Sophie is just one of 350,000 young adults in Ireland between the ages of 20-35 still living in her family home. Like many millennials in Ireland, the 28-year-old marketing executive from Galway is locked out of the housing market.

This problem is not unique to Ireland, according to Eurostat, approximately 67% of people (between 16-29) in Europe live at home with their parents or relatives, but for some, this is not a choice.

The Galway native told Euronews that rising inflation coupled with the cost-of-living crisis is largely to blame: “It’s so frustrating, I have a master’s degree, a good salary and like so many of my friends I’m saving to buy a house.

“But I had to move back in with mum and dad because I was struggling to save money, let alone pay rent, even now it is going to take me forever to save a deposit,” she said.

Affordability is a major issue, as Ciarán Lynch, a former member of the Irish Parliament explained: “House prices have never been so expensive and interest rates are increasingly rising for people coming into the housing market.

“They are almost as close to the figures from two years ago when interest rates were particularly set by the European Central Bank”.

The Mortgage Crux

Considering that house prices on average in Ireland are 94% above those of the EU, Sophie’s dilemma is not surprising.

In order to be eligible for a mortgage in Ireland, first-time buyers are limited to a loan of four times their gross annual income, a prospective mortgage is also capped at 90% of a property’s value.

However, house prices across the country have risen 537% since 1988 and are not in line with today’s earnings.

According to recruitment solutions giant Morgan McKinley, professionals in Ireland take home an average salary of €45,000. However, the Irish Central Statistics Office (CSO) recently revealed that the average Irish house price is now a record-breaking €359,000.

So, for single-income, first-time buyers with a salary of €45,000, the maximum amount they can borrow is €180,000, which is slightly more than half of the average house price.

Ireland vs Italy

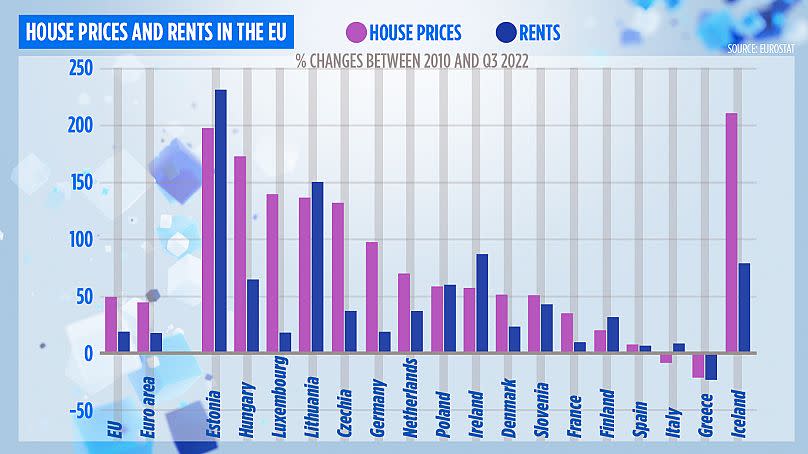

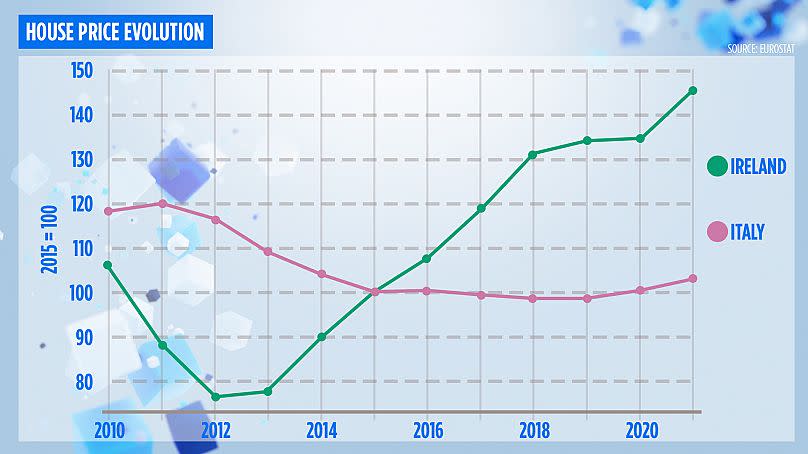

House prices and rents vary from one EU Member State to the next, in fact, in some EU countries, house prices have dropped in recent years. Italy, for example, experienced a boom until the financial crash in 2008 and then the cost of property steadily dropped. According to Eurostat, prices were cheaper in 2022 compared to 2010.

