The Bank of England has upped base rate from 3.5 per cent to 4 per cent, the latest decision by its Monetary Policy Committee in a bid to curb inflation.

Monetary Policy Committee members voted to raise interest rates by 0.5 percentage points – taking base rate to its highest level in over 14 years.

It is the Bank of England’s tenth consecutive base rate hike in 13 months – taking base rate from just 0.1 per cent in December 2021 to 4 per cent today.

We explain why the Bank of England is raising interest rates and what it means for the economy, mortgage borrowers and savers.

Tenth hike: The Bank of England today upped the base rate from 3.5% to 4%, as it continues to try and bring inflation down

Why are interest rates rising?

The Bank of England is raising what is officially known as Bank Rate but more commonly called base rate to try to tame inflation.

The Monetary Policy Committee sets interest rates to try to keep inflation at the Bank’s 2 per cent target – but consumer prices index inflation is actually running at 10.5 per cent. The idea is that by raising rates, the Bank of England makes borrowing money more expensive and reduces the demand to do so, slowing the economy.

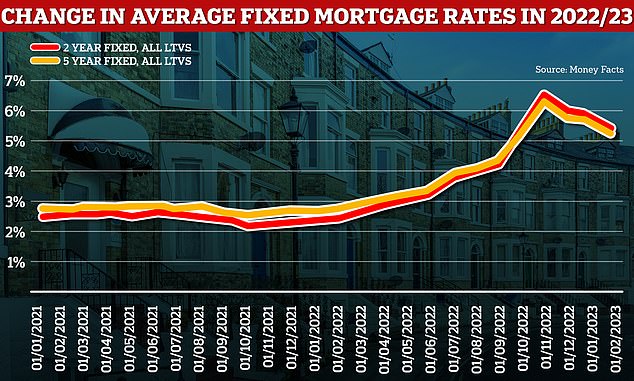

The rate rises are inflicting pain on many mortgage borrowers on variable deals and those who are coming to the end of their fixed-rate deals this year.

This has been compounded by further mortgage rate hikes in the wake of September’s disastrous mini-Budget. Some of the sharp rise in mortgage rates has since been unwound, but they remain far higher than they were.

However, rising interest rates have been good news for savers, with interest rates paid on accounts rising to levels not seen for more than a decade.

The move by the Bank of England is higher than the Federal Reserve in the US, which yesterday announced a 0.25 percentage point rise in interest rates. However, the American central bank’s hike took its rate to 4.75 per cent.

Some predict the UK’s base rate may continue to rise to 4.25 per cent in the spring before levelling off and maybe falling in 2024.

> When will the base rate peak?Analysts suggest 4.25% next month

Will fixed mortgage rates go up?

The increases since December 2021 have seen the base rate rise from 0.1 per cent to 4 per cent today.

As a result, the typical cost of a mortgage has been pushed up over the past 12 months by successive base rate rises.

The average two-year fixed mortgage rate is now 5.44 per cent, with a five-year fix at 5.20 per cent, according to Moneyfacts. This time last year they were 2.44 per cent and 2.71 per cent respectively.

Fixed rate mortgages are expected to level off somewhere between 4% and 5% over the year

More than 1.4 million people face remortgaging to a much higher rate this year, as fixed deals locked in during periods of record-low interest come to an end.

Almost six in ten deals (57 per cent) coming up for renewal in 2023 are at rates below 2 per cent, according to ONS statistics.

The average borrower coming off a two-year fix at the moment will see their rate rise from 2.53 per cent to 5.44 per cent when they remortgage.

On a £200,000 mortgage being repaid over 25 years, a typical borrower in this situation will see their monthly repayments rise by £321, from £900 to £1,221. That equates to £3,852 more in mortgage costs each year.

> Find out how a rate change would impact: Mortgage interest rate rise calculator

Fixed mortgage rates are not tied to the base rate in the same way that tracker products are, but lenders have tended to pass on increases in the base rate to customers taking out new fixes.

But despite the base rate continuing to rise, fixed rates have come down from their high in October. This has come because mortgage rate hikes ran ahead of the Bank of England.

Although rates were already rising due to the base rate hikes, they spiked following the ill-fated mini-Budget in September.

Five year fixes followed a similar trajectory, having fallen from a peak of 6.51 per cent in October. Over the past two weeks several major lenders including Santander, Halifax and Barclays have reduced their rates.

Given this direction of travel, experts don’t expect this rise to impact fixed rates. Most say rates are likely to continue falling despite an increase.

Amit Patel, adviser at mortgage broker Trinity Finance said ‘I would be very surprised if lenders opt to increase the fixed rates if the Bank of England vote to increase the base rate at their next meeting, as rates are priced in correlation to the Sonia swap rate.

Swap rates are an agreement in which two banks agree to exchange a stream of future fixed interest payments for another stream of variable ones, based on a set price.

‘Sonia is based on actual transactions and reflects the average of the interest rates that banks pay to borrow sterling overnight from other financial institutions and other institutional investors,’ Patel says.

