Getty Images/Getty Images News

Introduction

This may be one of the most important articles I’ve written this month as Northrop Grumman (NYSE:NOC) isn’t just one of my largest investments, but it is also a cornerstone of NATO defense capabilities. In this article, we discuss the long-term NOC bull case, developments in global defense, supply chain issues, and everything related to that.

We will be using a lot of input from the company’s peers who all reported earnings this month.

We’ll also discuss its valuation in light of NOC becoming one of the strongest components of the S&P 500 this year.

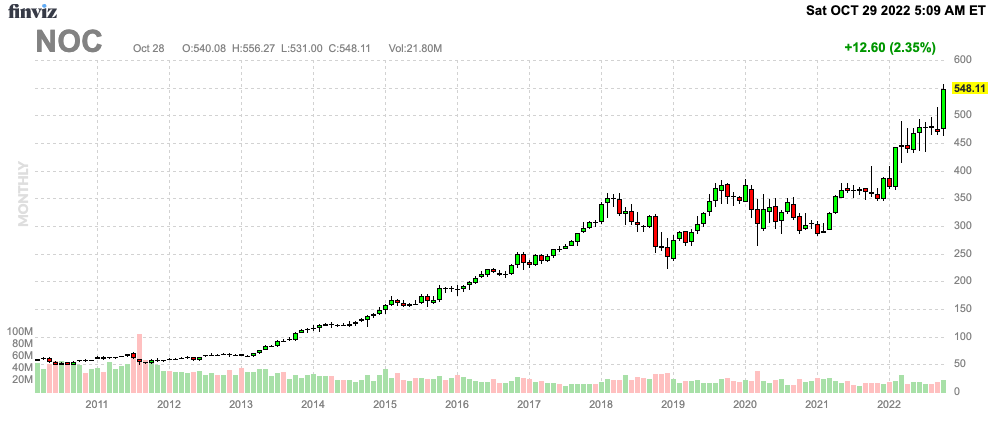

FINVIZ

The bottom line is that everything confirms my bull case. The problem is that the stock is trading at a lofty valuation.

So, let’s get to it!

The Initial Bull Case

In January, I wrote an article titled “2 Important Reasons To Buy Northrop Grumman”.

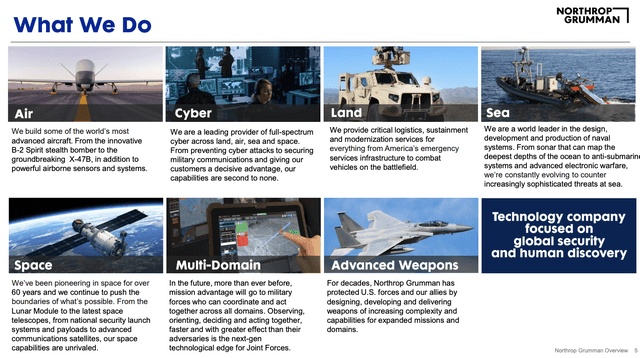

Reason number one was the Department of Defense’s focus on high-tech defense solutions. That’s where Northrop Grumman shines as no competitor has as much “next-gen” exposure as Northrop Grumman.

Wall Street Journal

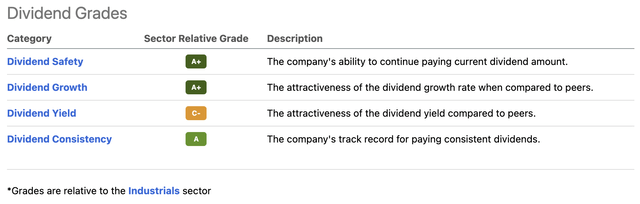

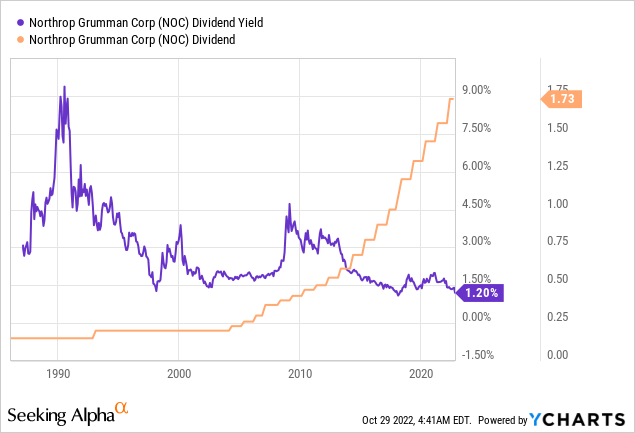

Reason number two was the fact that Northrop Grumman offers a quality yield. The company has one of the best dividend scorecards (provided by Seeking Alpha) in the industrial sector, scoring high on safety, growth, and consistency.