While rents have increased in Italy, the differences are marginal compared to Estonia, Lithuania, or Ireland where the average monthly rent stood at €1,733 in December 2022, that’s 126% higher than in 2011.

If the Italian house prices are more attractive to potential buyers, does this translate to higher levels of property ownership among young adults? On the contrary, a higher percentage of young adults live at home with their parents in Italy than in Ireland.

So, what are the drivers behind this trend in both countries?

Ireland’s lack of supply

While median gross salaries in Ireland are considerably higher than in Italy, available homes are also few and far between on the Emerald Isle.

“In 2010, we had 24,000 rental properties advertised on Daft (Ireland’s top property site) on any one day of that year, compare this to recent figures when we had just 700 properties available right across the country,” said Mark Rose, the managing director of Rose Properties.

“So now we have approximately 3% of what was available in 2010, we need thousands of rental properties to be loaded onto the market today, tomorrow or as soon as possible, they are urgently, urgently needed,” Rose added.

Limited properties are increasing demand and are placing a serious strain on rents and potential buyers, as the managing director of Dennehy Auctioneers in Cork told Euronews: “The rental market in Ireland is totally and utterly dysfunctional. We put a house up to rent two weeks ago at 12:55 pm and by 13:20 pm we had 90 emails (enquiries)”.

“We need thousands of apartments in cities to keep up with demand, however, Ireland is a victim of its own success, a lot of people want to come and live and work in this country and are attracted by the lifestyle, but our population is also growing and we can’t keep up,” Dennehy said.

The Central Statistics Office estimated that the population in Ireland increased by 88,800 between April 2021 and April 2022, the largest 12-month population increase since 2008. This is largely due to a 445% surge in migration and according to Dennehy, foreign direct investment is part of this trend: “Ninety per cent of the inquiries I am currently receiving for a new housing development in Carrigaline (a commuter town in Cork) are from non-nationals, and ninety per cent of those again are non-EU”.

“The professionals coming here have good jobs, they are well paid and they love this country”.

But former deputy Lynch who chaired the Committee on Finance, Public Expenditure and Reform in October 2012, said non-nationals with money to burn are also running into problems: “Foreign direct investment is a very, very significant part of the Irish economic model. And job creation has become a problem because it’s not that the jobs aren’t there, but the houses aren’t actually there for the employees when they get those jobs.”

The Italian job

“Property might be cheaper in Italy but the problem lies with the country’s stagnant labour market,” said Mimmo Parisi, a sociology professor from the University of Mississippi.

The senior advisor for European and data science development told Euronews: “Everyone is looking for that dream job in Italy and professionals don’t move around much, once they find a dream position they stay, often for life. As a consequence, there are fewer job openings and it’s difficult for young adults to enter the job market”.

High youth unemployment in Italy is a major factor. According to Italy’s national statistics institute, ISTAT, the unemployment rate (for youths aged 15-24) was 22.9% in January 2023, nearly eight points higher than the EU average of 15.1%, as a consequence young Italians are less financially independent.

“Add dubious work contracts, slow wage growth and low salaries to the mix and it is easy to see why young Italians are stuck at home despite falling house prices. It is also difficult for university graduates to secure relevant short-term work experience when the labour market works in favour of an ageing workforce,” explained Parisi.

According to the Organisation for Economic Cooperation and Development (OECD), Italy is the only European country where wages fell between 1990 and 2020, all the other Member States experienced a rise with Lithuania leading the charge with a 276.3% increase.

“Many students stay in university that bit longer when hunting for that dream job, which as we’ve learned is difficult to come by. This forces young adults to be more reliant on their parents until that happens,” Parisi said.

To add to the plight of youths, an Italian bank will not approve a mortgage without a permanent work contract otherwise known as ‘il contratto a tempo indeterminato’, which creates additional obstacles.