Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

There’s no getting around it: a large percentage of working adults are unprepared for retirement.

Many Americans used to be able to rely on employer pensions to cover their retirement expenses, but pensions are increasingly rare as employers utilize less expensive alternatives. According to the Federal Reserve, just 22% of non-retired adults had access to a pension as of 2021, the last year for which data is available.

But what is a pension, and why is it so advantageous to have one?

What Is a Pension?

A pension is a benefit that some employers provide to their employees. If an employer offers a pension, they commit to making contributions to fund payments to their employees in retirement.

Defined Benefit Plans

A traditional pension is what’s known as a defined benefit plan. As their name suggests, these plans provide retired employees with a specified, or “defined,” monthly benefit that is guaranteed for life. For example, a defined benefit plan may guarantee $500 per month once an employee retires.

A defined benefit plan is very different from a defined contribution plan, which is an increasingly popular benefit offered by employers.

Defined Contribution Plans

Defined contribution plans don’t guarantee specific payment amounts in retirement. Instead, the contributions—or payments into the plan—are specified. In addition to a worker’s contributions, the employer usually contributes to the retirement plan, such as a 401(k), typically matching employee contributions up to a certain percentage of their salary.

For example, an employer might match 100% of an employee’s contributions up to 5% of their salary. When the employee retires, they can make withdrawals from their retirement plan.

How Do Pensions Work?

For defined benefit plans, the employer commits to making payments during the employee’s retirement. The payment amount varies depending on factors such as how long the employee worked for the employer and the employee’s salary.

Usually, the salary is your average annual pay during your last three or five years of work, or else your three or five highest paid years of work.

However many years it is based on, though, the average annual pay is known as your final average salary, also called final average compensation.

The pension payment amount is fixed, and it’s established using a plan formula. For example, a company may pay a pension at a rate—called the multiplier—such as 1.5% of the employee’s final average salary.

How to Calculate Your Pension

Let’s say you worked for an employer for 10 years. During the five highest-paying years of your career with that employer, you earned:

Based on those five years, your average salary is $93,200. Multiply that number by 1.5%—if that’s the plan’s multiplier—and your years of total employment to get your pension amount.

1.5% (Plan Multiplier) x $93,200 (Final Average Salary) x 10 (Years of Employment) = $13,980

In this example, the pension’s guaranteed income amount would be $13,980 per year or $1,165 per month.

In general, employees need to be vested—meaning they have to work for an employer for a certain number of years—before they are eligible for the full pension amount. For example, an employer may require employees to work for five years before they are fully vested in the pension plan.

Are Pensions Regulated?

Defined benefit plans are protected by the Employee Retirement Income Security Act of 1974 (ERISA). This is a federal law that sets minimum standards for private companies’ retirement plans, requires plans to provide participants with plan information and sets accountability standards for pension fiduciaries.

What does this mean for you? Employers that offer defined benefit plans must follow strict regulations to ensure that they will pay out the promised pension amount to you.

Advantages of Pensions

- The employer takes on the risk: With a pension, the employer manages the investment fund or hires a professional money manager to do so. Because they guarantee the payments, the employer or its manager does research and chooses the best investments, so the employee doesn’t have to worry about diversifying their portfolios or buying or selling securities.

- They provide guaranteed income: If you have a traditional pension, you are guaranteed fixed payments for the remainder of your life. Knowing exactly how much money to expect can help you plan and budget for the future.

- They’re funded by the employer: Although some defined benefit plans allow the employee to make contributions, the employer is required to contribute money. Even if you don’t put in a single dollar, your employer must meet the plan’s minimum contributions.

Drawbacks of Pensions

- They may not provide enough income: Although pensions are a valuable benefit, they are unlikely to be enough to cover all of your expenses in retirement. The median annual pension amount for retirees 65 and older was just $10,606 in 2022, so even if you have a pension, you will likely need to have other sources of income in retirement to be financially secure.

