Pensioners could be set for an unprecedented boost to their income worth double inflation figures made possible by potential savings on benefits, a former minister has predicted.

With a week to go before the Autumn Statement, ministers are still wavering over whether to award give pensioners full uprating based on wage growth or shave nearly a £1bn off the cost of the triple lock increase by tweaking the data.

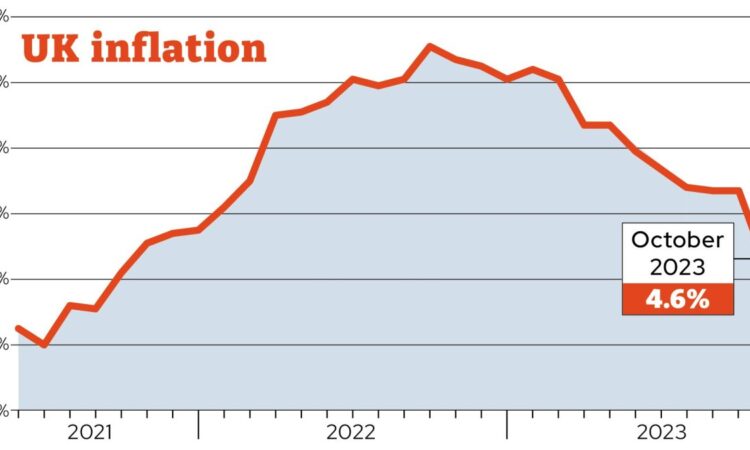

Government insiders said the fall in inflation, announced on Wedneday, could see the Jeremy Hunt offer a lower benefit uprating but would not impact his decision as to whether to give pensioners the full increase.

And experts suggested the drop in inflation now could inadvertently allow the Chancellor to offer the full uprating because it eases off financial pressure elsewhere.

Forecasts indicate that a full pension uprating – in line with wage growth – would see a rise in April that would amount to double the projected inflation.

Increasing the pension in line with with earnings in April 2024 would, based on Office for National Statistics figures of pay growth between May and July 2023, result in a rise of 8.5 per cent.

This is the highest figure on record outside of the coronavirus pandemic and, according to Bank of England forecasts, would see a rise worth at least double that of inflation for spring next year.

Liz Emerson, CEO of the Intergenerational Foundation, told i this would be a “massive inter-generational unfairness on the young who will have to work for less money for longer and take less while propping up older people”.

Government sources said a decision had not been taken as to whether the full earnings figure will be used – with both options still on the table – and added that the Chancellor would make the call based on what’s affordable.

But they said benefits could see a smaller-than-expected uprating next year as ministers factor in falling inflation, which would give the Chancellor more headroom to spend money on pension uprating or, indeed, tax cuts.

And lower inflation could give Mr Hunt the opportunity to argue that with prices falling, the lower rate is justified in order to save millions.

Former Lib Dem coalition pensions minister Steve Webb said the lower inflation figure “may actually give the Government means to pay for the triple lock”.

He said: “These figures show inflation is 4.6 per cent and they give the Government tools to save money by uprating benefits in line with this figure, rather than September’s figure for inflation, which was far higher. They can then use this saving to comfortably pay for that overshoot on the triple lock.

“I think they will be looking very seriously at doing that. Whenever they have had a choice in recent years they have squeezed benefits and prioritised pensions, so this would be consistent with that.”

Economic adviser to the Treasury, Dr Sushil Wadhwani, suggested the figures may give the Chancellor more fiscal head room as it could bring down debt payments.

Speaking on Radio 4’s Today programme, he said: “Lower inflation is a precondition for growth in the UK economy in the sense that we need low and stable inflation, to give businesses the confidence to invest.

“In addition, higher debt interest has been cramping the amount of room that the chancellor has. So to the extent that better inflation news allows debt interest to follow it would clearly give the Chancellor more room.”

Government sources said, however, that the Office for Budget Responsibility had already accounted for lower inflation forecasts, so the figures had already been built into the calculations.

But the Liberal Democrats – the only party promising to continue with the triple lock in full past the next election – put pressure on the Government not to dilute the pension pledge.

The party’s work and pensions spokesperson, Wendy Chamberlain, told i: “The Government must keep its promise to pensioners and that means honouring the triple lock in full.

“Conservative ministers have broken their pledge on the triple lock before. It’s no wonder they can’t be trusted to make sure pensioners won’t have to choose between heating and eating once more this winter.”

Under the triple lock, pensioners receive an uplift equivalent to 2.5 per cent, inflation or wage growth, whichever is higher. This year’s wage growth of 8.5 per cent is the highest of the three measures, reaching a level of £221.20 for the full new state pension.

But that figure is inflated by a one-off payment given to many public service workers over the summer in a bid to end strike action.

The Chancellor is still considering using a figure for average earnings growth which excludes bonuses, coming in at 7.8 per cent. This would cost pensioners up to £1.45 a week, or £75 a year, while saving around £900m for the Exchequer.

A Department for Work and Pensions spokesperson said: “The Government is committed to the triple lock. As is the usual process, the Secretary of State will conduct his statutory annual review of benefits and state pensions using the most recent data available.”