Social Security protects all generations. We need a multi-generational movement to protect and expand it!

Don’t fall for the Republicans’ lies and the caving in to those lies on the part of right-wing Democrats. The Social Security Old-Age, Survivors, and Disability Insurance Trust Funds had more than $2.8 trillion in reserves at the beginning of 2022. The accounts hold 68 years of tax contributions from workers and employers.

While a fraction of that surplus is currently being drawn on to pay benefits to baby boomers born between 1946 and 1964, it also has a built-in source of continuing revenue: Social Security bonds which the fund cashes in for U.S. Treasury bonds, similar to how corporations refinance their debt.

Even before collecting taxes that the rich in reality owe the fund, its bond revenue remains ample enough to cover 100% of benefits through 2035, and enough to cover 75% of benefits for many years after.

The rich currently avoid taxes through the Social Security tax cap, which saves high income tax filers from having to pay anything toward Social Security on any income over $160,200. They are also let off the hook for unearned income such as returns on stocks, or capital gains.

Yet, the distortions and lies about Social Security are so widely and so frequently repeated that younger people in the U.S. accept as an incontestable fact the myth that they will not get Social Security benefits after a lifetime of paying into it. Nancy Altman and Eric Kingson cover many of these details in their 2021 book Social Security Works For Everyone!

Next time someone tells you Social Security is going broke, remember: the Social Security trust funds are actually owed money from the guaranteed government bonds it has purchased.

Our party program clearly states, “Seniors and retirees are under attack. This attack includes right-wing efforts to privatize Social Security and slash Medicare, price gouging by pharmaceutical companies, and the divestment of pension plans by businesses eager to avoid their contractual obligations.”

The program also says, “National health care, including coverage of catastrophic illness, increased Social Security benefits and COLAs, expanded housing programs for low-income seniors, social support for culture accessible to all, and the acknowledgment of seniors’ contributions to society will all help this expanding sector of society.”

As pointed out in a 2005 report to the CPUSA National Board, the privatizers tell young workers they are being taxed to finance the retirement of ‘greedy’ baby boomers, and claim there will be nothing left for current workers. They also argue that African Americans are being ripped off by Social Security because of their shorter lifespans. These same liars argue that women live “too long” and draw too much money out of the fund.

They hope to divide the working class and win them over to privatizing this gigantic pot of public money, which would, in turn, be used to help maintain divisions in the working class. Some of the tactics the right wing uses to ideologically stampede workers with the privatization campaign include:

- Advancing the ideology of the ownership society

Since 1936, the right has attacked Social Security on principle — branding as evil the idea that we should design a collective solution to social problems, and instead insisting that each individual fend for themselves. The ideological hoodwinking, which continues even now, even convinces some young workers to peg their retirement plans to some form of bitcoin. - Work till you drop

Workers over age 55 have accounted for huge increases in the overall labor force in recent decades — driven by soaring healthcare costs and 401(k) investment schemes with volatile balances. Under most plans being discussed, benefits will be cut, and seniors are already forced to work until they drop, often in low-wage, part-time jobs.

The ruling class staffs its Walmarts with impoverished seniors, while avoiding the expense of educating the majority of working-class youth. Media stories laud workers who never retire.

Yet at the same time, Social Security and Medicare remain widely popular. Nearly 8 in 10 U.S. people want to maintain or increase funding to Social Security and Medicare. Even among Republicans, only 1 in 10 want to actually cut funding for these programs.

Among voters in states without Medicare expansion, 65% support implementing Medicaid expansion. This includes 85% of Democrats, 65% of Independents, and a majority of Republicans.

Social Security embodies the best of our values: that all human beings deserve dignity, freedom, and independence, and that we are all connected, sharing the same risks and benefits. Generations of workers in the U.S. built our Social Security system. It has worked efficiently for nearly eighty years, never failing to meet its obligations.

Through pandemics, wars, and economic recessions, Social Security continues paying monthly benefits, allowing workers to pay rent, buy food, and fill life-saving prescriptions.

People in the U.S. of all political backgrounds rely on our earned Social Security benefits. Social Security is not only the most reliable source of retirement income for all workers — it is also the primary disability and life insurance protection for the vast majority of the working class, including children. If a working parent of dependent children dies or is so seriously or permanently disabled that they are unable to work, Social Security pays dependents and survivors.