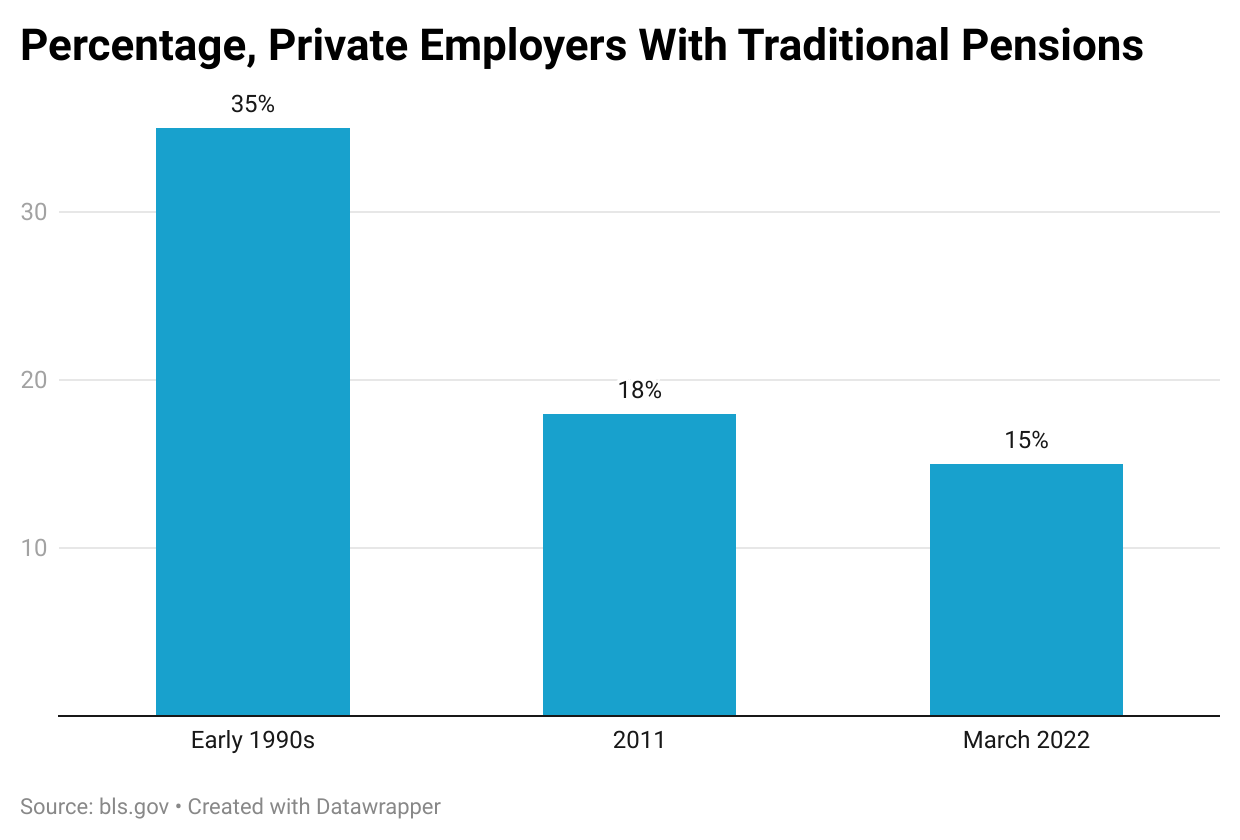

- Traditional pensions are increasingly rare: Fewer companies have pensions today than in past decades. The percentage of private employers that offered traditional pensions fell from 35% in the early 1990s to 18% in 2011 and to 15% in 2022, according to the Bureau of Labor Statistics. On the other hand, about 86% of government workers have access to a pension. So, especially in a private business, finding an employer that provides this benefit can be challenging.

- Payments may end when the employee passes away: Unless your employer offers a joint or survivorship benefit, the pension payments end when the retiree passes away. If you have a spouse or children who depend on that pension income, losing that payment can be a significant hardship.

- You may lose the pension if you leave: With pensions, you usually have to stay with the employer for several years before the money is vested. You may lose some or all of that money if you leave before the vesting period.

Why The Shift From Pensions?

Previously, pensions were much more common. Over the past 30 years, however, the number of private employers offering pensions has dropped from 35% to only 15%.

Employers have increasingly turned to defined contribution plans, such as 401(k) accounts, rather than pensions. For example, 43% of workers participated in a 401(k) or other defined contribution plan in 2013. However, as of 2021, that number reached 55%.

Why the shift? Employers are turning to defined contribution plans over traditional pensions because they shoulder less of the risk and cost. Defined benefit plans can be more expensive, so transitioning to a defined contribution plan is often a cost-saving measure.

Pension Alternatives

If you don’t have access to a pension, you can use the following options to save for retirement:

Employer-Sponsored Retirement Plans

Many employers offer defined contribution plans, such as 401(k) or 403(b) accounts. With these plans, you can put some of your pre-tax earnings toward your retirement and invest it in a range of securities, including index funds.

Some employers will match your contributions up to a percentage of your salary, so contributing enough money to qualify for the full match will help boost your savings.

Looking For A Financial Advisor?

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

Looking For A Financial Advisor?

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

Individual Retirement Account (IRA)

If you don’t have access to an employer-sponsored retirement plan—or if you want to save even more money—you can open an IRA. There are several forms, but the most common are traditional IRAs and Roth IRAs.

If you contribute to an IRA in 2023, you can save up to $6,500 per year in your account ($7,500 if you’re 50 or older).

Not sure if your retirement savings are on track? Use the Forbes Advisor retirement calculator to see where you are based on your current age, savings and contributions.