On Saturday, August 26, 2023, the administration released a proposed

labor agreement between the state and Bargaining Unit 6 (Corrections).

Unit 6 consists of correctional officers, parole agents, and other

correctional staff who provide custody, supervision, and treatment of

people in state custody. As of July 3, 2023, Unit 6 members work under

the terms and conditions of an expired memorandum of understanding

(MOU). Compensation costs for Unit 6 members and their managers

constitute about one-third of the state’s General Fund state employee

compensation costs. Unit 6’s current members are represented by the

California Correctional Peace Officers Association (CCPOA). This

analysis of the proposed agreement fulfills our statutory requirement

under Section 19829.5 of the Government Code. The administration has

posted on the California Department of Human Resources’ (CalHR’s)

website the agreement,

a summary

of the agreement, and a summary of the administration’s estimates of the

proposed agreement’s fiscal

effects.

Background

Unit 6 in Context of State

Workforce

Represents 10 Percent of State Workforce.

The monthly average size of the state workforce in 2022 was 252,300

full-time equivalent employees. About 10 percent of these employees were

a member of Unit 6.

Accounts for About One-Third of State General Fund

Payroll Costs. The annualized April 2023 state salary and

salary-driven benefit costs paid from the General Fund was

$17.8 billion. The salary and salary-driven costs for rank-and-file and

affiliated excluded employees for Unit 6 constituted roughly one-third

of these General Fund payroll costs.

Prison Costs

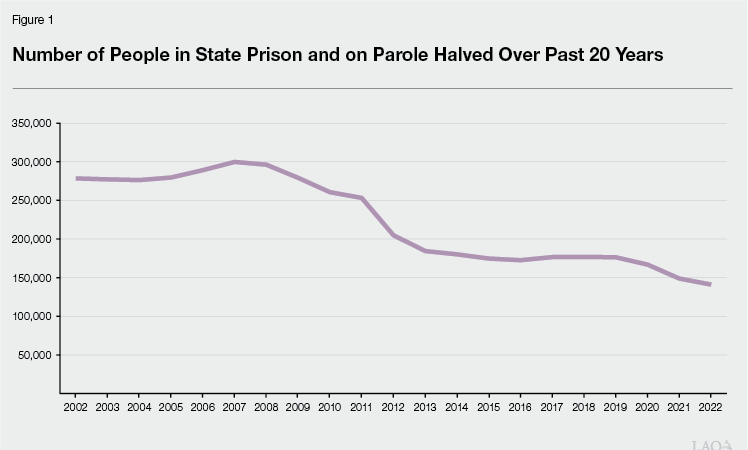

Number of People in Prison and on Parole Has Decreased

but Costs Have Not. As Figure 1 shows, the number of

people in state prison or on parole has decreased significantly over the

past 20 years such that the number of people in state prison or on

parole in 2022 is about one-half the number in 2002. The state

correctional population is projected to continue to decline somewhat

through June 2027. The decline in prison population has allowed the

state to reduce prison capacity without violating a federal

court-ordered limit on prison overcrowding. Specifically, in 2021, the

California Department of Corrections and Rehabilitation (CDCR) completed

a multiyear drawdown of people housed in contractor-operated prisons. In

addition, the department deactivated various state-operated prison

facilities since 2021. Specifically, CDCR deactivated Deuel Vocational

Institution in Tracy in 2021, California Correctional Center in

Susanville in 2023, and eight yards at various prisons between 2021 and

2023. However, despite these declines in the number of people in prison

and the number of facilities used to house them, CDCR spending generally

has increased. Specifically, CDCR operational spending increased from

$11.8 billion in 2017‑18 to an estimated $14.8 billion in 2022‑23—a

25 percent increase. With inflation during this period rising

23 percent, this means that growth in CDCR operational spending slightly

outpaced inflation. The budget assumes that CDCR operational spending

will decrease by $415.8 million in 2023‑24 relative to 2022‑23 levels;

however, this does not reflect any increased costs resulting from new

labor agreements. Employee compensation costs are a major driver in CDCR

operating costs. If the proposed Unit 6 and other agreements are

ratified by the Legislature, costs will be higher than they were in

2022‑23.

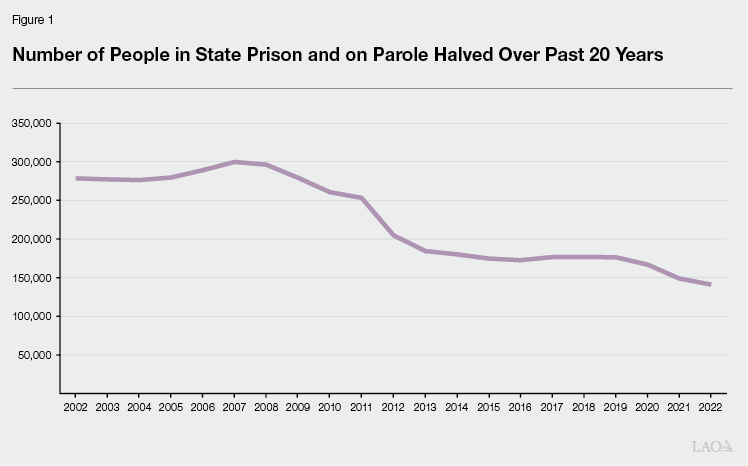

Number of People in Prison and on Parole Has Declined

Faster Than Number of Unit 6 Members. Over the past 20

years, the number of Unit 6 members has decreased as the state has

employed fewer correctional staff. However, the decline in the number of

Unit 6 members has been less than the decline in prison and parole

populations. As Figure 2 shows, while the prison and parole populations

decreased by 50 percent during the period, the number of Unit 6 members

decreased only 15 percent. This trend is, in large part, related to a

federal court order that required California to reduce prison

overcrowding. Specifically, despite the decline in the number of people

in prison, the state had to maintain existing prison capacity, as well

as build and staff new prison capacity, in order to comply with the

limit.

Compensation Studies

Important Tool for Any Employer. A

compensation study aggregates and analyzes internal and external data so

that an employer can compare the compensation structure it offers to

what is provided by similar employers with similar employees in the same

labor market. Employers in both the public and private sectors commonly

conduct regular compensation studies to monitor changes in the labor

market. A well designed and executed compensation study is a valuable

tool that provides a number of benefits, including helping employers

(1) determine if they are compensating employees fairly and at a level

that will attract skilled workers, (2) allocate limited resources

efficiently and effectively by not paying employees more than is

required to retain them, (3) identify internal equity issues regarding

their compensations structure, and (4) establish a structure for their

decision-making process when making changes to their compensations

structure. In addition, for public employers, a compensation study

brings transparency to the decision-making process such that employees,

policymakers, and the public all have the same information against which

to evaluate proposed changes in compensation.

Comparators and Methodology Key to Understanding Purpose

and Usefulness of Compensation Study. Not all compensation

studies are equally relevant or helpful in assessing the issues we

identified above. Factors that affect the quality of a compensation

study include (1) the similarity of jobs that are included in the study

for comparison, (2) the extent to which the elements of compensation

compared capture the total compensation earned by employees, and (3) the

similarity and relevance of employers selected for comparison.

State Law Requires General Salary Increases (GSIs) Be

Justified… A GSI adjusts the entire salary range for a

classification such that all employees within that classification

receive the pay increase. Section

19826 of the Government Code specifies that CalHR shall establish

salary ranges for state classifications “based on the principle that

like salaries shall be paid for comparable duties and responsibilities.”

Further, the law requires that—when establishing or changing pay

ranges—“consideration shall be given to the prevailing rates for

comparable service in other public employment and in private business.”

These requirements necessitate that changes to state salaries be

justified based on comparisons to other comparable employers.

…And Requires CalHR to Conduct Salary

Studies. Since 1981, Section 19826 has required the

administration to submit to the Legislature and bargaining units a

report containing the department’s findings related to salaries of

employees in comparable occupations in private industry and other

governmental agencies. Originally, the law required that this report be

submitted to the Legislature on or before January 10 of each year.

