I’ve Had it with Stupid Stuff about Hotels in San Francisco: Park Hotels & Wall Street Screwed Shareholders, Bond-Fund Holders, and Pension Funds, but Blame San Francisco?

The clueless WSJ reporter needs to be taken to the woodshed. That kind of BS article doesn’t belong in the WSJ.

By Wolf Richter for WOLF STREET.

The Wall Street Journal managed to publish another stupid article this morning with a clickbait headline and subtitle about hotels in San Francisco, concocted by a young clueless reporter who lives on the other side of the country and got her notions about San Francisco from reading what exactly?

As her core example, she regurgitated a clickbait story engineered via press release by Park Hotels & Resorts, a publicly traded REIT that owns a bunch of decades-old overleveraged hotel properties. It doesn’t operate the hotels, other companies do that. It just owns the land and buildings.

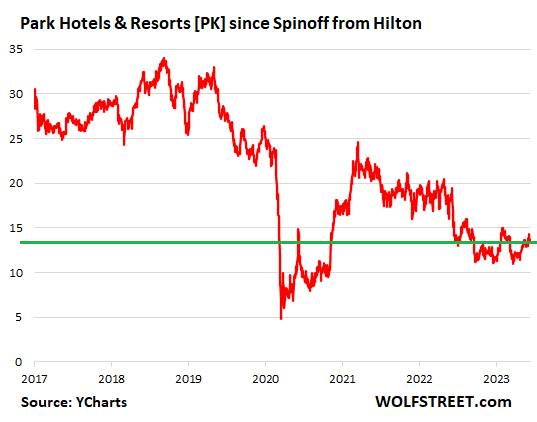

Its shares have collapsed by 59% from the high, and by 54% from the IPO in 2017, after it slashed its dividends multiple times and lost $1.9 billion in 2020 and 2021, far more than it had ever made as a public company.

And after ripping off its shareholders, Park Hotels is now ripping off bond mutual funds and pension funds that bought the commercial mortgage-backed securities (CMBS) backed by the mortgage that it defaulted on, and after ripping off all its investors to the tune of billions of dollars, it blamed in a ridiculous press release on June 5 the “street conditions” and high vacancy rates in San Francisco?

Park Hotels failed to pay off a $725 million interest-only non-recourse mortgage that matured last November. The mortgage was secured by two run-down mega-hotels in San Francisco, the 1,921-room Hilton San Francisco Union Square and the 1,024-room Parc 55 San Francisco. Their towers were built in the 1960s through 1980s and need an estimated $200 million in upgrades and renovations.

Park Hotels refinanced the properties in 2016, during the era of free money, with a high-risk interest-only non-recourse 4.1% mortgage of $725 million, backed by fantasy valuations of these decades-old run-down properties of $1.02 billion and $540 million respectively.

Banks hang on to their low-risk high-quality loans. But no bank would ever want that kind of toxic mortgage on its books, that interest-only, non-recourse commercial mortgage, backed by fantasy valuations of some old towers.

So, JPMorgan sliced and diced the mortgage and securitized it into CMBS, to where the top-rated slices were well into investment grade. The slices were sold to bond mutual funds, pension funds, etc., that manage other people’s money.

These other people whose money this was are now getting screwed, and they likely don’t even know about it.

So in November 2022, Park Hotels was supposed to pay off the $725 million mortgage but obviously didn’t have the cash. The mortgage had an interest rate of 4.1%. But by the time it matured, interest rates on these types of high-risk commercial mortgages were already over 7%. And getting a new 7% mortgage to pay off the old 4.1% mortgage wouldn’t work out at all. That’s why interest-only mortgages rolled into CMBS are toxic.

So forget it. Let other people’s money take the hit.

Park Hotels only owns the properties. The hotels themselves are operated by other companies, and when Park Hotel defaults on a mortgage and walks away from the property, it means ownership of the property will change. That’s all it means for the hotel. The operating company remains the same.

This default has no impact on San Francisco. But Park Hotels is screwing your bond mutual fund and pension fund.

Park Hotels was spun off from Hilton Hotels. In 2007, Hilton was taken private in a huge leveraged buyout (LBO) by PE firm Blackstone. In 2013, Blackstone began to unload its Hilton stake via IPO, ultimately at a huge profit. In late 2016, Hilton spun off its hotel properties into a REIT, Park Hotels and Resorts [PK], which began trading in January 2017.

Park Hotels has been a catastrophic nightmare for retail investors. The misdeeds that sank Park Hotels’ shares didn’t happen on the streets of San Francisco – as the company ridiculously alleged – but in the C-suite of Park Hotels and on Wall Street. And its investors and now the holders of the CMBS are getting ripped off.

