UK MPs Warn of Financial ‘Nightmare Before Christmas’ as Fixed-Term Mortgages Expire

As the festive season descends upon the UK, a specter of financial instability looms over countless households. Members of Parliament have sounded the alarm about the imminent expiration of nearly 200,000 fixed-term mortgages, a development that could significantly burden families already wrestling with the ongoing cost-of-living crisis.

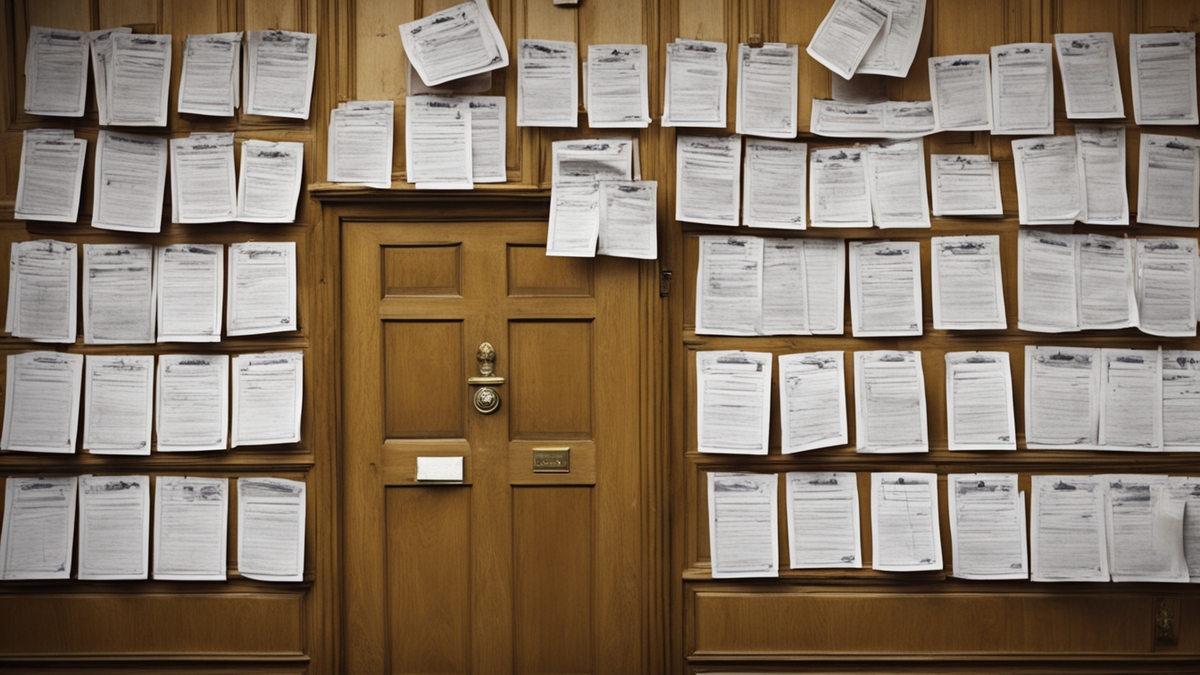

‘Nightmare Before Christmas’

This impending mortgage shift, described by MPs as a ‘nightmare before Christmas’, threatens to plunge families into financial difficulties. Homeowners who had secured their mortgage rates through fixed-term agreements will face the possibility of increased payments if they’re forced to change to a higher variable rate or renegotiate their mortgages at the currently elevated interest rates.

Inflation and Living Costs Compound Woes

The timing could not be more challenging. The UK grapples with soaring inflation and increased living costs, placing additional pressure on household budgets. The prospect of higher mortgage payments adds another layer of strain to an already tense economic environment.

Potential Outcomes and Risks

The consequences of this shift could cause financial instability for those unable to meet the potential mortgage increases. The risk extends beyond individual households, with increased debt levels and, in the worst cases, loss of homes, posing considerable social and economic challenges.

As the year draws to a close, the situation underscores the importance of financial resilience, particularly in these uncertain times. The end of fixed-term mortgages serves as a stark reminder of the precarious nature of the current economic climate and the potential hardships many may face in the coming year.