Chapter 465 of 2003 (SB 624, Committee on Public Employment and

Retirement) changed the frequency of this report such that the report

was required to be submitted to the union and the Legislature at least

six months before the end of the term of an existing MOU. Chapter 39 of

2023 (AB 130, Committee on Budget) amended the section such that the law

now requires that CalHR submit to the unions and Legislature a report

containing the department’s findings relating to the salaries of

employees in comparable occupations in private industry and other

governmental agencies (1) on February 1, 2025 and biennially thereafter

for 11 bargaining units and (2) on February 1, 2026 and biennially

thereafter for the remaining ten bargaining units (including Unit 6). If

this requirement under law conflicts with provisions of a ratified MOU,

the law specifies that the ratified MOU shall be controlling.

Annual Budget Act Imposes Additional Requirements of

Total Compensation Studies. As the administration

indicated in its 2013

total compensation study for Unit 6, provisional language under

CalHR’s budget item (Item 7501‑001‑0001) of the annual budget act

“requires that in addition to salaries the report must include total

compensation and geographic comparisons.” In the department’s total

compensation reports for most bargaining units, these requirements are

fulfilled by (1) comparing both salary and ancillary benefits offered by

the state and comparator employers and (2) evaluating how the state’s

total compensation compares with other employers statewide as well as in

four regions across the state (specifically, the regions surrounding the

San Francisco Bay, Sacramento, Los Angeles, and San Diego).

Evaluating

State Correctional Officer Compensation

State Law Requires Administration to Take Into

Consideration Compensation Offered by Other Large Employers of Peace

Officers in California. Section

19827.1 consists of two paragraphs. The first paragraph expresses

legislative intent. Specifically, the first paragraph asserts that, at

the time the law was passed in 1986, (1) there existed a “historic

problem of recruitment and retention of peace officers in the Department

of Corrections and the Department of Youth Authority” and that (2)

“salaries must be improved and maintained by the state” to address the

“continuing need to recruit new officers to fill vacancies, retain

seasoned correctional peace officers to reduce turnover rates, and

provide comparability in pay to effectively compete with large peace

officer employers and ensure necessary staffing levels.” The second

paragraph directs CalHR to “take into consideration the salary and

benefits of other large employers of peace officers in California.”

Last Unit 6 Total Compensation Study Found State

Correctional Officers Compensated High Above Market. The

last Unit 6 compensation

study that CalHR submitted to the Legislature in compliance with the

requirements under Section 19826 used data from 2013. That compensation

study found that state correctional officers were compensation

40.2 percent above their local government counterparts and

28.1 percent above their federal government counterparts.

Expired MOU Requires CalHR to Discuss Section

19826 Compensation Study Methodology With Union. First

appearing in the 2016 Unit 6 MOU, the expired Unit 6 MOU includes

language related to the compensation study required by Section 19826.

The expired MOU’s provision is Article 15.19 and requires that:

Within ninety (90) days of ratification of this MOU, the parties

agree to form a Joint Labor Management group who will meet to discuss

the criteria, comparators and methodology to be utilized for [Bargaining

Unit] 6 in the next Total Compensation Report created pursuant to

Government Code section 19826. The Joint Labor Management group will be

comprised of no more than two (2) representatives from each of the

following: CCPOA, CalHR, CDCR and Department of Finance. The first

meeting of the Joint Labor Management group will occur no later than

eighteen (18) months prior to the expiration of the MOU.

It is important to note that the text of Article 15.19 (1) does

not relieve CalHR of the requirements established by Section 19826

and the annual budget act related to the total compensation study

produced by CalHR—including that the report be submitted to

both the Legislature and the union, (2) does not make

any reference to Section 19827.1, and (3) specifies that any discussion

between the administration and the union related to the compensation

study will occur before CalHR begins its compensation

study.

No Compensation Study Provided to the Legislature in

2018. Despite the statutory requirements to submit a

compensation study to the Legislature prior to the expiration of the

2016 MOU, none was provided. The administration states that it met with

Unit 6 as provided under Article 15.19 described above and that CalHR

completed a compensation study based on the methodology agreed to by

CCPOA and the administration. Although the administration provided the

compensation study to CCPOA in 2018, the Legislature did not receive it.

CalHR stated that it had agreed not to submit to the Legislature the

compensation study until all of CCPOA’s questions and concerns had been

addressed.

Since 2019, our office has asked on numerous occasions for the

administration to provide us a copy of the 2018 compensation study or to

provide us information about the methodology used in that study. To

date, the administration has refused to provide the study itself or to

share any information about the study’s methodology or findings. The

administration asserts that the 2018 compensation study and all

information related to it is confidential pursuant to Section

7928.405 of the Government Code—a section from the California Public

Records Act (CPRA). The administration states that this law classifies

as confidential any work, including draft reports, from a Joint Labor

Management Committee (JLMC). The administration views the 2018

compensation study as a draft product of a JLMC process. Accordingly,

the administration’s position means the Legislature is not privy to the

draft report or any information or documentation related to it.

2022 Unit 6 CalHR Compensation

Study

Study Submitted After Statutory Deadline.

The term of the expired MOU ended on July 2, 2023. As discussed above,

Section 19826 of the Government Code before Chapter 39 amended it in

July 2023, required CalHR to submit its total compensation study for a

bargaining unit six months before the expiration of the bargaining

unit’s MOU. To comply with state law at the time, CalHR should have

submitted a Unit 6 compensation study to CCPOA and the Legislature by

January 2023. While we do not know when CalHR submitted the study to

CCPOA, the department did not meet its statutory deadline. The study was

submitted to the Legislature in April 2023. This study was revised in

August 2023.

Methodology and Report Product of JLMC

Process. Pursuant to Article 15.19 of the expired MOU, the

parties discussed the methodology to be used to develop a new Unit 6

compensation study. Because the administration has not provided any

information about the 2018 compensation study, we do not know how the

methodology or findings of the 2022 compensation study differs from the

methodology or findings of the 2018 methodology. We also do not know how

the issues that prevented the 2018 compensation study from being

submitted to the Legislature were resolved to result in the release of

the 2022 study.

Study Design and Findings

Stated Intent of Report. The report

specifies that the findings of the report do not define the appropriate

level of compensation for state correctional officers. Instead, the

stated purpose is to compare the state’s total compensation costs with

other local government employers in California.

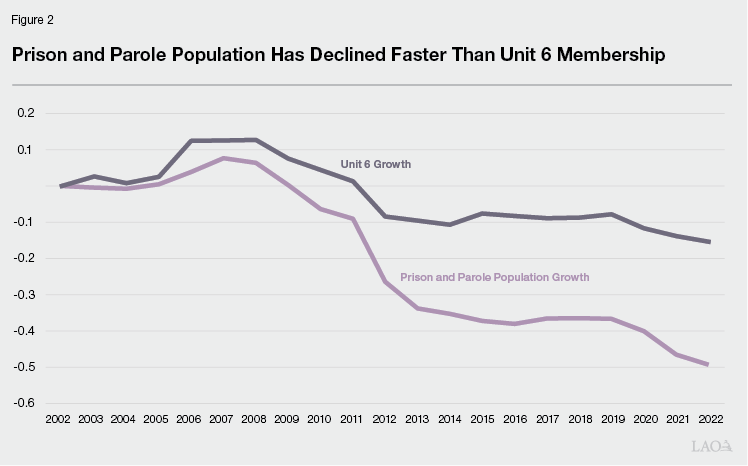

Employers Surveyed. The report compares

employer costs to pay for elements of compensation provided to state

correctional officers with the costs incurred by six county employers to

compensate similar employees. The six counties included in the study are

the six counties that employ the largest number of peace officers.

Specifically, the study compares the state’s compensation costs with the

costs incurred by the Counties of Los Angeles, Orange, Santa Clara,

Sacramento, San Bernardino, and San Diego.

Classifications Compared. The survey asked

each county employer to report compensation costs related to specific

classifications. Figure 3 shows the classifications that were used for

comparison.

