Latest information on the cost of living crisis as it affects households and individuals across the UK

12 June: Plugging National Insurance Gaps Could Boost Entitlement

Thanks to a near two-year deadline extension announced today, taxpayers have until 5 April 2025 to plug gaps in their National Insurance contribution records from 2006 to 2016, potentially increasing their state pension entitlements, writes Andrew Michael.

The period 2006 and 2016 was a transitional period coinciding with the move from a previous state pension arrangement to the present one. The government originally imposed a deadline of 31 July 2023 for those looking to top-up their contributions for these years.

NICs are a means of taxing earnings and self-employed profits. Paying is a legal obligation, and those who do so also earn the right to receive certain social security benefits.

However, not everyone manages to keep up with a full set of NI payments, often because of a career break, potentially lowering the amount in benefits to which they are entitled.

This includes the amount received under the post-2016 state pension, which currently stands at £203.85 a week.

To make up for this, the government allows people to fill the gaps in their NI history by topping-up missed contributions. Making voluntary contributions can leave individuals significantly better off in retirement than not doing so.

Rates vary for different classes of NIC, payable according to employment/self-employment status. They currently stand at £3.15 per week for Class 2 NICs and £15.85 a week for Class 3.

Britons typically need at least 10 years of NICs to qualify for any kind of retirement payment at all and at least 35 years to receive the maximum state pension amount.

The government said the move means that “people have more time to properly consider whether paying voluntary contributions is right for them and ensures no one need miss out on the possibility of boosting their state pension entitlements.”

But the government added that paying voluntary contributions does not always increase state pension entitlement: “Before starting the process, eligible individuals with gaps in their NI record from April 2006 onwards should check whether they would benefit from filling those gaps”.

Alice Hayne, personal finance analyst at Bestinvest, said: “The good news is that Britons with gaps in their National Insurance record no longer need to panic about running out of time to make up a gap and receive the full pension income they are entitled to. Buying back missed years is a great way to bolster retirement income, and this window of opportunity to backdate contributions all the way to 2006 is something not to be ignored.

“The deadline extension will not only give the government time to catch up on the volume of enquiries, but also allow more taxpayers to find out if they would benefit from making up any missing years. The extra time will also give those that will gain from making up a shortfall the chance to build up funds to cover the cost, which can run into the thousands, depending on how many missing years they have on their record.”

Individuals can check their records by obtaining a state pension forecast. To check individual NI records, use the government’s personal tax account website.

7 June: Arrears And Repossessions Also On The Increase

Household budgets continue to face intense pressures, according to industry figures which show mortgage borrowing and personal savings fell in the first three months of 2023 while arrears and home repossessions increased, writes Jo Thornhill.

UK Finance’s Household Finance Review for the first quarter of the year found mortgage lending to first-time buyers and home movers fell to its lowest level since the early months of the Covid 19 pandemic in 2020.

Excluding those months during lockdown when the housing market was effectively closed, first-time buyer numbers are at their lowest since 2015.

As we reported earlier this week, the number of first-time buyers opting for a mortgage over 35 years or more (increasing the term of the loan can make it more affordable) is also at a record high, at 19%.

For the first time in 15 years, the savings held by households has contracted year on year with the total value of money on deposit in instant access accounts falling by 4% to £867 billion, compared to £905 billion at the same time last year.

Among households still able to put away cash savings, there has been a revival of longer-term savings products, such as fixed rate bonds and notice accounts. These accounts, which have been unpopular over the past decade due to low interest rates, are now showing increased popularity due to more competitive terms.

The number of borrowers getting into difficulty with their mortgage repayments rose in the first few months of the year following a rise in Q4 of 2022. There were 2,530 new cases of arrears in the first three months of 2023, up from 1,050 in the final quarter of 2022. It brings total arrears cases to 83,760.

Home repossession figures also climbed, albeit from a low base, according to UK Finance. Possessions figures had seen an expected dip in the last quarter of 2022, as the industry paused enforcement activity through the festive season. But the numbers resumed a gradual increase in the early months of this year.

There were 1,250 mortgage possessions recorded in the first three months of 2023, up from 860 in the previous quarter – but up 28% from the 960 possessions seen in the first quarter of 2022.

Eric Leenders at UK Finance, said: “We expect near term mortgage market activity to remain relatively fragile. Borrowers coming to the end of their fixed-rate deal are encouraged to seek advice from a whole-of-market broker.”

Consumer spending (on debit and credit cards), which typically sees a dip in the early months of the year, as households tighten their belts after the festive period, was predictably subdued in the first quarter of the year. But this was partly offset by higher than expected spending on travel and foreign holidays.

Overall credit card debt is up around 10% year on year.

Sarah Coles, personal finance expert at Hargreaves Lansdown, said: “Our enthusiasm for travel has held up surprisingly well. It seems as though having to stay home during the pandemic has shifted how people see their holidays – so more are classing it as an essential that they can’t do without – no matter how hard it is to afford.

“For some consumers, they are covering the extra costs with savings, perhaps build up during the pandemic.”

5 June: Electric Vehicles Boom As Diesels Slump

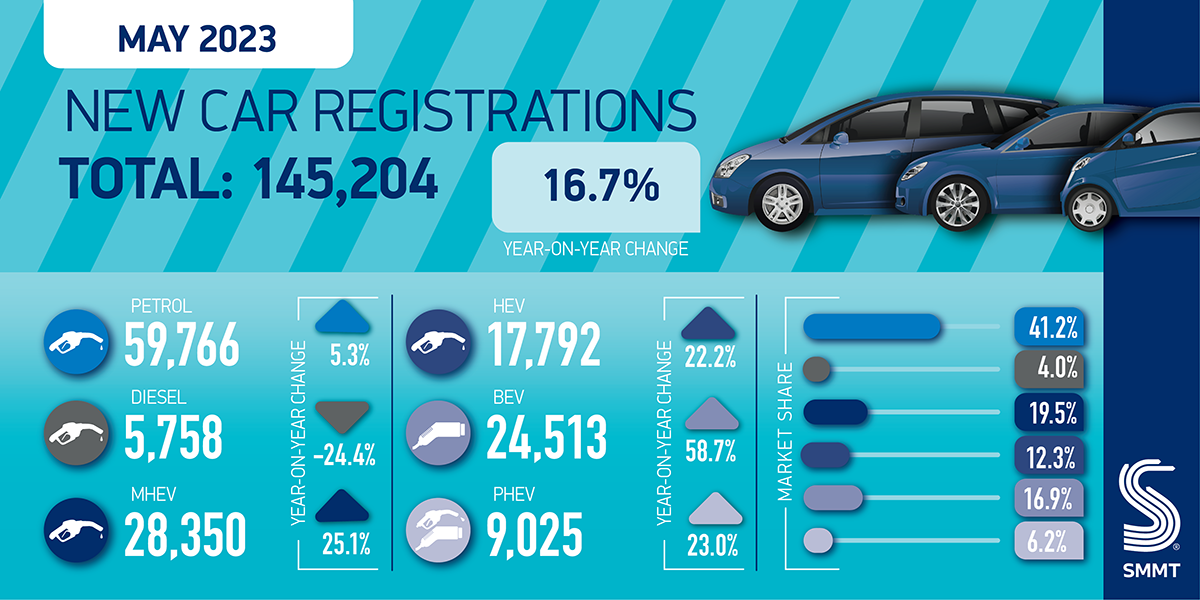

New car sales to private buyers fell in May, with fleet sales alone helping the industry achieve a tenth consecutive month of growth.

Official figures from the Society of Motor Manufacturers and Traders (SMMT) showed that May’s 65,932 private registrations marked a 0.5% drop compared to the same period last year.

Meanwhile, the month’s 76,207 new fleet registrations figure was up by more than 20,000 on May 2022.

For the month overall, there were 145,204 registrations, up by around 20,000, or 16.7%, on the same period in 2022.

While registrations improved year on year and reflected a tenth month of growth, they were lower than 2021’s numbers. In fact, discounting the pandemic-stricken May of 2020, registrations were at their lowest since 2011.

The electric vehicle market continues to grow, with Battery Electric Vehicles (BEV) registrations up nearly 60% year-on-year to account for 16.9% of all registrations in May.

Ford’s Puma once again topped the best-sellers table in May, retaining its spot as the most registered vehicle for the year so far.

Mike Hawes, SMMT chief executive, said: “After the difficult Covid-constrained supply issues of the last few years, it’s good to see the new car market maintain its upward trend.”

The figures also show a continuing decline in sales of diesel vehicles, down almost a quarter year on year to 5,758.