Seeking Alpha

Over the past 10 years, the company has grown its dividends by 12.1% per year. That number has fallen to 9.4% over the past three years but still beats inflation.

The “problem” (for new investors) is that since my January article, NOC shares have added more than 40%. This results in a yield of just 1.3%, including a dividend hike of 10.2% announced on May 18.

The New And Improved Bull Case

Fast forward to October, and we’re dealing with a new situation that still relies on the two reasons presented in January, but has evolved well beyond that.

Northrop Grumman is now benefiting from a new set of tailwinds, which I am going to discuss in this article. We’re also using data and findings from its many peers to establish a clear “big picture”.

This year (so far) was influenced by a number of headwinds and tailwinds. The headwinds impacting defense contractors are supply chain issues, related to labor shortages, material and component shortages, and high shipping costs – on top of defense budget uncertainties. The biggest tailwind has been the war in Ukraine, which worsened already high global geopolitical tensions.

Now, we’re in a situation where the tailwinds are getting stronger, resulting in more funding and demand for next-generation defense solutions. If anything, the war in Ukraine has shown that “traditional” technologies like tanks aren’t what gives nations an edge. There’s also a case to be made that the US military has a lot of catching up to do when it comes to improving its “readiness” despite having the world’s largest defense budget.

As reported by 19fortyfive:

For nearly 20 years following 9/11, the U.S. military conducted operations that consumed platforms, munitions, and equipment purchased to fight the Soviet Union. Sadly, these assets have not been replaced at similar rates. As a result, the military is stuck with aged platforms and diminished inventories. America’s support to Ukraine has exacerbated the problem, as the Pentagon digs deep into existing inventories of weapons and munitions to help Ukraine defend itself against Russia. Inventories are nearing war-reserve levels, and it will take years to replenish them.

Though some new equipment is slowly being fielded, the force continues to shrink. A military barely able to handle one war is ill-equipped to do more. Should the U.S. be called to defend NATO partners in Europe, it will not be able to support Israel, Taiwan, Japan, South Korea, or anyone else, anywhere else.

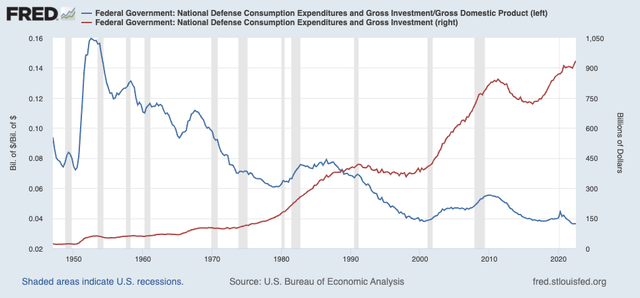

According to the data below, US defense spending has dropped to 3.6% of nominal GDP. That’s one of the lowest numbers ever, despite a total spending surge above $900 billion.

St. Louis Federal Reserve

Moreover, headwinds are slowly fading as supply chain issues are easing, two years after the start of the pandemic.

With all of this in mind, let’s look at some facts, starting with Northrop Grumman’s just-released third-quarter earnings.

