Treasury Secretary Janey Yellen testified before the Housing Financial Services Committee yesterday.

Of note, were her comments reportedly relating to the staying power of the dollar as the global reserve currency.

Since the Ukraine war, countries have become increasingly keen to diversify their assets, trade, and cross-border settlements in non-dollar currencies.

This trend has been greatly accelerated by the Biden administration’s commitment to rolling-out aggressive unilateral sanctions.

In her comments, she noted,

We should expect over time a gradually increased share of other assets in reserve holdings of countries…But the dollar is far and away the dominant reserve asset.

Another report regarding the Yellen proceedings suggested that we should,

…expect a slow decline in dollar as reserve currency.

Although the global anti-dollar winds are no secret, the words of the Treasury Secretary, much like the Federal Reserve Governor hold incredible weight in the global financial markets.

In the Fed’s announcement scheduled for later today, the FOMC is widely expected to announce a pause in rate hikes on the back of yesterday’s largely positive CPI report.

A report on the CPI number and the Fed’s likely steps is available here.

Given that the Fed may signal a meaningful shift in momentum towards a more sustainable return to 2% levels, Yellen’s comments raised eyebrows and may make for unfortunate timing.

Global developments

The China-Brazil bilateral agreement

China and Brazil, two heavyweights of global exports, signed a memorandum in 2023 to reduce their dependence on the greenback and shift to trading in local currencies.

In 2022, trade flows between the two countries amounted to $150 bn, a nearly 40-fold increase since 2001.

With the partnership only expected to go from strength to strength, this could certainly play a part in eroding the influence of the dollar.

For both two countries, operationalizing such lines would also help shield transactions from undue foreign exchange risk.

In an earlier article for Invezz, I noted that in 2023, China engaged in similar deals with several partners including,

…Argentina, Kazakhstan, Bangladesh, Pakistan, and Laos, and is seeking to operationalize new lines in the Middle East.

China’s rising influence in the Middle East

The Middle East has been crucial to the maintenance of the dollar’s reserve currency status, particularly due to its use as the standard for pricing global energy.

However, in a show of their rising diplomatic clout, President Xi recently visited the region and was instrumental in brokering a diplomatic agreement between Iran and Saudi Arabia.

Last year, Iran had elected to become a full-member of the Shanghai Cooperation Organization.

This year, Saudi Arabia has also agreed to integrate into the organization.

This is a strong show of external, non-American power which may come to rival the US in the region.

BRICS momentum in the West?

As per Lena Petrova, CPA, a popular YouTuber and financial commentator,

…France (could) become the first European country to join BRICS…Macron has asked South African President Ramaphosa for an invitation to the upcoming BRICS Summit that is scheduled to take place in Pretoria South Africa.

If approved, France would be the first Western country to join the growing bloc, that is increasingly searching for dollar alternatives.

Earlier in March, France’s TotalEnergies completed their first yuan-settled LNG trade likely kicking off a trend of non-dollar transactions.

For the BRICS nations, the upcoming summit is potentially a very significant one.

In an earlier article regarding the upcoming meet, it was stated,

With an alternative monetary framework being one of the points up for discussion, the BRICS Summit in August 2023 could offer a potential roadmap.

Eager to break away from dollar dependence, Schectman expects that these countries are likely to negotiate a shift towards commodity money, or fixed currency creation pegged to a unit of the chosen commodity.

If such a shift materializes, the dollar would undoubtedly lose a significant portion of its appeal in the global markets.

The meeting is very likely to address the issue of a lack of deeply liquid bond markets on diversifying away from the dollar.

Thus,

…any fresh currency endeavour will demand consensus upon a capital raising model and a robust framework that offers the protection of commodity money mechanisms.

Indian turns down US invitation to NATO

The rise of the greenback has greatly benefitted from the supremacy of the US’s military capabilities.

In an earlier article for Invezz entitled ‘Gold and silver outlook as 23 states move to reclaim precious metals as legal tender’, a reference was made to David Graeber, anthropologist and noted author of ‘Debt – The first 5,000 years’, in which he stated,

…U.S. military predominance…No other government has ever had anything remotely like this sort of capability. In fact, a case could well be made that it is this very power that holds the entire world monetary system, organized around the dollar, together.

However, despite this standing, the US and NATO’s combined military diplomacy met with a significant setback earlier this week.

In response to an invitation extended to India to join the alliance, External Affairs Minister S. Jaishankar noted,

…the reality is that is not a template that applies to India.

A different take on the war in Ukraine?

In an interview made available on the 13th of June 2023, Col. Douglas Macgregor, Ph.D., spoke with The Center for the National Interest in Washington DC.