Homeowners can check the rates they could get based on their home’s value and loan size, using our best mortgage rates calculator powered by broker L&C.

Worth the risk? Tracker rates were cheap when rates peaked but are becoming less attractive

Will tracker and variable rate mortgages rise?

Fixed-rate mortgages are the most popular choice for homeowners in the UK, with around three quarters of borrowers opting for the product.

But while most borrowers prefer the certainty of fixed monthly payments, around a quarter of UK mortgages are on variable deals.

Variable rate mortgages include tracker rates, ‘discount’ rates and also standard variable rates, and monthly payments on them can go up or down.

With future mortgage rate movements uncertain, some borrowers may still prefer to go for a tracker mortgage instead of a fixed rate for now, especially if there are no early repayment charges.

Trackers follow the Bank of England’s base rate minus a certain percentage, while discount rates are linked to the lender’s standard variable rate.

Mortgage holders on a base rate tracker product will therefore see their payments increase immediately to reflect the rise.

Those on a variable discount rate or who have fallen onto their lender’s standard variable rate, will go on to a rate chosen by their lender. However, they will likely see rates edge up over the coming weeks.

According to Moneyfacts, the average standard variable rate is now at 6.84 per cent, up from 4.46 a year ago. This means that since February last year, the average standard variable rate has risen by 2.38 per centage points.

On a £200,000 mortgage on a 25-year term, the rise would mean an additional £286 a month on mortgage payments, or £3,432 more a year.

What does the base rate rise mean for savings?

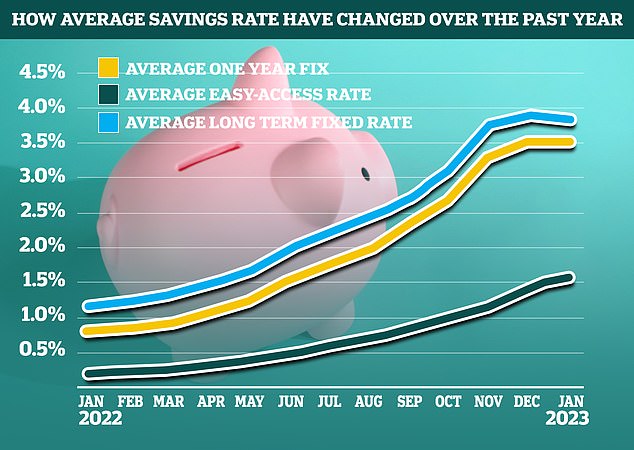

When the base rate first started rising, savings providers usually responded in kind. But savers may have noticed that fixed rate savings deals have stalled in recent months rather than improved, despite the Bank of England rate hikes.

The average one-year fixed bond has only risen by 0.1 percentage points over the past two months, rising from 3.51 per cent to 3.61 per cent, according to the latest Moneyfacts data.

That’s despite the Bank of England upping the base rate from 3 per cent to 3.5 per cent in December.

Have rates peaked? Market trends suggest a period of stability has arrived in the aftermath of the interest rate volatility seen in 2022

And those keeping a keen eye on This is Money’s best-buy savings rates tables will have noticed that the very best fixed rates have been falling back since the start of November.

The best one-year fix currently pays 4.16 per cent, having peaked at 4.65 per cent in November, while the best two-year fix pays 4.45 per cent, having peaked at 5 per cent.

However, easy-access savings rates are continuing to rise each month.

The average easy-access rate rose from 1.43 per cent to 1.73 per cent over the past two months and stands at its highest point since 2008.

Will banks increase savings interest rates?

Even if fixed rate deals remain the same, banks and building societies are expected to raise their variable savings rates due to the base rate increase. This includes easy-access accounts and notice accounts.

However, most commentators are in agreement that they are unlikely to pass on the rise in full to their customers.

This time last year, the average easy-access rate was paying 0.21 per cent, according to Moneyfacts. Now it has risen to 1.73 per cent. That’s an average of 1.51 percentage points passed onto savers.

During that same time the base rate rose by 3 percentage points from 0.5 per cent to 3.5 per cent, excluding the change to 4 per cent as of today.

This means that on average, only half of the base rate hikes have been passed onto savers over the past 12 months.

Were savers to see a 0.5 percentage point rise passed onto them in the aftermath of today’s base rate hike, someone with £20,000 saved could expect to receive £100 more per year.

Holding back: Since December 2021, the Bank of England base rate has risen from 0.1% to 3.5%. But big banks have not passed on the bulk of the increases to savers

Rachel Springall, finance expert at Moneyfacts, said: ‘Interest rates on variable savings accounts are continuing to rise, as several providers have improved their offers since the start of 2023.

‘The influence of the Bank of England base rate rises, along with rate competition, has made a positive impact on variable rate savings accounts, which include cash Isas.

‘Challenger banks and building societies continue to take the most prominent positions in the top rate tables, so savers who fail to review their existing account to the latest top rates may miss out.

‘Loyalty does not always pay and the majority of the biggest high street banks have failed to pass every Bank of England base rate rise to easy access accounts, with two in particular passing on just 0.54 per cent since December 2021.’