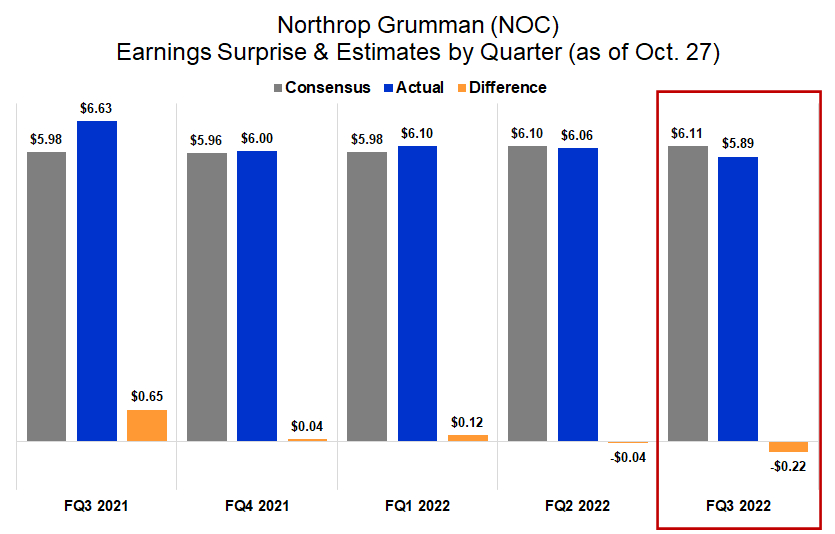

The third quarter wasn’t spectacular when looking at the headline numbers only. The company generated $9 billion in revenue (+3% year-on-year), missing estimates by $140 million. Adjusted EPS came in at $5.89, missing estimates by $0.22.

As the Seeking Alpha chart below shows, it was the second-consecutive miss after barely beating estimates in the two quarters prior to that.

Seeking Alpha

That’s where the bad news ends as the company’s comments and developments hint at improving sales growth in the years ahead.

First of all, defense demand is set to improve. One of the reasons why Northrop Grumman is upbeat is the fact that higher defense requirements come with higher funding needs. In its latest earnings call, the company highlighted the Biden administration’s National Security Strategy. When looking at the details, it becomes clear that the defense environment of 2022 is unlike anything we’ve dealt with in recent history.

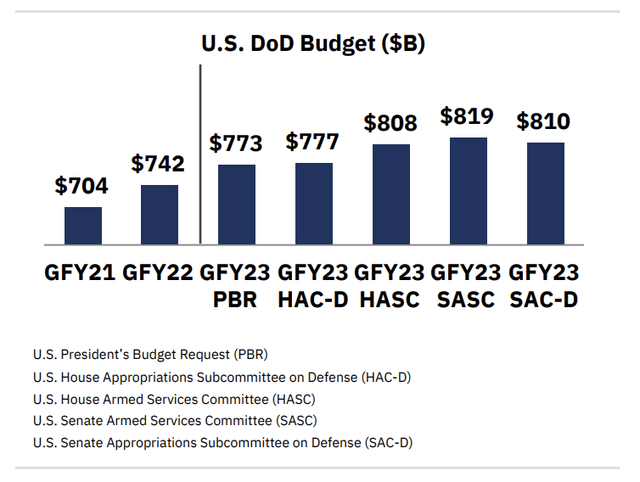

Hence, it could push the Department of Defense budget to more than $810 billion, up from $742 billion in 2022.

L3Harris Technologies

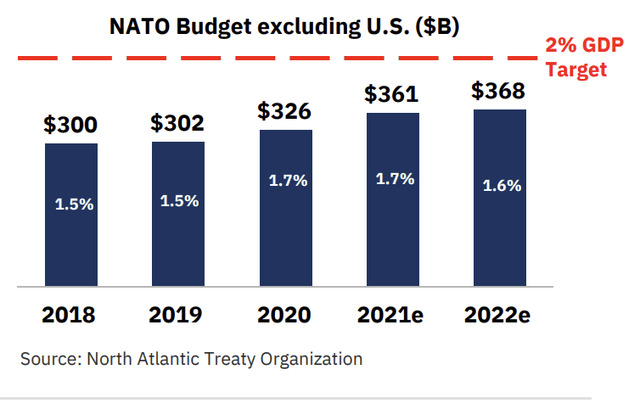

Moreover, NATO has made clear that it wants to make the 2% GDP target the floor of its funding, not the ceiling. This would mean at least another $92 billion in NATO (ex-USA) funding based on 2022 GDP numbers.

L3Harris Technologies

The Biden administration cited the need to improve partnerships like the one with the United Kingdom and Australia to build nuclear-powered submarines. In addition to what has been named “AUKUS”, the US is a part of Quad, which includes Australia, India, and Japan.

These partnerships are built to pressure the expansion of nations like Russia and (especially) China as it protects the interest of allied nations in key areas.

