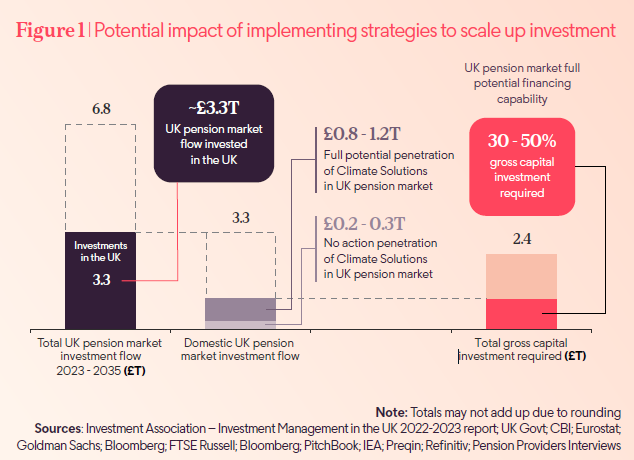

The research, which sourced data from interviews with pension providers, the government, and other providers, found the industry has invested 4% (£0.1trn) of its assets in UK climate solutions, and is on track to invest around 10% to 15% of its assets (£0.2trn to 0.3trn) by 2035.

However, it said the industry could “quadruple” its investment by this date to stay on track to deliver the ‘balanced pathway’ to net zero, which was established in the Climate Change Committee’s 2020 report on the sixth carbon budget (2033-37) and aims to allocate £50bn of capital each year in low carbon solutions by 2030.

The report said by 2035, £2.4trn in gross capital investment is needed in climate strategies to deliver the ‘balanced pathway’ to net zero, with the UK pension industry having the potential to make up between 30% and 50% of the total capital required.

Globally, between US$40 and US$60trn in gross capital investment solutions is needed by 2035. The report also noted the UK is currently on track to invest £3.3trn in the UK, and £6.8trn overall, by 2035, with £2.2trn expected to be invested in listed equity, £1trn in sovereign and corporate debt and £0.2trn in private debt, private equity, and real estate internationally.

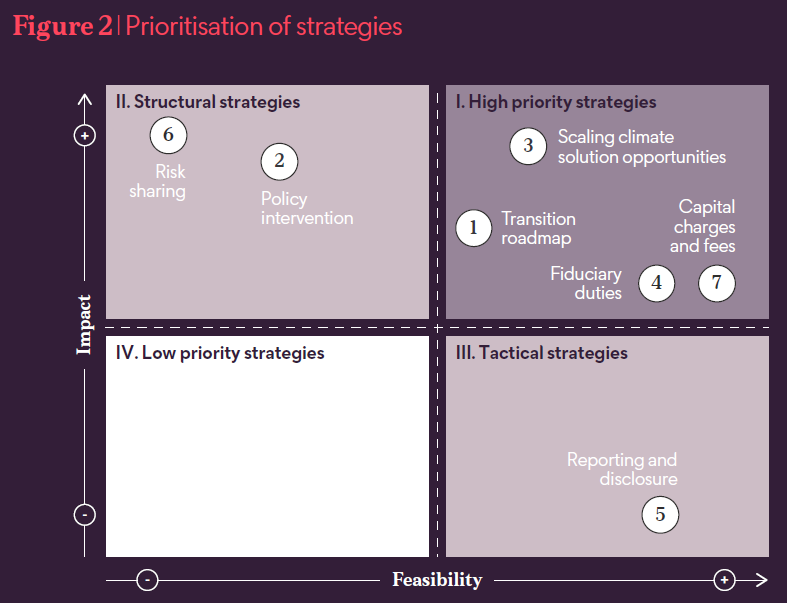

To address the barriers to investment, the report called for a UK economy-wide “national transition plan” with sector-specific roadmaps and policy instruments, as well as “long-term policy certainty and incentives” to attract investment, with measures aimed at reducing volatility of returns and “abating costs for early-stage technology providers”.