Hugo Griffiths, automotive expert at carwow, said “With diesel cars now making up a near trace amount of the market, holding just a 4% share, and EVs representing 17% of sales, buyers from all walks are almost unanimous that new cars should be powered by petrol engines, electric batteries and motors, or a hybrid of those two technologies.”

Manufacturer Mercedes Benz last week joined calls to delay the ‘cliff edge’ for new rules that will, from January 2024, impose 10% tariffs on electric vehicle sales into and out of Europe if more than 40% of battery components come from outside either territory.

At the opening of a cell manufacturing plant in northern France, Mercedes chief executive Ola Källenius called for the introduction of the tariffs to be pushed back to 2027.

26 May: Report Suggests Millions Miss Out On Correct Products

Customers are failing to get the financial products they need when shopping online, according to a report that says up to 13 million ‘vulnerable’ people were affected in the past year, writes Candiece Cyrus.

The market regulator, the Financial Conduct Authority (FCA), defines a vulnerable customer as one who, “due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care”.

The Vulnerability Void study from consultants Newton involved around 3,000 consumers, including at least 50 who are vulnerable because of their physical, mental or neurodegenerative conditions. These include learning difficulties, autism, poor sight and Parkinson’s disease.

The vulnerable sample also included consumers who have difficulties understanding finance or are struggling financially, and those who have experienced moments of vulnerability such as falling ill, or suffering bereavement.

The report estimates that 30 million people in the UK shopped for financial products online in the past year, and that more than 24 million are estimated to be in the ‘vulnerable’ category. Of this group, around 13 million either did not get what they needed or are unsure they did.

The research suggests that online application processes for financial products fail to account for cognitive fatigue, can ‘raise alarm instead of awareness’ about risks, and use industry jargon.

It says this leaves vulnerable customers susceptible to falling into debt, being under-insured and using products such as short-term payday loans and prepaid debit cards. These products can incorporate high fees, while the former often charge high interest rates, making it easy to spiral into debt if repayments are missed.

Vulnerable customers who applied for products such as current accounts, savings accounts and insurance were more likely to get what they needed than those who started investing or took out credit.

Over 60% of vulnerable customers who were looking to start investing were not provided with the product they needed, while 72% of those who had an overdraft approved, 60% of those who took out a loan and 45% of those who took out a credit card, also did not get the product they needed.

Meanwhile, nearly 48% of vulnerable customers who remortgaged felt they weren’t given the product they required. This increased to 67% for vulnerable customers who took out a new mortgage.

Vulnerable customers who did not get what they needed used alternative channels (such as calling the provider or going into a branch), tried another provider or ‘gave up’ trying to get a product.

The FCA is to introduce new Consumer Duty rules from 31 July which stipulate that financial services providers must avoid causing ‘foreseeable harm’, and ‘drive good outcomes’ for their customers, especially those who are vulnerable.

25 May: UK Leads Europe For Stolen Payment Data

There are more stolen payment card details on the dark web from Britain than from any other European country, selling for an average of just £4.61, according to new research.

VPN provider NordVPN says the UK came third behind the US and India for stolen payment data, after analysing six million stolen details being sold illegally on dark web marketplaces.

The VPN provider’s study showed the UK had a total of 164,143 payment card details listed online, which was nearly as many as the next two biggest European victims, Italy and France, combined.

52% of the stolen British data concerned credit cards and 37% related to debit cards. The remainder of the data came from other payment cards.

Almost two thirds (63%) of the stolen UK data also came bundled with other personal information, including addresses, phone numbers, email addresses and National Insurance numbers.

NordVPN cybersecurity expert Adrianus Warmenhoven said: “The card numbers found are just the tip of the iceberg when it comes to payment fraud. This is a crime with a huge ripple effect and the extra information being sold makes it far more dangerous, as a skilled criminal can use these to acquire more personal details.”

Selling for an average of £4.61 per record, the asking price for Brits’ data was 18% cheaper than the global average (£5.61) and half the cost of Denmark data – the most expensive data for sale – at £9.23.

Despite higher-than-average numbers of stolen data, however, UK victims are less at risk than those in other countries, according to NordVPN.

Its Card Fraud Risk Index measures how likely payment information is to be sold with additional identifying data. The UK ranked 22nd place on the index, far behind the highest risk countries: Malta, New Zealand and Australia.

Staying safe online

The VPN provider advises cardholders to protect themselves online by using strong passwords comprised of a mix of upper and lower case letters, numbers and symbols, taking advantage of two factor authentication and keeping an eye out for suspicious transactions on bank and credit card statements.

If you spot anything you can’t identify, you should contact your card issuer urgently to investigate the unusual activity.

The majority of the data examined by NordVPN was not stolen using brute force techniques – that is, via computer programs that attempt transactions guessing the thousands or even millions of possible combinations of a card number until they successfully guess the correct combination.

Instead, data was harvested in other ways such as phishing – where web users are duped into following links to fraudulent websites and sharing payment details, or malware, where a malicious program which records their online activity is unwittingly downloaded to a user’s device.

To protect against these kinds of scams, you should only make purchases from trustworthy websites – checking carefully any links that led you there and the URL displayed in the address bar to make sure you’re not looking at a lookalike or ‘spoof’ site.

Similarly, you should never download files attached to an email you weren’t expecting, or from a sender you’re unfamiliar with. The same goes with websites, which you should check are genuine and trustworthy before downloading anything.

24 May: Soaring Grocery Costs Mean Checkout Woes Continue

Food prices are continuing to rise at near-record levels, despite the fall in overall consumer price inflation announced today by the Office for National Statistics, writes Jo Thornhill.

As reported in our story, the headline rate of inflation in the year to April fell from 10.1% the previous month to 8.7%. But the rate at which grocery shopping prices are rising – 19.1% – is only marginally down from the 45-year high of 19.2% in March.

Commenting on the figures, the Chancellor, Jeremy Hunt, said food prices remained ‘worryingly high’.

While lower wholesale energy price rises are helping reduce the main inflation rate, food prices have continued to rise. Inflation for staples including bread, milk, eggs and fresh fruit and vegetables remains stubbornly high.

A basket of 10 household food items, including eggs, milk, cheese, bread, bananas, pasta and tinned fish, now costs an average of £25.60 – £5.76 more than a year ago, according to the Office for National Statistics interactive inflation tool. This represents an annual inflation rate of 29%.

Among some of the biggest annual rises in food costs (all above the 19.1% grocery inflation figure recorded today) are:

- Cucumber: 83p each (+54%)

- Granulated white sugar: £1.08 (+47%)

- Olive oil 500ml-1litre: £5.95 (+46%)

- Broccoli (per kg): £2.38 (+44%)

- Iceberg lettuce: 79p (+41%)

- Baked beans 400g-425g: £1.07 (+41%)

- Cheddar cheese (per kg): £9.42 (+39%)

- Eggs per dozen: £3.29 (+37%)

- Carrots per kg: 66p (32%)

- Self-raising flour 1.5kg: 83p (30%)

- Frozen breaded/battered white fish 400-550g: £5.20 (+30%)

- Butter 250g: £2.34 (+28%)

- White potatoes per kg: 73p (+28%)

- Small yoghurt (single pot): 84p (+26%)

- Dry pasta 500g: £1.06 (+22%)

The ONS Shopping Price Comparison Tool, below, shows how much costs of individual products have risen in the past year.

It is not just food costs that remain extremely high. While the rate of increase in prices for many non-food grocery items is below the overall CPI rate of 8.7%, many are much higher – including in particular household cleaning products and children’s clothing.

Among some of the biggest annual price rises for non-food products are over-the-counter medicines such as cold and flu drink powder sachets (23%), washing-up liquid (18%), bleach (22%) and kitchen roll (33%), plus children’s clothing including sports trainers (21%) and girls’ coats (15%).

23 May: HMRC Says Three Million Could Get Savings Boost

Up to three million people on low incomes or receiving benefits stand to gain from an extension to the government’s Help to Save scheme, confirmed today, writes Jo Thornhill.

The scheme was due to end in September this year. But HM Revenue and Customs has confirmed it will continue until April 2025. A consultation, announced in the Budget in March, is looking at ways the scheme can be reformed and improved.

Help to Save is open to those receiving benefits including working tax credit, child tax credit and universal credit. Savers can deposit funds at any time from £1 up to a maximum of £50 a month.

The savings plans last for four years, with savers receiving a 50% government bonus, with payments paid in the second and fourth years. A saver making the maximum deposit each month would save £2,400 over four years. This would attract the maximum £1,200 bonus.

Deposits can be made by debit card, standing order or bank transfer and there is no limit on withdrawals, although withdrawing funds could affect the overall bonus payment.