However, it’s also a platform for shared technology needs. According to National Defense Magazine:

As for military technology, the administration vowed to “remove barriers to deeper cooperation” between like-minded allies in fields such as cyber and space, missile defense, trusted artificial intelligence, and quantum systems, “while deploying new capabilities to the battlefield in a timely manner.”

I’m also bringing this up because the new defense requirements align with what I said in the first part of this article and Northrop’s own comments. The company believes that it not only benefits from higher defense spending, in general but also because its portfolio is extremely well-aligned with the new requirements outlined in the aforementioned National Security Strategy.

As I wrote in my prior article, Northrop Grumman is not focused on any specific product but highly diversified in advanced segments like space, cyber, and advanced weaponry, the exact areas that governments want to highlight through accelerated funding.

Northrop Grumman

Funding is expected to be strong as Northrop Grumman believes that the ultimate fiscal year 2023 base defense budget will be higher than the President’s budget request (also see the L3Harris chart I used in this article). So far, defense companies are operating on a continuing solution, which extends to mid-December. The company’s 2022 guidance is based on that.

Moreover, Lockheed Martin (LMT) highlighted additional funding needs in its 3Q22 earnings call – as highlighted in this article. Additional funding for Ukraine (as part of the continuing resolution) also comes with new replenishment needs for the US armed forces, which we also briefly discussed in the first part of this article.

As part of the continuing resolution, Congress approved additional support for Ukraine. They added $3 billion in funding, bringing the total defense support to $9 billion.

There is also a total of $14 billion available to replenish US stocks of equipment, to make up for equipment sent overseas.

So far, this translates to higher demand for its Integrated Air and Missile Defense solutions, precision weapons, and advanced ammunition. In this case, this is mainly supported by European demand growth related to the war in Ukraine.

In the APAC region, the company also sees strong growth for Air Missile Defense as well as Maritime ISR, Advanced Radar, and other Mission Systems.

This is resulting in backlog growth in all of its segments. The total backlog is up 5% year-to-date, indicating that the full-year book-to-bill ratio will be over 1.00. This means that the company receives orders faster than it can turn backlog into finished products. This indicates strong sales growth in the year(s) ahead.

The company also got a $1.3 billion award for Ground-based Midcourse Defense Weapon Systems. This award builds on its Missile Defense portfolio, improving intercontinental missile attack defense. Northrop also benefited from $1 billion worth of funding for the development of the Hypersonic Attack Cruise Missile (“HACM”), a project it works on with Raytheon Technologies (RTX).

With that said, one of the biggest headwinds is now turning into a tailwind – albeit extremely slowly.

Supply chain issues and inflation have done a number on defense companies. After all, they are highly dependent on qualified labor and the availability of high-tech electrical supplies like semiconductors.

The company is now at a point where efforts are paying off. According to Northrop Grumman:

[…] we are implementing operational efficiencies and working with many of our customers on program funding and other contract actions to support the health of the defense industrial base. We believe this balanced approach is the best solution to allow continued investment in the capabilities to support our customers’ mission. With that said, we see these as temporal challenges and remain committed to driving our segment margin rates higher over time.

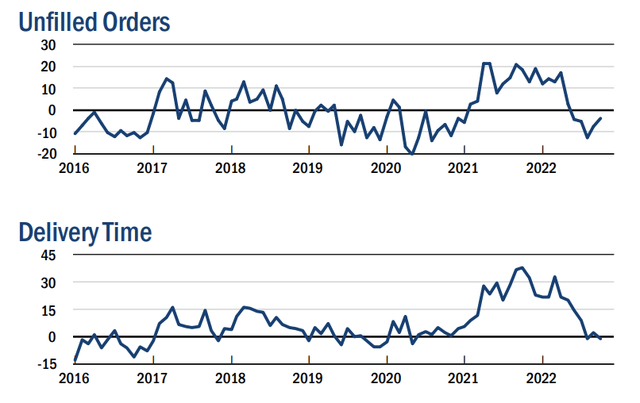

In a recent article, I used charts to visualize fading supply chain problems.

For example, using New York Fed data, delivery times have come down from all-time highs in 2021 to contraction territory. The same goes for unfilled orders, which have been contracting for a while now.