Figure 3

Employers and Classifications

Compared in 2023 Unit 6 Compensation Study

|

Employer

|

Classification Title

|

|

State of California

|

Correctional Officer

|

|

Los Angeles County Sheriff’s Department

|

Deputy Sheriff

|

|

Orange County Sheriff’s Department

|

Deputy Sheriff I

|

|

Santa Clara County Sheriff’s Department

|

Sheriff Correctional Deputy

|

|

Sacramento County Sheriff’s Department

|

Deputy Sheriff

|

|

San Bernardino County Sheriff’s Department

|

Deputy Sheriff

|

|

San Diego County Sheriff’s Department

|

Deputy Sheriff, Detentions/Court Services

|

Elements of Compensation Included. CalHR

surveyed the six counties to provide employer compensation cost data as

of January 31, 2022 for the classifications indicated above. The report

seeks to compare separately the compensation cost of entry-level

correctional officers with entry-level deputy sheriffs (after graduating

from the academy) and full journey-level correctional officers with full

journey-level deputy sheriffs. This distinction is important because

employees who have worked for the state or for one of the counties for a

significant number of years have higher compensation than new officers

who recently graduated from the academy. Newly hired employees typically

(1) are in a lower step of the classification pay range (earning lower

base salaries), which results in lower employer costs to salaries and

any salary-driven benefits; (2) are not eligible for payments that are

based on length of service until they have worked for at least a

specified time; (3) typically are not eligible for payments based on

special certifications or training as they have less experience than

more senior employees; and (4) were first hired after 2013, meaning that

they likely receive a lower pension benefit pursuant to state

law. Below are the elements of compensation included in the

study.

-

Pay. The report includes base wages and

specified other payments to employees included as compensation. For base

pay, the report assumes that entry-level employees are paid at the

bottom step of their classification’s salary range and journey-level

employees are assumed to be paid at the top step of their

classification’s salary range. For the other payments included in the

study—education pay, payments provided for certifications attained by

employees from the California Commission on Peace Officer Standards and

Training, and payments received by employees who have worked for the

employer for more years—the study assumes that entry-level employees

receive the lowest available payment and journey-level employees receive

the highest available payment. -

Health, Dental, and Vision Benefits.

The report assumes that both entry-level and journey-level employees are

enrolled in employer-sponsored health, dental, and vision insurance with

policy coverage for a family. -

Retirement Benefits. As we discuss in

greater detail later, the study includes employers’ costs towards

pension benefits and retiree health benefits.

Methodology. CalHR developed and

distributed a survey to the six county employers to collect the employer

costs to provide the specified elements of compensation. CalHR then took

a simple average of the employer costs across the six employers to

compare total compensation costs of the six employers with that of the

state.

Findings. Based on the comparators and

methodology used in the study, CalHR found that state correctional

officer compensation lags the compensation provided to similar employees

by the six counties. This means that CalHR found that state correctional

officers are compensated less than similar employees in the six

counties. Specifically, the study (as revised) found that (1) the

state’s salaries (not including benefits) lag 28 percent for

entry-level employees and 10 percent for full journey-level employees

and (2) the states’ total compensation (salary plus benefits)

lags 33 percent for entry-level employees and 23 percent for

full journey-level employees.

Retirement Security

Factors That Affect Retirement Security.

The amount of money that a person can expect to need in retirement

depends on a variety of factors that are unique to the individual’s

circumstance. Some of the key factors to consider when assessing

retirement security include: the individual’s expected lifespan, the age

at which an individual retires. the standard of living the individual

expects to live in retirement, the individual’s savings level upon

retirement, and any employer-sponsored pension or other income benefit.

A person’s level of retirement security depends in part on how much of

their pre-retirement income can be replaced after retiring through a

combination of what often is referred to as the “three-legged stool” of

retirement in the United States: (1) Social Security benefits,

(2) employer-sponsored retirement plans, and (3) personal financial

assets. There is no one-size fits all replacement ratio; however, a

number of researchers have identified that the replacement ratio for the

median individual is between 66 percent and 75 percent of preretirement

income. In general, lower-income workers would need a higher replacement

ratio because they would be expected to spend a higher proportion of

their income on food, clothing, housing, transportation, health care,

and other essentials.

Employer-Sponsored Retirement Plans. There

are two broad categories of employer-sponsored retirement plans: defined

benefit plans and defined contribution plans. In both types of plans,

employers and employees might make contributions towards the plan over

the course of employees’ careers. The primary difference between the two

plans is (1) who makes investment decisions and (2) who bears the risk

of investment losses. In the case of a defined benefit plan, the

employer chooses how the funds are invested and bears all the risk of

investment loss—the employee is provided a guaranteed annuity in

retirement. In the case of a defined contribution plan, the employee

chooses how contributions are invested and bears all the risk of

investment losses. Unlike a defined benefit plan, there is no

guarantee—either by the employer or by government—of assets held in a

defined contribution plan.

Hybrid Employer-Sponsored Retirement Plans.

Some employers offer employees a hybrid plan that combines elements of

traditional defined contribution and defined benefit plans. For example,

a parallel hybrid plan provides employees both an employer-funded

defined benefit pension and an employer-funded defined contribution

plan. Typically, the defined benefit and defined contribution components

of these types of plans are smaller than if the employer offered only a

defined benefit or only a defined contribution plan. The amount of money

that the employer contributes to each plan typically is based on an

employee’s total pay.

Correctional

Officer Retirement Income Benefits

Not Eligible for Social Security. When

Social Security was initially established in 1935, all federal, state,

and local government employees were excluded from the program. Beginning

in the 1950s, the program was changed to allow governments to enroll

some of their employees in the federal program. By 1991, the program

covered all federal employees and most state and local government

employees. Under federal law, state and local government employers may

continue to exclude some employees from Social Security coverage, but

only if those employees are enrolled in a retirement plan that meets

federal regulations requiring at least a specified level of benefits. In

California, peace officers and teachers generally are excluded from

Social Security.

Defined Benefit Pensions a Long-Standing and Significant

Element of Compensation in California State Employment.

The state has included in its compensation package a defined benefit

pension since 1932. The benefit, as it exists today, provides retired

state employees a guaranteed annuity that is determined by (1) the

employee’s date of hire, (2) the number of years of service the employee

has upon retirement, and (3) the employee’s age at retirement. These

benefits are paid for through contributions towards two components of

the benefit’s cost, discussed below.

-

Normal Cost. The normal cost is the

amount of money that actuaries determine must be set aside for the

benefit employees earn today so that the contribution and any

future investment returns on that contribution are sufficient to pay for

the benefit after the employee retires. Under the Public Employees’

Pension Reform Act of 2013 (PEPRA), the state has a standard that state

employees pay one-half of the normal cost of their pension benefit and

the state pays one-half of the normal cost. -

Unfunded Liability. When investment

returns or other actuarial assumptions do not materialize (or actuarial

assumptions change) such that actuaries determine there are not

sufficient assets to pay for benefits earned in the past, the

resulting shortfall is called the “unfunded liability.” Any unfunded

liability is the employer’s responsibility.

Unit 6 Employees Hired Before 2013 Receive Pension Based

on “3 Percent at 50” Formula. The pension benefits earned

by state public safety employees—including Unit 6 members who earn their

pension benefit under the state’s Peace Officers and Firefighters

plan—are described in this publication

produced by the California Public Employees’ Retirement System

(CalPERS). Unit 6 members hired before 2013 earn a pension benefit based

on what is referred to as the 3 percent at 50 formula whereby an

employee earns 3 percent of their final compensation for every year of

service if they retire at the age of 50 years. Under this formula, the

maximum income replacement ratio a retiree may receive is 90 percent of

their final compensation (defined as compensation over a 12-month

period) after attaining 30 years of service credit. According to

information provided by CalHR, in the five fiscal years between 2017‑18

and 2021‑22, the average Unit 6 member retired at 55 years old with 23

years of service and retired with a pension that replaced 68 percent of

their final compensation.

Unit 6 Employees Hired After 2013 Receive Pension Based

on “2.5 Percent at 57” Formula. Under PEPRA, employees

hired after 2013 receive a lower pension benefit that require employees

to work additional years in order to maintain the same level of benefit

as employees who were hired before 2013. In the case of Unit 6,

employees hired after 2013 earn a pension under the 2.5 percent at 57

formula. Under this formula, employees who work for 40 years and are

older than 57 years may receive a pension that replaces 100 percent of

their final compensation (defined as compensation over a 36-month

period). However, an employee under this pension formula who retires at

55 years old with 23 years of service would be eligible for a pension

that replaces 54 percent of their final compensation. In order to

receive the 68 percent income replacement ratio received by average

recent Unit 6 retiree, a Unit 6 member hired after 2013 would need to

work until they are at least 57 years old and have 27 years of

service.

