Credit/Shutterstock

Credit/Shutterstock

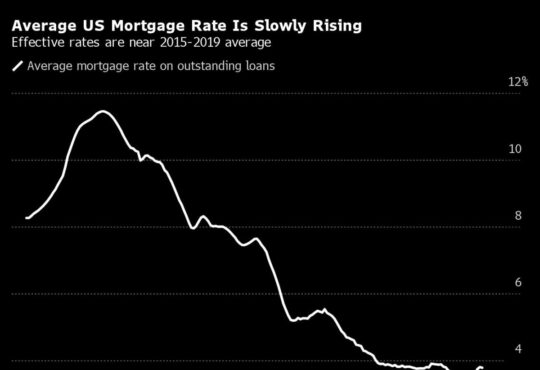

The Consumer Financial Protection Bureau took an initial step toward tightening rules for fees charged in the home-buying process.

The US consumer financial watchdog on Thursday sought comment on fees that are “increasing mortgage closing costs.” The CFPB said it wants to understand why costs are increasing and who benefits from them. The agency mentioned lender title insurance as a specific area of concern.

President Joe Biden has zeroed in on title insurance as one way to lower closing costs. The White House previously announced a pilot program to waive the requirement for title insurance altogether for a small amount of refinances at the mortgage giant Fannie Mae, a government-sponsored enterprise.

Thursday’s request for information by the CFPB could eventually lead to a rule proposal in 2025, Bloomberg News reported.

The CFPB asked the public for comment on:

- Which fees in the mortgage process are subject to competition.

- How fees are determined and who gains from them.

- Ways that consumers are affected.

“The CFPB is looking for ways to reduce anticompetitive fees that harm both homebuyers and lenders,” Rohit Chopra, the agency’s director, said in a statement.

.jpg)