Charles Stanley’s Rob Morgan shares his top tips for building a strong financial grounding in the most important stage of your investment journey.

People moving into their 30s enter an important part of their investment life that many advisers refer to as the ‘accumulation stage’.

The personal lives of people at this age can differ greatly, but it is essential they make a plan for their long-term future, according to Rob Morgan, chief analyst at Charles Stanley.

“Regardless of whether you’re a homeowner or renter, married with children or single and partying in Ibiza, your 30s is also the time to begin building lasting wealth once some important foundations are in place,” he said.

That is why Morgan provided five priorities people in their 30s need to address to make the most of these crucial years. Before anything else, they first need to make sure they have a stash of cash to fall back on in an emergency.

Unexpected costs can fly out of nowhere, so having a surplus of cash saved up to cover them is important to have. Morgan suggested holding enough savings of three to six months expenditure, but those with more responsibilities might want to consider having a bit more backed up.

“That is often referred to as a rule of thumb, though if you now have kids to support, you’ll ideally want more to cover you if life takes an unexpectedly bad turn,” he said.

Once they have a solid foundation of cash, it is essential for people to set goals and work towards them.

Morgan said people in their 30s should establish what they want to save for and divide them up into long- and short-term savings pots.

Short-term goals are often aimed towards things that people want to achieve within the next five years, such as buying a new car or making a house deposit, so lower-risk options such as a savings account might be most efficient.

However, longer-term goals such as saving for retirement or education fees will likely come into play far beyond the next five years, so taking more risk by investing could work best.

Morgan added: “Unlike cash, riskier assets do not offer security of capital but, over the long term, they tend to do better and therefore they build wealth more effectively.”

Morgan’s next essential tip is to start investing as early as possible. Investing can seem intimidating at first, especially if savers experience an early fall in the market, but it is much more likely to generate a far greater return than cash.

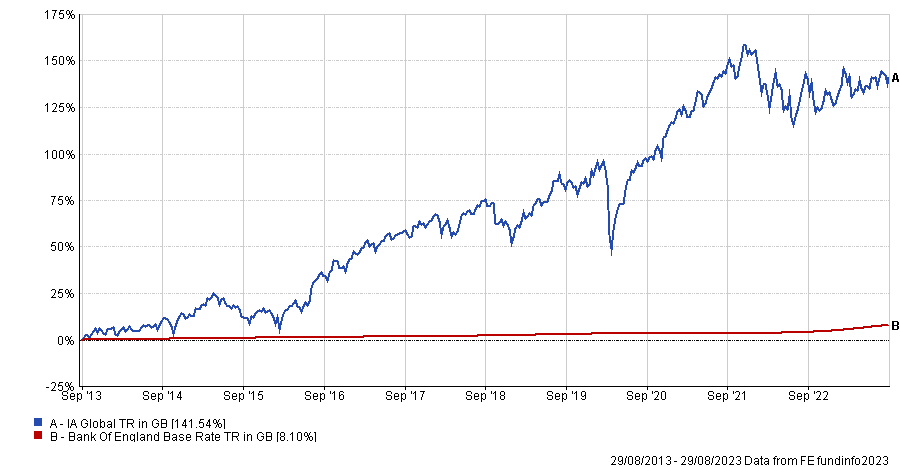

Take the most popular sector for example – IA Global was far more volatile than a cash savings account over the past decade, but its 141.5% increase over that period was much better than the incremental gains from the interest on savings accounts.

Total return of the IA Global sector vs UK interest rates over the past decade

Source: FE Analytics

Morgan said: “The realistic way to invest money in your 30s is little but often, and don’t underestimate the power of regular investing in meeting your goals. Even if you can only save a small amount each month, it will all add up.

“Time is the other critical factor. The earlier you start saving, the more time your money has to grow – thanks in part to the powerful effect of compounding.”

It is also important for people in their 30s to put some thought towards their eventual retirement and get their pension on track.

An employer will match the amount that an employee puts into their pension so people should “take advantage of free money,” according to Morgan.

People can also get a sizable boost from pension tax relief which many people in their 30s tend to ignore.

Morgan said: “It’s sad that so many aren’t aware of pension tax relief, the substantial boost to the payments you make into your pension. Almost everyone includes a comfortable retirement as one of their financial goals so countless people are missing out.”

Under the policy, higher rate taxpayer can claim back up to 20% via their tax return, reducing the overall cost of their pension contributions.

“That’s a huge boost to your money right away, and an uplift that would otherwise only come with lots of risk or plenty of time in the market,” Morgan added.

Lastly, Morgan told people in their 30s to get their insurance in check to protect them and their family’s future.

People can overlook policies such as life insurance and critical illness cover because they are automatically included as part of their employer’s benefits package, but it is important to go through the details carefully and understand exactly how they work in different circumstances.

“If you don’t have them through work these insurance policies might seem like a monthly expense you could do without, especially when there’s still lots of fun to be had in your social life and travel plans,” Morgan added. “But provided you are healthy they can often be very cost effective and give you peace of mind.”