When will mortgage rates go down? Experts predict how long it will take for UK repayments to reduce

In the not too distant future, interest rates will go down and stay down, the International Monetary Fund (IMF) said on Tuesday.

“Recent increases in real interest rates are likely to be temporary,” it said, reassuringly adding: “When inflation is brought back under control, advanced economies’ central banks are likely to ease monetary policy and bring real interest rates back towards pre-pandemic levels.”

This would have been music to the ears of many mortgage borrowers who have seen their monthly repayments rocket as rates started climbing with the base rate now on its 11th consecutive rise at 4.5 per cent.

So what will happen to rates and is any relief on the way for mortgage borrowers already troubled by a cost of living crisis?

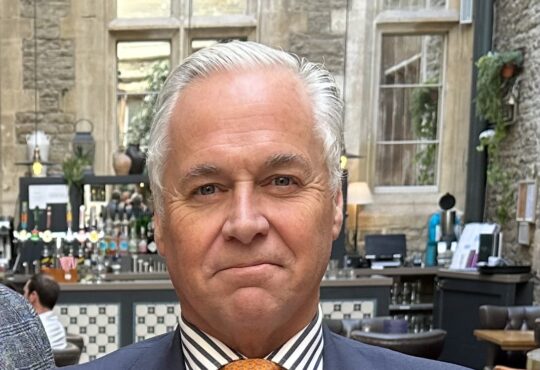

Scott Taylor-Barr, financial adviser at Carl Summers Financial Services, says trying to guess the path of interest rates is a bad idea for most people.

He said: “It is out of their control and an unknown quantity in the decision-making process, especially if we are trying to guess the path of interest rates over years; how many people taking out two year fixed rate deals at the end of 2020 expected fixed rates to be nudging 6 per cent in 2022?”

Mr Taylor-Barr advises people instead to concentrate on the factors that are in their control and consider whether their plans need flexibility.

“Can you afford to see your mortgage payments increase if interest rates rise? Do you plan to move, or think you’ll need to borrow more in the next few years? Spending time thinking about these factors, which are far more in your control, is more likely to get you to the right mortgage deal than trying to guess what is going to happen to interest rate.”

But there’s a glimmer of hope from Katy Eatenton, mortgage and protection specialist at Lifetime Wealth Management, who notes that fixed rates are still creeping down slowly, with several lenders offering below 4 per cent on low loan to value (LTV) products. Buy-to-let rates are also lower than we have seen in the last six months, the lowest being 4.01 per cent from Virgin for those with a 40 per cent deposit.

Ms Eatenton says: “A tracker is still a good product if you don’t want to be tied in and incur early repayment charges, but the lack of stability doesn’t appeal to everyone. Advice is so crucial at the moment, as the decision will be based on the client’s attitude to risk, rather than just what the lowest rate is right now.”

But others are more pessimistic about the outlook. Graham Cox, director at Self Employed Mortgage Hub, believes mortgage rates will possibly fall late this year or early next if inflation falls as quickly as expected.

He points out that there’s no guarantee that rates will fall, with a number of factors making for a cocktail of economic uncertainty.

“Increasing wage demands could propel the UK economy into an inflationary spiral. Whilst Putin is waging war in Ukraine, geopolitical tensions will add to the uncertainty.”

In this environment, education about mortgage rates is what’s most important to borrowers currently, Aaron Foster, director at Create Finance, argues.

Whilst the Bank of England has been increasing the base rate, fixed rates over the past few months have been steadily falling and continue to do so, he observes, with tracker rates affected the most by the recent changes as they are linked to the base rate so these are less attractive to customers.

“Borrowers listen to the news and see rates are increasing which makes them nervous about making decisions when in reality this isn’t the case. Speaking to a mortgage adviser is so important to understand the best options for them. Whilst inflation is slowing down it’s unlikely we will see any change to the base rate until later this year/early next year at the earliest,” Mr Foster says.