Will savings rates go up or down this year?

Looking ahead, savers should expect easy-access rates to continue to rise.

However, fixed rate savings may have already peaked with much of today’s base rate rise already factored in by savings providers.

This is because longer term swap rates and market expectations on where the base rate is going to peak have fallen dramatically in recent months.

They tend to show where the markets think rates are headed in the longer term.

Going up: Easy access savings rates are expected to rise over the next few weeks. However fixed rates may see little change

Anna Bowes, co-founder of Savings Champion said: ‘Another base rate hike should see variable savings rates increasing too, although as we know, most accounts are unlikely to see the full rise being passed onto them.

‘But fixed term bonds are unlikely to move in a positive direction as they are priced by what the market expects from the base rate and after the mini-Budget last year, the markets thought that base rate would peak at as high as 6 per cent, so the rates on offer soared at that time.

‘Now that the consensus seems to be that base rate is close to the top, top fixed rates have actually been falling over recent months, and that’s unlikely to change unless the outlook for base rate does.’

A spokesperson for the Savings Guru added: ‘A base rate rise of 0.5 per cent is likely to see both easy access and easy access Isa rates continue to rise.

‘Expect to see best buy easy access accounts to head towards 3.25 per cent during the month and easy access Isa rates go north of 3 per cent.

‘While some providers will be lined up to move this afternoon and tomorrow, expect the majority to digest the news and move in the new week or two.

‘One year fixed rates are likely to hold out around the 4.1 per cent mark and, while we may see further small reductions on longer term rates, expect to see fixed rates to hold around current levels.’

Looking even further ahead, some analysts are predicting that today’s base rate hike will be the penultimate rise in the bank’s hiking cycle.

Whether the Bank of England increases the base rate again in March will play a key role in how savings rates change over the course of this year.

The Savings Guru spokesperson added: ‘In terms of fixed rates, I think we’ve peaked for now but there’s a reasonable chance of seeing increases from current pricing, particularly in the second half of the year.

‘If we see further base rate rises in March and May then it is very likely we will see higher fixed rates in the second half of 2023.

‘Easy access best buy rates could go north of 3.5 per cent in April or May, particularly if we see a jump in base rate to 4.25 per cent or 4.5 per cent in March.’

Which banks offer the best savings rates?

As can be expected, the advice is to shop around and ensure you get the best rate possible.

The gap between top savings rates of high street banks versus smaller rivals has dramatically widened over the past 12 months.

However, despite this, many Britons continue to remain loyal to the major brands.

Many of the high street banks continue to offer standard easy-access savings rates around the 0.5 per cent mark despite the base rate hikes.

Most savers would be better off moving their money to a challenger bank or building Society that will at least offer them a meaningful return.

The Savings Guru Spokesperson said: ‘Savers should check their current interest rates and not assume that base rate is being passed on – all the big high street banks main easy access savings account is paying less than 1 per cent.

‘Switching to best buy providers could improve your interest five or six fold. On a £10,000 balance, that could mean an extra £250 in interest, so not insignificant.’

Those looking for a better rate would be wise to check out This is Money’s independent best buy savings tables.

All banks and building societies listed are registered with the Financial Conduct Authority and signed up to the Financial Services Compensation Scheme, either directly (protecting up to £85,000) or via its passport scheme (where the compensation limit depends on the bank’s home country. In Europe it is €100,000).

In terms of easy access rates, Yorkshire Building Society is the best buy paying 3.35 per cent, albeit only on balances up to £5,000 and limiting savers to only two withdrawals per year.

For those looking to put more away or have less restrictions, they could consider opting for Shawbrook’s easy access deal paying 2.92 per cent.

For a higher rate taxpayer who already has significant savings, a cash Isa deal may make sense to avoid having to pay tax on the interest earned.

Top of the market: Yorkshire Building Society’s easy-access deal pays 3.35% on balances up to £5,000

The best one-year cash Isa deal is offered by Barclays and pays 4 per cent whilst the best easy-access cash Isa deal pays 2.85 per cent, courtesy of Cynergy Bank.

>> See all the top cash Isa deals

As for those with savings they can afford to stash away for a year or more, fixed rate bonds offer the highest returns.

The best one-year fixed rate deal pays 4.16 per cent, courtesy of SmartSave Bank whilst the best two-year fix pays 4.45 per cent – offered by Atom Bank.

Someone depositing £10,000 into Atom’s best two-year fix could expect to earn £911.10 in interest during that time.

Anna Bowes of Savings Champion says: ‘If you’ve not reviewed your savings for a while or are looking to open a new account, they key to earning as much interest as possible is to shop around.

‘You may be lucky enough to qualify for a special existing customers account with your bank – but before assuming it’s competitive, see what is available elsewhere, even if it’s with a bank or building society you are not familiar with.

‘As long as you have found the account in question from a trusted source such as This is Money or Savings Champion, there is no reason not to take a well-informed leap of faith.

‘After all, with inflation still above 10 per cent it’s important to earn as much as possible from your cash.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.