According to Mercom’s Solar Funding report almost 25.5 GW of solar projects were acquired in the first half of the year, totaling $18.5 billion.

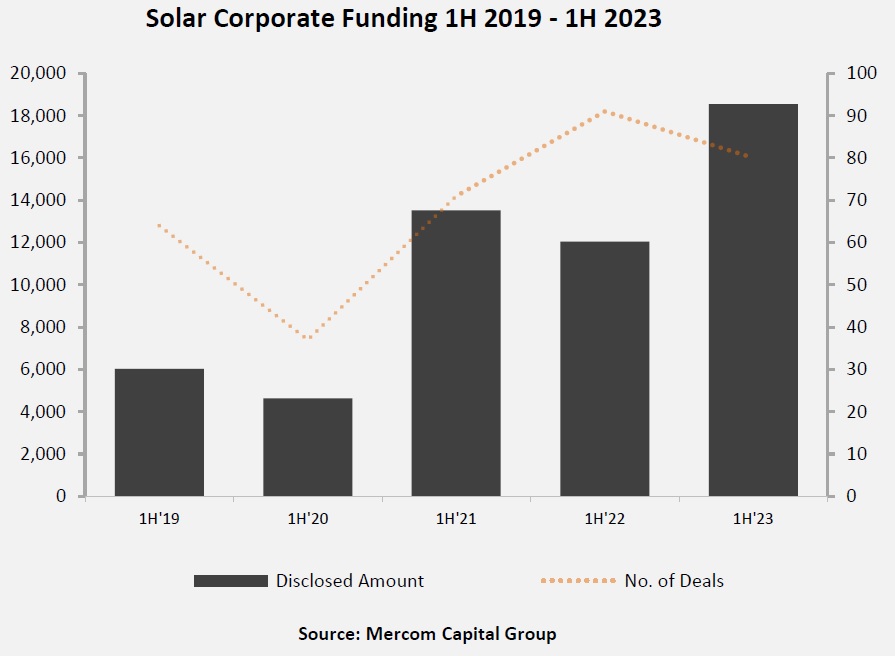

Mercom Capital Group’s Solar Funding and M&A, 2023 First Half Report finds healthy financial activity in the solar sector in the first half of 2023. And while the number of deals went down, total funding went up.

Total corporate funding, including venture capital (VC) funding, public market, and debt financing, was up 54% year-over-year (YoY) compared to $12 billion raised in the first half of 2022. The number of deals dropped from 91 in the same period last year to 80 in the first half of this year, a decrease of 12%

“Even amidst the tightening financial market conditions and high interest rates, the solar industry remained strong in the first half of the year. Besides AI, cleantech is one of the few sectors still attracting VC interest. Demand due to the Inflation Reduction Act (IRA) is so strong that even interest rate-sensitive public market and debt financing in solar was up year-over-year. The lack of easy money, however, affected M&A activity negatively,” said Raj Prabhu, CEO of Mercom Capital Group.

Global VC funding rose 3% YoY with 33 deals worth $3.8 billion compared to 53 deals in the same period last year, worth $3.7 billion.

Top five VC deals:

- 1KOMMAS, $471 million

- Silicon Ranch, $375 million

- CleanMax Solar, $360 million

- Amarenco, $325 million

- Amp Energy India $250 million

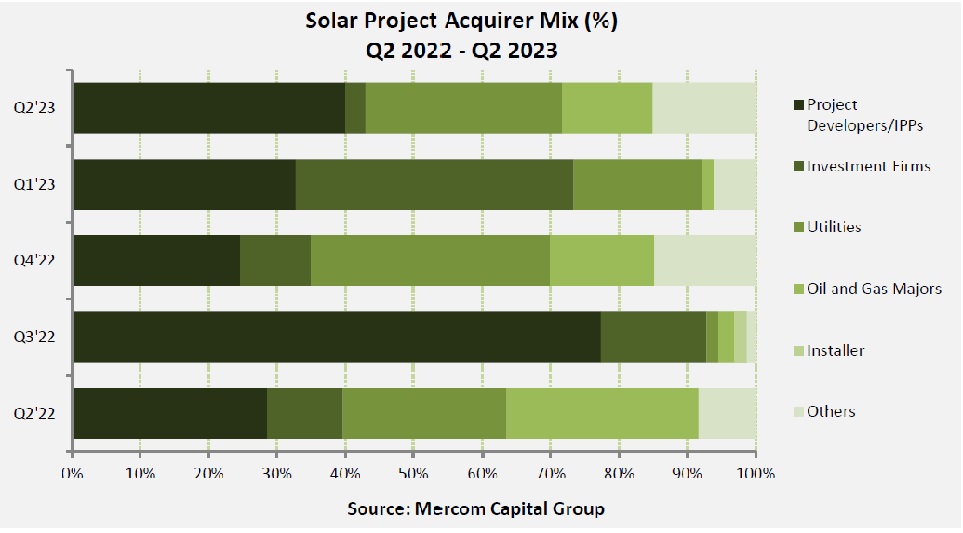

Developers and independent power producers (IPPs) acquired 5.5 GW of solar projects, whereas utilities acquired just under 4 GW. Insurance companies, pension funds, energy trading businesses, industrial conglomerates, and IT firms acquired another 2.1 GW. Oil and gas companies acquired 1.8 GW of projects, and investment firms acquired 407 MW.

Mergers and acquisitions (M&A) were down in the first half of 2023, with 116 project acquisitions for 25.5 GW of solar projects compared to 148 project acquisitions totaling 37.8 GW in the first half of 2022. The largest deal was by Brookfield Renewable, which agreed to acquire Duke Energy’s unregulated utility-scale commercial renewables business in the U.S. The business comprised close to 3.5 GW of utility solar, wind and energy storage projects, and was acquired for cash consideration of $1.1 billion and the assumption of $1.7 billion total debt.

Solar public market financing in the first half of 2023 totaled $6.7 billion in 14 deals, which was 103% higher than the $3.3 billion financed in eight deals in the first half of 2022. Solar debt financing activity in the first half of 2023 reached $8 billion in 33 deals, a 60% increase compared to 1H 2022, when $5 billion was raised in 30 deals.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: [email protected].