Whatever age you are now, you, every member of your family, your neighbors, and every person alive in the U.S. today benefits from Social Security. We benefit individually, starting with the first day of life. We benefit together from this life-long national insurance policy that we collectively fund.

For every U.S. generation, the current generation pays in for the generation behind them. Hence, we need a multi-generational movement to save and expand on this tried and true program.

How we got Social Security

In the 1930s, it took a powerful mass movement to force Congress to pass the Social Security Act. Both Social Security in 1935 and Medicare/Medicaid in 1965 resulted from working-class movements demanding fulfillment of people’s needs.

In 1934, President Franklin D. Roosevelt was branded a “Communist” when he urged Congress to pass Social Security. Newspapers, radio commentators and some members of Congress denounced FDR as a dictator and Social Security as a Communist plot to destroy the Constitution.

Roosevelt’s New Deal government also enacted unemployment insurance to provide financial assistance to laid-off workers. In addition, the Works Progress Administration (WPA) began to provide a significant number of public works jobs for needed infrastructure all around the country. Most importantly, a new government program called Social Security provided a system of retirement assistance. Communists stood in the forefront of the working-class struggle for much of this legislation, from labor law reform to Social Security and assistance for the unemployed.

The original legislation for the 1935 Social Security Act as written was fully intended to include national health insurance. But the right-wing push back against Social Security seemed too difficult to overcome. Roosevelt decided that the only way Social Security would pass in the Congress was to leave out the national health care plan, Medicare/Medicaid.

Insurance industry lobbyists and their paid puppets in Congress at the time waged a fierce attack against including health insurance in the Social Security Act.

Because of that resistance from Republican members of Congress at the time and for decades after, the national health insurance portion of Social Security — Medicare and Medicaid — was not added until 1965 during President Lyndon Johnson’s administration. Medicare, the federal program primarily for people over 65, and Medicaid, a state and federal program for people under 65, have, since 1965, comprised the health care portion of the Social Security Administration.

Social Security is one of the most successful and popular government programs in U.S. history. Before Social Security was signed into law, about 50% of the nation’s seniors were living in poverty, as were countless people with disabilities in the U.S. and the surviving dependents of deceased workers. Nearly 90 years later, the senior poverty rate is down to 10.3% and in 2021 alone, during the onslaught of the Covid-19 pandemic, Social Security lifted 26.3 million people in the U.S. out of poverty, including more than 18 million seniors.

Don’t cut it — expand it!

We need to strengthen all parts of Social Security, not cut it. The average Social Security payment is only $1,688 a month. Nearly 40% of seniors rely on this for a majority of their income; one in seven rely on it for more than 90% of their income; and nearly half of all U.S. people aged 55 and older have no retirement savings at all.

Our seniors, disabled, and survivors suffer in dire poverty because Social Security payments are woefully inadequate. We must fight to increase payments. The yearly Cost-of-Living Adjustment (COLA) increases are canceled out by increased costs of Medicare premiums and the drug co-payments recipients must pay, as well as the increasing costs of healthcare in general.

Another scheme Republicans have up their sleeves is the threat to raise the eligibility age. This has already been raised, because although you’re eligible to receive benefits at age 62, you can only get a portion of your benefit at that age.

This means workers are made to play the roulette wheel if they want to wait a few years to receive their full benefits. The rich have the money — demand that Congress pass the Social Security Expansion Act to make them pay their fair share! It can’t be said enough: unity of young and old is crucial for saving and expanding Social Security benefits, to lift up current recipients, and to ensure full benefits when younger workers reach enrollment age, which should actually be reduced. In the socialist countries, despite technological and productivity gaps, the retirement age has ranged between 50 and 60 years old, depending on the worker’s situation.

Even in capitalist France, striking workers are bringing their country to a standstill, protesting the Macron government’s recommendation for raising the retirement age from 62 to 64.

Republicans in Congress are threatening default and economic catastrophe unless they can force through their anti-worker agenda that includes robbing the Social Security fund that workers have paid into for decades. And while they are continuing to keep that agenda secret, virtually every Republican budget over the last decade has included repeal of the Affordable Care Act and deep cuts to Medicaid.

The Republican agenda would raise health care costs for people with pre-existing conditions — and cause millions to lose their coverage:

- More than 100 million people with pre-existing health conditions could lose critical protections.