Optional Employee-Funded Defined Contribution

Benefit. Since 1974, the state has provided employees with

an optional deferred compensation plan. The plan today is known as

Savings Plus. Through Savings Plus, employees can open a 401(k) and/or a

457(b) account and can choose to make contributions on a pre-tax or

post-tax basis to these accounts. Employees can then choose from a

variety of investment options, including indexed and managed funds and

target-date funds. The state has never made regular contributions to

rank-and-file employees’ Savings Plus accounts. (CalHR informs us that

the state briefly contributed a small specified dollar amount to

excluded employees’ Savings Plus accounts in the early 2000s.) In 2017,

we issued a report evaluating

the Savings Plus program. As of May 2016, we reported that 60 percent of

eligible state employees participated in the Savings Plus program. While

we do not know the statewide average participation rate today, CalHR

informs us that, as of July 31, 2023, 87 percent of Unit 6 members have

a Savings Plus account and that 57 percent of Unit 6 members contributed

to their Savings Plus account in July 2023 with an average contribution

amount of $387 to a 457(b) account and $353 to a 401(k) account. Based

on the data CalHR provided us, far more Unit 6 members have 457(b)

accounts (20,241 members with accounts) than 401(k) accounts (4,599

members with accounts). The administration indicates that the average

balances of Unit 6 457(b) and 401(k) accounts was $20,803 and $27,272,

respectively.

Legislature Chose Not to Adopt Hybrid Plan When Enacting

PEPRA. Under PEPRA, the Legislature established sweeping

changes to state pension benefits that reduced the benefits for future

employees and established a standard that state employees pay one-half

of the normal cost to fund these benefits. However, the law retained the

basic structure of the state’s benefit in that the employer-funded

retirement income benefit consists only of a defined benefit pension.

The Legislature could have adopted a hybrid plan, whereby the state

contributed money to both a defined benefit and a defined contribution

element of a retirement benefit, but it did not.

Proposed Agreement

Major Provisions

Term. The agreement would be in effect from

July 3, 2023 through July 2, 2025. This means that the agreement would

be in effect for two fiscal years: 2023‑24 and 2024‑25. This also means

that the agreement will expire, and the administration presumably will

begin negotiating a new MOU, before the February 1, 2026 date

when Section 19826 of the Government Code requires CalHR to submit to

the Legislature a new compensation study for Unit 6.

GSIs. The agreement would provide a

3 percent GSI on July 1, 2023 and another 3 percent GSI on July 1,

2024.

One-Time $1,200 Payments in 2023 and Again in

2024. The agreement would provide employees a $1,200

payment in November 2023 and another $1,200 payment in November 2024.

The stated purpose of this payment is to support employees’ health and

well-being. However, there is no requirement that the money be used to

further this purpose.

Recruitment and Retention Payments. The

agreement would provide specified payments related to recruiting and

retaining employees. Specifically, new and current Unit 6 members who

work at Salinas Valley State Prison (SVSP) in Soledad; California State

Prison, Sacramento (SAC); or Richard J. Donovan (RJD) Correctional

Facility in San Diego would be eligible to receive $5,000 payment on

July 1, 2024 and another $5,000 payment on July 1, 2025. In addition,

cadets who accept or choose to work at one of 13 facilities would be

eligible to receive a $5,000 bonus payment payable in two payments

($2,500 upon graduating from the academy and $2,500 30 days after

reporting to the institution).

Creation of Employer Funded Contributions to

401(k). Effective with the November 2024 pay period, the

agreement would provide that the state make a one-time contribution of

$475 to a Savings Plus 401(k) plan on behalf of all permanent full-time

employees who are active as of November 1, 2024. Effective with the

January 2025 period, the agreement would require the state to make a

monthly contribution equivalent to 1 percent of base pay to a Savings

Plus 401(k) plan.

State Contributions to Health Premiums. The

agreement would increase state contributions towards employee health

benefits to maintain the current proportion of average premiums paid by

the state.

Increased Pay Differentials. The agreement

would increase various Unit 6 pay differentials, including the

night/evening shift differential, weekend shift differential, and

bilingual pay differential.

One-Time Leave Cash Out. Under the proposed

agreement, all Unit 6 member would be eligible to cash out up to 80

hours of compensable leave in 2023. The administration estimates that

this provision could increase state costs by as much as $25 million. The

actual cost will depend on how many employees cash out leave and how

much leave they choose to cash out.

Provisions From

Past Agreements Not Included

No Reopener if Other Units Get Higher Pay

Increases. The expired Unit 6 MOU included a provision

that specified that CCPOA could choose to reopen that agreement if

another bargaining were to have received a higher GSI in 2022‑23. As we

discussed in our August 2022 analysis of the Unit 2 agreement

at the time, that particular reopener clause seemed to affect the

administration’s negotiating position with other bargaining units in

that none of the agreements provided GSIs higher than the Unit 6 GSI in

2022‑23. The proposed agreement does not appear to includes a

similar reopener clause.

No Provision Related to Compensation Study.

The proposed agreement deletes Article 15.19 from the agreement. This

means that the proposed agreement includes no language related to the

Unit 6 compensation study or to Section 19286 of the Government Code.

The administration states that it will use the same methodology in

future Unit 6 compensations studies that it used for the 2022

compensations study.

LAO Assessment

2018 Compensation Study

Disagree That 2018 Compensation Study Is Confidential

Under CPRA. We disagree with the administration’s

assertion that the 2018 compensation study and all information related

to it are confidential under the CPRA. The language of Article 15.19

clearly stated that the JLMC process would occur before CalHR

conducted its compensations study when it said that the parties would

discuss the criteria, comparators, and methodology to be

utilized. Further, Article 15.19 states that the compensation study

completed after the JLMC process would be “created pursuant to

Government Code Section 19826.” Under Section 19826 of the Government

Code, CalHR is the sole author of the compensation study as the study is

to report to the union and Legislature “the department’s

findings.” We would argue that the language of Article 15.19 does not

make the compensation study itself a product of the JLMC process—only

the discussion of the methodology. As such, when CalHR submitted the

compensation study to CCPOA it also should have submitted it to the

Legislature.

CPRA Issue Raises Broader Questions About JLMC Work and

Legislative Deliberation. Most, if not all, MOUs include

at least one JLMC or similar management/labor workgroup. These

workgroups can be tasked with discussing a wide array of topics. Often,

the topics of these workgroups are meant to be the initial assessment of

whether something is feasible. For example, an MOU might establish a

JLMC to assess the feasibility of consolidating classifications. In

these cases, the working group often submits a report to specified

individuals (typically, the Director of CalHR) with the group’s

recommendations, but the actual process of consolidating classifications

is left to the State Personnel Board process and the Legislature’s

budget review process (in the case of class consolidations that require

appropriations). In these cases, there is an opportunity for the public

and the Legislature to weigh in on the issue under consideration by the

JLMC. However, as the 2018 compensation study reveals, there also are

instances where the JLMC may influence state policy without legislative

insight. This is because the JLMC process generally is excluded from

public disclosure under the CPRA. Consequently, unless there is a

separate policymaking process—like in the example regarding

classification consolidation—the administration may propose policy

changes without sufficient justification. As the administration does not

offer justifications for things that are the product of the bargaining

table, neither the Legislature nor the public may have sufficient

information to weigh the rationale for the proposed policy change.

2022 Unit 6 Compensation Study

Study Flawed

As we discuss below, the study is flawed to the point that it is not

helpful in meeting its stated objective and we recommend policymakers

not use it to assess whether the state’s compensation package for

correctional officers is appropriate to attract and retain qualified

workers. On the whole, the issues we discuss below likely result in

overstating competitor employer’s total compensation while understating

the state’s total compensation; however, the flaws in the study raise so

much uncertainty that we cannot say that definitively.

Issues With

Comparators and Survey Sample

Study Omits Overtime, a Substantial Component of

Compensation. Overtime has long constituted a significant

source of income for Unit 6 members. CalHR’s 2013 Unit 6 compensation

study included overtime in its analysis and identified that the average

Unit 6 member earned overtime pay equivalent to 15 percent of their

wages. Overtime continues to be a major source of income for state

correctional officers. In 2022, Unit 6 members earned $547.8 million in

overtime payments and $2.2 billion in gross regular pay. This means that

overtime payments in 2022 were equivalent to roughly 24 percent of gross

regular pay for Unit 6 members. Overtime was excluded from CalHR’s 2022

compensation study analysis despite (1) overtime consistently being a

major component of Unit 6 compensation and (2) CalHR including overtime

in its 2013 Unit 6 compensation study and in its recent compensation

studies of most other bargaining units.