Around 360,000 savers have opened an account since the scheme launched in 2018. But HMRC says an additional three million people could benefit as a result of the extension if they chose to participate.

Individuals are eligible to open a Help to Save account if they are receiving:

- Working tax credit

- Child tax credit (and are entitled to working tax credit)

- Universal credit, and they (with their partner, if it is a joint claim) had a minimum take-home pay of £722.45 in their last monthly assessment period.

Even if a saver’s circumstances change after they open the account and they are no longer receiving one of the qualifying benefits, they can continue to save in the account and receive the bonus. Find out more and apply at the government’s site.

18 May: Citizens Advice Calls For More Action On Social Tariffs

A million households gave up their broadband in the last year because they couldn’t afford it, according to new research.

Citizens Advice found people claiming Universal Credit (UC) were worst hit by rising bills, and were six times more likely to give up their broadband access than non-claimants. The charity also found UC recipients were four times more likely to be behind on their broadband bills.

Inflation-linked annual price hikes have seen some telecoms providers put their existing customers’ bills up by as much as 14.4% – typically adding 3 or 4% to the current rate of the consumer price index (CPI) or retail price index (RPI) each April.

Dame Clare Moriarty at Citizens Advice said: “People are being priced out of internet access at a worrying rate. Social tariffs should be the industry’s safety net, but firms’ current approach to providing and promoting them clearly isn’t working. The people losing out as a result are the most likely to disconnect.

“The internet is now an essential part of our lives – vital to managing bills, accessing benefits and staying in touch with loved ones. As providers continue to drag their feet in making social tariffs a success, it’s clear that Ofcom needs to hold firms’ feet to the fire.”

Last month the telecoms industry regulator Ofcom said that 95% of 4.3 million eligible UK households are not signed up for a social tariff. To see a list of the social broadband tariffs currently available, click here.

In January the watchdog also reported concerns about affordability in the sector. The Ofcom Communications Affordability Tracker showed three in 10 households – roughly eight million – reported struggling to pay for their phone, broadband, pay-TV or streaming bills.

17 May: Regulator Says Almost 6 Million Brits Miss Payments

Around 5.6 million UK adults say they have missed at least three of their last six monthly bill or credit payments, writes Bethany Garner.

This represents an increase of 1.4 million compared with May 2022, according to data from the Financial Conduct Authority (FCA), the UK financial watchdog.

As living expenses continue to rise, the FCA also found that 10.9 million adults are struggling to keep up with bills and credit repayments – up from 7.8 million 12 months earlier.

Financial pressures are having a knock-on effect on mental health, with almost half UK adults (28.4 million) saying they felt more anxious in January 2023 than they did six months earlier, due to rising living costs.

With millions of individuals forced to skip monthly payments, the FCA is urging anyone struggling to afford bills or credit payments to get in touch with their provider as soon as possible.

The watchdog is also clamping down on lenders that do not offer customers appropriate support. The FCA recently told 32 lenders to change the way they treat customers, and secured £29 million in compensation for 80,000 borrowers.

Laura Suter, head of personal finance at AJ Bell, said: “While lenders are being urged to be supportive and lenient with customers, the nation faces a ticking time-bomb of defaults, whether that’s on mortgages, debt or council tax.

“Anyone struggling with repayments needs to face the issue head on. They should approach their lender to at least find out their options and weigh up which might work best for them. If they want an independent opinion they could speak to a charity such as Citizens Advice.”

16 May: Embattled Savers Withdraw £53Bn In Year To April

As the cost of living crisis drags on, almost a third of UK adults have dipped into their savings to make ends meet, collectively withdrawing more than £53 billion, writes Bethany Garner.

In the 12 months to April 2023, 29% of UK adults say they used savings to keep up with living costs, according to a study commissioned by life insurance broker LifeSearch (conducted by the Centre for Economics and Business Research (Cebr)).

The study, which surveyed 3,006 UK adults, found that 52% think they are in a worse financial position today than they were a year ago.

The study found that, in the coming months, respondents expect to become £232 worse off per month on average.

This pressure is largely down to the rising cost of everyday essentials, such as fuel and groceries. According to the Competition and Markets Authority (CMA), the increases are not solely driven by external factors.

Retail profit margins on petrol and diesel, for instance, have increased over the last four years. According to CMA analysis, average supermarket pump prices are five pence per litre higher than they would have been if average margins remained at 2019 levels.

Sarah Cardell, chief executive of the CMA, said: “Although much of the pressure on pump prices is down to global factors including Russia’s invasion of Ukraine, we have found evidence that suggests weakening retail competition is contributing to higher prices for drivers at the pumps.”

Mixed responses

While the majority of adults feel financially worse off than they did last year, 15% of respondents said they feel better off, and 33% said they feel about the same.

Adults aged 55 and over were the most likely to say they’re financially worse off, with 57% feeling worse off now than 12 months ago.

Younger adults were comparatively optimistic – just 41% of 18 to 34 year olds said they felt worse off now than this time last year, and 23% felt better off.

That’s despite the fact that this age group predicts they’ll be £367 worse off each month on average.

Nina Skero, chief executive at Cebr, said: “The latest edition of the Health, Wealth and Happiness Index shows that 2022/23 was a tough period for households. We expect pressure to persist in the coming year, especially in terms of inflation and spending power.

“Nevertheless, the outlook is somewhat rosier than was the case at the turn of the year, with consumers showing considerable resilience in the face of troublesome economic conditions.”

Dipping into savings isn’t the only action individuals are taking to make ends meet.

Over half of respondents (55%) told LifeSearch they have been using the heating less frequently to save money, while a further 25% have reduced their usage of household appliances, and 11% have delayed a large purchase, such as a car.

Adults aged 55 and over were more likely to cut back on heating than other age groups, with 62% saying they had done so in the last 12 months.

Elsewhere, 11% of adults have reviewed home and car insurance policies in search of a cheaper deal, and 25% have sold items they no longer want or need.

A significant portion of respondents – 17% – admitted to cooking fewer hot meals to cut costs, and 3% said they had turned to a food bank in the last 12 months.

Around one in three (30%) adults expect this financial strain to have a negative impact on their mental health.

Borrowing and credit

For some, however, cutting back on daily expenses isn’t enough.

Just under one in 10 adults (8%) say they have borrowed from friends and family to get by in the past 12 months, while a further 11% have taken out new unsecured credit.

Women were slightly more likely to have borrowed from friends and family, with 10% of women having taken this step versus 7% of men.

A further 5% of adults aged 34 and under said they were gambling more in a bid to increase their income.

Emma Walker at LifeSearch, said: “After the record lows we saw in the Index at the height of the pandemic, we experienced some optimism last year when we saw some green shoots of recovery as the Index rebounded.

“But that was short-lived as the cost-of-living crisis has dragged the Index back down close to pandemic levels again.”

9 May: Knock-On Effect Of Closures Will Force Prices Higher

The Federation of Small Businesses (FSB) is calling on energy firms to offer small businesses tariffs that reflect today’s wholesale energy prices, as it says hundreds of thousands of companies are trapped in fixed deals based on prices which soared in the last half of 2022, writes Candiece Cyrus.

It says failure to alleviate business expenses will feed through to higher household bills and result in business failures.

More than 700,000 small firms fixed their energy contracts between 1 July and 31 December last year, and 13% of this group (93,000) are now faced with needing to downsize, restructure or close due to not being able to keep up with their energy costs, says the FSB.

This follows a cut in government support to businesses last month, as the Energy Bill Relief Scheme was replaced with the Energy Bills Discount Scheme (see 30 March update).

The FSB says that businesses have now reverted back to paying the peak prices they were charged last year, which could be three or four times more than they paid when the Relief Scheme was in place.

Around 42% of all the firms that fixed contracts in the latter part of last year say it has been impossible for them to pass on costs to customers, who are already struggling with soaring prices.

The FSB’s data shows a large proportion of the struggling firms are from the accommodation and food sector (28%) and the wholesale and retail sector (20%).

It is calling on energy firms to automatically allow small firms the option to extend their fixed contracts at a rate between their original fixed rate and the current, lower wholesale rate.

Tina McKenzie at FSB said: “It’s disheartening to see a significant proportion of small firms could be forced to close, downsize or radically restructure their businesses just when we look to grow our economy. Our community shrank by 500,000 small businesses over the two years of COVID; we shouldn’t now be adding any more to that gruesome tally.

“The least energy suppliers should do is to allow small businesses who signed up to fixed tariffs last year to ‘blend and extend’ their energy contracts, so that their bills are closer to current market rates. We’d also like to see the Government and Ofgem support this initiative.”

