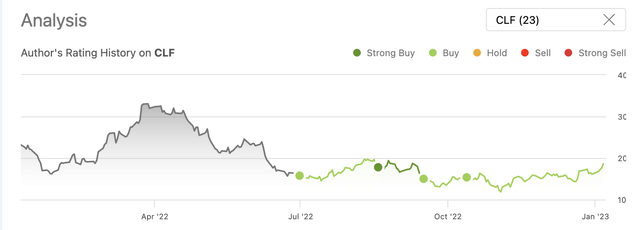

With that said, I became bullish on CLF during the summer of 2022. Since then, I have written four bullish articles, excluding this one.

Seeking Alpha (Leo Nelissen’s CLF Coverage)

I continue to be bullish. My fair value price target is $33, based on the company’s turnaround, earnings power, and healthy balance sheet. Moreover, the company benefits from:

- High odds of a longer-term decline in the dollar

- The energy transition

- Decarbonization in both Europe and Asia (including China)

- The expected automotive production rebound once demand rebounds

However, I do not expect the stock price to get to $33 without some drama and steep drawdowns. I still believe that the stock market will make another attempt to fall to the lower 3,000 points range (S&P 500). While CLF will likely keep outperforming the market, investors need to be aware that more weakness is highly likely.

Once economic growth indicators bottom – I expect that to happen in the second half of this year – we’re likely in for a rapid move higher.

(Dis)agree? Let me know in the comments!