The Bank of England stepped in and pledged to pump up to £65bn into the market to stop a crash. Without action, pension funds holding vast sums on behalf of retired people across the country would have collapsed.

Jon Cunliffe, the Bank’s deputy governor for financial stability, said pension schemes were at risk of going bust and this would have rippled through to other areas of the financial system. It could have triggered an “excessive and sudden” drop in lending into the real economy, akin to the credit crunch that his after 2008. In short, it could have been a disaster.

The pension fund squeeze was a near miss but there are signs of stress elsewhere in the system.

Many property funds have been forced to put limits on how much people can withdraw in recent months as investors try to cash out. A rush to the exit could spark a fire sale of property assets and push prices down across the sector. That would ultimately lead to losses for those invested in the sector.

Most property funds invest in commercial assets, such as offices and shopping centres, but a snarl-up in the mortgage market is also threatening the housing market. Mortgage deals have been pulled at record rates and interest on deals that are still available has shot up. Some analysts are now predicting a 15pc crash in prices next year.

Stepping out of the shadows

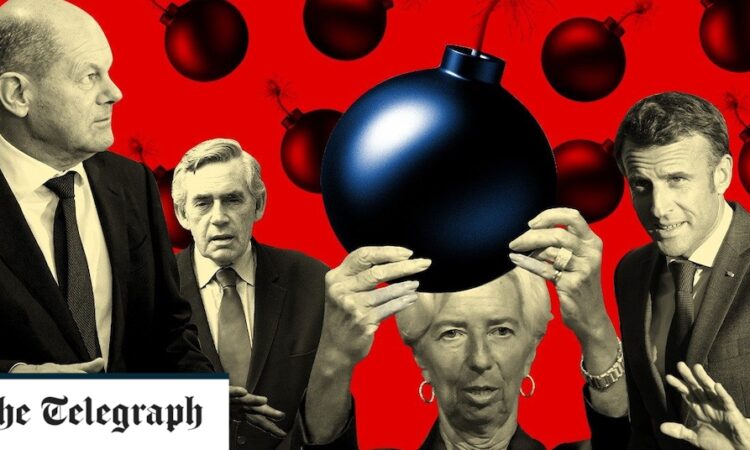

These could be the first knockings in a much larger crisis that could richocted across Europe and the world. Former Prime Minister Gordon Brown issued a public warning last week when he said there would be “grave” difficulties for companies as interest rates rise.

He singled out the “shadow banking” sector as the one most likely to trigger a meltdown.

Shadow banking is the term coined to describe non-bank financial institutions that sit outside the heavy glare of regulators in the post-financial crisis era. The sector covers everything from money payment cards to private equity and non-traditional lenders.

The sector has grown rapidly in size and scope since the financial crisis.

Shadow banks now account for almost 50pc of the global financial sector, according to the UN, up from 42pc in 2008. These lenders controlled $226.6 trillion of global financial assets out of a total of just over $468.7 trillion by 2021.

Non-banks wrote two-thirds of all US mortgages in 2020 and made almost as many loans to businesses as mainstream banks.

Gary Greenwood, a banking analyst at London stockbroker Shore Capital, says: “The risk has basically moved from the banking system to the shadow banking system, so all these other deep pots of money just sitting in asset managers’ and private equity funds are carrying a lot of the risk now. That’s where I would expect the bombs to go off now.”

Because these businesses operate under light touch regulation, the risks are less well understood. The shadow banking industry “poses systemic and financial stability risks in advanced and developing countries alike,” a recent report from the UN warned.

“Despite some efforts to contain and regulate parts of non-bank finance, over the past decade, the global shadow banking sector has expanded in size, geography and diversity,” it said.

Mr Brown told the BBC last week: “I would be worried about shadow banking – that’s the non-bank financial sector in this country.

“And I would be very careful if I was the Bank of England and make sure that the supervision of that part of the economy is tightened up.

“I do fear that as inflation hits, and interest rates rise, there will be a number of companies and organisations that will be in grave difficulty.

“I do think there’s got to be eternal vigilance about what has happened to the shadow banking sector. And I do fear there could be further crises to come.”

Huw Pill, chief economist at the Bank of England, admitted in a recent speech that policy makers had not done enough to combat the danger posed by the rise of an unregulated area of lending.

“While much effort has been made to deepen our understanding of and ability to respond to market dislocation since the global financial crisis, the emergence of these problems suggests the Bank and wider central banking community still have some work to do in throwing light on and building resilience in some of the shadow-ier parts of the non-bank financial sector,” he said.