New York Fed

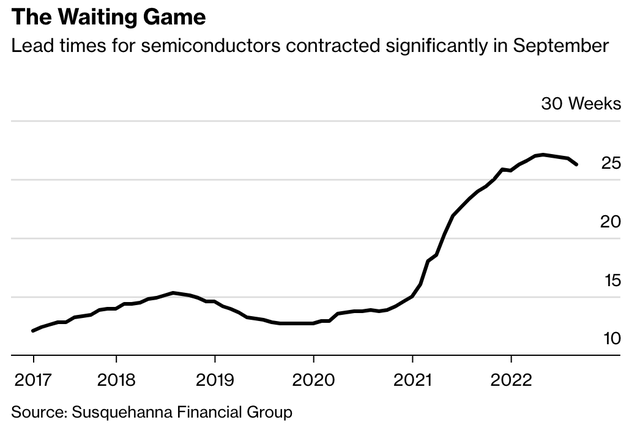

Moreover, semiconductor lead times are starting to decline. The gap between when a chip is ordered and when it’s delivered has come down to 26.3 weeks. That’s down from 27 weeks earlier this month.

Bloomberg

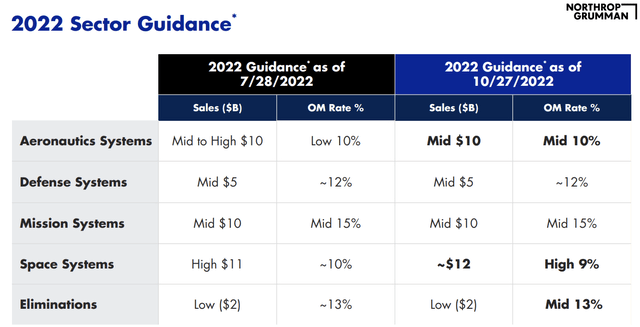

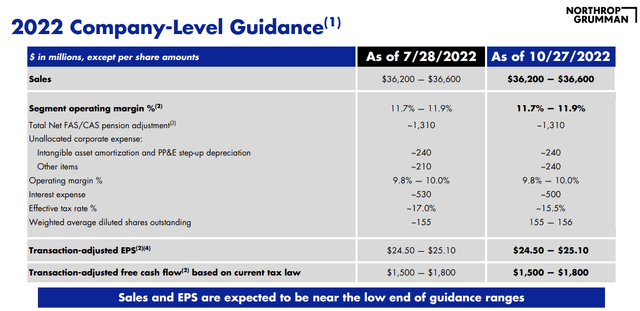

With this in mind, Northrop Grumman stuck to its 2022 guidance, which is good news. Lockheed Martin lowered revenue expectations. The same goes for L3Harris Technologies (LHX).

L3Harris temporarily fell 7% after reporting its earnings on October 27, as the defense supplier cut its outlook due to supply chain challenges. As reported by Seeking Alpha:

For the full year, the company cut guidance for adjusted EPS of $12.75-$13.00, down from its previous outlook of $13.35-$13.65 and well below $13.41 analyst consensus estimate, on revenues of ~$16.8B, below prior guidance of $17.3B-$17.7B and $17.34B consensus.

In a letter to investors, Chairman and CEO Christopher Kubasik cited ongoing challenges from supply chain disruptions, labor mobility and rising inflation for the downside guidance.

The good news is that Northrop refrained from lowering guidance.

Northrop Grumman

Moreover:

Northrop Grumman

According to the company:

We have not changed our sales, earnings, or cash outlooks. The foundation for our strong financial performance starts with the continued demand we’re seeing for our products. We’re increasing our expectation for book-to-bill again this quarter to greater than 1x which is a significant improvement from our original expectation. Our team has done an outstanding job of serving as a trusted partner to our customers in winning new business.

Before we dive into the valuation, I want to highlight another issue. The unveiling of the B-21.

What About The B-21?

On December 2, Northrop Grumman will unveil the B-21, the newest strategic bomber developed for the United States Air Force, as part of the Long Range Strike Bomber program.

Northrop Grumman

The plane will be the first new bomber in 34 years since Northrop revealed the B-2 Spirit in 1988. So far, the bomber had successful ground tests, which is good news ahead of its maiden flight in 2023.

Northrop currently works on six bombers in various stages of completion. Air Force Global Strike Command has announced that it would acquire at least 100 new bombers. That number could reach 200.

