Teacher and school employee pension funds in multiple states could lose millions of dollars with the collapse of Silicon Valley Bank over the weekend.

“In some respects, pension funds are exposed to the contagion effects of a bank run just like any other investor,” said Anthony Randazzo, who is closely following the issue and is the executive director of Equable Institute, a bipartisan nonprofit that provides public pension education and research.

Here are four takeaways on the domino effect the bank’s failure could have on teacher and other public school employee pension funds:

Teacher pension fund holdings in SVB Financial Group directly affected

At least 26 public pension funds managing money for about 80 pension plans directly held stock — which plummeted alongside the bank — in the SVB Financial Group, which is the parent of Silicon Valley Bank, according to Randazzo’s count so far.

“These aren’t large dollar amounts relative to the size of their portfolio,” Randazzo said. The broad diversity of school employee pension investments, of which SVB Financial is only one part, means the singular crash will more than likely not sink pension funds. Rather, it’s just a drop that dried up in a much larger bucket.

For example, out of those that reported direct investments in the bank, Ohio State Teachers’ Retirement System was one of the largest investors at approximately $40 million worth of SVB shares, per its filings with the U.S. Securities and Exchange Commission and Randazzo’s search. Ohio STRS said in an email to K-12 Dive that, as of Wednesday, it held $27.2 million in SVB shares. Both of those estimates are still a relatively small percentage of the system’s roughly $90 billion in assets.

There are at least 26 public pension funds (managing money for ~80 pension plans) who directly held stock in SVB Financial Group (#SIVB), the parent of Silicon Valley Bank.

A short ????????????????♂️ pic.twitter.com/677bw7mUBv

— Anthony Randazzo (@anthonyrandazzo) March 13, 2023

“In absolute terms, this is a little blip for these teacher pensions,” said David Backer, associate professor in education policy, planning and administration at West Chester University. Backer’s expertise includes education finance.

Others that directly held stock in SVB’s parent group within the last year include retirement systems for teachers or public school employees in California, New York, Pennsylvania, Texas, Kentucky, and New Mexico. It’s also likely that additional states held smaller shares in the company, but outsourced their investment management to third-party firms, said Randazzo.

Pensions hold stock in public companies also impacted by SVB failure

However, there’s also an indirect impact on pension funds that hold shares in other public and private companies affected by SVB’s failure. Some of the same state pension funds that owned the now-plummeted stock of SVB Financial also own stock in companies with substantial funds deposited in its bank.

For example, Kentucky, California, Texas, New York and Pennsylvania teacher or public school employee retirement systems are also all listed as shareholders for Etsy, which had funds tied to SVB and was struggling to pay vendors on its platform as a result.

In addition to Etsy, other publicly traded companies exposed by SVB’s failure that also have investments from teacher pension funds include Roku and Rocket Lab USA. Stock values for Etsy and Roku both dropped as of Monday evening.

“Some teacher pension companies are going to have exposure to those losses as well,” said Randazzo.

Teacher pensions more volatile than in past years

While the direct financial fallout of SVB’s collapse for teacher pensions may be relatively small, the incident highlights both the increasing volatility of teacher pension plans in recent years and the resulting burden on district and local finances.

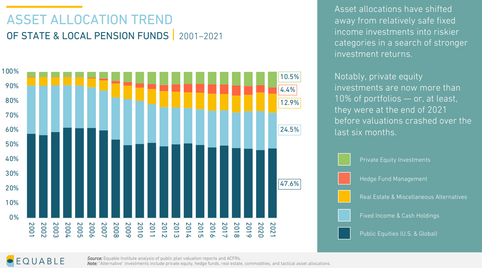

Over the past 15 years or so — since the financial crisis of 2008 — state and local pension funds have shifted some investments away from those that are relatively safe and fixed into riskier territory, like private equity and real estate, according to Randazzo. A 2022 Equable report shows the share of private equity investments making up state and local pension fund assets increased to 10.5% in 2021 from 3% in 2001. That increase noticeably set in after 2008.

The share of pension funds invested in riskier and less transparent areas like private equity increased after 2008.

Permission granted by Equable Institute

“State pension funds have had to take on a lot more risk with their investments,” Randazzo said. “And that has meant that there has been an increased amount of exposure to market volatility.”

It also means that when pension investments — such as those in SVB Financial — don’t yield the expected return, school districts have to contribute more to make up for the gap, indirectly impacting teachers in the process.

“And if school districts are on the hook for more, that’s another line in their budget that they have to send out into something else rather than putting it into their salaries or their operations or even capital expenditures,” Backer said.

Lack of transparency from state agencies

Despite multiple teacher retirement systems potentially feeling the fallout from SVB’s collapse, many teacher pension fund managers have been silent on the issue so far, making it difficult to pinpoint the exact exposure from the incident.

“Every single teacher pension fund manager should have had a statement out today, saying, ‘Here’s what our exposure was, here’s what kind of losses we think we might suffer,'” said Randazzo. “But that certainly hasn’t happened everywhere.”

In a statement, a spokesperson for State Teachers Retirement System of Ohio said, “We’re continuing to monitor and assess the impact of these developments on the financial system.” However, a search conducted by K-12 Dive of Ohio STRS’ website and websites of other teacher or school employee retirement systems suggests these institutions don’t share easily accessible information about their specific holdings.

Texas Teachers Retirement System, another public pension fund that held shares of SVB Financial, refused to comment and said it doesn’t plan to in the future.

Finance experts worry this lack of transparency makes the pension management institutions unaccountable to the current and retired teachers for whom they are managing money. It could also pick at old wounds left from past teacher pension debacles.

“I think it’s safe to say that teacher pensions are embattled, and there are a lot of challenges around them around the country,” said Backer. Controversies over teacher pension plans have arisen in states including Texas, Ohio, Pennsylvania and California in recent years.

“Anywhere that stakeholders fear a lack of transparency and disclosure from their retirement system, a failure by pension fund managers to get out in front of the SVB story will be a particularly bad mistake,” said Randazzo.

Districts can play an active role in pushing for this kind of transparency, added Randazzo, in a sentiment echoed by other finance experts.

“It should be in every district leader’s interest that the teachers who come to work every school day in their schools feel confident about the stability of the retirement benefits,” he said.