Texas lawmakers grilled finance industry executives they summoned to a remote corner of the Lone Star State for a hearing, questioning whether their environmental, social and governance policies are hindering state pension investments.

![2()h]gveon)xo3fa2wu]usag_media_dl_1.png](https://moneylowdown.com/wp-content/uploads/2022/12/state-decisions-on-esg-republican-led-states-push-back-on-.jpg)

Article content

(Bloomberg) — Texas lawmakers grilled finance industry executives they summoned to a remote corner of the Lone Star State for a hearing, questioning whether their environmental, social and governance policies are hindering state pension investments.

Advertisement 2

Article content

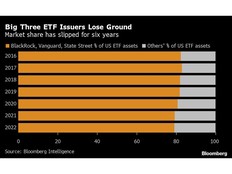

The GOP-led committee on state affairs called the hearing on Thursday amid growing concern in the party that financial firms are pushing a “woke” ideology with investing rules tied to ESG issues. They summoned officials from BlackRock Inc., State Street Corp. and Institutional Shareholder Services Inc. to defend their practices before a committee made up of seven Republicans and two Democrats.

Article content

Republican state Senator Lois Kolkhorst cited a Harvard Business Review study this year showing that funds ranked high in terms of sustainability typically fail to beat those with poor marks in that area. Other measures show ESG funds have outperformed conventional counterparts at times.

“We have a commitment to our retired teachers and we have a commitment to our retired state employees to do better with our money,” Kolkhurst said at the hearing in Marshall, in eastern Texas. The state is the nation’s largest energy producer.

Advertisement 3

Article content

BlackRock’s head of external affairs, Dalia Blass, stood by the firm’s record in handling the assets of its clients in the state.

“We are really proud of our performance for the Texas institutions that have entrusted us with their money,” Blass told the panel. “We have one bias: to get the best risk-adjusted returns for our clients.”

The setting, chosen because it’s in the district represented by the panel’s chair, was unusual for Wall Street. With a population of almost 25,000, Marshall is 150 miles (241 kilometers) east of Dallas, 70 miles south of Texarkana and about as far as can be from the world of high finance.

The committee is focused on how ESG policies may impact Texans’ retirement savings, but the investigation is part of a broader effort by GOP officials around the country to push back against what they see as progressive ideologies among corporations. New York-based BlackRock, the world’s largest asset manager, is a frequent target.

Advertisement 4

Article content

Read More: BlackRock Struggles to Escape From the ESG Crossfire: Timeline

Florida’s chief financial officer has urged state pension funds to remove BlackRock as an asset manager over ESG concerns, while Louisiana and Missouri have pulled a combined $1.3 billion from the company this year. In August, Texas included the firm on a list of those it says boycott the energy industry. Republicans have also clashed with PayPal Holdings Inc. and the Walt Disney Co. over their policies.

The firms have struggled with how to respond, often trying to assure conservative critics that they embrace fossil fuels while at the same time telling environmentalists they’re committed to helping to fight climate change. Vanguard Group Inc. recently announced it was leaving the world’s largest climate-finance alliance, saying it would help “provide the clarity our investors desire.” The company was slated to join the hearing but was then excused.

Advertisement 5

Article content

“We do not pick and choose what to invest in,” Lori Heinel, global chief investment officer for State Street Global Advisors in Boston, told the committee. “More specifically, we do not discriminate against energy companies, or any other sector.”

ESG’s impact on the fossil-fuel industry is of particular concern to lawmakers worried that it could dry up funding sources. In August, the committee sent letters to the four firms asking for documents and testimony from executives related to their investing and consulting practices and any impacts on state pensions.

“When there’s no funding for energy projects, energy projects don’t get done, energy costs go up, jobs go away and the cost of everything we buy goes up,” committee Chairman Bryan Hughes said Thursday. “This is real. This is family security. This is national security.”

Advertisement 6

Article content

Pension Vote

Senators criticized ISS for recommending that Texas pension funds vote against some energy-industry financing, saying it was a stance that harmed the state, given its economic dependence on oil and gas production.

Lorraine Kelly, ISS’s global head of investment stewardship, apologized for the decision and said the company had updated policies to ensure it wouldn’t happen again. She said the decision stemmed from ISS’s understanding of the funds’ investment goals.

“As we are a client-focused company, we deeply regret we disappointed the state of Texas,” Kelly said. “It was not corporate bias, sir. It was a mistake.”

Republicans in the US Senate have also homed in on how the biggest asset managers use their stakes in public companies to cast proxy votes, alleging they favor a “liberal political agenda,” according to a report from Banking Committee staff. They called for congressional probes into how the firms influence corporate policies on carbon emissions reduction, board diversity or racial-equity audits.

The battle over sustainable investing comes as some of the largest ESG funds by assets have posted steep losses this year, some even more than the S&P 500 Index’s roughly 16% decline through Wednesday’s close. BlackRock’s $20 billion iShares ESG Aware MSCI USA exchange-traded fund (ESGU) was down about 18% in that period and Vanguard Group’s $5.8 billion ESG US Stock ETF (ESGV) dropped 21%.

—With assistance from Saijel Kishan.

(Adds ISS comments)