May 5: Rocketing Repair Costs Adding To Cost Of Cover

The average price of a used car reached £17,843 in April, according to the Auto Trader Retail Price Index, with an inevitable knock-on effect on insurance premiums, writes Mark Hooson.

The increase in car prices equates to a near 3% jump in a year, but average prices shot up by 1.5% from March.

April marked the 37th consecutive month of year-on-year price rises, but not all vehicle types are going up in value.

Average prices of used electric vehicles (EVs) in April this year were 18.1% lower than in April 2022, at £31,517. Last month also marked the fourth consecutive month in which average EV prices fell.

Auto Trader’s Richard Walker, said: “The used car market has had a strong year so far. Rising used car values have done little to dampen demand and, based on what we’re tracking across the market, there’s no indication of it slowing significantly anytime soon.”

With car insurance premiums dictated, in part, by the value of a vehicle and the cost of parts and repairs, the rising average price of a used car is having a knock-on effect.

Data from the Association of British Insurers (ABI) in February showed average premiums were up 8% to £470 in the fourth quarter of 2022.

As part of its research, the ABI said its members – over 90% of the UK insurance industry – blamed higher paint and material costs, up by nearly 16%.

It says 40% of all repair work is affected by parts delays, and that the average price of second-hand cars increased by 19% in the year ending July 2022.

Jonathan Fong at the ABI said: “Every motorist wants the best insurance deal, especially when coping with cost of living pressures, and insurers continue to do all they can to keep motor insurance as competitively priced as possible.

“Yet, like many other sectors, insurers continue to face higher costs, such as more expensive raw materials, which are becoming increasingly challenging to absorb.”

4 May: Tariff Change Casts Shadow Over EV Manufacturing In UK

Uptake of electric vehicles (EVs) continues to gather pace as the UK approaches a ‘cliff edge’ for tariffs on vehicles sold into Europe.

The latest data from the Society of Motor Manufacturers and Traders (SMMT) represents the ninth consecutive month of growth in the new car market, with EVs now making up roughly one in six (15%) new registrations.

New vehicle sales were up 11.6% in April at around 132,000 registrations. This is the best April since 2021 but much lower than registration levels pre-pandemic. By comparison, April 2019 registrations were around 17% higher.

Battery electric vehicles (BEV) registrations were up by more than half (59.1%) in April, at 20,522 units. Plug-in hybrid vehicles (PHEVs) were up 33.3% at 8,595 registrations. Hybrid electric vehicles (HEVs) were up 7.7% to 15,026 registrations.

The SMMT has revised its predictions upward for the quarter, anticipating higher-than-expected registrations as a result of lower pressure on supply chains. This is the first time it has done so since 2021.

‘Country of origin’ changes

Meanwhile, a forthcoming change in the UK’s trading relationship with Europe could have an impact on EV registrations unless a new agreement is reached.

As it stands under the UK-EU Trade and Cooperation Agreement (TCA), the UK can sell EVs into Europe without having to pay tariffs as long as no more than 70% of an electric battery’s components come from outside the UK. From the beginning of 2024, however, the threshold will drop to 40%.

At that point, any vehicle with a battery comprised of more than 40% imported components will attract a 10% levy when sold into Europe. This could deter manufacturers from setting up or remaining in the UK.

While the change is eight months away, fulfilling orders in time for sale in the EU next year will start well ahead of that time, creating uncertainty for manufacturers about whether the agreement can be amended in the meantime.

In February the Department for Business and Trade said: “We are aware that some members of UK and EU industry are concerned about the 2024 rules and we continue to work closely with industry to understand and mitigate the impact of external factors, such as the Covid-19 pandemic and the global semiconductor chip shortage on the production of electric vehicles and batteries.”

Hugo Griffiths, spokesperson at Carwow, said: “There are issues around sourcing EV battery components, sure, and both the EU and UK are way behind other nations’ battery-production capabilities, and this needs addressing.

“But insisting that from next year only 40%, rather than 70%, of an EV’s battery components can come from outside the UK or EU before additional trade tariffs kick in is a purely synthetic, legislative problem: it has been concocted by policymakers, so it must be solved by them on behalf of the populations they represent.”

4 May: £1.6bn Added To Household Debt

Consumers borrowed £1.6 billion in March, up from £1.3 billion 12 months ago, according to fresh data from the Bank of England, writes Jo Thornhill.

The figure is also up on the £1.5 billion reported in February, making it the six monthly increase in a row.

Borrowing in March was split between £700 million on credit cards and £900 million on other forms of consumer credit, such as car dealership finance and personal loans.

The cost of credit card borrowing edged higher, increasing by 0.18 percentage points to its highest ever level at 20.29%.

Interest rates on bank overdraft borrowing fell by 0.27 percentage points, according to the report, to stand at 21.07%. The rate on new personal loans fell by 0.36 percentage points to 7.79%.

Mortgage approvals for house purchase rose significantly in March, according to the Bank data, reaching 52,000, up from 44,100 in February. However, the figures remain subdued compared to the levels seen in March 2022, when mortgage approvals were recorded at 70,700.

Jeremy Leaf, north London estate agent and a former RICS residential chairman, said: ‘We regard mortgage approvals as a very useful indicator of future direction of travel for the housing market.

“Lending was in the doldrums, reflecting the quiet period between the mini-Budget and the end of last year, whereas the approvals figures illustrate that stabilising mortgage rates and inflation is prompting an increase in activity.”

The Bank says households withdrew £4.8 billion from banks and building societies in March. Net deposits into interest-bearing easy access accounts fell significantly, but £6.5 billion was paid into notice accounts.

In addition, during March, households deposited £3.5 billion into National Savings and Investment (NS&I) accounts. This is the highest net flow into NS&I since September 2022, when the figure was £5 billion.

3 May: Consumers Told To Assume Any Contact Is A Scam

The government announced today that all cold calls offering financial products will be banned to protect consumers from scams, writes Bethany Garner.

While cold calls relating to pensions have been banned since 2019, the new rules will apply to all financial products – including investments, insurance and cryptocurrency.

According to government estimates, fraud accounts for 40% of crime in the UK and costs individuals around £7 billion each year.

Once the new rules come into effect, consumers can automatically assume that any unsolicited calls about financial products are scams.

The new rules will also ban ‘Sim farms’ – where fraudsters send scam text messages to thousands of people at once – and prevent scammers from impersonating the phone numbers of legitimate banks and other businesses.

At the same time, a new National Fraud Squad is to be created, led by the National Crime Agency and City of London Police. The squad’s 500 members will work with the international intelligence community to identify and disrupt potential scams, the government says.

Funding to the tune of £30 million will also be funnelled into a new fraud reporting centre, which will be operating “within a year” and which will work with tech companies to make reporting online fraud easier.

Tom Selby, head of retirement policy at AJ Bell, said: “Financial scams are a scourge on society and ruin lives, so any move to protect more consumers from different types of fraud is extremely welcome.”

“For this cold-calling crackdown to work we need two things: tightly worded legislation, to ensure nefarious contacts are specifically targeted, and a legitimate threat of enforcement where someone breaks the new rules.

“The plans also need to go hand-in-hand with greater responsibility being taken by internet giants like Google for paid-for scam adverts, something which the Online Safety Bill can hopefully bring into UK legislation.”

While these plans are widely welcomed, the government has faced criticism for not acting sooner.

Rocio Concha at consumer group Which? said: “The fight against fraud has progressed far too slowly in recent years and in particular more action is needed to guarantee that big tech platforms take serious action against fraud.”

Mr Selby also warns consumers to remain vigilant: “It is vital, regardless of what the government does, that Brits keep their wits about them and are cautious when they are contacted out of the blue by someone they don’t know about their finances.”

2 May: Spring Discounts Barely Dent Annual Price Increases

The soaring cost of shop prices appears to have peaked but food is continuing to get more expensive, according to figures out today from the British Retail Consortium (BRC), writes Laura Howard.

It says annual shop price inflation slowed to 8.8% in April, edging down from 8.9% in March. But shop-bought food costs continued to climb in April, with annual inflation for this category rising to 15.7% from 15% in March.

The cost of fresh food and ambient food, which can be stored at room temperature, continued to accelerate in the 12 months to April by 17.8% and 12.9% respectively (17% and 12.5% in March).

The BRC said cost pressures throughout the supply chain, more expensive ready meals due to higher packaging costs and the high price of coffee beans were primary drivers behind the food prices rise.

Experts say the overall shop price plateau is due to heavy ‘Spring discounts’ in the clothing, footwear and furniture sectors.