According to 19fortyfive:

In 2010, it was estimated that the initial order of aircraft could cost as much as $550 million per unit. This past June, Bloomberg estimated the cost to develop, purchase and then operate 100 aircraft over 30 years would be at least $203 billion. That would include $25.1 billion for development, $64 billion for production, and $114 billion for maintenance and operation.

The B-21 Raider is running on schedule and under budget. It helps that the B-21 test aircraft that are currently being manufactured under the Engineering and Manufacturing Development contract with Northrop Grumman are utilizing the same production line, with the same tooling, processes, and technicians that will eventually build the production aircraft.

In April, NOC was awarded $108 million for advance procurement support for the B-21 program. This supports the acquisition of long lead items necessary to build the first production B-21 aircraft.

Valuation

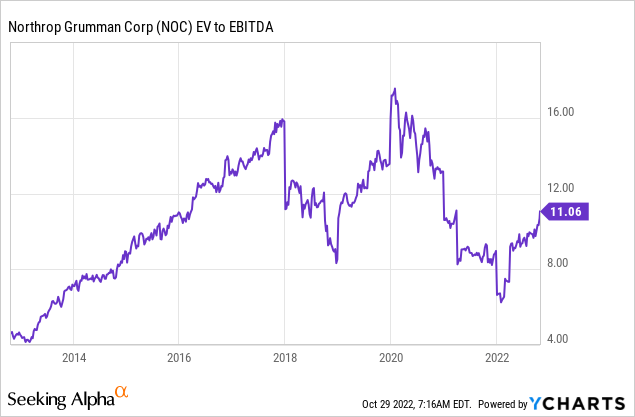

As bullish as this article is – so far – this part is less fun. After all, we already discussed that NOC shares are up more than 40% year-to-date, making NOC the 25th best-performing S&P 500 stock. That doesn’t make the valuation attractive.

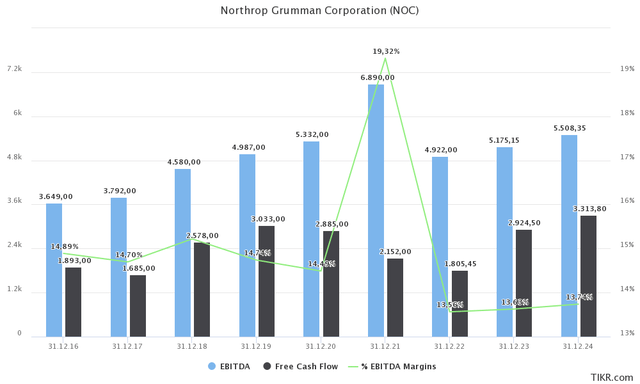

TIKR.com

Northrop is trading at 18.6x 2023 EBITDA of $5.2 billion. That’s based on its $96.9 billion enterprise value, consisting of its $84.8 billion market cap, $9.7 billion in 2023 net debt (just 1.9x EBITDA9, and $2.4 billion in pension-related liabilities.

While EBITDA and EBITDA margins are expected to accelerate in the years ahead, that valuation is elevated. The same goes for the implied 2024 free cash flow yield of 3.9%, using 2024E free cash flow of $3.3 billion.

That is not a high yield and makes buying a large stake in NOC not attractive at current prices.

In August, I wrote that NOC shares were working on a breakout to $520. That worked out quite well. However, we’re now at $550.

As bullish as I am on a long-term basis, I wouldn’t start buying unless we get a 10% (or larger) opportunity in the months ahead.

Takeaway

In this article, I discussed the Northrop Grumman bull case using defense industry developments, Northrop’s earnings, comments and earnings from all major peers, and geopolitical developments.

The good news is that Northrop’s stock price surge this year is completely justified. Defense demand is rising as global spending is accelerating. This benefits NOC as a backbone of NATO, but also because NOC specializes in advanced defense programs like space, missile defense, and much more.

Moreover, as supply chain issues fade, the company is set to accelerate orders and sales in the years ahead.

Unfortunately, a lot has been priced in. The valuation is lofty.

Hence, as bullish as I am, my advice is to wait for correction opportunities before buying.

For example, on October 14, I tweeted that defense stocks offered great buying opportunities as most fell more than 4% after downgrades. Buyers stepped in, supported by strong earnings.

As lofty as some valuations might be, that’s the way to play these stocks.

So, make sure that NOC shares are on your watchlist!

(Dis)agree? Let me know in the comments!