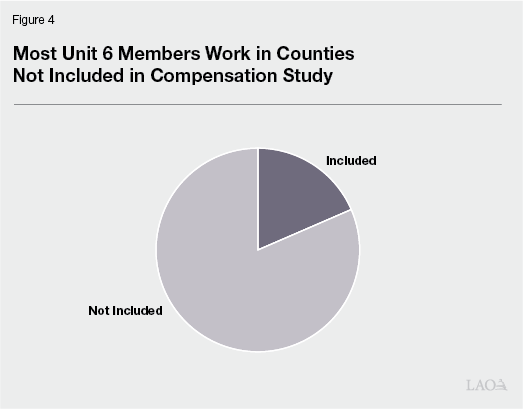

Survey Sample Not Representative of Where State

Correctional Officers Work… The compensation study

surveyed the six counties that employ the most peace officers in the

state. This methodology results in a sample consisting mostly of

counties that are part of large metropolitan regions in the state. In

contrast, most state prisons are located in rural parts of the state

located far from major urban centers. As a result, the six counties

surveyed for the compensation study are not representative of

where state correctional officers work. While some state correctional

officers work in four of the counties included in the survey, there are

zero state correctional officers who work in the Counties of

Orange or Santa Clara. Thus, one-third of the compensation comparison in

the study is not actually directly competing with the state for

workers.

As Figure 4 shows, only 18 percent of Unit 6 members work in one of

the six counties included in the survey. If, instead, the survey was

based on the six counties where the most Unit 6 members work—the

Counties of Kern, Kings, Riverside, Solano, Monterey, and Sacramento—the

study would have included counties where more than 50 percent of Unit 6

members work. (If the survey only included the two counties where the

highest numbers of Unit 6 members work, the Counties of Kern and Kings,

the sample would have been more representative than the sample used by

the administration as more than 25 percent of Unit 6 members work in one

of those two counties.)

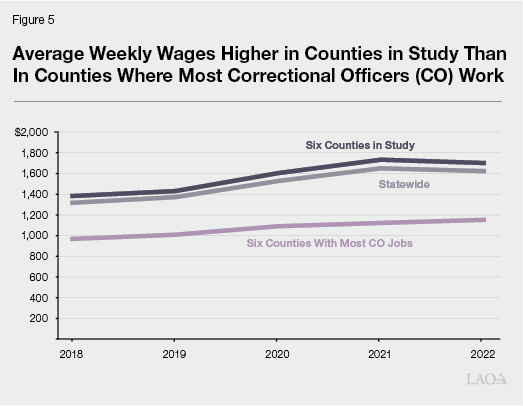

…Reflects Regions With Much Higher Wages and Cost of

Living Than Where Correctional Officers Work. Wages and

the cost of living vary significantly across the state. As Figure 5

shows, the six counties in the study have average wages that are

somewhat higher than the statewide average and far above

average wages in the six counties with the highest concentration of Unit

6 worksites (the Counties of Kern, Kings, Riverside, Solano, Monterey,

and Sacramento). This means that the study includes counties in the

state with substantially higher wages than where most state correctional

officers work. Furthermore, as Figure 6 shows, the six counties in the

study have far higher housing costs (a major component of the cost of

living) than the six counties with the highest concentration of Unit 6

worksites.

Issues With

Treatment of Retirement Benefits

Study Uses Wrong Measure to Compare Pension

Benefits. Using the total employer contribution rate

towards pension benefits is problematic when trying to evaluate the

value of the pension benefit earned by employees today. This is because

the total contribution rate paid by employers (1) might include a single

blended contribution rate towards normal cost and not distinguish

between the value of benefits earned by different employees in the same

classification, as is the case with at least the state; (2) includes

payments towards unfunded liabilities that reflect costs associated with

pension benefits earned in the past and that are affected by

decisions made by employers (for example, making supplemental pension

payments) or pension boards (for example, assumed rates of return on

investments not be realized) that are not related to the benefit earned

by employees today; and (3) does not capture any employer cost to the

benefit that is excluded from the contribution rate (for example,

supplemental pension payments in excess of the contribution rate). The

normal cost is driven by (1) the design of the pension benefit (in other

words, the terms of the benefit) and (2) the actuarial assumptions used

to calculate normal cost. While different pension systems might use

different assumptions—for example, different assumptions related to

future investment returns—that affect the normal cost, they also have

different policies—for example, different mixes of asset classes in

their investment portfolios. A pension board has a fiduciary

responsibility to use actuarially sound assumptions consistent with its

policies when determining employer contribution rates. As such, the

normal cost for the benefit earned by employees is the best estimate of

the value of the employer-provided benefits earned today by

employees and therefore the best way to compare pension benefits across

employers. We discuss the specifics of the methodological issues related

to pension benefits in the subsequent paragraphs.

Study Includes Employer Payments Towards Unfunded

Liabilities to Value Pension Benefits… As we discussed

above, employers and employees each make contributions towards the

normal cost of a pension benefit. However, the unfunded liability is the

employer’s responsibility. In addition to experience (for example,

lower-than-assumed investment returns) and assumption changes,

employers’ actions also can increase or decrease unfunded liabilities.

For example, an employer choosing to make supplemental pension

payments—meaning they pay more than actuaries say is necessary—will

directly reduce their unfunded liability with no effect on the benefit

provided to employees. When conducting compensation studies, including

the 2022 Unit 6 study, it is CalHR’s practice to include the

total employer contribution rate (expressed as a percentage of

pay) paid by employers to fund employees’ pension benefits. This total

contribution rate includes employers’ costs to both the normal cost and

unfunded liabilities when determining the value of employees’ pension

benefits. This means that the study reflects the cost both for pension

benefits earned today as well as for pension benefits earned in

the past.

…Assumes Same Employer Contribution Rate for Entry-Level

and Journey-Level State Correctional Officers Despite Very Different

Benefits… Under PEPRA, as we discussed above, state

correctional officers hired after 2013 receive a lower benefit than

employees hired before that date. To make state payroll less

complicated, CalPERS provides the state one employer contribution rate

that the state pays, regardless of which benefit an employee earns, that

is based on a blended normal cost. The compensation study uses this

blended employer rate to value the pension benefits earned by newer

state hires and journey-level state correctional officers. As such, the

study assumes that the value of both pension benefits is equivalent to

32.84 percent of pay (19.14 percent of this is the employer’s share of

the blended normal cost). This results in the study undervaluing the

benefit earned by journey-level state correctional officers and

overvaluing the benefit earned by entry-level employees. If the study

had, instead, used the unblended employer share of normal

cost to value the pension benefits earned by state correctional

officers, the study would have assumed that entry level state

correctional officer pension benefits were equivalent to 15.1 percent of

pay and journey-level state correctional officer pension benefits were

equivalent to 22.1 percent of pay. (We note that the study also assumes

that the County of Santa Clara pays the same contribution rate for both

entry-level and journey-level employees.)

…And Uses Data From Year When State Contributions to

Unfunded Liability Was Temporarily Low, Distorting State’s Pension

Benefit to Appear Less Valuable Overall. In recent years,

the state has made a number of supplemental pension payments to CalPERS.

These payments are in addition to the payments CalPERS identifies the

state must pay pursuant to state law and go directly towards paying down

the state’s unfunded liability. (In addition, it is the state’s policy

to apply the Proposition 2 debt

repayments towards the CalPERS unfunded liabilities.) As we describe

in The 2020‑21

Spending Plan: Pensions, the 2019‑20 budget plan included a

$2.5 billion supplemental pension payment to CalPERS to reduce the

state’s long-term unfunded liabilities; however, the 2020‑21 budget

repurposed this supplemental pension payment to instead

supplant the state’s actuarially required contributions over a

multiyear period beginning in 2020‑21 (due to anticipated budget

shortfalls). This action resulted in the portion of the state’s

contribution rate that goes towards the unfunded liability to be lower

than it otherwise would have been in 2021‑22, the year from which data

was pulled for the compensation study. To illustrate the temporary

effect this had on the state’s contribution rates, this action resulted

in the state’s contributions to Unit 6 members’ pensions to total

32.84 percent of pay in 2021‑22, but the rate is 50 percent of pay in

2023‑24 (after the supplanting payment ended).

