By Stephen Johnson, Economics Reporter For Daily Mail Australia

03:16 27 Jul 2023, updated 03:17 27 Jul 2023

- Futures market regards August rate rise as 14 per cent chance

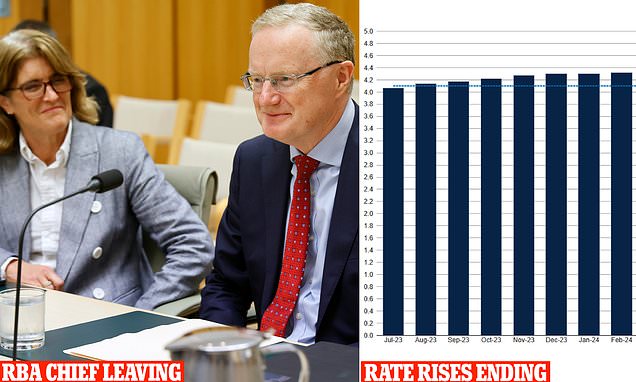

- Outgoing RBA chief Philip Lowe tipped to pause in September

Outgoing Reserve Bank chief Philip Lowe could spare Australian home borrowers further rate rises in August and September as his term ends – with inflation falling.

The futures market, which bets on interest rate movements, now regards another increase on August 1 as a 14 per cent chance.

Just two days ago, another rate rise on Tuesday next week was priced in as a 41 per cent probability.

That changed dramatically on Wednesday after the Australian Bureau of Statistics revealed annual inflation in June had fallen to six per cent, down from seven per cent in the March quarter.

The 30-day interbank futures market is now also expecting the Reserve Bank of Australia to leave interest rates on hold in September, but potentially raise them one more time in November.

Should those predictions materialise, June’s rate hike would have been the last from Dr Lowe, whose seven-year term ends on September 18.

With inflation still well above the Reserve Bank’s two to three per cent target, that means his deputy and successor Michele Bullock could be left to hike rates again in late 2023.

Treasurer Jim Chalmers has revealed he told Dr Lowe his seven-year term would not be extended several weeks before his replacement was announced on July 14, following 12 rate increases since May 2022.

‘Well, the decision to appoint Michele Bullock and not to renew Phil Lowe was a decision taken by the Cabinet the day that we announced it but obviously, a couple of weeks before that, I indicated to Governor Lowe that my recommendation to the Cabinet would be that we appoint somebody else,’ he told ABC Radio on Wednesday.

‘I just saw that as a respectful way to engage with someone who’s had a lot of dedication and commitment to our country and its economy for a long time but it wasn’t finalised and decided till the day that we announced it.’

In the first week of July, the Australian Securities Exchange’s 30-day interbank cash futures market saw an August rate rise as a 52 per cent chance.

As recently as July 21, a rate increase was regarded as a 48 per cent chance.

The Commonwealth Bank, Australia’s biggest home lender, is still expecting an August rate rise but senior economist Belinda Allen said this would be the last hike in this cycle.

‘At this stage we continue to expect the RBA to lift the cash rate one final time in August,’ she said.

Another rate rise would take the Reserve Bank cash rate to an 11-year high of 4.35 per cent, up from 4.1 per cent now, adding to the most aggressive pace of monetary policy tightening since 1989.