- Tens of millions of people could see their prescription drug coverage scaled back.

- 40 million people’s health insurance coverage would be at risk.

- Over 7 million seniors and people with disabilities could receive worse home care, and nursing care could suffer, with ballooning wait lists for those still in need.

- Millions of people could lose access to substance use treatment or mental health care.

In addition, more of the over 500 rural hospitals at risk of closure could close. What the radical right is planning is to use Medicare’s “financial problems” as an excuse to privatize the system of healthcare for our elderly and disabled folks.

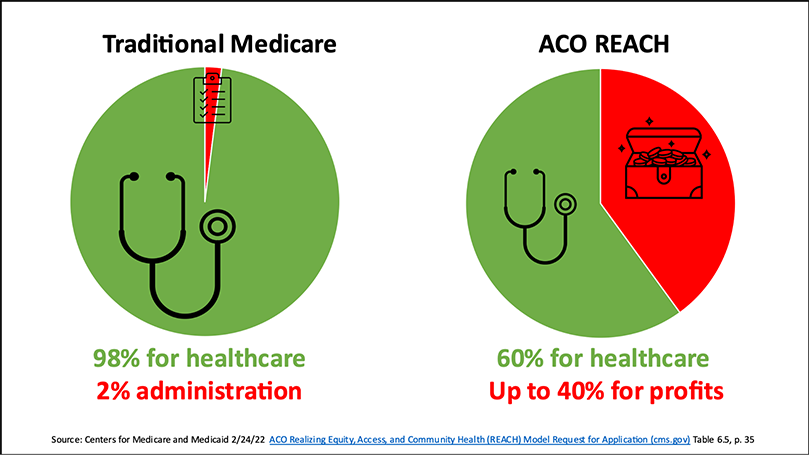

Last year, strong protests by a coalition of groups, including the Alliance for Retired Americans (an affiliate of the AFL-CIO), Physicians for a National Health Plan, seniors, unions and others, succeeded in forcing the Centers for Medicare and Medicaid Services (CMS) to shut down the privatization scheme called Direct Contracting Entities. This year, the financial vultures are back with their new scheme, ACO-REACH.

Here’s what ACO-REACH is in a nutshell:

The program’s goal is the complete privatization of Medicare by 2030. ACO-REACH started Jan. 1, 2023. Under this CMS program, companies that have no background in healthcare can buy healthcare providers like hospitals and clinics and take as much as 40% of the Medicare dollars paid to them as overhead and profit.

In this way, a powerful economic incentive is created to deny healthcare to seniors and the disabled (and to all patients) to increase profits. Amazon’s purchase of One Medical is an example of ACO-REACH in action. The companies buying up healthcare providers are typically hedge funds, private equity firms, and healthcare insurance companies whose only interest is making a profit.

Here is a graphic and five point explanation of ACO REACH:

- ACO REACH is a third-party private pay scheme, like Medicare Advantage, designed to weaken and destroy Traditional Medicare.

- Neither Medicare Advantage nor ACO-Reach are Medicare. They are private insurance. Traditional Medicare is what we need to preserve and build on.

- ACO REACH forces you into a program without your consent, taking away your freedom and your choice.

- ACO REACH creates perverse financial incentives for your doctor to limit your healthcare.

- ACO REACH funnels the money that came out of your paycheck your entire working life directly to Wall Street.

The fight in D.C.

Democratic legislators have authored several plans to preserve and strengthen Social Security. President Biden ran on a similar plan. Advocacy groups such as Social Security Works! call on Biden now to release an official White House plan that expands Social Security with no cuts and that requires the wealthiest to pay their fair share — that means ending the $160,200 wage income cap on Social Security contributions.

In his 2023 State of the Union Address, President Joe Biden called out Congressional Republicans for their plans to cut Social Security and Medicare. Several Republicans erupted in outrage, and Rep. Marjorie Taylor Greene (R-GA) yelled, “liar!” Biden responded, “I enjoy conversion … as we all apparently agree, Social Security and Medicare is off the books now, right?” and urged the entire room to “stand up for seniors.” Many Republicans in the room, including Speaker Kevin McCarthy, stood up and applauded.

