The Office for Budget Responsibility’s latest fiscal risks and sustainability report highlights the growing share of government debt in the hands of foreign private investors as one of the main vulnerabilities of the UK’s debt position. But this is a muddled understanding of the behaviour of foreign investors in the gilt market.

The OBR report states that ‘Over the last two decades, the share of UK sovereign debt in the hands of private foreign investors has doubled and is now the second highest in the G7.’ But this is misleading in that this statement also includes UK domestic holders of gilts via offshore investment vehicles. This is clarified in a small footnote in the report stating that ‘[Liability-driven investment]-related investments of UK defined benefit pension funds may account for a substantial part of the rise in foreign ownerships of gilts.’

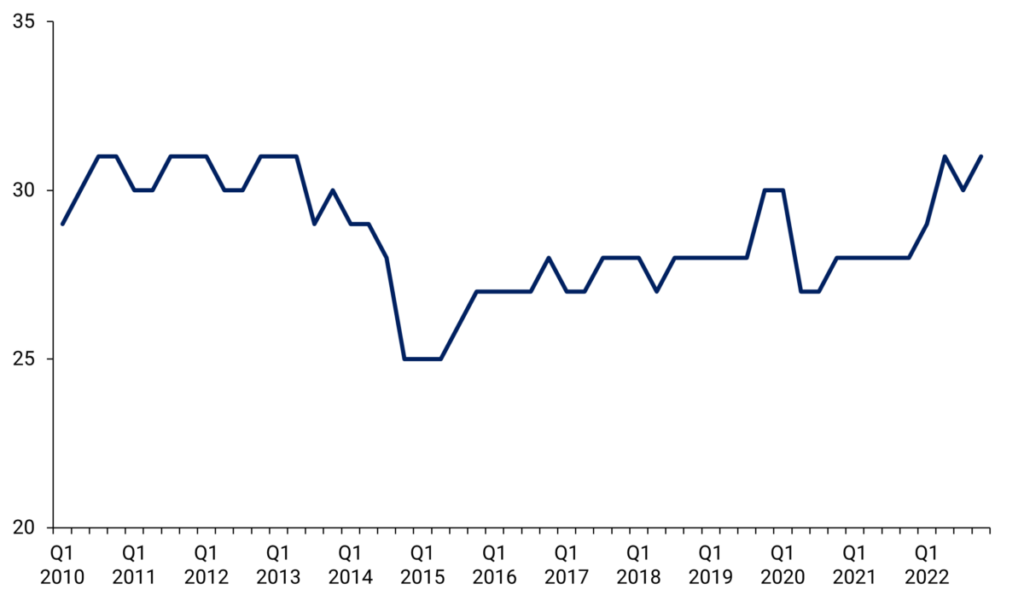

Foreign investors in gilts have certainly increased in the last few decades but, as a proportion of the total gilt portfolio, this has remained steady over the last decade at around 25% to 30% (Figure 1). By the end of 2022, overseas holdings of gilts represented around 30.6% of the total gilt stock – the highest since the end of 2012.

Figure 1. Foreign investors in gilts have remained steady

Overseas gilt holdings, %

Source: UK Debt Management Office, Office for National Statistics

Source: UK Debt Management Office, Office for National Statistics

The report goes on to say that ‘overseas holders of gilts are less likely to have a such a structural desire for sterling assets’ than domestic holders, so ‘smaller changes in the relative attractiveness of gilts can mean foreign investors quickly switch to other assets in potentially large volumes’. It is true that the core domestic investor base of gilts such as UK pension funds and insurance companies have more of a need for sterling assets to meet their liabilities. But to say that this means foreign investors are more prone to sell-off gilts than domestic investors is simply unproven.

It is also true that foreign investors represent some of the most long-term investors in the UK government bond market, partly due to sterling’s role as a reserve currency. Let us not forget that during last autumn’s LDI crisis, it was the domestic investor base that proved the greatest source of instability in the gilt market as UK pension funds scrambled to sell their bonds to meet margin calls. Meanwhile, the gilt market saw significant interest from overseas official institutions due to the weakening of sterling.

As the report states, foreign investors bring a lot of value to the gilt market. The diversification of an investor base can bring down the cost of borrowing with more demand being poured in, especially at a time when the domestic investor base is being stretched with a record amount of net supply entering the hands of private investors. Overseas investors therefore play an important role in the functioning of the UK government bond market and the rise in their holdings of gilts should be seen as a positive.

Another vulnerability of the current UK debt market highlighted by the OBR is the increase in the proportion of UK government debt indexed to inflation. This is more of a valid concern, but it also needs context.

Over the past two decades, the proportion of the UK’s index-linked debt has been steady at around 25%. By the end of 2022, index-linked debt stood at 25.2% of the total net gilt portfolio. Still, as the report states, this is an increase from around 10% in the 1980s and the proportion of index-linked debt is high in relation to other advanced economies.

It is true that a large share of debt and inflation-linked debt at a time when inflation is high has a huge impact in increasing both debt interest costs and the stock of debt, particularly while interest rates are high and continue to rise. The UK will spend £110bn on debt interest payments in 2023, according to a forecast by Fitch, representing 10.4% of total government revenue and the highest level of any high-income country.

This is exacerbated even further by the fact that UK index-linked gilts are tied to the retail price index. This is even higher than the consumer price index, which tends to be the typical headline inflation number. In June, CPI inflation was 7.3% while RPI inflation was 10.7%.

But the UK is not alone in this problem with many countries facing a similar issue of index-linked debt at a time of high inflation. It is also worth noting that inflation-linked debt has been a huge boon for the UK over the past few decades with record low inflation.

Burhan Khadbai is Head of Content, Sovereign Debt Institute, OMFIF.