Chickens have come home to roost across the industry. In Europe alone, $400bn was wiped off the value of tech companies in 2022, according to Atomico.

Irrational exuberance wasn’t restricted to private markets. The insanity that was “meme stocks” made a return yet again over summer as small time traders with more money than sense bid up the share prices of businesses like Bed Bath & Beyond and GameStop in the US.

Buying stocks in this manner is more akin to gambling than investing. All they have to show for it now are losses.

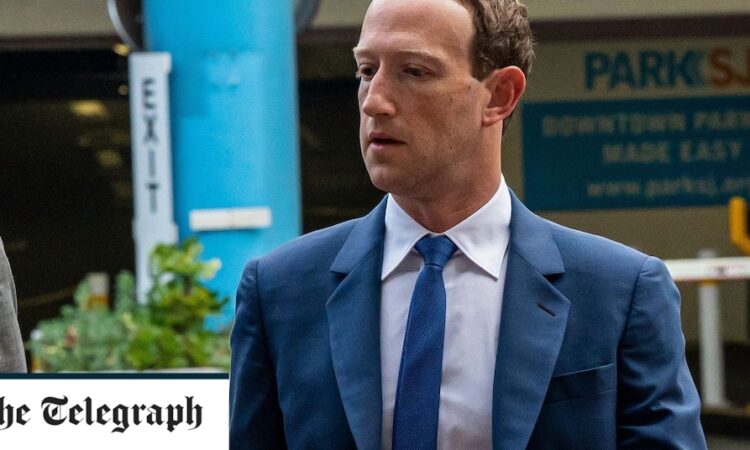

The biggest folly of them all was Mark Zuckerberg’s bizarre attempt to make the metaverse a reality. Zuck has blown tens of billions on this vanity project with precious little to show for it, tanking Meta’s stock price in the process.

These are not simply cautionary tales – it affects us all. Many retirement funds will have exposure to these self-imposed share price immolations, whether directly or indirectly.

Take Tesla: Elon Musk’s electric car business joined the S&P 500 in December 2020. By October 2021, with the free money bonanza well under way, its market value hit an eye-watering $1trn – far ahead of where it should have been.

Today, it is worth only around $355bn. Partly that is a product of Musk’s costly distraction by Twitter, but mostly it is a bubble popping. The mania is over.

Retirement funds will have been exposed to this historic rout, as many will have an S&P 500 tracker fund in their portfolios. Some may have bought Tesla directly or backed fund managers who did.

Low yields over the previous decade have pushed many pension funds – usually the most conservative of investors – to put ever greater sums into venture capital and other more high-risk investments in a desperate hunt for returns. Poor judgement makes us all poorer in the long run.

Thankfully, investors have seen the error of their ways. Rising interest rates have put a stop to all this madness by giving money some actual worth. Cash is now largely flowing to more productive ideas rather than marginal consumer tech ventures.