Study Treats Retirement Health and Retirement Pension

Benefits Inconsistently. The state pays for retiree health

benefits differently from how it pays for pension benefits. In the case

of retiree health benefits, the state pays a percentage of pay towards

normal cost (specified in labor agreements and matched by employees) to

prefund the benefit and it pays the unfunded liability on a

“pay-as-you-go” basis where it pays out the claims cost for existing

retirees. (The state has a significant unfunded liability associated

with retiree health benefits. The most recent valuation

of the benefit estimates the portion of the unfunded liability

associated with Unit 6 to be about $10 billion.) Unlike its treatment of

pensions, the compensation study does not include any portion of the

state’s payments towards retiree health unfunded liabilities. As we

indicated above, we think it is better practice to only include the

normal cost when trying to value a retirement benefit; however, a

compensation study also should be consistent. Had the compensation study

been consistent with how it valued retirement benefits, it would have

included both the state’s contribution to Unit 6 normal cost

($136 million) and the state’s payments towards Unit 6 retirees’ claims

($471 million) that constitute the state’s payments towards the unfunded

liability.

Study Does Not Accurately Reflect Value of Retiree Health

Benefits Provided by County Employers. The study indicates

that all of the surveyed jurisdictions offer an employer-subsidized

retiree health benefit or some form of a retiree health savings or

reimbursement account. However, to establish a value for the benefit,

CalHR only asked the employers if employers made prefunding

contributions towards the benefit. The state only recently began

prefunding retiree health benefits. Many local governments still do not

prefund the benefit and, instead, make payments on a pay-as-you-go basis

after an employee retires. Of the six counties included in the survey,

only two indicated that they make contributions towards the benefit

during employees’ careers (the Counties of Sacramento and San

Bernardino). Accordingly, the study does not attribute any value to

retiree health benefits and undervalues the total compensation earned by

employees of the Counties of Los Angeles, Orange, Santa Clara, and San

Diego.

Study Does Not Accurately Reflect Value of State Retiree

Health Benefit. Following the 2015‑16

budget, the state established lower retiree health benefits for all

future state employees in MOUs. For Unit 6, the arrangement was

established in the MOU that was

ratified in 2016, reducing the benefit for employees hired after 2017.

Per the Unit 6 MOU, the state and all Unit 6 members each pay 4 percent

of pay to prefund the benefit, which is roughly one-half of the total

normal cost for the benefit earned by employees hired before 2017. The

compensation study uses the state’s 4 percent of pay contribution for

both entry-level and journey-level employees, ascribing the same value

to the retiree health benefit to all Unit 6 members. The state’s

actuarial valuation of retiree health benefits calculates the

total normal cost of the benefit for each bargaining unit. The

valuation does not provide separate normal costs for the benefit for

employee hired before 2017 versus those hired after 2017;

however, the normal cost for the benefit earned by new employees

certainly is lower than the normal cost for the benefit earned by

employees hired before 2017. Accordingly, the compensation study

overvalues the retiree health benefit earned by entry-level state

employees and undervalues the retiree health benefit earned by

journey-level state employees.

Overall, Reliance on Employer Cost to Estimate Value of

Benefit Distorts Findings. While comparing employers’

costs to provide compensation to employees makes the survey easier to

administer and complete, the comparisons can be inaccurate, particularly

in the case of retirement benefits. In addition, this methodology also

ignores any deductions that might be made from employees’ pay—reducing

their salaries—to support the benefits provided to them as part of their

total compensation. For example, the study does not capture the effect

on employees’ pay when they are required to contribute a portion of

their salary to prefund a retirement benefit. Employee contributions

towards benefits directly reduce their pay. If two employees have

identical compensation packages except one is required to contribute

4 percent of pay to prefund retiree health benefits while another does

not, that contribution requirement lowers the employee’s pay, resulting

in the employee who is required to contribute towards the benefits

receiving a lower total compensation than the other employee. To

accurately assess the relative attractiveness of employers’ supplied

compensation packages to workers in the labor market, a study should sum

the total pay (including overtime, scheduled pay differentials, or other

payments in addition to base pay), total insurance premiums (health,

dental, and vision), and total normal cost of retirement benefits

(pension and retiree health) and subtract from that the deductions from

pay that employees make towards premiums and normal cost of retirement

benefits.

Study Not Helpful

For the reasons described above, we find that CalHR’s 2022 Unit 6

compensation study is not helpful in assessing how the state’s total

compensation for state correctional officers compares with the six

counties included in the study. Further, because the six counties

included in the study are not representative of where state correctional

officers work and, instead, includes among the highest cost of living

regions of the state, we conclude that the study is not helpful in

assessing the state’s position as an employer of correctional officers

across the state or where state correctional officers work. We recommend

the 2022 study not be used to evaluate whether or not the

state’s compensation for correctional officers is competitive.

Legislative Oversight

Legislative Oversight of State Compensation Policies Key

to Effective Oversight of State Spending. State employee

compensation is a significant portion of the cost of state government

operations, totaling more than $30 billion (roughly one-half of which is

paid from the General Fund). In addition, the state has significant

unfunded liabilities associated with retirement benefits for state

employees’ and retirees’ past service (in excess of $70 billion for

pensions and $95 billion for retiree health benefits). Changes in

employee compensation policies can have profound effects on the state’s

expenditures and long-term plans to address unfunded liabilities. As

such, the Legislature’s ability to exercise a high degree of oversight

over the state’s employee compensation policies is critical.

Compensation Studies Helpful Tool to Evaluate Proposed

Compensation Policies. The Legislature regularly considers

changes to state employee compensation policies through the policy bill

process, the budget bill process, and through its role in considering

labor agreements reached between the administration and state bargaining

units. A regularly occurring, well-designed, and well-executed

compensation study helps provide the Legislature a baseline from which

to assess (1) the state’s current position as an employer in the labor

market and (2) the effect that any proposed employee compensation policy

might have on the state’s position as an employer.

Regular Total Compensation Studies Should Not Be Subject

of Bargaining Process. A compensations study should

present a set of facts identified using a transparent methodology that

can serve as a starting point in negotiations. A compensation study,

itself, should not be the subject of negotiations. If a bargaining unit

disagrees with the methodology or findings of a CalHR compensation

study, it can pay for its own compensation study to be conducted by a

third party. (We note that Unit 2 [Attorneys] contracted with the

University of California at Los Angeles to conduct a study leading up to

the 2019 MOU.)

Allowing compensations studies to be the subject of bargaining (1) opens

the door to inconsistent methodologies used to assess different

bargaining units’ compensation, which, in turn, makes compensations

studies less helpful in identifying internal equity issues across

bargaining units and (2) allows issues at the bargaining table to

prevent a compensation study from being submitted to the

Legislature.

Unit 6 Compensation

Given the shortcomings of the 2022 compensation study, we look to

other metrics to assess the state’s ability to recruit and retain

correctional officers. We discuss those factors below. On the whole, we

see little evidence to suggest that the state’s ability to recruit and

retain correctional officers has deteriorated such that the state is not

an employer of choice for correctional officers in California.

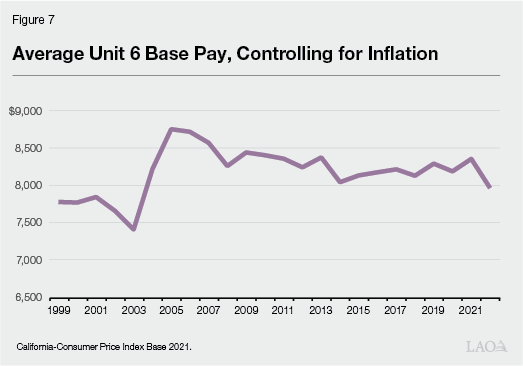

Inflation and Unit 6

Unit 6 Base Pay Has Not Kept Pace With Inflation, but

Well Above Pre-2006 Levels. As we discussed in our 2008

analysis, CDCR experienced high vacancies and recruitment challenges

for correctional officers in the early 2000s that were addressed through

operational changes as well as significant increases to

correctional officer compensation provided by the Unit 6 MOU that was in

effect from 2001 to 2006. At the time, we indicated that “the job of

state correctional officer may now be the most sought after in the

California economy” thanks to the increase in compensation. Controlling

for inflation, Figure 7 shows that average Unit 6 base pay

increased by 18 percent between 2003 and 2006 under the terms of the

2001‑06 MOU. Since 2006, inflation has eroded the average Unit 6 base

pay such that real base pay in 2022 was almost 9 percent lower than it

was in 2006. However, average real base pay remains more than 7 percent

higher than it was in the early 2000s when the state last experienced

significant challenges recruiting correctional officers. (As we discuss

below, turnover may be contributing to the decline in the average base

pay. With an increase in retirements in recent years—and an increase in

new officers—average base pay declines reflect the lower tenure of staff

as well to some extent.)

