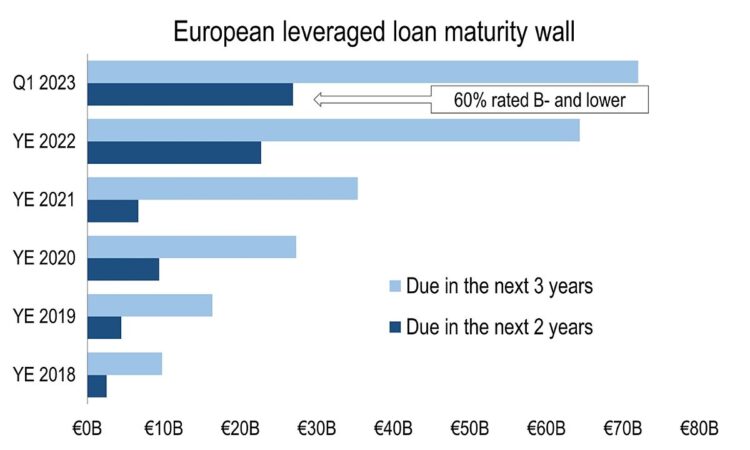

Borrowers in Europe continue to face a significant debt maturity wall over the next two-to-three years, despite having addressed a number of looming maturities through refinancings and amend-to-extend exercises over the last six months.

At the end of the first quarter, companies with loans outstanding in the Morningstar European Leveraged Loan Index (ELLI) faced nearly €72 billion of debt coming due within the next three years, and nearly €27 billion in the next two years — the highest figures on both these measures for five years.

Of the amount due before the end of 2024 (within two years), nearly 68% of the loan amounts outstanding fall into the B-minus rated or lower category, while 50% of loans by amount are rated CCC+ or lower, according to LCD. Similarly, for those maturities coming due before the end of 2025 (within three years), 57% have a rating of B-minus or lower. The share is smaller for those credits rated CCC+ or lower, at 28% — as those borrowers are usually facing the most near-term refinancing risks.

Time check

The average time to maturity for loans in the ELLI currently stands at 4.14 years, which is the shortest monthly reading since September 2013, while the ELLI’s maturity pressure currently peaks in 2028. Despite the large amount of debt falling due in the next three years compared to historical periods, work has already been done by borrowers to address maturities, and — compared with end-December 2021 — loans maturing in 2023 have been reduced by 46%, and 2024 maturities trimmed by 33%. Since the end of last year, the 2023 maturities have declined by 14% and the 2024 maturities by 28%, whereas the 2028 maturities increased by 7%.

Looking at supply type, refinancings in the European leveraged loan market accounted for 64% of institutional new-issue volume in the fourth quarter of 2022, the such highest quarterly percentage since 2Q13. In the first quarter of this year the same refinancing measure fell to 41% (the second-highest quarterly percentage since 4Q19), however new-issue volume has generally been subdued compared to prior years, due to the economic uncertainty generated by factors such as rising interest rates and war in Ukraine.

The looming maturities come as the downgrade ratio (the ratio of downgrades to upgrades for leveraged loans in the ELLI) ticked up to 3.8x at the end of March (on a rolling three-month basis), as downgrades outnumbered upgrades — up from 2.8x at the end of February, and as low as 0.56x back in February last year. Apart from the three months to the end of October 2022, when the ratio reached 4.5x, this is the highest this measure has been since the autumn of 2020.

Against this backdrop, rating agencies have flagged concerns. “Tighter financing conditions could uncover pockets of financial vulnerability, rendering refinancing difficult,” said S&P Global Ratings in a report published March 28, adding that this situation is exacerbated by the “erosion of confidence in the banking sector following, most recently, the forced takeover of Credit Suisse by UBS.”

Challenged credits

These downgrades include more challenged credits within the cohort of facilities due for repayment inside the next 21 months, such as Keter, with the BC Partners-backed resin furniture group on March 15 downgraded at S&P by two notches to CCC, on uncertainty around the refinancing of its €1.2 billion term loan due October, and a €102 million revolver due July.

Flint has also been downgraded, to SD by S&P Global Ratings, after the firm announced it had reached agreement with roughly 70% of first-lien lenders and 90% of second-lien lenders for a restructuring. S&P Global Ratings also downgraded the firm’s first-lien term loan to CC from CCC, and the second lien to C from CC (the rating is expected to be lowered to D when the next interest payment is due on April 24). The restructuring comes as the company faces headwinds from weak demand for its packaging business, amid a structural decline in print media, increased competition and difficulties in passing on higher costs.