Non-food inflation fell to 5.5% in April, down from 5.9% in March. While the figure remains elevated, it is below the three-month average rate of 5.6%, said the BRC. Inflation for other food categories is above the three-month average.

Helen Dickinson, chief executive of the BRC, said: “We should start to see food prices come down in the coming months as the cuts to wholesale prices and other cost pressures filter through.”

The official UK inflation figure, as measured by the Office for National Statistics’ Consumer Price Index (CPI), eased from 10.4% to 10.1% in the year to March 2023, but is still more than five times the Bank of England’s target of 2%.

14 April: Drivers Obliged To Concentrate As If Driving Normally

Ford has become the first car manufacturer to offer hands-free driving in Europe with the introduction of ‘BlueCruise’ technology in its 2023 Ford Mustang Mach-E electric vehicles (EVs), writes Candiece Cyrus.

With the vast majority of road traffic accidents deemed to be the result of human error, it is hoped the introduction of increasingly sophisticated autonomous vehicles will improve safety statistics, which in turn may result in a general reduction in car insurance premiums.

Drivers of the Ford Mustang Mach-E model, which costs from £50,830, can use what the manufacturer calls ‘hands-off, eyes-on’ technology. It has been government-approved for driving on 2,300 miles (3,700km) of motorways in England, Scotland and Wales, which have been designated as ‘Blue Zones’.

The first 90 days’ use of BlueCruise is included with the purchase of the vehicle. After this, drivers can subscribe to use it for £17.99 a month.

The ‘Level 2 hands-free advanced driver assistance system’ builds on Level 1 cruise control technology, which is available as standard in an increasing number of cars and sets a vehicle’s accelerator at a specific speed, allowing the driver to take their foot off the pedal.

There are six levels of driving autonomy in total. Level 0 provides no automation, while Level 3, the step beyond this Ford initiative, provides conditional automation, which includes features such as a traffic jam chauffeur.

Level 4, high automation, includes vehicles where a wheel and pedals are not installed, such as a driverless taxi, while Level 5, full automation, offers the same features as Level 4, but everywhere and in all conditions. Both 4 and 5 do not require any form of manual driving.

BlueCruise uses cameras and radars to monitor the environment, including traffic, road markings, speed signs and the position and speed of other vehicles, to allow drivers to take their hands off the steering wheel.

An infrared driver-facing camera is also used to check the driver’s attentiveness, by monitoring their gaze, even when wearing sunglasses, as well as the position of their head.

If the system detects a lapse in the driver’s attention, it will display warning messages. This is followed by audible alerts, activation of the brakes and finally slowing the vehicle down while controlling steering. Similar actions will take place if the driver does not place their hands on the steering wheel on leaving a Blue Zone.

Ford has already introduced the technology in its own–branded and luxury Lincoln-branded vehicles, in the US and Canada, where it has been used across 64 million miles (102 million km), during an 18-month period. During this time, there have been no reported linked incidents or accidents, according to Ford.

The firm intends to roll out the technology across other European countries and other Ford vehicles.

Jesse Norman, transport minister, said: “The latest advanced driver assistance systems make driving smoother and easier, but they can also help make roads safer by reducing scope for driver error.”

The introduction of hands-free technology in driving is part of the larger goal of ultimately producing fully autonomous vehicles. It is thought that such technology could reduce the number of accidents on the roads and in turn car insurance costs, with the potential to save up to 1,500 lives a year. Currently, nine out of 10 accidents on the road are a result of human error.

However, car insurance is still a necessity even when driving a car that uses automated driving technology. It can cover theft of the vehicle, as well as accidents where the driver or the automated system is at fault.

Drivers will need to be able to take control of the vehicle if necessary. Falling asleep and crashing the car, for example, would put them at fault.

If someone is injured or their property damaged as a result of an accident with a driverless car, they could claim in the usual way against the insurer of the vehicle. The insurer then may choose to pursue its own claim against the vehicle manufacturer if it believes the autonomous driving technology is to blame.

Drivers can find a map of the Blue Zones on the Ford website.

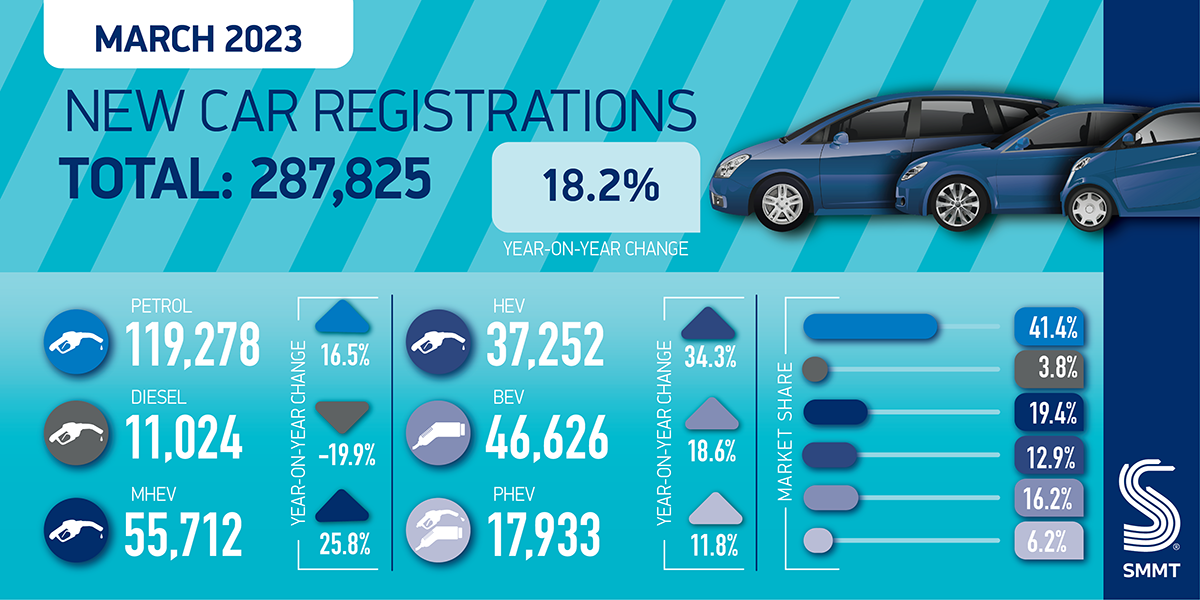

5 April: Electric Vehicle Registrations Hit Record Monthly High

The number of battery electric vehicles (BEVs) registered in the UK in March reached a record monthly high of over 46,600 – up 18.6% from around 39,300 in March last year, according to the Society of Motor Manufacturers and Traders (SMMT), writes Candiece Cyrus.

However, the overall BEV market share remained almost the same as last year at a little over 16%.

Overall, new car registrations rose year-on-year by 18.2% last month – the highest level recorded by the SMMT in a ‘new plate month’ since before the pandemic. Year-related registration plates are released in March and September.

As supply chain issues eased coming out of the pandemic, March marked the eighth consecutive month of growth in the car market, with almost 288,000 units delivered compared to around 243,400 last year. The first three months of 2023 were the strongest for the market since 2019, with just under 500,000 new cars registered.

Plug-in hybrid (PHEV) registrations rose by 11.8%, from just over 16,000 registrations last year to almost 18,000 this year. Plug-in registrations overall – the total of BEV and PHEV registrations – comprised 22.4% of the market – a slight fall on last year.

This follows the closure of the government’s plug-in car grant scheme in June last year.

Hybrid (HEV) registrations fared better, rising by 34.3% from around 27,700 last year to around 37,200 this year – its largest year-on-year growth – helping electric vehicles account for more than 33.3% of car registrations last month.

Hybrids use both battery and internal combustion engine powertrains.

Year-to-date in 2023, BEVs accounted for over 76,000 sales compared to over 64,100 in the period between January and March 2022, showing growth of 18.8%. PHEVs accounted for over 31,700 sales, and HEVs over 65,800 sales, seeing growth of 6.7% and 36.9% respectively compared to January and March last year.

The Tesla Model Y – a BEV – was the most popular car model in March, with 8,123 sold, followed by the Nissan Juke (7,532) and the Nissan Qashqai (6,755).

With the publication of the government’s consultation on a Zero Emission Vehicle Mandate last week, the SMMT said: “The market will have to move more rapidly to battery electric and other zero tailpipe emission cars and vans.

“Models are coming to market in greater numbers, but consumers will only make the switch if they have the confidence they can charge whenever and wherever they need.

“Success of the mandate, therefore, will be dependent not just on product availability but on infrastructure providers investing in the public charging network across the UK.”

