Privacy Salaries Excel in North America Says New Annual IAPP Survey | TRU Staffing Partners, Inc.

If you are a privacy professional based in North America, we’ve got some good news about your annual salary. According to a recent webinar presented by the IAPP and TRU Staffing Partners, the new 2023 IAPP & TRU Privacy Professionals Salary Survey shows your annual earnings exceed those outside the U.S. and Canada. The webinar hosted by TRU’s Founder and CEO Jared Coseglia and IAPP Principal Researcher in Privacy Management, Saz Kanthasamy, CIPP/E, CIPM, FIP, and IAPP Research & Insights Director, Joe Jones, delivered many fascinating details about the more than 1,400 survey respondents who work in the privacy industry across 60 countries — and their financial compensation.

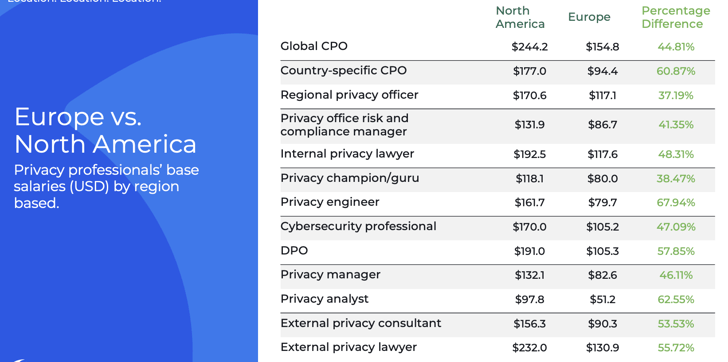

Location, Location, Location: Key Takeaways on Global Privacy Salary Data

According to Coseglia, the overall survey detail shows that compensation, especially raises and bonuses, is the key to incentivizing data privacy professionals no matter where they work.

- The overall average base salary for internal privacy pros was $146,200. When adjusted for sample distribution and currency exchanges, this represents a 7% increase from 2021 and a 10% increase from 2019 for internal privacy pros.

- The highest average base salary for an internal privacy pro continues to be the chief privacy officer, with those in a global role averaging $206,000. Externally, privacy lawyers earn the highest average base salary at $200,800.

- Nearly eight in 10 (76%) respondents received a raise in the last 12 months, while almost seven in 10 received a bonus.

- Cash comp (base salary and bonus) is still the best way for employers to retain and attract talent.

Global Privacy Salaries: Who Is Getting What Where?

However, knowing that data privacy is a global concern, and the worldwide privacy industry continues to hire and grow, it was interesting to find that, according to survey results, U.S. privacy pros make 55% more on average in their base salaries compared to their European counterparts.

The chart above shows that the greatest variation in base salary was seen among privacy engineers, with those in North America earning 103% more than their European counterparts. The second largest difference was seen among privacy analysts, with North Americans earning 91% more than their European counterparts.

Privacy Pros Worldwide Earned Additional Compensation

When looking at the types of additional compensation received by privacy professionals, the survey showed:

- Seven in 10 respondents received a bonus. This percentage rose to 73% for North America and fell to 65% in Europe and 61% for the rest of the world.

- Global location determined employer pension contributions. Generous pension contributions, greater than 7%, were only available to three in 10 in North America as opposed to the European market where this was received by almost six in 10. Some contributions, of more than 15%, were offered in Europe, but not in North America.

- Of the 23% of respondents who received long-term incentives, the majority of those recipients were based in North America, suggesting this incentivizing method is more common in the U.S. and Canadian markets.

What Motivates Global Privacy Pros?

The survey also looked at motivations to move roles by respondents’ global location. Those pros based in Africa and North America were more motivated by pay raises to find a new role, with 88% and 74% of respondents from these regions, respectively, selecting this factor in their top three. Of respondents based in Europe, 20% would move to a new role to work for a more privacy-conscious employer. Respondents in South America overwhelmingly preferred international opportunities to work as their top motivator to switch to new roles. This was the only region to do so, as pay raises were the top factor in all other markets.

And in looking at time off by region, 78% of Europeans have at least five weeks’ vacation allowance. Unlimited vacation allowances were also popular among privacy pros, particularly in North America, where this was available to 23% of respondents. When compared to the 56% of those in North America with less than four weeks of vacation time, this shows a divide between vacation allowances available in this market.