What does an 8% mortgage rate mean for YOU? Higher rates will cost the average American homeowner an extra HALF A MILLION dollars in the course of a 30-year loan

Homebuyers today face paying $500,000 more in the course of a 30-year mortgage than they would have done two years ago after rates shot up to 8 percent.

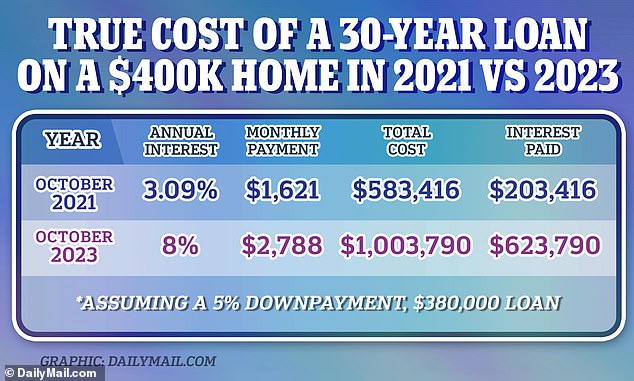

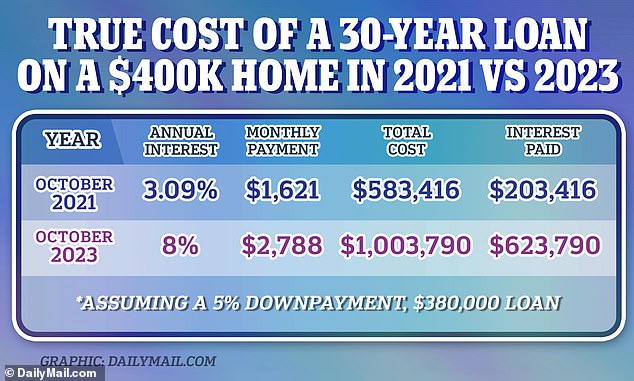

Analysis by DailyMail.com found that in 2021, an individual purchasing a $400,000 home would pay just $1,621 each month on their loan.

However, today that figure stands at $2,788 – a difference of over $1,100 per month. The findings assume the house was bought with a 5 percent downpayment.

In the course of a 30-year loan, it means somebody buying today would have to fork out over $1 million in mortgage payments. It is almost double the $583,416 they would pay on a loan taken out in October 2021 when rates were 3.09 percent.

Mortgage News Daily reported that the average rate on a 30-year loan had shot up to 8 percent today for the first time since 2000.

Homebuyers today face paying $500,000 more in the course of a 30-year mortgage than they would have done two years ago after rates shot up to 8 percent

It is one of three main indexes to report on mortgage rates across the US. The other two – Freddie Mac and the Mortgage Bankers’ Association – put rates at a slightly lower 7.63 percent and 7.7 percent respectively.

The latest figures lay bare just how big a burden soaring rates are to the average homeowner.

Mortgage rates have been pushed up by the Fed’s aggressive campaign of interest rate hikes which has taken them from near zero to between 5.25 percent and 5.5 percent.

While the Fed’s funds rate does not directly set mortgage rates, it does influence them.

[item name=module id=119913159 style=undefined /]

Instead lenders track the yield on 10-year US Treasuries, which is dictated by the Fed’s actions, investor reactions and predictions about what the Fed will do next.

As a general rule of thumb, when Treasury Yields go up, mortgage rates follow. The same applies when they decline.

Last week, the Mortgage Bankers Association, National Association of Realtors and National Association of Home Builders wrote a letter to urge the Fed to stop hiking rates.

Fed officials will next meet on October 31 to discuss the possibility of a hike – but experts largely expect rates to hold steady at their current number.

According to figures from the National Association of Realtors (NAR), existing home sales fell to a rate of 4.04 million a year in August, down 15.77 percent on last year

Figures from the Mortgage Bankers Association show home purchase applications dropped by 5.7 percent in the week to October 4 – the lowest level since 1995

But already the soaring cost of home ownership has poured cold water on America’s red-hot property market.

According to figures from the National Association of Realtors (NAR), existing home sales fell to a rate of 4.04 million a year in August, down 15.77 percent on the same month last year.

Meanwhile Chen Zhao, economics research lead at real estate brokerage Redfin told the

it expected the total number of existing home sales in 2023 to hit around 4.1 million. It would mark the smallest number of sales since 2008 – the year the Lehman Brothers collapsed.

Mortgage applications in late September also dropped to their lowest levels since 1995, according to the Mortgage Bankers Association.