The shares have collapsed by 54% since the IPO in January 2017, and by 59.5% from the peak in September 2018:

Park Hotels cut its quarterly dividends in big increments starting in 2020 to where it eventually paid just 1 cent for three quarters in a row. Last December, it raised its dividend to 25 cents, compared to a range of 43 cents to $1.00 in 2017 through 2019. Then in Q1 2023, it cut its dividend again to 15 cents, and for Q2, it also declared a dividend of 15 cents. People invest in REITs to get the juicy dividends, and to have a somewhat stable share price, and they got screwed on both fronts by this company.

Park Hotel lists “46 premium-branded hotels and resorts with over 29,000 rooms primarily located in prime city center and resort locations” on its site today, still including the properties that it is walking away from in San Francisco.

Alas, at the time of the IPO, the REIT had, according to the hype-and-hoopla press release, “67 premium-branded hotels and resorts with more than 35,000 rooms located in prime U.S. locations and international markets with high barriers to entry.” Such is the hype and hoopla, and investors fell for it, and paid a huge price.

First, they screwed the investors that bought the shares hoping for rich dividends and a roughly stable share price. Now, by refusing to pay off the mortgage, they’re screwing whoever indirectly holds the CMBS, such as retail investors in bond funds and pension fund beneficiaries. And the company blames the “street conditions” in San Francisco to distract from this rip-off?

It always makes great clickbait headlines if you can stick “crime” and “San Francisco” into it, and the blogosphere and the media, in their braindead manner jumped, all over it last week. Put “crime” and “Tulsa” into a headline, and no one reads it. That’s why clickbait exists: it creates clicks.

So now, the Wall Street Journal published another article with a clickbait headline and “crime” and “quality-of-life-issues” in the subtitle about hotels in San Francisco, specifically the two defaulted Park Hotels properties. Did the author, who lives on the other side of the continent, get her info about “crime” and “quality-of-life-issues” from the vast collection of fantasy porn about San Francisco?

In terms of hotel data, she wrote that revenue per available room was “nearly 23% lower in April compared with the same month in 2019.” I mean, DUH, hotels have to compete with a gazillion vacation rentals in San Francisco, and that’s hard. And so room rates have to come down.

In addition, the largest group of leisure tourists before the pandemic, leisure tourists from China, have yet to come back in large numbers, though they have started to trickle back. But that’s the case everywhere in the US where Chinese leisure tourists like to go.

And the Hilton is a convention hotel, catering to expense-account travelers that attend conventions and trade shows at the Hilton and other venues. During the pandemic, most conventions and trade shows were shut down across the US, which taught a lot of business executives that not every convention or trade show is necessary. But even that business is coming back, believe it or not.

San Francisco is teeming with tourists, they’re just not all staying in expense-account hotels. Many of them are staying in a gazillion vacation rentals and are very hard to track. Condos throughout the city are listed on the vacation rental market. This is a huge thing. And hotels have to compete with them.

Then get this: To cement her fantasy about “crime and other quality-of-life issues” or whatever in San Francisco, she throws in references about some retail stores that closed in San Francisco. Jeeesus. Doesn’t she know anything?

In a phenomenon triggered by ecommerce that I’ve called “brick-and-mortar meltdown” since 2017, and that I have reported on since 2017, retailers closed tens of thousands of stores. There are zombie malls everywhere. An endless number of retailers, from Sears Holdings and Toys ‘R’ Us on down to Bed, Bath & Beyond filed for bankruptcy and most of them vanished. All regional and nearly all national department store chains filed for bankruptcy and vanished. There are just a few left. J.C. Penney, which finally filed for bankruptcy in 2020, was bought out of bankruptcy by the largest mall landlords in the US, Simon Property Group (SPG) and Brookfield, because they didn’t want shuttered anchor stores doom their malls. Macy’s, one of the few surviving department stores, has closed hundreds of stores over the years and continues to close stores. SPG defaulted on and walked away from overindebted malls across the US, no problem, including the 170-store 1.2-million-square-foot Town Center at Cobb in Georgia, the 1.1-million-square-foot Montgomery Mall in North Wales, Pennsylvania, and in 2019, the 1-million-square-foot Independence Center in a suburb of Kansas City, Missouri, which generated what was then the largest loss ever by a retail CMBS loan. Three mall REITs have filed for bankruptcy since November 2020, SPG’s spinoff, Washington Prime Group, CBL & Associates Properties, and Pennsylvania Real Estate Investment Trust.

But when a few stores close in San Francisco, a clueless reporter thinks it’s a sign of “crime and other quality-of-life issues” instead of six years of brick-and-mortar meltdown due to the way Americans now shop, namely online, with San Francisco being the epicenter of ecommerce?

That kind of bullshit article doesn’t belong in the WSJ, and the reporter needs to be taken to the woodshed.

Someone is going to buy those hotel properties for a song from the ripped-off CMBS holders (represented by the special servicer Wells Fargo). The new owners of the buildings can then perform the necessary upgrades and renovations and end up with a decent business in San Francisco.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()