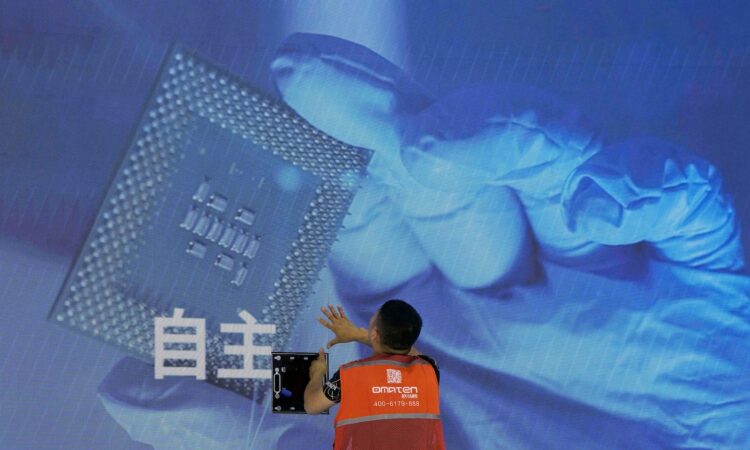

Last week, the Biden administration announced new restrictions on U.S private investment in several of China’s high-technology sectors. For years now, the U.S. government has been scrutinizing Chinese investments in the United States in areas that impinge on national security. Now Biden is expanding that scrutiny to outbound investments. His new executive order seeks to prevent U.S. firms from helping China develop artificial intelligence, quantum mechanics and semiconductor technology that would almost certainly benefit the Chinese military.

Some congressional Republicans criticized the move as too weak, noting that other sensitive areas, such as biotechnology and energy technology, were not included. Beijing decried the move as “blatant economic coercion and tech bullying” and threatened unspecified retaliation. National security adviser Jake Sullivan has described the action as an attempt to place a “high fence” around a “small yard” of critical technologies.

Biden’s move represents a compromise between his national security officials and his economic team. This is only the first step on a long path. There is already a bipartisan effort on Capitol Hill to address another huge loophole that allows the Chinese military and companies linked with it to get money from Americans. Wall Street firms are using money from U.S. investors to fund Chinese companies that are working against U.S. interests and values, and lawmakers want to push back.

“It makes no sense that we restrict the export of sensitive technologies to China but allow Wall Street to fund Chinese companies trying to overtake us in these same technologies with clear military applications,” Rep. Mike Gallagher (R-Wis.), chairman of the House select committee on the Chinese Communist Party, told me.

Biden’s executive order covered direct investment in specific industries, but it did not address U.S. investment in Chinese military-related companies by huge Wall Street index funds that guide large institutional investors, such as state pension funds and university endowments.

Through these outlets, U.S. companies provide not only money but also technical know-how to Chinese companies that are connected to the People’s Liberation Army or complicit in the Chinese government’s human rights abuses. Those avenues of investment are ripe for more transparency and restrictions, Raja Krishnamoorthi (Ill.), the top Democrat on the committee, told me.

“It’s really important we do things to make sure that we don’t end up either wittingly or unwittingly funding the military capability that could be used against us,” he said. “It doesn’t get enough attention, but it is vital.”

Wall Street index funds, for example, have been adding more Chinese companies to their rosters, including dozens that have been blacklisted by the U.S. government for their connections to the Chinese military or their complicity in Chinese government repression, according to a preliminary investigation by the China committee’s staff. Gallagher and Krishnamoorthi wrote letters last month to the leaders of BlackRock and MSCI detailing how their investment funds are underwriting problematic Chinese firms and therefore undermining U.S. national security.

For example, the Aviation Industry Corp. of China (AVIC), which produces advanced Chinese air force fighter jets; the China State Shipbuilding Corp., which produces Chinese navy warships; and CGN Power Co., which has been accused of trying to steer U.S. nuclear technology to the Chinese military, are all part of MSCI and BlackRock fund either directly or through their subsidiaries. This means they are receiving money from U.S. investors indirectly even though Americans are legally restricted from investing in them outright.

Moreover, as Chinese President Xi Jinping institutes his project of “civil-military fusion,” the distinction between these companies and the Chinese state is disappearing. That means American investment in these entities is neither safe nor accountable, because Beijing can crush or absorb these firms at any time.

“Why average American investors should be invested in those entities doesn’t make sense,” Krishnamoorthi said. “But there is a bigger issue: What is the systemic risk?”

Some will argue that restrictions on investing in China are protectionist or likely to increase economic tensions between the two superpowers. But such arguments fail to acknowledge that these actions are simply a response to protectionist policies China has had in place for a long time.

Others argue that because these Wall Street firms are engaging in technically legal activities, Congress and the government have no right to intervene. But that’s exactly backward. It’s the job of Congress and the government to respond to national security vulnerabilities and make new laws and policies to protect Americans.

“For anyone who thinks it should remain legal to allow American firms to invest dollars and contribute expertise to companies that threaten our security and undermine our values, they are in for a surprise,” Krishnamoorthi told me. “The American people don’t want that. Certainly, my constituents don’t.”