Proposed GSIs Close to Most Recent Inflation

Levels. The most recent (July) California Consumer Price

Index was 3.1 percent higher compared to the prior year. Since 2020,

however, prices have risen 17 percent. GSIs provided by prior agreements

to Unit 6 did not keep pace with these increases, as noted above.

Although the tentative agreement’s GSIs would maintain wages, they do

not catch up to prior price increases.

Recruitment

and Retention of State Correctional Officers

Use 2013 Compensation Study as Benchmark.

Although not perfect, the 2013 compensation study had far fewer

methodological flaws than the 2022 compensation study. Consequently, we

use the 2013 study as our benchmark and look at recruitment and

retention patterns to assess if the state’s position in the labor market

to attract and retain qualified employees has deteriorated significantly

since 2013, when CalHR found that state correctional officers were

compensated well above local government counterparts.

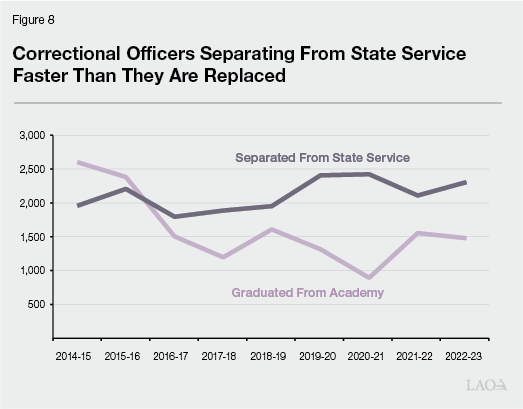

Number of Unit 6 Members in Decline. As we

discussed earlier, state policy has changed in recent years to result in

a decline in the state correctional population (including people in

prison, and on parole) and the closure of state prison facilities. This

trend has resulted in the number of Unit 6 members to decrease over the

years. The number of Unit 6 members reached a high-water mark of over

32,500 members around 2008 and has steadily declined since then with

26,000 members in 2013 and fewer than 24,500 members in 2022. This also

is illustrated by the fact that, as Figure 8 shows, fewer correctional

officers are graduating from the academy and entering the workforce than

are separating from state service.

Fewer Vacant Correctional Officer Positions Today Than in

2013. The reduction in the number of state correctional

officers is the result of changes in state policy and does not appear to

be due to challenges in filling established positions. Compared with the

time of the last compensation study, the share of state correctional

officer positions that are vacant has decreased from 14.5 percent in

January 2014 to 12.1 percent in January 2022. On one hand, this suggests

that CDCR is not experiencing greater challenges recruiting and

retaining correctional officers than in 2013. On the other hand, prison

closures have resulted in a substantial reduction in the number of state

positions. With fewer authorized positions, we would expect the vacancy

rate to decrease. The fact that the vacancy rate has only dropped

2 percentage points might signal a recruitment or retention problem,

however, as we discuss below, there are indicators pointing the other

way as well. (Moreover, Unit 6 is unique in that its vacancy rate is

declining, whereas for almost all other bargaining units, the vacancy

rate has increased in recent years.)

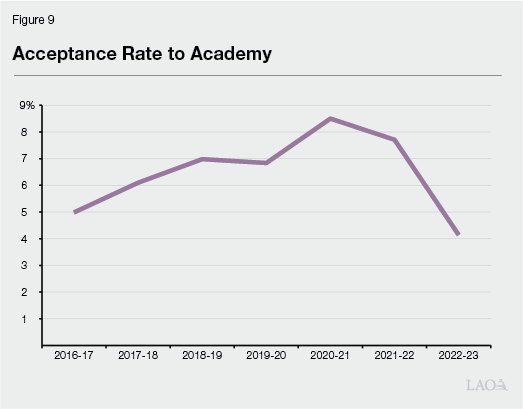

Correctional Officer Academy Turns Away More Than

90 Percent of Qualified Applicants. The job of state

correctional officer consistently is a sought-after job. Between 2013‑14

and 2022‑23, CDCR received 372,998 applications to the correctional

officer academy. Of these applications, 292,488 applications were from

applicants who met the minimum qualifications. During this same time

period, the department accepted 17,530 applicants into the academy. This

means that CDCR accepted about 6 percent of qualified

applicants to enroll in the academy to receive training to become a

correctional officer. Among all applications, qualified and not

qualified, CDCR accepted about 5 percent of applicants. (For context,

the academy for the California Highway Patrol accepted 4 percent of

qualified applicants in 2022‑23.) Figure 9 shows how the acceptance rate has fluctuated since 2016-17. There clearly is very high interest

among people to become state correctional officers. The high level of

interest in the job despite its challenging working conditions likely

reflects that, compared with other jobs that have similar education

requirements, the state provides correctional officers competitive

salaries and benefits as well as job security.

Evidence of Turnover Among Staff. There is

some evidence that there has been elevated turnover among correctional

officers since 2013 where more senior employees are being replaced by

less experienced employees. While the factors that we discuss below show

that the bargaining unit is becoming younger and less experienced, the

average correctional officer continues to be a mid-career correctional

officer with more than a decade of experience. This suggests that the

younger workforce might not be an indication of a problem, but rather

natural turnover as employees retire.

-

Fewer Years of Service Among Staff. The

average Unit 6 member in 2022 had 11.4 years of service. This is about

one year fewer years of service than the average Unit 6 member had in

2012. However, the average Unit 6 member has about one more year of

service than they did in 2008 when the average Unit 6 member had 10.4

years of service. -

Fewer Employees at Top Step. The share

of Unit 6 members who are at the top step of the correctional officer

salary range has decreased from 71 percent in 2013 to 57 percent in

2021. This is consistent with the fact that state correctional officers

tend to have fewer years of service today than they did in

2013. -

Younger Workers. Over the past ten

years, the average Unit 6 member has become younger. The share of Unit 6

members who are 40 years old or younger has increased 10 percentage

points form 42 percent in 2012 to 52 percent in 2022. The fastest

growing age group during this period was 26 to 30 years old.

Any Retention Issues Likely More Attributable to Factors

Other Than Compensation. The turnover of state

correctional officers in recent years likely is due to factors other

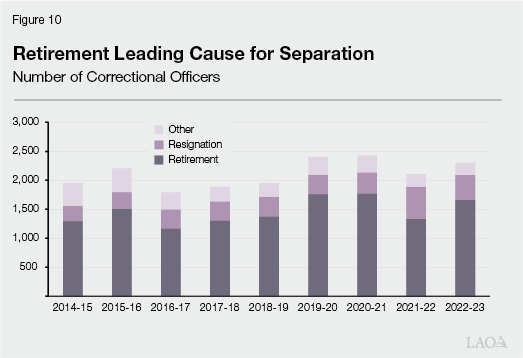

than compensation. Figure 10 shows that separations have been driven

primarily by retirements; however, there was a notable increase in the

number of resignations in 2021‑22. When a person resigns, they

voluntarily end their employment without going into retirement. The

person might seek employment with a different employer doing the same

job, change careers, or exit the workforce. If a person is dissatisfied

with their job or with the level of compensation they receive for their

job, they are more likely to resign. As such, a spike in resignations

warrants further investigation to understand the root cause of the

resignations. As we discuss below, we do not think that compensation has

been the main driver leading to increased retirements and a spike in

resignations.

-

Aging Cohort of Correctional Officers Driving

Retirements. The average correctional officer retires at

the age of 55 years after having worked for the state for 23 years—this

statistic is unchanged from 2013. This means that the average retiring

correctional officer was hired at the age of 32 years. In the early and

mid-2000s, the state hired a large number of new correctional officers.