However, some borrowers have been able to take advantage of being in more favoured sectors, or have been able to use strong operating performance and a history of deleveraging to extend their debt profiles. In January, for example, Nord Anglia extended its September 2024 loans by 3.25 years to January 2028, pricing a €1.5B deal at E+475 with a 0% floor offered at 98. This compared with guidance at launch of a €1.3 billion tranche at E+475-500 offered at 97, that was then revised to E+475 at 97.5-98. At the time, the deal was the largest sponsor-backed loan in the ELLI with a 2024 maturity (based on issuance amount), and dated from a cross-border term loan which allocated in June 2017 and was split between a roughly €1 billion tranche priced at E+325 and a $315 million pre-placed dollar piece, which — along with a second lien — backed the firm’s take-private.

When put together, the five sectors with the most amount due of debt maturing by 2025 comprise 51% of the total amount due in that time frame, and are from issuers in the more inflation-hit, cyclical sectors (namely Chemicals; Hotels; Restaurants & Leisure; Specialty Retail; Broadline Retail; and Food Products). These are sectors that are either more consumer-facing and likely to be hit by recession fears, or impacted by increased energy prices and the war in Ukraine — and which may struggle to pass on these costs.

Extension lead

Another route to addressing maturities is via extensions, and sponsors over the last quarter have returned to the amend-and-extend trail with a gusto not seen in at least four years. Just as in the aftermath of the Eurozone debt crisis, banks are today using the technique to hold together syndicates at a time of uncertain liquidity, with extensions of two or three years that should not challenge CLO WAL tests.

LCD’s volume figures do not include amend-and-extend activity, but the first quarter hosted 13 such extensions totaling €10.8 billion, while a few others — including Fläkt Woods — have been completed quietly. By their nature, amend-and-extends and refinancings do not provide much in the way of new money, but do help to reprice portfolios and provide extra runway for sponsors as they manage their exit plans in an uncertain economic environment. They also provide an opportunity for lenders to tighten documents.

Sponsors are also taking advantage of excess liquidity to mop up non-rollers, meaning deals are tending (though not always) to extend in full without a stub. In the main, bankers say roughly 20% of the syndicate can be expected to drop in an extension, with the number typically dependent on the age of the facility. There are also specific cases, and Motor Fuel Group highlighted liquidity challenges in sterling in mid-March when it extended £600 million of its £765 million term loan by three years to June 2028. The CD&R-owned petrol station group was able to upsize the euro portion of the deal slightly, to €1.15 billion.

Other deals have also struggled in early birds, and Nordic-backed Alloheim is understood to have withdrawn an initial proposal to extend a €500 million term loan, while in the US, Tekni-Plex is said to have withdrawn a move to extend cross-border term loans due 2024. There are other ways to deal with maturities, and Ontario Teachers’ Pension Plan is looking to sell Irish national lottery operator Premier Lotteries ahead of a 2024 loan maturity.

However, those able to extend will have to contend with increased costs of financing. Last week, Banijay completed its cross-border first-lien term loan extension that extends the maturity of its facilities by three years to March 2028, according to sources. The euro-denominated tranche, which will total €555 million pro forma for a €102 million add-on, cleared tight to talk at E+450, with a 0% floor and OID of 99 to yield 7.99%. This pricing represents a considerable increase on the original deal, which included a €453 million euro-denominated B term loan due March 2025 which priced at E+375 and par, to yield 3.8%.

Overall yields continued to rise in the first quarter, with the average YTM at issue for single-B euro-denominated TLBs at 8.61%, according to LCD, up from 8.21% at the end of 4Q22. Spreads also rose, to an average of 488 bps at the end of 1Q for the same cohort, from 474 bps at the end of 2022. OIDs, however, shrunk on average, with the OID over three years for all European transactions contracting to 114 bps at the end of the quarter, from 185 bps at the end of 2022.

Although Europe’s leveraged finance markets remain functional, the pipeline of underwritten deals is thin, even if the recent launch of the €446 million loan backing Towerbrook’s buyout of Group Services France shows there may still be some older deals lurking. The buyout was announced in March last year, and the deal received regulatory clearance in June. The US may also provide some supply, and previous cross-border borrower Univar is expected to get syndication underway shortly for the debt backing its Apollo-led buyout.

Beyond these situations, however, extensions and add-ons are set to dominate supply heading into the summer. Sources note that most of the more-straightforward 2024 maturities have been addressed already, thereby leaving the more-complex stories remaining and shifting the focus to 2025. Earlier this month 3i-backed discount retailer Action stepped out with a request to extend a minimum-€1.5 billion of its €2.285 billion term loan B1 due March 2025 by 3.5 years.

Featured image by gopixa/Shutterstock