Republicans have a long history of trying to cut Social Security and Medicare. Republican leaders keep saying — often to their donors behind closed doors — that they want to cut it. Most recently, former Vice President Mike Pence told a closed door conference that he wants to “replace the New Deal with a better deal” by privatizing Social Security, handing our hard earned money over to Wall Street.

Pence was only the latest in a long line of Republicans with plans to cut Social Security and Medicare. Last year, the Republican Study Committee, which counts about 75 percent of House Republicans as members, released a budget to raise the retirement age for Social Security and Medicare to 70, decimate Social Security benefits, and voucherize Medicare.

The story is no different in the Senate, where Senator John Thune (R-SD), the second highest ranking Republican in the Senate, has said that he wants to use the debt limit to force cuts to Social Security and other programs. Thune specifically endorsed raising the retirement age.

Thune’s colleagues have plans of their own. Last year, Senator Rick Scott (R-FL) released a plan to put Social Security and Medicare on the chopping block every five years. Scott recently compared spending on the programs to “alcoholism.” Not to be outdone, Senator Ron Johnson (R-WI) wants to turn Social Security and Medicare into discretionary spending, putting them in jeopardy every year, and says that Social Security was “set up improperly.”

Yet despite all these plans, Republicans realize that cutting Social Security and Medicare is incredibly unpopular, even with their own voters. That’s why, when Biden put them on the spot, they had no choice but to stand and applaud for protecting benefits. And it’s why Republicans are so desperate to go behind closed doors and force Democrats to cut our Social Security and Medicare benefits, so that the public can’t see which party’s fingerprints are on the cuts.

Two bills, the TRUST Act and the Bipartisan Social Security Commission Act, would hide their plans to cut benefits. Both of these bills would create fast-tracked commissions to cut Social Security and Medicare behind closed doors. They are designed to give politicians cover to enact unpopular benefit cuts and claim they had no choice.

The Biden Administration has rightfully called these bills “death panels” for Social Security and Medicare. We should push Democrats to refuse to cave in to the Republicans’ closed door tactics. No cuts to Social Security, Medicare, Medicaid, or any other program is acceptable!

Every member of Congress — Republicans and Democrats alike — need to be contacted and urged to take the pledge authored by a coalition of progressive organizations to never cut Social Security and Medicare under any circumstances.

People with annual incomes of one million dollars or more stopped contributing to Social Security for the rest of 2023 on February 28th, because they only paid Social Security taxes on the first $160,200 of their wage income, which doesn’t even begin to encompass their actual total income.

People with annual incomes of one million dollars or more stopped contributing to Social Security for the rest of 2023 on February 28th, because they only paid Social Security taxes on the first $160,200 of their wage income, which doesn’t even begin to encompass their actual total income.

Several members of Congress have introduced bills this year that would expand Social Security and require the wealthiest people in the U.S. to pay their fair share by raising or eliminating this cap. All of these bills would strengthen the Social Security trust funds.

Others on Capitol Hill are discussing significant changes to Social Security, including reportedly raising the retirement age and allowing the trust funds to be invested in the stock market. This would allow Wall Street to get their mitts on this public asset that we all pay into.

According to Semafor, a bipartisan group of senators led by Sens. Angus King (I-ME) and Bill Cassidy (R-LA) is considering a plan to gradually raise the retirement age to “about 70” as part of discussions to overhaul Social Security.

“Raising the retirement age and allowing Wall Street to gamble with our earned benefits is unacceptable,” Robert Roach, Jr. has said, a former top Machinists official and current President of the Alliance. “We don’t need gimmicks or schemes when we can strengthen the Trust Fund by requiring the wealthiest among us to pay their fair share.”

Do Republicans hate kids? Yes, they really do!

The Dept. of Health and Human Services (HHS) estimates that as many as fifteen million children and adults could lose Medicaid, some because their incomes had risen, others because they did not provide timely proof, despite still being eligible. Some won’t even respond because the state they live in does not have their correct address.

States have until May 2024 to cut their Medicaid enrollment rolls. But some states, such as Florida, seem intent on dropping as many people as possible as soon as possible.

For some right-wing members of Congress, kicking fifteen million low-income people off of Medicaid and CHIP (Children’s Health Insurance Program) isn’t enough. They want to cut these critical health care lifelines even further.