Eyes on Europe

The recent upheaval in pension funds has prompted a search for where the next weak spot may be.

Lord O’Neill, a former Goldman Sachs economist who served in the Treasury under David Cameron, says: “The big banks are generally much better capitalised because of the crisis that forced them to do that 14 years ago.

“But as a result of this, much of the unregulated risk-taking has shifted to asset managers, pension funds, and others. If we have fresh bouts of completely unexpected policy events, and we have inflation issues getting worse, then they will be exposed wherever they are.

“I’ve found through 40 years of working with markets that they have a recurring ability of always finding out where the problems really lie.”

The concern is that these financial products will demand another bailout from the Bank of England to stave off a rapid sale of assets that ultimately trickles down into the real economy.

Greenwood says: “There is massive complexity within the financial system, so you can think you’re not exposed to something, but then it gets you by the back door.”

Regulators will need to take “early action” if they spot new issues emerging in the coming weeks and months, says Skeoch, to stop potentially small issues snowballing into something much worse.

He says: “The issue for stability and financial stability is the way in which that failure is managed and dealt with, so the collateral damage is minimised.

“At the moment I think we will have something which is manageable, as long as there’s early, clear-cut action and a joining up between the Government and the Bank. That should avert a real stress to the financial system.”

He adds: “I think what you are seeing is the result of the risk being pushed elsewhere in the system. I wouldn’t be surprised to see some funds or some smaller institutions failing in this environment.”

The banking sector is widely regarded as one of the safer parts of the financial system after years of tighter regulation aimed at preventing a re-run of the global financial crisis.

But the market ructions of the last few weeks show investors remain concerned about some high-profile institutions.

Skoech says: “You will start to see global financial institutions coming under pressure because there are concerns about the quality of their balance sheet, and Credit Suisse seems to be in the firing line for that at the moment.”

The Swiss bank has found itself an unwanted target of speculation in recent weeks after a leaked memo from its chief executive that was meant to reassure staff inadvertently backfired. The bank’s shares tanked to new lows amid concerns that the bank will be forced to raise billions of francs to prop up its balance sheet.

Ulrich Koerner, the bank’s chief, told staff that he was conscious of the “uncertainty and speculation” about the bank, but that the lender had a “strong capital base and liquidity position”.

He insisted that employees should not be concerned by Credit Suisse’s “day-to-day stock price” and that the bank had strong finances.

The market was already jittery about the 166-year-old bank because of the litany of disasters that have befallen it in recent years.

Last year, the bank had to suspend $10bn worth of funds tied to the collapsed finance firm Greensill Capital, which became the centre of a political scandal in Britain.

Greensill Capital specialised in a little-known area of lending known as supply chain finance but rose to prominence by recruiting former Prime Minister David Cameron as an adviser. Lex Greensill, who established the company in 2011, was given access to key ministers and civil servants of his powerful political connections to help build his business.

Credit Suisse was a key backer of Greensill. After the company’s collapse, the bank admitted it would have to spend $291m to recover the funds it lent through Greensill.

The bank suffered another huge loss from the collapse of a US investment office of a wealthy ex-hedge fund trader.

Archegos Capital blew up spectacularly last year after bets it had made on stocks using borrowed money went wrong. The collapse triggered losses across some of the biggest investment banks in the world.

However, Credit Suisse bore the brunt, swallowing a $5.5bn loss. It was forced to go cap in hand to shareholders to raise $2bn.

The missteps come on top of other costly fiascos such as a £350m fine over the so-called “tunabonds” scandal, which saw the bank arrange loans for the Republic of Mozambique between 2012 and 2016 that turned out to be the subject of corruption.

The bank was also rocked by an embarrassing corporate spying scandal that ultimately led to the exit of the bank’s then chief executive Tidjane Thiam in 2020.

Credit Suisse has issued profit warnings in five of the last six quarters and many senior bankers have left. Shortly before he departed in July Credit Suisse, former chief executive Thomas Gottstein admitted that the string of recent scandals had left the bank “bleeding”.

Credit Suisse’s problems largely came before the global economy began to decline but as the famed investor Warren Buffett famously said: “Only when the tide goes out do you discover who’s been swimming naked.”

Higher interest rates and the looming threat of recessions have brutally exposed the problems at the bank and made the job of repairing it even harder.

Shares have fallen by nearly 60pc so far this year as investors fret about its financial position.