Mike Hawes, the SMMT’s chief executive, said: “March’s new plate month usually sets the tone for the year so this performance will give the industry and consumers greater confidence.

“With eight consecutive months of growth, the automotive industry is recovering, bucking wider trends and supporting economic growth. The best month ever for zero emission vehicles is reflective of increased consumer choice and improved availability but if EV market ambitions – and regulation – are to be met, infrastructure investment must catch up.

28 March: Fruit And Vegetables Drive Soaring Food Costs

Rocketing food and drink prices have pushed shop price inflation to a record high, according to figures from the British Retail Consortium (BRC), writes Jo Thornhill.

Annual food inflation was recorded at 15% in March – up from 14.5% in February. It is the highest level seen since the BRC started collecting the data for its Shop Price Index in 2005.

The index is a measure of the cost of 500 of the most commonly bought items – including food, drink and non food goods, such as clothing and electrical appliances.

Non-food price inflation rose from 5.3% to 5.7% for the same period and overall shop price inflation rose to 8.9% – up from 8.4% in February and marking a record high.

The steepest price rises were seen in fresh foods, such as fruit and vegetables, driven by shortages and supply issues. Inflation for prices of fresh food rose 0.7 percentage points in March to 17%.

Helen Dickinson OBE, chief executive at the British Retail Consortium, said: “Shop price inflation has yet to peak. As Easter approaches, the rising cost of sugar coupled with high manufacturing costs left some customers with a sour taste, as price rises for chocolate, sweets and fizzy drinks increased in March.

“Fruit and vegetable prices also rose as poor harvests in Europe and North Africa worsened availability, and imports became more expensive due to the weakening pound. Some sweeter deals were available in non-food, as retailers offered discounts on home entertainment goods and electrical appliances.

“Food price rises will likely ease in the coming months, particularly as we enter the UK growing season, but wider inflation is expected to remain high.”

It follows the shock rise in inflation recorded by the Office for National Statistics (ONS) earlier this month. Experts were expecting the rate to start easing downwards. But the Consumer Price Index (CPI) rose to 10.4% in the 12 months February – up from 10.1% in the previous month.

The ONS said the price of food and non-alcoholic drinks rose at their fastest rate in 45 years over this period, with the largest contributor to the increases being fresh vegetables.

Laura Suter, head of personal finance at AJ Bell, said: “Food costs keep going up and up, much to the dismay of the British public, who had hoped the bill at the checkout would have dropped by now.

“We’re still seeing the impact of high energy prices and the war in Ukraine coming through into food prices, as well as more specific supply issues, like the shortage of salad items or eggs recently. All of these are pushing up costs, particularly for a lot of staple items. It now looks like we’re going to have a more expensive Easter, as sugar prices have pushed up the cost of Easter treats.”

Ms Suter added that those hit hardest are low income families, who spend more of their overall income on food.

27 March: 95% See Real-Terms Pay Cut Over 12 Months

Almost half of households (47%) say they are concerned about paying their mortgage or rent in the coming year, according to new data from financial services provider Legal & General, writes Jo Thornhill.

The findings, from its Rebuilding Britain Index survey of 20,000 households, also show that 95% have experienced a real-terms pay cut over the last 12 months due to soaring inflation.

The lowest income groups – those with a household annual income of less than £20,000 – are most likely to feel that their quality of life is declining at 29%, compared to 13% in the highest income households.

More than half of respondents to the survey said they had reduced day-to-day expenditure in response to rising inflation and costs. And 51% said they expect their spending to have to decrease even further over the next 12 months.

Inflation, which was recorded at 10.4% last week (an increase from 10.1% in January), is widening the gap between the wealthiest and poorest households, according to L&G’s survey. It found that one in five households have experienced a decline in income, with lower income communities hit the hardest.

As part of the survey L&G asked respondents what long-term solutions might best tackle the cost of living crisis, with investment in energy-efficient homes and offices (59%) and the creation of higher wage employment (52%) proving the most popular.

24 March: Four-In-10 Use Cards To Bridge Gap To Payday

New research from Nationwide Building Society has revealed that almost four-in-10 (38%) consumers have used credit cards in the last six months to tide them over until payday or benefits payment, writes Laura Howard.

The poll of more than 2,000 people across the country also revealed that almost two thirds (63%) are worried about the state of their personal finances and their ability to cover essential costs. However, the figure is down from the 70% reported last month.

Supermarket groceries (29%), eating and drinking out (14%), fuel/electric car charging (13%), utilities (12%) and holidays and travel (11%) were the main spending areas being plugged by credit cards.

Nationwide’s Spending Report, published alongside the research which collects data from 208 million debit card, credit card and direct debit transactions, showed that essential spending was 12% higher in February than 12 months before, at £3.97 billion.

Nationwide defines essential spending as utility bills, supermarkets, credit card repayments and childcare costs.

Non-essential spending, which includes holidays, eating out and subscriptions, was up by 9% year-on-year at a total of £2.75 billion.

TV subscriptions are the first cost to be culled, with nearly a quarter (23%) of people reporting they have already reduced or cancelled TV subscriptions, with a further 14% considering doing so.

Mark Nalder at Nationwide said: “Despite rising costs, households are clearly looking to strike the balance between being fiscally responsible and still being able to spend money on themselves.

“However, our research shows that, while the number of people worried about their finances has fallen slightly, there are people relying on credit as a way of bridging the gap for essential bills.”

Rising living costs are showing no signs of abating, with the latest annual inflation rate in the year to February at 10.4% – up from 10.1% in January and higher than the 9.9% many analysts had been predicting.

Yesterday the Bank of England also raised interest rates from 4% to 4.25%, potentially affecting the cost of mortgages and other consumer borrowing.

15 March: Chancellor Says Inflation To Be 2.9% By Year-End

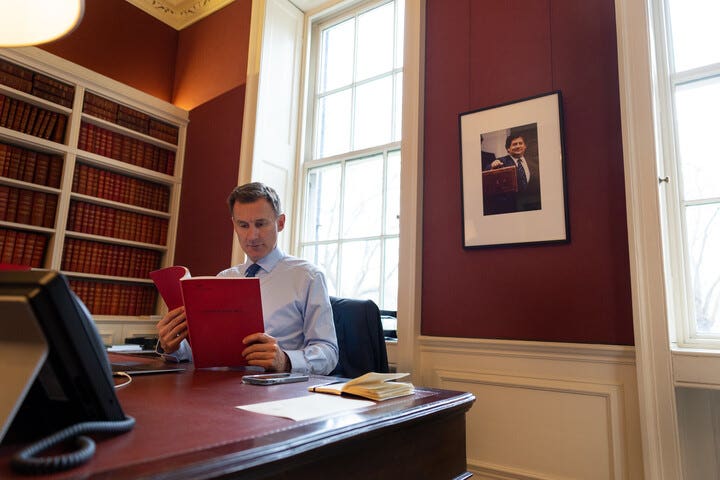

Today’s Budget offered a buoyant assessment of the UK economy’s prospects while acknowledging the financial distress being suffered by millions of households in the cost of living crisis.

The Chancellor, Jeremy Hunt MP, says UK inflation will fall from its present level of 10.1% to 2.9% by the end of the year. He also said that the UK will avoid falling into a technical recession in 2023.

He said the government has spent £94 billion in providing cost-of-living support – the equivalent of £3,300 for every household.

He announced sweeping reforms to pensions and extended the provision of subsidised and government-funded childcare for parents looking to enter the workplace or increase their employment hours.

The Energy Price Guarantee, which was due to rise from £2,500 to £3,000 on 1 April, will remain at its current level until the end of June, and the price differential which makes prepayment meters more expensive than credit meters will be removed.

This will save average consumption prepayment customers around £45 a year when it comes into effect later this year.

The UK’s nuclear industry will be expanded, with the aim of reaching 25% of electricity production being nuclear by 2050.

There was no announcement of increased support for commercial energy users beyond the Energy Bills Discount Scheme, which runs from

Mr Hunt announced a series of corporation tax reliefs to reward businesses that invest in their operations, and unveiled proposals for 12 investment zones across the UK. There will also be significant investment in the artificial intelligence sector.

Here’s a look at the main points from the Budget.

Energy bills

The Energy Price Guarantee (EPG) will be kept at an average of £2,500 until the end of June. It was scheduled to rise to £3,000 on 1 April.

Mr Hunt also said that the so-called prepayment premium is to be eliminated, meaning prepayment customers will effectively be charged on the same terms as those with credit meters. At present they pay more because of the higher cost of running prepayment infrastructure.

