- Every month 150,000 mortgage holders reach the end of cheap fixed deals

- But while more are falling behind on payments, repossessions haven’t gone up

- We look at how Britons are coping with higher mortgage payments

Since mortgage rates began rising, many of the nine million mortgaged households in the UK and close to two million landlords have been faced with the prospect of much higher payments.

Before that, many had become accustomed to ultra-low interest rates for more than a decade.

In this six-part series, we look at how much more people are really paying when they take out a new mortgage, how households are coping and if a mortgage crisis is afoot.

Last time, we revealed the extent to which people are raiding their savings, falling behind on their mortgage payments and having their homes repossessed.

Next up, we look at why the vast majority of households are coping so well under the strain of higher rates.

Why aren’t more people in a mortgage crisis?

There has been an increase in mortgage arrears in the past year, and more people are spending their savings.

The Bank of England’s latest figures showed the value of outstanding mortgage balances with arrears increased by 9.2 per cent in the three months to December 2023, compared to the previous three month period.

Arrears rose to £20.3 billion, which was 50.3 per cent higher than a year earlier.

This is due to a rise in mortgage rates, which means those coming off two or five-year fixes may see their monthly payments double.

Related Articles

HOW THIS IS MONEY CAN HELP

The average two-year fixed rate mortgage deal, according to Moneyfacts, is currently 5.78 per cent, while the average five-year fix is 5.35 per cent. Someone who took out a mortgage in March 2022 will now be coming off an average rate of 2.64 per cent.

However, there has not been a rise in repossessions, where homeowners hand back the keys to the bank to pay off the mortgage.

This is because, since the 2008 financial crisis, borrowers have been subjected to tough affordability checks.

Without these checks, the number of people in arrears would also be higher according to experts.

In 2014, the Government’s Financial Policy Committee made two recommendations for mortgage lenders which it said would avoid household debt spiralling again as it did in 2008.

One was a limit on the loan-to-income ratio, and the other was an affordability test, which required a ‘stress’ interest rate for lenders when assessing peoples’ ability to repay a mortgage.

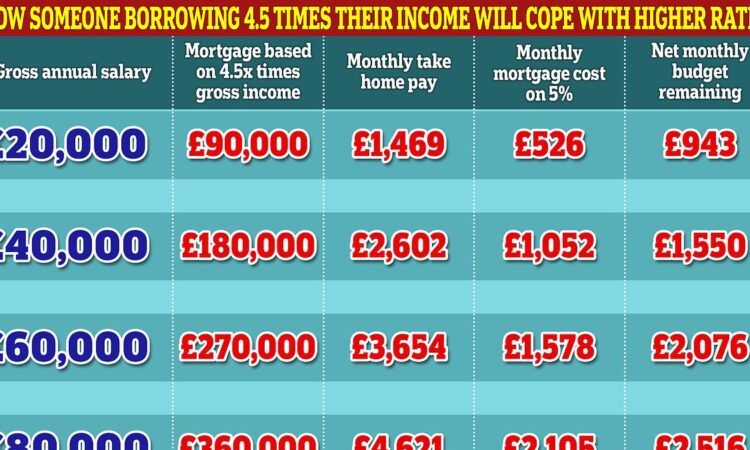

The loan-to-income-ratio is the amount banks will lend based on someone’s annual salary. Since 2014, banks have had a limit on the number of mortgages they can offer where someone is borrowing more than 4.5 times their salary.

This means most people are restricted to borrowing no more than 4.5 times their gross annual salary, or collective salaries if buying as a couple.

In reality, most people don’t stretch themselves to the maximum anyway.

Last year, the average first-time buyer borrowed at an average of 3.36 times their annual income, according to UK Finance. The previous year, the typical first-time buyer was borrowing at 3.62 times their income.

There was also an additional affordability test, which meant borrowers needed to prove they could still afford their mortgage repayments if these were to increase to 3 per cent above their lender’s standard variable rate – but this was scrapped in 2022.

SVRs are the default rate that people move to when fixed or other deals end, and they are far more expensive. For that reason, most borrowers switch to a new fixed mortgage deal and don’t end up on one.

Although the additional affordability test was scrapped, it means that anyone who took out a mortgage or remortgaged between 2014 and 2022 will have been subjected to the original test.

The average standard variable rate during these years ranged between 4.4 per cent and 6.4 per cent, according to Moneyfacts. It means, typically borrowers would have been stress tested at between 7.4 per cent and 9.4 per cent to ensure they could cope at higher rates.

Current mortgage rates are lower than the rates at which borrowers were stress tested at. So in theory people should be able to cope, unless their financial circumstances have changed for the worse.

UK Finance says: ‘A key factor mitigating the pressure on mortgage customers is the affordability stress tests that have been in place since 2014.

‘These have worked well to ensure that, even as rates have risen sharply, most customers on variable rates, as well as those coming off fixed rates and looking to refinance, have been able to cope with the increase in their payments.’

A lot of what came out of the financial crisis should mean that borrowers are better equipped to deal with the higher rates

David Hollingworth, associate director at L&C Mortgages agrees that these affordability checks have prevented people from over-stretching themselves.

‘When compared with the financial crisis in 2008, then it looks as though a lot of borrowers will be able to navigate the issues more easily today,’ says Hollingworth.

‘A lot of what came out of the financial crisis should mean that borrowers are better equipped to deal with the higher rates.

‘The Mortgage Market Review which followed the financial crisis and will have allowed borrowers some headroom to cope with increases.

‘That doesn’t mean it’s painless, but the fact that mortgage affordability was stressed at higher rates means there was a buffer in place when lenders decided how much they lend.’

