UK pensions provider Aviva has been strongly criticised for charging pension fund clients for adding exclusions to their funds.

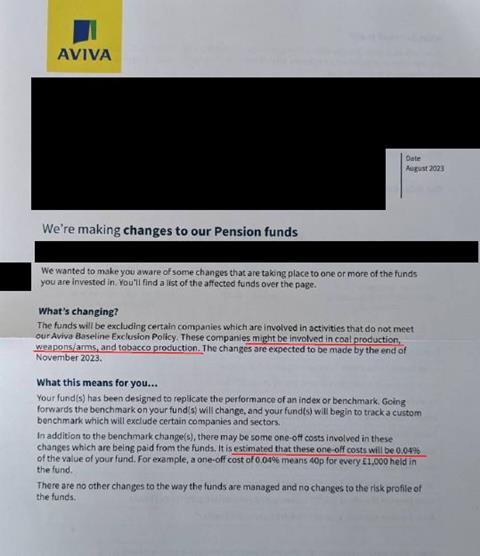

According to a leaked letter to clients posted on social media, Aviva has told investors “there may be some one-off costs” involved in making the changes, which involve excluding certain companies involved in activities that do not meet Aviva’s baseline exclusion policy.

The activities concern coal production, weapons/arms, and tobacco production.

To implement the changes the benchmark on the funds will change to a custom benchmark. Aviva said that in addition to the benchmark change(s), “there may be some one-off costs involved in these changes which are being paid from the funds”.

According to the letter, Aviva has estimated that the one-off costs will be 0.04% of the value of the investors’ funds.

The letter also states that there are no changes to the risk profile of the funds and no other changes to the way the funds are managed.

Ben Dear, the chief executive officer of Osmosis Investment Management, described the move as “the latest irresponsible ESG action by a so-called leader in ESG investing”.

Charging pension fund clients to add exclusions to their portfolios was “another shameful example of an investment firm taking liberties with their investors’ money,” he added.

”The thought of passing these costs on wouldn’t even cross our minds, so whose minds did it cross at Aviva and who thought this was a sensible idea?,” he added.

Another person commenting said Aviva “just became a budget airline pension fund manager”. Another observer with years of experience in trust, fiduciary and fund administration, told IPE that although the charge was one-off it was “a very big chunk of change” and “just not on”.

“Aviva’s stance is plainly unacceptable,” he wrote.

Aviva responded to IPE: “Our investment philosophy promotes the merits of engagement over divestment as a more effective mechanism to deliver positive change, however, there are specific sectors and economic activities where we consider the sustainability risks so severe that they are fundamentally misaligned with our long-term investment beliefs and corporate values.

“In these cases we forgo the opportunity to engage and actively exclude companies from our investment universe which we believe is in the best interest of our customers.”

According to Aviva’s response, teh firm is “excluding certain companies above certain revenue thresholds and caveats from all of our investments where we have decision making control, in line with our fundamental investment beliefs and recently published baseline exclusions policy”.

Aviva added: “There will be some costs associated with the divestment of holdings that we have made transparent to customers and are comfortable with in context of the overall day-to-day trading activity. The costs will vary by fund and region; for the majority of funds there will be no trading costs at all.

“We are providing our customers with sufficient notice in advance of the changes.”

Read the digital edition of IPE’s latest magazine