The U.S. digital sector is the proverbial goose that lays the golden eggs for the broader U.S. economy. While it may be understandable why other countries may want to hold back U.S. tech companies, it is puzzling why U.S. policymakers would pursue policies that take aim at our own economic interests.

The Bureau of Economic Analysis (BEA) estimated that the U.S. digital sector accounted for $2.41 trillion of value added in 2021, which is more than 10% of U.S. GDP. BEA further estimated that the digital sector accounted for $1.24 trillion of worker compensation and 8 million jobs in 2021, with an average worker compensation of $155,000 per year, more than double U.S. GDP per capita.

The digital sector also enables an enormous fraction of U.S. exports: the U.S. earned $626 billion from digitally-enabled services exports in 2022, and digitally-enabled services exports accounted for 67% of all services exports in 2022, supporting 2.3 million U.S. jobs.

Not only is the digital sector an excellent source of good jobs, but it’s a growing source of good jobs: the digital economy grew 9.8 percent in 2021, greatly outpacing 5.9 percent growth in the overall economy. However, some U.S. policymakers want to kill this proverbial goose that lays the golden eggs.

A bipartisan group of U.S. lawmakers called on the administration to stop the European Union (EU) from unfairly discriminating against U.S. digital businesses and their workers in policies like the Digital Markets Act (DMA) in 2022. This would normally be a no-brainer: as a matter of course, countries try to protect their businesses and workers from being discriminated against by foreign jurisdictions.

However, not only did the administration ignore this bipartisan exhortation and fail to stop Brussels from enacting the DMA, but in March 2023, U.S. Federal Trade Commission (FTC) Chair Lina Khan and Department of Justice (DOJ) Antitrust Division Assistant Attorney General Jonathan Kanter announced plans to send U.S. government personnel to Brussels to help the EU enforce the DMA’s discrimination against U.S. businesses. These moves came despite studies showing that the DMA and related EU policies would cost U.S. businesses and workers $22 to $50 billion, would discriminate against leading U.S. digital services, and would increase Beijing’s influence and market share. Moreover, these moves directly threaten at least the 2.3 million good jobs attributable to U.S. digitally-enabled services exports, and potentially the 8 million good jobs in the U.S. digital sector.

Such unprecedented “friendly fire” by U.S. officials against U.S. digitally-enabled businesses and exports abroad has been accompanied by competition authorities’ domestic policy campaign against leading U.S. employers and services. For example, in January, the DOJ announced an antitrust lawsuit against Google, the third most favorably viewed institution in America – just barely behind the U.S. military and Amazon. The DOJ case against Google will start Sept. 12.

Similarly, this month, the Federal Trade Commission (FTC) gave Amazon its “last rites” ahead of the FTC’s expected antitrust lawsuit against the most favorably viewed institution in America.

The friendly-fire by some U.S. policymakers against leading publicly-traded U.S. digital service businesses will lower share prices and harm their owners: ordinary investors and savers. Anyone who owns an S&P 500 index fund will be impacted, as well as the 6.5 million federal Thrift Savings Plan participants significantly invested in the C Fund, and 27.9 million state and local government worker pension plan members who have Google, Amazon, Meta, Apple, and Microsoft among their top 10 holdings. See the state by state impact to government pension fund holders here.

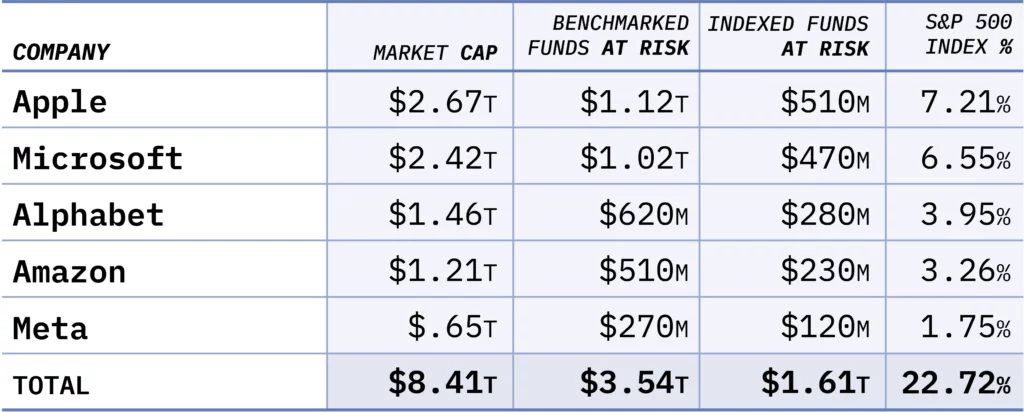

Google represents about 4% of the S&P 500 Index, Amazon represents more than 3% of the S&P 500, and the top 5 publicly-traded firms in the U.S. digital sector collectively represent more than 20% of the S&P 500 by value. More than $15.6 trillion in assets are indexed or benchmarked to the S&P 500, with $7.1 trillion in ordinary investors’ assets passively tracking the index, so over $3 trillion in investors’ savings are potentially at risk from this friendly fire, including about $1.5 trillion in ordinary investors’ funds passively tracking the index. Expert economists estimated that just the “split-up” cost of reverse mergers for the top 5 digital services businesses would amount to about $319 billion, which would come directly from ordinary investors. The costs of discriminatory foreign policies targeting these businesses would further compound investors’ losses, as would behavioral “remedies” imposed by domestic competition authorities.

Ordinary Americans wouldn’t just lose out through individual savings in 401(k) plans and IRAs; they would also lose out through their pension plans. For example, just one subcategory of pension plans, state and local government employee pension plans, are relied upon by at least 27.9 million Americans for retirement income. These pension plans typically invest heavily in securities issued by U.S. firms that would be significantly adversely impacted by the friendly-fire targeting of U.S. digital services businesses.

Google, Facebook, Apple, Microsoft, and Amazon stocks have an overall 86% representation in these pension plans’ top 10 holdings – the average such pension plan has 4.3 of the 5 businesses that would be regulated upon enactment of the bills in its top 10 holdings. The expenses involved in forcing the 5 leading digital businesses to split up would cost these pension plans more than $6 billion immediately–a cost of $252 per pension plan member. These pension plan losses would also be compounded further by discriminatory foreign policies targeting these firms, as well as behavioral “remedies” imposed by domestic competition authorities.

Current and former federal government employees would also lose out through their retirement savings in the Thrift Savings Plan. About 6.5 million current and former federal employees invest in the Thrift Savings Plan, and collectively invest $262.9 billion in the C Fund that directly tracks the S&P 500, with a more than 20% weighting to the top 5 digital services businesses. U.S. government friendly-fire against tech jeopardizes $53 billion, more than $8,000 per Thrift Savings Plan member. This means that senior policymakers at the FTC and DOJ pushing to target digital businesses would directly harm the retirement savings of their subordinates, creating yet another category of friendly-fire.

Targeting leading U.S. digital firms would result in an unprecedented regressive wealth transfer. If policymakers succeed in reducing these firms’ exports or even splitting them up, ordinary investors could see enormous declines in the value of their portfolios. These losses for ordinary investors could be partially offset by gains for others, but those gains would accrue largely either to Chinese Communist Party-controlled digital firms, or to wealthy investors in venture capital and private equity funds, not to ordinary investors in passive U.S. index funds. In other words, policymakers trying to target tech would engage in an enormous regressive wealth transfer from ordinary Americans to wealthy Chinese investors and the richest U.S. investors.