This created a cohort of correctional officers of a similar age. As this

cohort, and the officers hired before this cohort, became eligible for

retirement, they have retired and have been replaced by new, younger

correctional officers. The growth in retirements that CDCR has

experienced in recent years likely is due more to the natural aging of

the workforce rather than a response to Unit 6 compensation

levels.

-

Pandemic. The time period from

March 2020 through September 2022 was a particularly turbulent time for

state prisons. The weekly cases of COVID-19

per 100,000 in state prisons was far above levels seen in California

broadly during each of the waves of the pandemic. The threat to the

health and safety of both people living in prisons and working in

prisons resulted in the administration implementing a number of

personnel policies related to staff testing for the virus, mask wearing,

and vaccination. Both the health risk itself and the administration’s

policies to address the health emergency may have driven the spike in

resignations that occurred in 2021‑22 and could have been a contributing

factor for eligible employees to decide to retire.

Female Correctional Officers

2018 State Law Limits Use of Male Officers at Female

Institutions. In 2018, the Legislature approved and the

Governor signed Chapter 174 (AB 2550,

Weber), adding Section

2644 of the Penal Code. This law seeks to protect females in prison

from sexual assault, abuse, and other improper contact with male

correctional officers. Specifically, the law prohibits—except in

specified emergency situations—male correctional officers from

(1) conducting a pat down search of females in custody, (2) entering an

area inside the prison where females may be in a state of undress, or

(3) being in an area where they can view females in custody in a state

of undress.

Few Female Correctional Officers. The

profession of correctional officer historically has been dominated by

men. Since 2003, the share of Unit 6 members who are women has steadily

declined. Specifically, whereas 21 percent of Unit 6 members were women

in 2003, 17 percent of Unit 6 members were women in 2022. As we said in

2019 when we

reviewed the Unit 6 MOU submitted for ratification that year, CDCR might

need to recruit additional women correctional officers to work in its

women’s prisons to maintain compliance with Section 2644.

2019 MOU Established Working Group to Develop Recruitment

Strategies for Female Staff. The 2019 MOU included

a provision that established a working group to develop strategies to

enhance recruitment, transfer, and retention of female staff at women’s

prisons. We asked CDCR to provide an update to us on the outcome of this

working group. The department informed us that (1) the working group did

not meet and, consequently, did not produce any strategies to improve

recruitment and retention of female staff but (2) the department

independently has implemented strategies. The strategies that CDCR

indicated it has implemented to improve recruitment and retention of

women include targeted marketing; development of a website focused on

women in CDCR; using women recruiters and ambassadors at recruitment

events; recruiting at women-focused events (for example, the Central

Valley Women’s Conference); partnering with women-focused organizations

(for example, women’s athletics programs); and attending national and

state women’s conferences to learn new strategies to attract women

applicants. Lastly, CDCR indicated that it signed onto the 30×30 pledge to

improve the representation of women in police recruits to 30 percent by

2030.

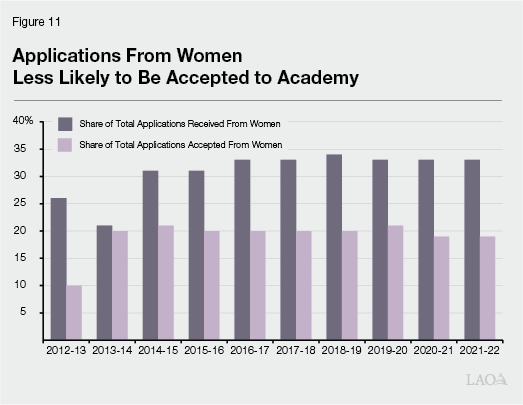

Women Disproportionately Rejected From Academy

Application Process. Part of the challenge of hiring

female correctional officers is due to the fact that more men apply to

become correctional officers than women. For example, since 2011‑12, men

consistently have made up more than 66 percent of the applications

received for the academy with the highest share being in 2011‑12 when

82 percent of the applications were from men. In addition, however,

something in the application screening process results in applications

from women being more likely to be rejected. Specifically, as Figure 11

shows, in all of the past ten years, women have represented a smaller

share of the number of people admitted to the academy than they did the

share of people applying for a position in the academy. As long as this

trend continues, the share of female correctional officers likely will

continue to decline and put at risk CDCR’s compliance with Section 2644.

CDCR indicated that one reason that women have been dropped out of the

application process in the past is because women were more likely to

fail the Physical Fitness Test element of the application process where

applicants are required to carry weights in varying size to specific

distances to simulate carrying a stretcher during an emergency. The

department informs us that, as of March 2023, the Physical Fitness Test

has been removed from the applicant selection process; however, all

cadets will still be required to pass the Physical Fitness Test at the

academy, but can do so in an environment where they can learn and be

mentored in developing the skills needed to pass the course. This could

result in fewer female applicants being rejected from the academy.

The Proposed Agreement

Changes to

Retirement Benefits Established by PEPRA

Agreement Fundamentally Enhances Unit 6 Retirement

Benefit. The agreement would change the employer-funded

retirement income benefit for Unit 6 members from a defined benefit

pension to a parallel hybrid plan whereby the state funds both a defined

benefit pension and a defined contribution plan. This fundamentally

changes the state’s retirement benefit. Such a change warrants serious

and extensive deliberation to work through issues and questions like

those below.

-

What Problem Is The Proposal Trying to

Address? The defined benefit pension provided to new and

senior Unit 6 members provides a substantial income replacement ratio

that allows the average retiring Unit 6 members to replace nearly 70 of

their income without regard to any personal savings or assets available

to the retiree. A new employee only needs to work four years longer than

more tenured employees to receive the same level of benefit. -

With a New Employer-Funded Defined Contribution

Component, Should the Employer-Funded Defined Benefit Component

Decrease? Hybrid pension plans where employees earn both

an employer-funded defined benefit pension and an employer-funded

defined contribution plan typically include a somewhat less generous

defined benefit than employers who provide only a defined benefit

pension. -

Does Establishing a Hybrid Retirement Plan for Unit 6

Raise Equity or Parity Issues With Other Bargaining Units?

The state’s pension benefit is largely consistent across bargaining

units by providing a defined benefit pension that offers different

income replacement levels depending on date of hire, whether an employee

is in Social Security, and the employee’s job. With an average base pay

of over $95,500, Unit 6 is not a low-income bargaining unit. In

contrast, the average base pay for Unit 15 is about $45,000. As we

indicated earlier, lower-income people typically need a higher income

replacement ratio in retirement as a larger share of their income goes

towards basic needs. -

Should There Be a Vesting Requirement for the State’s

Contribution? Employers generally can establish vesting

requirements that require employees to work for a specified amount

of time before the employee has a right to employer contributions made

to a 401(k). -

With a Larger Share of Unit 6 Utilizing Savings Plus

457(b) Plans, Why Require the Employer Contribution to Go to a

401(k)? Employees must pay Savings Plus maintenance fees

for each account they hold. An employee might want to minimize these

fees by maintaining only one account. With 85 percent of Unit 6 members

participating in a Savings Plus 457(b) plan (compared with 19 percent in

the 401[k] plan), it would make sense to give employees an option to

have the state’s contribution go towards a 457(b) plan.

Location-Specific Bonuses

Administration Gives No Supporting Evidence That Three

Institutions Are “Hard to Fill.” The agreement identifies

SVSP, SAC, and RJD as hard to fill. The administration provides no

evidence or justification to support this claim. Vacancy rates of the

institutions do not support the claims. All three facilities have

lower-than-average vacancy rates of correctional officer positions with

11 percent, 11 percent, and 9 percent vacancy rates, respectively, in

January 2022.

Administration Provides No Justification to Create

Incentive Payments for New Officers to Go to Specified

Institutions. The administration provides no evidence or

justification to suggest that the incentive payments for new officers at

specified facilities are necessary to maintain an inflow of new recruits

to those institutions. The list of institutions includes seven of the

facilities with the most Unit 6 positions (Kern Valley State Prison in

Delano; SVP; San Quentin Rehabilitation Center; Substance Abuse

Treatment Facility and State Prison in Corcoran; California Health Care

Facility in Stockton; RJD; and California State Prison, Corcoran).

However, it is not clear that these institutions are less desirable work