The EPG will remain in operation while it remains lower than the price cap operated by Ofgem, the market regulator. The cap, which is reviewed quarterly, rose to £4,279 in Janaury and will be set at £3,280 on 1 April.

However, the cap is forecast to fall to £2,013 in July, at which point suppliers will be required to offer tariffs that conform with the cap, rather than the EPG.

If wholesale prices continue to fall, we may see the re-emergence of competition between suppliers, with keenly priced tariffs being used to encourage customers to switch between firms – a market phenomenon that hasn’t functioned for 18 months.

The EPG will remain in place until the end of March 2024, rising to £3,000 on 1 July. It will come into play once more if the Ofgem cap rises above this figure due to increases in wholesale prices.

Industry analyst Cornwall Insight predicts it will reach £2,002 in the fourth quarter of 2023.

Childcare

A scheme offering 30 hours of free childcare for working families with three and four year-olds is being expanded to cover those with children aged 9 months and older.

The Chancellor hopes to boost the economy with the expansion of the scheme in England by encouraging more parents and caregivers into work. Equivalent expansion in Wales, Scotland and Northern Ireland is expected to follow.

The 30 hours’ free childcare scheme was introduced in September 2017, covering registered nurseries, childminders and nannies, registered after-school clubs and play schemes and home care workers from a registered home care agency.

Both parents (or a child’s sole parent) must work at least an average of 16 hours per week on the National Living Wage to qualify for the support, leaving some low-income families (for example, where one parent is in full-time education) ineligible.

To support families struggling to access the offer because of the initial outlay, the government will pay upfront childcare costs of up to £951 for one child and £1,630 for two.

Critics say the funding won’t fully cover providers’ costs, that there already aren’t enough nursery places available to meet demand, and that expansion could create safety issues by forcing providers to relax the ratio of carers per child.

In his speech, Mr Hunt said providers would be permitted to increase the ratio of carers to children from 1:4 to 1:5.

The expanded free childcare offer will be rolled out gradually from April 2024, starting with 15 hours’ free childcare for two-year-olds, followed by 15 hours for children aged 9 months to three years in September 2024.

All under 5’s will be eligible for 30 hours’ free childcare by September 2025.

Welfare

Universal Credit (UC) claimants will have to work more hours each week in order to avoid having to meet with Department of Work and Pensions (DWP) ‘Work Coaches’.

The Administrative Earnings Threshold (AET), which reflects the minimum a claimant is expected to earn from work in order to keep receiving UC, is being increased.

Previously, the threshold for individuals was set at £617 for individuals and at £988 for couples. These thresholds were the equivalent of a single person working 15 hours per week at National Living Wage (NLW) or 24 hours for a couple.

The new thresholds are equivalent to 18 hours at NLW for a single person. Claimants who fail to make up the hours will risk having their UC payments cut.

Elsewhere, the Chancellor also announced reforms to disability benefits with Universal Support – a voluntary scheme in England and Wales to help people with disabilities find work worth £4,000 per person.

Fuel duty

Drivers will be pleased to hear that the 5p-per-litre fuel duty discount, introduced in March 2022, will remain in place for a further 12 months.

This discount will save motorists around £100 a year, the Chancellor said.

A further £200 million will also be made available for pot-hole repairs in 2024, in addition to the current budget of £500 million.

Kevin Pratt, Forbes Advisor UK editor, said: “Motorists will be relieved that the government is freezing fuel duty and maintaining the 5p-per-litre fuel duty cut, which was due to end next month, for another year. But they’ll also be happy to see an official acknowledgement of the shocking state of Britain’s roads, with an addition £200 million of funding to tackle the scourge of potholes.

“This is nowhere near enough – billions is needed to fix the nation’s potholes sufficiently well they they don’t simply reappear in a few weeks – but it is better than nothing.

“In many areas, driving is the equivalent of slaloming down the road trying to stay out of the worst divots, with expensive repair bills lying in wait for those who fall victim. More needs to be done to help beleaguered drivers.”

Hugo Griffiths at Carwow said: “In the grand scheme of things the Government is clearly lacking ideas in a number of key strategic areas [regarding driving].

“To name but a few: we are still being kept in the dark with regard to how fuel duty will be replaced once electric cars are mandated. There is also little clarity on how EVs will be made affordable for private buyers as we edge ever closer to 2030.

“The £200 million pothole fund is likely to be yet another sticking plaster for the country’s road network, which needs comprehensive, fundamental attention.

“All things considered, Jeremy Hunt’s Budget is thin gruel that will sustain motorists for a while, but drivers need substance and clarity that are sorely lacking.”

Pensions

The Chancellor surprised the pensions industry by significantly altering the total amount of money workers can put into their pensions before being hit with a hefty tax bill.

Mr Hunt is abolishing the pensions ‘lifetime allowance’ (LTA), which currently stands at £1,073,100, from April next year. He is raising the cap on tax-free annual pension contributions – the ‘annual allowance’ – from £40,000 to £60,000.

The Chancellor also increased the money purchase annual allowance, or MPAA, from £4,000 to £10,000. The MPAA is a special restriction on the amount you can pay into a pension and still receive tax relief.

There is no limit on the value of pension savings that can be built up by an individual, but if the LTA is exceeded, the balance is subject to a charge known as the ‘lifetime allowance charge’.

Workers who have accrued pension pots in excess of the allowance face an extra 25% levy – on top of income tax – when they take the money above that level as income, or are liable for a 55% tax charge if they withdraw money as a lump sum.

Part of the thinking behind today’s announcements is to deter workers – including well-paid hospital consultants – from reducing the hours they work or retiring early to swerve punitive taxation levels in relation to their pension arrangements.

Lily Megson of My Pension Expert, said: “Abolishing the lifetime allowance is eye-catching – but it only affects the most affluent earners. Indeed, in the year leading up to April 2020, only 42,350 breached the allowance.”

Commenting on the increase to the annual allowance, Dean Butler at Standard Life said: “Only a small number of earners will ever reach the current annual allowance of £40,000, but the benefits of today’s increase will be a particular help to those who are looking to catch up with their savings later in their careers.”

With regard to the hike in the money purchase annual allowance, Mr Butler said: “This is one of the few areas of the pension system where there was near universal agreement on the need for change.

“At a time when the government is hoping to encourage retirees back to work, this is arguably the biggest lever they could have pulled from a pensions perspective. Upping the allowance to £10,000 will provide some incentive to return.”

Alcohol and tobacco

In a bid to support bars and pubs, the Chancellor announced that draught beer and cider will continue to be taxed at a lower rate than supermarket equivalents.

The Draught Relief Scheme, introduced in 2021, cut duties on draught beer and cider by 5%. From August, the discount will increase to 9.2%.

Dubbed the “Brexit Pubs Guarantee” by the Chancellor, this measure means the alcohol duty charged on draught pints will be up to 11p lower than duties charged on supermarket beer.

From August, the duty rate for alcohol sold in supermarkets and other shops will rise 10.1%, in line with inflation.

Smokers also face a tax hike. Tobacco duty will rise by 14.7% from this evening, the Chancellor announced.

Following the increase, the price of a packet of 20 cigarettes could rise from around £15.35 to £17.65.

Crypto

From 2024/25, self assessment tax forms – which must be completed by the self-employed, high earners and those with investment income, among others – will have a separate section for capital gains made by crypto traders.

Corporation tax

The Chancellor confirmed the increase to corporation tax from 19% to 25% from April 2023, although he said only 10% of businesses, typically the largest, will pay the full rate.

While it was confirmed that the corporation tax super-deduction, which enables businesses to cut their tax bill by 25p in every £1 they invest, will end on 31 March, the Chancellor announced a new tax deduction scheme – full expensing (FE).

The FE policy will be introduced from 1 April 2023 and will run for three years until 31 March 2026. Under the new scheme businesses can immediately deduct 100% of the cost of certain capital spending from their pre-tax profits, including spending on IT equipment, plant machinery, fire alarms, vehicles and office furniture. This equates to a 25p tax saving for every £1 invested.

The first-year allowance (FYA), which was due to end on 31 March, has been extended for a further three years until March 2026 with a view to making it permanent. This allowance enables businesses to deduct 50% of the cost of plant equipment and machinery (known as special rate assets) from pre-tax profits in the year of purchase.

The combined savings to businesses of FE and the FYA are calculated at £9 billion a year.

But Martin McTague, national chair of the Federation of Small Businesses (FSB), was left unimpressed: “The distinct lack of new support in core areas proves that small firms are overlooked and undervalued. With billions being allocated to big businesses and to households, 5.5 million small businesses and the 16 million people who work for them will be wondering why the choice has been made to overlook them.