The Republicans continue demanding to tie the upcoming national debt ceiling to cuts of Medicaid, SNAP, and many other basic needs programs. This is reckless and irresponsible. We must contact our members of Congress and tell them to stop threatening the health care of millions of low-income adults and children.

What can we do to preserve Social Security and Medicare?

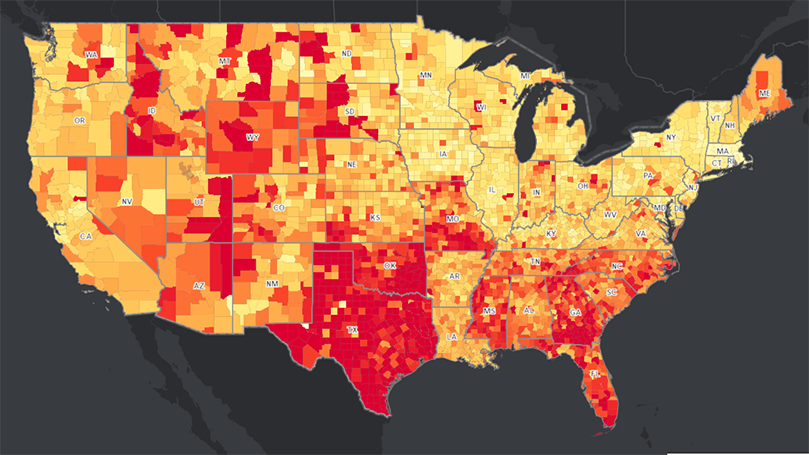

This interactive map shows how many people in every congressional district would be impacted by benefit cuts and the congressional representatives to contact. Republicans are getting paid with your tax dollars while slashing your health benefits.

Click here to retweet this tweet by the Center for Budget and Policy Priorities:

“Those who claim that Social Security won’t be around at all when today’s young adults retire, and that young workers will receive no benefits, either misunderstand or misrepresent the trustees’ projections.”

Support the Social Security Expansion Act! This bill would:

- Extend the solvency of Social Security for 75 years by requiring the wealthiest U.S. households pay their fair share of taxes. Today, because of the earnings cap on Social Security taxes, a CEO making $20 million a year pays the same amount of money into Social Security as someone who makes $147,000 a year. The Social Security Expansion Act would lift this cap and subject income above $250,000 to the Social Security payroll tax. Under this bill, over 93 percent of households would not see their taxes go up by one penny.

- Expand Social Security benefits across the board for current and new beneficiaries. Under the bill, Social Security benefits for current and existing recipients would be increased by $200 a month.

- Increase Cost-Of-Living-Adjustments (COLAs). The bill would more accurately measure the spending patterns of seniors by adopting the Consumer Price Index for the Elderly (CPI-E). Older U.S. people, by and large, are not going out on spending sprees buying big screen TVs, laptops, or the latest high-tech gadgets. Rather, they spend a disproportionate amount of their income on health care and prescription drugs, and that would be reflected in the formula for calculating COLAs under this legislation.

- Require millionaires and billionaires pay their fair share into Social Security. Currently, workers have 12.4% taken out of each paycheck and contributed to Social Security, half paid by the employer and half by the worker. The bill would require the wealthy to pay the same 12.4% on their investment and business income, by increasing the net investment income tax by 12.4% and applying it to certain business income not already covered by payroll taxes.

- Improve the special minimum benefit for Social Security recipients. This bill will update and increase the special minimum benefit by indexing it to 125% of the poverty line, or about $17,000 for a single worker who had worked their full career.

- Restore student benefits up to age 22 for children of disabled or deceased workers, if the child is a full-time student in a college or vocational school. This important benefit was eliminated in 1983.

- Combine the Old Age and Survivors Trust Fund with the Disability Insurance Trust Fund to help senior citizens and persons with disabilities.

Images: VA: Alliance for Retired Americans: Protect Social Security Rally by AFL-CIO America’s Unions (CC BY 2.0); “Social Security Protestors” — People protest Sen. John McCain’s Social Security privatization plan at the Republican National Headquarters by TALK MEDIA NEWS PHOTO ARCHIVES (CC BY-NC-SA 2.0); Traditional Medicare vs. ACO REACH (infographic) by Physicians for a National Health Program (PNHP); Millionaires and billionaires must pay their fare share by Alliance for Retired Americans; screenshot of interactive map;