He believes,

…counter-attacks that have cost the Ukrainian forces enormous numbers of lives. We can’t even begin to imagine how desperate the Ukrainian Army must be at this point having lost close to a hundred thousand… they’re launching these attacks relentlessly in the hopes they can create the illusion of success.

Regarding the United States’ role, he added,

…they assumed that they could crush Russia financially and economically… they’ve also tried to isolate Russia from the rest of the world when in fact the rest of the world minus Europe and North America is largely sided with Russia…(support from) United States (and) European allies is shrunk to a trickle. It’s drying up and we are now reaching the end of our war stocks

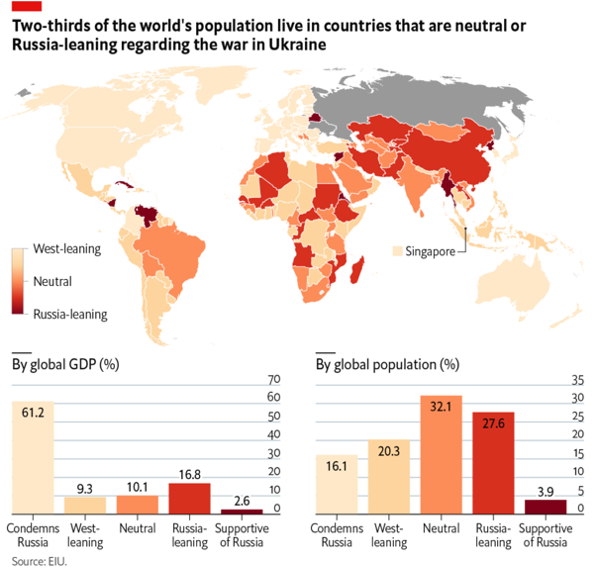

His comments are in line with an interesting graphic published by The Economist in 2022, which showed that countries that accounted for over 60% of the global population (ex-Russia) were supportive of or neutral to Russia’s stand on Ukraine.

Being an incredibly complex and developing story with competing perspectives, Macgregor seems to imply that as the conflict stretches on, this may have negative repercussions on US’s image.

This in turn may have a further knock-on effect on global trust in the dollar.

Domestic dollar challenges

Precious metals as legal tender

Ironically, perhaps the most important challenge to the US dollar has materialized at home.

An ever-growing number of states have begun to display a lack of confidence in the dollar.

The article above which relates to the legal tender status of gold and silver notes three key reasons for the brewing discontent,

First, inflation continues to ravage household budgets and threatens access to essentials such as fuel and food.

Secondly, in July this year, the US government is expected to roll out its Central Bank Digital Currency (CBDC).

Given the programmable nature of this instrument, Robert E. Wright, a Senior Research Fellow at the American Institute for Economic Research warns against excessive centralization of control over purchasing decisions of ordinary citizens.

Wright adds that CBDCs may not qualify as money under the Constitution.

Thirdly, with bonds bleeding over the past two years, an increasing number of states have found their pension funds in dire straits.

Delving deeper into the dollar-pension crisis,

In this environment, states are being forced to liquidate ever larger amounts of their holdings to cover obligations, while liabilities continue to mount at an alarming rate.

As a result, pension funds are seeing material losses in capital, a decline in income on the sale of bonds, increased credit risks and higher chances of regulatory intervention.

In an earlier article, I noted that the debt ceiling fiasco has also had a knock-on effect on local government budgets, where,

…the Treasury has elected to suspend the issuance of State and Local Government Series (SLGS) Treasury securities, which are issued to local bodies to comply with specific tax codes and smoothen public financial management.

As a result, several states have already recognized or are accelerating legal processes to allow gold and silver to be treated as legal tender.

In essence, local governments are shielding themselves against the potential for a dollar fallout.

Debt ceiling and banking crisis

Janet Yellen has been flagging the debt ceiling situation for some time and the damage it does to the global credibility of USA’s debt obligations.

In a letter to Congress earlier this year, the Treasury Secretary wrote,

…while the first phase of the banking problem is probably over, there is a slow-burning distress emerging in the banks as they find they have long-term loans made at low-interest rates and deposits are repricing to much higher interest rates, so their profitability, especially the small and medium sector is getting hurt…… (debt limit uncertainty could) raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States…cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests.

More information on Yellen’s letter to Congress is available here.

A shift in tone?

As mentioned earlier, the Treasury Secretary’s comments can have a significant impact on global markets.

A 2022 Bloomberg article stated,

…(Yellen) said the U.S. Dollar is in no danger of losing its status as the world’s dominant reserve currency as a result of sanctions imposed against Russia over its invasion of Ukraine.

However, during her comments reported from her testimony this week, Yellen stated there was,

…a natural desire to diversify…

This suggests there is plenty of motivation to shift away from the greenback, while the US’s foreign policy over the past year has certainly been a source of anxiety for a host of important trading partners.