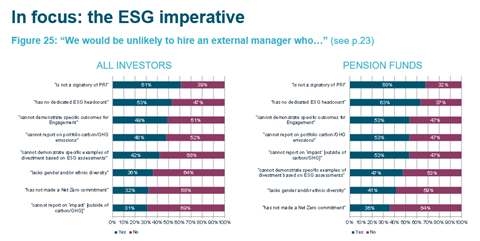

Asset managers that cannot show serious results of their engagement efforts with listed companies have a hard time winning business from pension funds, according to a new survey from consultancy bfinance.

According to a survey among 170 pension funds around the globe, 53% of participating schemes are unlikely to hire an asset manager that cannot demonstrate engagement successes.

Moreover, four in 10 funds demand asset managers to show at least one example of divestment for ESG reasons.

Impact investing

The survey also confirms the rise of impact investing as a core theme for pension funds. More than half of pension funds said they are unlikely to hire a manager that cannot report on the impact of their investments, for example on the UN Sustainable Development Goals.

This figure is considerably higher for pension funds than for other investors (insurance firms, endowments and family offices) who also participated in the survey (see chart below).

“The responses to impact-related questions are particularly compelling, given that financially-focused investors have historically found it harder to engage with this subject than with more risk-oriented ESG topics,” commented bfinance’s Kathryn Saklatvala.

“European investors are significantly more active than international counterparts, but there are considerable disparities between different European countries: we note a particular shift of sentiment in Italy, where just 22% of investors have been involved in impact investing but 44% are planning to enter the space,” she added.

European investors are also frontrunners when it comes to reducing CO2 emissions. While only 10% of US investors have official goals to reduce their carbon output, this figure rises to 37% for UK investors and 44% for Dutch investors.

Similarly, European investors are also more likely to demand a net zero commitment from their asset managers than investors in other parts of the world.

A whopping two thirds of UK investors expect such a commitment, perhaps a reflection of the COP26 climate conference having been organised in the UK, while this figure stands at just 31% on average.

Satisfied despite record losses

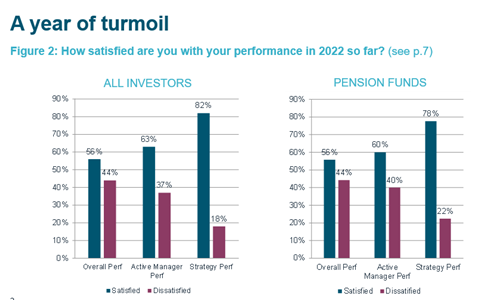

Despite having lost hundreds of billions between them, the participating pension schemes prove surprisingly satisfied about their investment results this year. Those happy with their performance outnumber those unsatisfied by 56% to 44%.

The conspicuously high satisfaction rate may have something to do with the funding position of many pension schemes having improved despite high investment losses thanks to rising interest rates, noted Saklatvala.

“Pension funds that have explicit liabilities are more likely than other asset owners to have seen a positive shift in their funded position than a negative shift,” she said.

Pension funds are even happier with the strategies they have chosen (see chart below). This likely has to do with them having increased their exposure to illiquid asset classes in recent years, something they are planning to continue to do over the next 18 months.

Unsurprisingly, pension funds are by far most satisfied with the performance of their infrastructure, private equity, private debt and non-listed real estate investments. Emerging market equities and bonds are the only two categories where net satisfaction is negative.

The general optimism about their investment performance and strategies is overshadowed, however, by worries about inflation.

As an anonymous Dutch pension fund put it: “I’m very concerned. Our pension obligations are in nominal terms, however pensioners are actually expecting a real income, which is nowhere near possible with this large inflation shock.”