Average property values in the UK climbed 0.5% to £283,615 in November, some £1,300 more than in October, recent figures from lender Halifax showed.

It was the second monthly gain in a row after six consecutive falls before that.

However, it was still a 1% drop compared with November a year ago, a steep fall from the 3.1% decline in the year to October.

But according to property website Zoopla, house prices have fallen across 80% of the UK as the cost of living crisis dents demand and budgets.

UK Finance said the main pressures on affordability look to have peaked, despite the outlook of continuing challenges in the mortgage market in 2024.

More than one million homeowners this year had to refinance on to higher mortgage rates. Next year a further 1.5 million Britons will need to move to new mortgage rates. The cost of living crisis is also forcing many to delay their plans of jumping on the property ladder.

So for those looking to buy, or sell, in the new year, here’s a look into what is expected to happen in 2024.

Read more: UK house prices predicted to fall in 2024

Property prices

The average property value is forecast to fall further next year, with analysts estimating that the decline in annual prices seen this September will last until the fourth quarter of 2024.

The Centre for Economics and Business Research (Cebr) is forecasting weak house price growth for 2023, rather than an annual decline, followed by a modest fall of 2.6% in 2024.

“We are still anticipating a decline in house prices next year before a recovery takes place from 2025,” Cameron Misson, an economist at Cebr said.

Nationwide expects house prices to see low single digit decline or remain broadly flat in 2024.

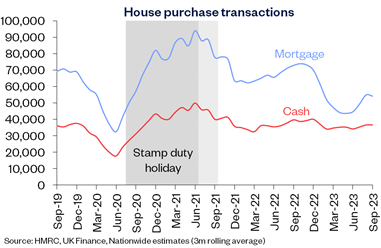

Nationwide’s chief economist Robert Gardner said: “Housing market activity was weak throughout 2023. The total number of transactions has been running at about 15% below pre-pandemic levels over the past six months, with those involving a mortgage down even more (c25%), reflecting the impact of higher borrowing costs. On the flip side, cash transactions have been running above pre-COVID levels.”

He further explained the impact on house prices: “This subdued picture was also reflected in house prices, which in November were 2% lower than the same period in 2022, and 4.3% below the all-time high recorded in late summer 2022.”

Halifax predicts house prices to fall by as much as 4% in 2024, after a resilient 2023.

“Overall, with the combination of cost of living pressures and interest rate levels that are still much higher than even two years ago, we will likely see continued mild downward pressure on house prices,” said Kim Kinnaird, director at Halifax Mortgages.

Meanwhile, according to Rightmove, the average UK house price is expected to ease by 1% over the next year.

The pressure is on sellers to price under the competition to secure a buyer as affordability remains stretched, the property site said.

Tim Bannister, Rightmove’s director of property science, said: “With mortgage rates more settled and on a slow downward trend, potential movers who have been biding their time and waiting for calmer market conditions may decide to act in the early part of next year.”

He added: “Rightmove’s research and agent feedback is that the best strategy to sell in the current market is to price temptingly at the outset of marketing, rather than testing the waters with a higher price.

“This will hopefully avoid the need to reduce your asking price later, and capture that early-bird buyer’s interest in the new year, whilst also avoiding the stress of drawing out the selling process and risking having the for-sale board still up at Easter.”

Zoopla has predicted that UK house prices will fall by 2% during 2024 based on mortgage rates dropping to 4.5% by the end of the year and remaining there into 2025.

The property website also estimates there will be one million sales in 2024, but it suggests this could be higher if mortgage rates fall back towards 4%.

Meanwhile, analysts at Capital Economics predict house prices will fall by 5-6% by mid-2024, because “we think that mortgage rates will stay around their current high level until next summer”.

Read more: Mortgages: First-time buyers facing deposits twice their annual income

Alice Haine, personal finance analyst at Bestinvest, said: “While [recent] data offers hope that stability has returned to the property market, it may be the calm before the storm if house prices weaken over the course of next year as the drag effect from the Bank of England’s (BoE) 14 interest rate hikes continues to filter through to the market.

