Oi! Guvnor! Why were you so soft on inflation? Bank of England head Andrew Bailey has left money markets in chaos

THE money markets are in panic and UK pension funds with trillions of pounds in their care are at risk of implosion.

Britain’s centuries-old reputation as one of the world’s safest economies risks falling into tatters.

Who’s to blame? Accusing fingers point at Liz Truss and her Chancellor Kwasi Kwarteng for last month’s shambolic mini Budget.

Some of the criticism is well-deserved, not least the new PM’s admitted failure to “prepare the ground” over the 45p tax cut.

But there is another key player in this shambolic display of top-level incompetence — not least the Bank of England, now suddenly in a lethal tug of war with Britain’s trillion-pound pension industry.

Gone berserk

Governor Andrew Bailey is at the centre of a storm, public and private, over his failure to deliver on his two major responsibilities — control over inflation and stability in the money markets.

Inflation has run out of control because he refused to raise interest rates, it is claimed. And money markets are in chaos after he cut the ground under the UK’s giant pension fund investors.

Speaking at the International Monetary Fund in Washington, he gave the industry just three days to solve a multi-billion cashflow crisis before the £65billion lifeline from the bank expires.

“You’ve got three days to get this done,” he snapped triggering chaos on the bond markets and a collapse in the value of Sterling.

“The guy has gone berserk,” said Patrick Minford, Professor of Applied Economics at Cardiff Business School.

“I am absolutely staggered.

“Andrew Bailey is in charge of the second most powerful central bank in the world, with the longest history in the money markets, and yet he is saying he cannot stop financial instability in the UK pension market.

“It is a crime against central banking and financial stability.

“Bailey is basically screwing government economic policy.”

As governor, Bailey’s contract stipulates that he must ensure inflation stays at or below two per cent or explain in writing why not.

The bank is also responsible for market stability.

Some City analysts believe Bailey, a historian, not a qualified economist, is taking revenge against ministers who privately blame him for letting inflation rip and failing to raise interest rate sooner.

This currency crisis is complex and fast moving.

But one thing is clear. The slide in the value of the Pound began well before Liz Truss became PM and before Chancellor Kwasi Kwarteng’s controversial Budget.

Stripped to its essentials, it has been caused by the bank’s complacency over the cost of living crisis and the failure of pension regulators to do their job.

Bailey has consistently played down inflation and the dangers of a wage-price death loop.

Alarm bells began to clang as far back as early 2021, when the bank’s own chief economist, Andy Haldane, called for rate hikes to cool the surge in prices.

He quit in disgust when his advice was ignored.

Inflation, sniffed Bailey, was “transitory” and unlikely to exceed four per cent.

Even when gas prices began soaring after the Russian invasion of Ukraine, the governor remained complacent.

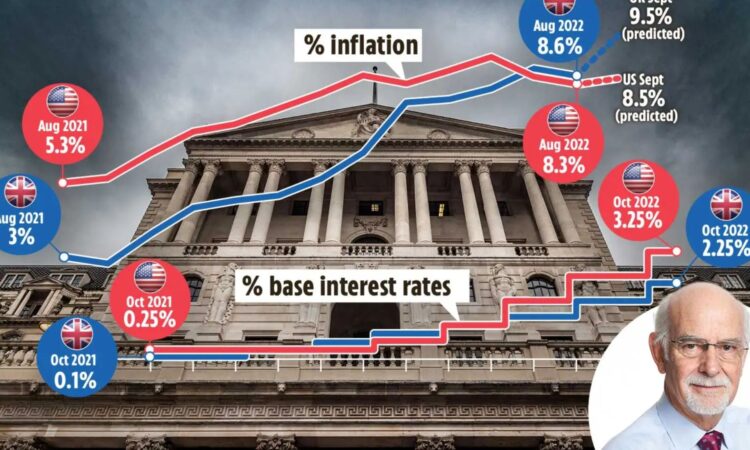

He ignored forecasts that inflation would rocket to double figures and, while the EU and USA raised rates sharply, the Bank imposed tiny rises of 0.25 per cent, leaving Britain well outside the curve.

Government ministers were privately appalled but forced to avoid any hint of public criticism of the independent central bank — a “red flag” to global investors.

Even Bailey’s respected predecessor, Mervyn King, went on the record to call for rate hikes to dampen inflation.

Markets were braced for a sharp 0.75 per cent interest rate rise on the eve of Kwarteng’s mini-Budget last month.

They were dismayed when the rate rose 0.5 per cent, triggering a run on the Pound just as Kwarteng was rising to his feet.

“This is political,” says a senior financial analyst.

“The Bank is blaming the Government for its own policy mistakes. Yet everyone in the markets is blaming the bank for what is happening.

Typically flippant

“The bank has been slow and the bank has been wrong. Now he is leaving the market without support.”

Global investors poured cash into America, boosting the dollar at the expense of the Pound.

Then last week, UK pension funds had to plead for a £65billion rescue as rising rates caught them in a complex and risky form of “borrowing against borrowing” last seen in the 2008 global crash.

It was this bail-out which Bailey suddenly threatened to cut this week with a three-day deadline.

“This was a typically flippant remark unworthy of a central bank governor,” says one senior economist.

What it revealed is that, not for the first time, the Bank of England and the regulators have been caught asleep at the wheel.