“The Chancellor stressed that the UK is one of the best places to do business – but small businesses need more ambition and more focus. Action is what counts if we are to reverse the 500,000 small businesses lost over the last two years.”

Investment zones

The government announced the creation of 12 investment zones outside London, including in the West Midlands, East Midlands, Greater Manchester, Liverpool, the North East, South Yorkshire, Teeside, West Midlands and West Yorkshire, plus at least one each in Scotland, Wales and Northern Ireland. The Chancellor said the aim of the zones was to ‘drive business investment and level up’.

The move is backed with £80 million in funding for each location over the next five years. This will be in the form of tax breaks for businesses and grant funding.

It follows the introduction of 10 freeports, created in 2021 around seaports and airports in the UK, where businesses in these regions already take advantage of tax breaks and customs incentives.

The 12 investment zones will be focused around universities and research institutions with the hope this will boost the technology sector, including artificial intelligence. Each region will have to identify a suitable location.

There was also the announcement of £400 million for levelling-up projects in 20 areas across England including Bassetlaw, Blackburn, Oldham, Redcar and Rochdale, and a further £8.8 billion over the next five years for investment in sustainable transport schemes in the regions.

14 March: Bank Of England Figures Note Decrease by Third

New mortgage lending plummeted by a third at the end of 2022, according to the Bank of England’s latest quarterly statistics, suggesting rising interest rates and the continuing cost-of-living crisis took a toll on the housing market, writes Jo Thornhill.

Between October and December, new mortgage commitments (lending agreed for the coming months) was £58.4 billion – 33.5% less than in the previous quarter when it stood at £87.8 billion, and 24.5% less than a year earlier when it was £77.3 billion.

Excluding the time around the start of the Covid-19 pandemic in 2020, this is the lowest level of new lending since 2015.

The value of mortgage balances in arrears increased by 4.6% in the final quarter of last year from £13 billion to £13.6 billion. The number was up 1.3% over 12 months when it was recorded at £13.5 billion (Q4 2021).

This is the first time there has been a rise since Q1 in 2021 – a reflection of increased financial stress among borrowers.

But arrears account for just 0.81% of total outstanding mortgage balances and remain close to the historical low of 0.78%, recorded in Q3 of 2022.

On Friday last week (10 March) the regulator, the Financial Conduct Authority, published guidance for lenders on dealing sympathetically with mortgage borrowers who are struggling.

Total outstanding mortgage debt on residential home loans was £1.67 billion at the end of Q4 2022, 3.9% higher than in the same period in 2021. The value of gross mortgage advances was £81.6 billion, which was £4.3 billion lower than the previous quarter, but 16.3% higher than in the same quarter in 2021.

Charlotte Nixon, mortgage expert at wealth management firm Quilter, said: “The period leading to up to Christmas 2022 was rife with uncertainty, and while the country is still not out of the woods, and is still suffering with the impact of higher interest rates and high inflation, the direction of travel does at least look less unpredictable.

“After the troubling days following the mini budget [in September last year, while Liz Truss was prime minister and Kwasi Kwarteng was Chancellor], mortgage rates have dropped faster than originally expected and therefore there is a chance that this will help encourage more people to the market and more people will be seeking a mortgage.

“As lenders take part in a race to encourage borrowers, we are seeing rates stabilise as banks compete for customers.”

7 March: Option To Boost State Pension Entitlement

The government is giving UK individuals three additional months to plug the gaps in their National Insurance (NI) contribution records, Andrew Michael writes.

It will extend the deadline from 5 April 2023 to 31 July 2023 for people wanting to top-up missing NI years between 2006 and 2016. This was a transitional period coinciding with the move from a former state pension arrangement to the present one.

To be eligible, you must have qualified or will qualify for the new state pension on or after 6 April 2016.

You can check your national insurance record on the government website.

NI contributions are a means of taxing earnings and self-employed profits. Paying is a legal obligation, and those who do so also earn the right to receive certain social security benefits.

Not everyone manages to keep up with a full set of NI payments, perhaps because of a career break, potentially reducing the amount in benefits to which they are entitled. This includes the amount received in state pension, currently worth £185.15 a week.

To remedy this, the government allows individuals to fill the gaps in their NI history by topping-up missed contributions. Making voluntary contributions can make individuals significantly better off in retirement than not doing so.

After income tax, NICs are the UK’s second largest tax, raising nearly £150 billion in the tax year 2021/22 – about a fifth of all the country’s annual tax revenue.

The decision to extend the deadline comes after many people reported being unable to access vital government helplines, run by the Department for Work and Pensions and HM Revenue & Customs, to receive essential advice before the original 5 April deadline.

Rates vary for different classes of NIC, payable according to employment/self-employment status, but currently stand at £3.15 per week for Class 2 and £15.85 a week for Class 3.

Victoria Atkins, financial secretary to the Treasury, said: “We’ve listened to concerned members of the public and have acted. We recognise how important state pensions are for retired individuals, which is why we are giving people more time to fill any gaps in their NI record to help bolster their entitlement.”

Alice Haine, personal finance analyst at Bestinvest, said: “Buying back missed years is a great way to bolster retirement income.

“Britons typically need at least 10 years of NI contributions to receive anything at all and at least 35 years to receive the maximum amount, which currently stands at £9,600 a year for those retiring after 6 April 2016 and which will rise to £10,600 a year from this April.”

6 March: Hybrids Lead Charge For Electric Vehicles

The number of new vehicles registered in February was 26% higher year-on-year, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT), writes Jo Groves.

There were over 74,000 new registrations, marking the seventh consecutive month of growth as supply chain issues from the pandemic continue to ease. This was significantly lower than the 132,000 new cars registered in January, as is typically the case ahead of the release of the new registration plates on 1 March.

Growth was seen across the market, with large fleets leading the charge with a 46% year-on-year increase, compared to a more modest 6% increase in private car registrations.

Looking by category, super-minis accounted for a third of all deliveries, with multi-purpose vehicles also rising in popularity. At the other end, registrations of executive and luxury saloon cars fell by 15% and 6% respectively.

The transition to electric vehicles continued, with the highest growth of 40% posted by hybrid electric vehicles, while battery electric vehicles now account for one in six new cars registered by UK households.

The SMMT expects the addition of nearly half a million hybrid and fully-electric vehicles to Britain’s roads in 2023. However, it warns of potential problems if charging infrastructure fails to keep pace with increased demand.

Mike Hawes, chief executive of SMMT, said: “After seven months of growth, it is no surprise that the UK automotive sector is facing the future with growing confidence.

“As we move into ‘new plate month’ in March, with more of the latest high-tech cars available, the upcoming Budget must deliver measures that drive this [net-zero] transition, increasing affordability and ease of charging for all.”

Hugo Griffiths, consumer editor of carwow, said: “The approach of spring really does seem to mark a time of renewal and regeneration where the UK car market is concerned, with February’s registration figures being a mere 6.5% down on pre-pandemic 2020.

“Given the maelstroms faced by the UK car industry and the economy as a whole over the last few years, we should be shouting this success from the rooftops – while keeping every available appendage crossed that this upswing continues.”

14 February: Regulation Of BNPL Sector Expected 2024

The government is consulting on regulation of the controversial buy-now-pay-later (BNPL) credit sector, which is used by an estimated 10 million people in the UK.

The proposed rules would see BNPL firms regulated by the Financial Conduct Authority (FCA), the watchdog that governs banks, insurance companies and other financial services businesses.

Two years ago, the FCA said regulation was needed to protect consumers, while last summer it warned firms about the use of misleading advertising and promotions, especially on social media.

Under the new proposals, BNPL customers would also, for the first time, be able to take complaints to the Financial Ombudsman Service (FOS).

The government says it wants to protect customers from “unconstrained borrowing” while still ensuring those who need it have access to interest-free credit.

Ahead of regulation, the FCA will monitor the market and intervene using its existing powers where it identifies consumer detriment. The government says that, as regulation approaches, currently unauthorised BNPL lenders have a strong incentive to treat customers fairly and prepare their business models shead of applying for FCA authorisation.

BNPL schemes enable people to pay for purchases in interest-free instalments over a matter of weeks, usually with no credit or affordability checks taking place. Penalties may be levied for missed or late payments.

At present, customers have no recourse to compensation or redress if something goes wrong.

Firms make money through revenue-splitting arrangements with retailers. Leading BNPL players include ClearPay, Zilch, Klarna and Affirm.

The popularity of BNPL has soared in the cost-of-living crisis, with consumers reportedly using the facility to pay for items such as groceries and utility bills, rather than so-called ‘discretionary’ spending on clothes and non-essentials.