“It means sellers may be forced to price their homes more competitively to secure a sale while mortgage rates are expected to ease further though remain high in line with the ‘higher for longer’ mantra for interest rates from the BoE.”

Mortgage rates

Mortgage rates have already begun to ease but still remain elevated after spiking in the summer. Two-year (75% LTV) fixed mortgage rates stood at 5.6% in October 2023, according to Bank of England data, down from their recent peak of 6.3% in July.

“With these pressures unlikely to ease significantly in the short term, we expect lending to remain weak in 2024, with a gradual improvement in affordability reflected in a modest increase in activity levels in 2025,” said James Tatch, head of analytics at UK Finance.

However, this still represents a significant rise in the cost of mortgages compared to October 2021, when the average two-year rate stood at 1.3%.

But this will continue to decline throughout next year as recent figures have shown that average swap rates have fallen for five months in a row.

This is according to property lending firm Octane Capital, who analysed average monthly swap rates over the last year to predict what could be in store for the market.

The analysis showed that the average one year swap rate has fallen to 5.20% in December, down by 2% from November, and the fifth monthly decline seen since hitting an annual high of 6.09% in July.

Five year swap rates are even lower, reaching an average of 4.32% in December, down from 4.48% in November, having also fallen consistently from an annual high of 5.25% in July.

Watch: How much money do I need to buy a house?

While both still remain higher than at the start of the year, it provides further evidence that mortgage rates are set to drop.

Rhys Schofield of Peak Mortgages and Protection said: “It seems that rate reductions are definitely now being priced into what lenders are charging for new fixed-rate mortgages.”

What are swap rates?

Mortgage market swap rates reflect the price lenders have to pay financial institutions when securing fixed rate funds, which they use to offset short-term risks associated with fixed rate mortgages.

They are generally based on government bonds called gilt yields, which reflect what the market anticipates will happen to interest rates down the line.

In sum, the cost of swap rates filter through to mortgage rates, whether they rise or fall, and currently they are falling.

Swap rate activity signals that the markets feel it is more likely that the BoE will cut the base rate than opt for another increase, which should filter through to lower mortgage rates in the new year. This is even before the Bank actually opts for a cut.

Jonathan Samuels, chief executive of Octane Capital, said: “Falling inflation means the Bank of England’s strategy over the past two years seems to be working, albeit the reduction in headline inflation has been largely driven by food and energy price drops.

“Such a consistent reduction in swap rates in recent months should also bring hope to borrowers as this suggests that more affordable mortgage rates are on the horizon as lenders pass on the benefit to mortgage holders.”

Mortgage approvals

In November it was revealed that UK mortgage approvals increased for the first time in four months as the BoE decided to keep interest rates steady.

The net number of agreements rose from 43,700 in September to 47,400 in October, which was the most since July, according to the data. Despite this improvement, they remain below the pre-pandemic average of 65,752 in 2019.

This indicates that housing market activity remains weak following the BoE monetary policy tightening campaign, which has resulted in elevated mortgage rates.

Net approvals for remortgaging with a different lender increased from 20,600 in September to 23,700 in October.

The effective interest rate on newly drawn mortgages picked up to 5.25% in October, from 5.01% in September.

Read more: UK mortgage lending set for ‘sharp contraction’ in 2024

Interest rates

The BoE base rate has been on hold since August 2023, signalling that the period of rapid rate increases has ended.

It previously raised interest rates from 0.1% in December 2021 to 5.25% as a bid to tame runaway inflation, which peaked at 11.1% in October 2022.

CPI inflation has since fallen to 4.7%, as of October, down from 6.3% in September, highlighting that the UK is finally treading closer to the Bank’s target of 2%.

Money markets are predicting that the BoE will reduce interest rates five quarter-point cuts next year, down from their 15-year highs of 5.25% to 4%.

Traders are betting there will be four interest rate cuts in 2024 after official figures showed the economy shrank 0.3% in October.

They also predict that Threadneedle Street will begin reducing borrowing costs by May at the latest, having previously forecast it would start by June.

Watch: Will UK house prices ever fall?

Download the Yahoo Finance app, available for Apple and Android.