Sole earners feel the mortgage pain

However, while the affordability checks will have prevented many people from facing financial ruin under current mortgage rates, there is no denying that current rates will be hurting – particularly households reliant on a high-paid sole earner, for example.

For example, take a household relying on one person earning £100,000 a year. After income tax and the current rate of National Insurance they will be taking home £5,587.47 each month.

If they borrowed at 4.5 times their gross annual income, they might have secured a mortgage worth £450,000.

If they were now remortgaging with the same income and required the same loan amount and a 25 year term today, at a 5 per cent rate the mortgage would cost them £2,631 a month.

Minus that from their monthly take home pay and they’re left with £2,956 to support their family, which could include childcare or school fees.

A financial emergency, such as needing to buy a new car or fix a leaky roof, could see them get into trouble if they don’t have savings to fall back on.

Little more than two years ago they might have secured a rate of 2 per cent on their £450,000 mortgage resulting in £1,907 monthly payments and leaving them with £3,680,47 of their take home pay to take care of their family.

Ultimately, it’s a lot more nuanced these days than just an income multiple and those who use a broker to scour the market may find they can borrow more or less than 4.5 times their gross annual salary.

Chris Sykes, mortgage technical manager at broker Private Finance adds: ‘A couple earning a combined £100,000 between them with no commitments and no children could likely get up to 5.5 times their income – so £550,000.

‘But throw in a couple of cars on finance and that could be reduced to £475,000. Then throw in a couple of children into the mix and their maximum borrowing could be slashed to £250,000.

‘It’s all dependent on the overall situation really, you’re more often capped by affordability these days than income multiples.’

Borrowers sticking with the lender they know

Many homeowners may fear they are unable to remortgage to a different lender due to these affordability rules.

Last year, almost 83 per cent of the 1.8 million people who refinanced their mortgage opted to stick with their existing lender, according to UK Finance.

The benefit of staying with your existing bank or building society, known as a product transfer, is that you don’t have to go through all the same checks and balances you would if switching to a new lender. However, the limited rates on offer might also prevent you from getting the best possible deal.

Product transfers tend to require less paperwork, no new affordability assessment and no re-valuation of the property.

Lee Hopley, director of economic insight and research at UK Finance says: ‘Affordability pressures came to bear on mortgage refinancing activity in 2023.

‘External remortgaging – which theoretically had a sizeable market last year – fell by 18.5 per cent compared with 2022.

‘However, with the widespread availability of internal product transfers which do not require affordability tests, virtually all customers were able to refinance their loans.

‘As a result, refinancing activity shifted even further towards retention deals, and the product transfer market saw annual growth of 17.1 per cent, the sole area of mortgage business growth last year.’

Higher mortgage rates result in fewer home movers

While many homeowners have coped, affordability pressures have driven a sharp contraction in mortgage lending towards first-time buyers and home movers.

Last year the number of first-time buyer mortgages fell by 22.4 per cent compared to 2022, according to UK Finance, while the number of home mover mortgages dropped by 26 per cent.

While some will be locked out due to lender affordability checks or lack of a big enough deposit, many may just feel unable to afford the monthly payments on the type of home they want given current rates.

For example, a first-time buyer who could previously afford £1,000 a month on monthly payments would have been able to afford a mortgage of up to £221,000 when rates were at 2.5 per cent (assuming a 25 year repayment term).

Now that first-time buyer will be limited to rates of around 5 per cent, based on the same £1,000 monthly budget they would only be able to afford a mortgage of £169,000.

The same could be said for some home movers – particularly upsizers who need to borrow more.

With fixed rates at 2.5 per cent, a £2,000 monthly payment on a 25-year loan could secure a £442,000 mortgage. But with fixed rates at 5 per cent, that same £2,000 monthly payment gets a £338,000 loan.

Some home buyers might be able to create a bit more financial wiggle room. They might be able to use money from savings, or borrow over a longer term.

Some may have increased their earnings since they last got a mortgage, allowing them to pay more each month, or built up enough equity in their home that they can remortgage on to a cheaper rate.

But other household bills have also gone up substantially and many will not be in that situation.

Unless those buyers are able to rustle up a lot more money for monthly payments, or tens of thousands of pounds extra for a deposit, then either the price of the house they can buy will have to give way, or they’ll just hold off buying altogether until rates fall.

The fall in the number of new mortgages suggests more are doing the latter.

Buyers opt for longer mortgage terms

It’s perhaps not surprising that increasing numbers of borrowers have opted to stretch out their mortgage term to cope with the added costs.

The mortgage term is the number of years you agree to repay the mortgage for – which used to commonly be 25 years.

Between mid 2022 and the end of 2023, the proportion of new first-time buyer mortgages taken out with a mortgage term of over 35 years rose from around 7 per cent to almost 20 per cent, according to UK Finance.

By lengthening the term of a mortgage, a borrower spreads their repayments over a longer period of time and therefore reduces the monthly costs.

However, whilst taking out a longer mortgage term will reduce the monthly costs, it will ultimately mean paying interest for a longer period of time and therefore paying more in the long run.

For example, someone with a £200,000 mortgage paying 4.5 per cent interest over 20 years would face monthly repayments of £1,265, paying a total of £303,672 over the lifespan of the mortgage.

Someone with a £200,000 mortgage paying the same interest rate over a 40-year term would face monthly repayments of £899. However, they would pay £431,580 over the lifespan of the mortgage: £127,908 more than on a 20-year term.

While their interest rate would likely change during this time if they remortgaged or fell on to their lender’s standard variable rate, the principle remains the same.

The massive spike in first-time buyers stretching their mortgage for 35 years or more suggests higher rates will result in more people having a mortgage later into life.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.