Additionally, “investable and scalable opportunities” are needed, including “initiatives that accelerate the go-to market of new technologies, aggregate fragmented opportunities and provide a consistent planning regime at a national level”.

Addressing regulatory barriers, considering climate impact as part of fiduciary duties is key to help the industry “integrate the net-zero transition into investment decisions and engage investee companies”, while improved “reporting transparency and standardisation” of disclosure requirements can help investors and consumers evaluate climate risk.

The report also recommended risk-sharing mechanisms between investors and both central and local government to make opportunities “more attractive to long-term investors” and suggested the government “consider exempting fees related to investing in climate solutions from the defined contribution regulatory charge cap” as well as “deliver matching adjustment reform”, referring to Solvency UK.

It also recommended the industry defined “clear net-zero targets and timelines”, ensured high levels of governance and accountability, integrated climate risk into their investment, and upskilled their workforce on climate opportunities and risks.

Additionally, innovation on climate scenarios and modelling tools, improved member engagement, developing new investment products and engaging directly with government and regulators can also lead to better outcomes.

Also noted within the report was research from MMMM among 2,050 adults with a pension in September this year, which found almost half (42%) wanted their pension fund to invest more in climate solutions.

The research also found two thirds (66%) of pension holders supported their scheme investing in renewable energy, and a similar percentage (68%) supported investments in companies that protect natural habitats. Only one in five (19%) supported their scheme investing in fossil fuels.

Phoenix Group head of climate change and nature Bruno Gardner agreed pensions can play “a significant role” in ensuring savers outcomes are prioritised while enabling the transition to net zero.

“It’s exciting to see that pension funds could finance up to half of the investment needed to keep the UK’s transition on track and provide savers with greater access to the investment potential of climate solutions, but it’s even more important to have identified why there isn’t already more funding for climate solutions and what can be done about it.

“By setting out the scale of the opportunity, we hope to show that by creating a pipeline of investable opportunities and by making it easier to invest in climate solutions we can come together and drive positive change.”

MMMM co-founder Richard Curtis said: “Our pensions can – and must – play a critical role in tackling the climate crisis. But right now, we are nowhere near maximising the potential of our pensions for people or for planet.”

He added that taking recommended steps to boost investment will mean money is mobilised “for people, planet, and a prosperous retirement, and [to] ensure we all have pensions we can be proud of”.

Pensions and Lifetime Savings Association (PLSA) director of policy and advocacy Nigel Peaple said the report “recognises the good work already undertaken by pension schemes to achieve net zero and rightly acknowledges the willingness of pension trustees and managers to do more”.

He agreed with many of the suggestions put forward in the report, adding the PLSA has also called for initiatives such as a national transition plan, policy certainty and incentives, and agreed that any investments “must be in the interests of scheme members and customers”.

“The disclosure requirements in the UK are world-leading, with the government being the first to apply the internationally mandated Taskforce on Climate-related Financial Disclosures requirements to pension schemes.

“The pensions sector wants the government to accelerate its climate roadmap to ensure companies, asset managers and service providers catch-up with the expectations on pension schemes. Doing so will ensure that schemes have more accurate and meaningful data on which to base their strategies and commitments.

“While we agree with many of the detailed policy solutions proposed, we note that Phoenix and MMMM see this report as a means to start a discussion on how best pension schemes can play a bigger role in achieving net-zero emissions and we look forward to contributing to this work.”

Also commenting on the research was the Mission Zero Coalition, which was set up earlier this year as a network of business and stakeholder leaders to encourage political parties to focus on climate change following the government’s net-zero review in January.

Coalition chair Chris Skidmore said: “We welcome this report by Phoenix Group and MMMM, which shows the enormous opportunity both in the short and long term, that the pensions industry can achieve in helping drive the UK’s net-zero ambition.

“To do this, collaboration between government, regulators and industry will be key, and we look forward to continuing working, through the Mission Zero Coalition, with Phoenix and the wider industry to drive investment and growth in the UK economy.”