High levels of inflation have been a constant headwind over the last couple of years. That’s caused central banks around the globe to raise interest rates to bring it back under control.

That’s affected mortgage costs on both sides of the Atlantic. But the US and UK housing markets are very different, creating unique challenges.

In this article, we’ll look at impacts on both sides of the pond and why housebuilders could be the ones to benefit from the tough conditions.

This article isn’t personal advice. If you’re not sure an investment is right for you, seek advice. Investments and any income from them will rise and fall in value, so you could get back less than you invest. Past performance isn’t a guide to the future.

Investing in an individual company isn’t right for everyone because if that company fails, you could lose your whole investment. If you cannot afford this, investing in a single company might not be right for you. You should make sure you understand the companies you’re investing in and their specific risks. You should also make sure any shares you own are part of a diversified portfolio.

What’s happening in the UK housing market?

When a central bank, like the Bank of England (BoE), raises interest rates, it’s not a clean operation. Substantial rate hikes have spillover effects into other aspects of life. In the UK, that’s caused mortgage costs to climb, with the typical rate on a five-year fixed mortgage now up above 4.3%.

Source: Bank of England, 11/09/2023.

That’s already quashed a lot of buyer demand. And as inflation’s proving sticky, the BoE is expected to keep raising the base interest rates to a peak of around 5.5%, and could hold it higher for longer than expected. That’s not good news for most homeowners and would-be buyers.

What’s key to understand is that the fixed interest period on mortgages in the UK – typically up to five years – tends to be a lot shorter than in the US.

This means UK mortgage holders are likely to see their payments rise as they roll off their fixed periods, regardless of whether they move home or not.

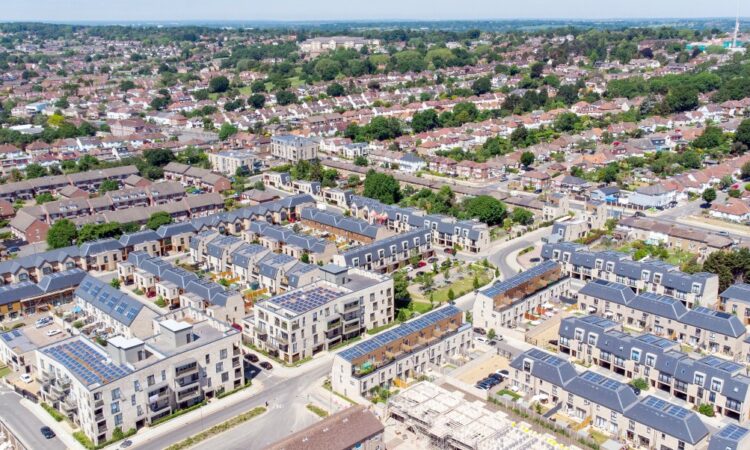

Further housing demand’s underpinned by the fact that Brits are ideologically committed to home ownership, and given the UK’s been in a prolonged period of housing undersupply, these look like long-term tailwinds for the housebuilding sector.

But remember, housebuilders are cyclical businesses and investors should be prepared for the ups and downs that come with investing in a business closely tied to the health of the economy and housing market.

Profits across the UK housebuilding sector are expected to fall drastically this year. But some housebuilders look better positioned than others to weather the downturn.

Vistry

Vistry, one of the UK’s largest housebuilders, announced a shift in strategy that looks set to help address undersupply and affordability issues.

The group’s pivoting away from traditional housebuilding and focusing its resources towards its partnerships business. This comes as the purchase and subsequent integration of smaller rival, Countryside, back in November 2022 has been a huge success.

Partnerships specialises in providing affordable housing by teaming up with local authorities and housing associations. These partners foot most of the bill, which reduces risk and allows Vistry to operate as a capital-light business. But that comes at a cost, as these tend to be lower margin than ordinary housebuilding projects.

That’s where Vistry’s strategy change comes in. Increasing its size and scale in the Partnerships space looks set to increase how many houses it builds. This should offset the margin decline’s effect on overall profits. The huge £3.0bn Partnership order book is a real asset too, providing good revenue visibility with 90% already secured this financial year.

There are a couple of tailwinds working in Vistry’s favour as well.

Partnership revenues are typically more defensive than those from ordinary housebuilding operations. That’s helpful given the current affordability struggles. And coupled with a historic undersupply of new homes in the UK, demand for the types of houses Vistry builds looks to be secured for years to come.

That’s underpinning management’s expectations for full year underlying pre-tax profit to be in excess of £450m this year. This is up from £418.4m last year and 15% ahead of analyst forecasts at the start of the calendar year.

Looking to financial resilience, Vistry’s slipped into a net debt position as it looks to drive growth in its Partnerships business.

Fire-safety commitments are also taking their toll on cash resources. But winding down the traditional housebuilding business should help. Land on the books that doesn’t fit the new strategy is set to be sold off, and Vistry expects to return to a net cash position by the end of the next financial year.

Vistry offers something different to the broader sector. The Partnerships focus and undemanding valuation make it one of our preferred names in the sector.

It’s an exciting time as Vistry transitions into a Partnership giant, but there’ll undoubtedly be plenty of operational hurdles to overcome. In the meantime, be prepared for further ups and downs.

Register for updates on Vistry

Find out more about Vistry shares including how to invest

What about the US housing market?

In the US, substantial rate hikes have pushed the 30-year fixed mortgage rate up to around 7.2% – the highest level in at least 18 years.

Source: Refinitiv Eikon, 08/09/2023 (United States MBA 30-year mortgage rate).

These higher mortgage rates are crushing housing affordability for buyers, and suppressing demand. Interestingly though, there’s been an even bigger collapse in supply.

As previously mentioned, mortgage rates in the US tend to be fixed for a longer period of time – typically 30 years.

Almost two-thirds of outstanding mortgages in the US are locked in at rates below 4%. If homeowners move, they’d have to take out a new mortgage at a much higher interest rate. So, there’s a large proportion of existing homeowners that are either unable or unwilling to move home.

This reluctance to give up ultra-low mortgage rates has led to sales of existing homes drying up and stifling overall supply. If this continues, it’ll be new, rather than existing, homes set to play an increasingly important role in the US housing market.

D.R. Horton

With the US housing market appearing to be in a bit of a stalemate, we think housebuilders could hold the key to breathing life back into the market.

Warren Buffett’s investment vehicle, Berkshire Hathaway, bought stakes in three US-based housebuilders during the second quarter of 2023, with D.R. Horton being the biggest entry to the portfolio.

D.R. Horton is America’s largest new home builder by volume. If analysts are correct in their estimates of $34.9bn in revenue this year, that’ll be a compound annual growth rate of almost 20% since 2020. That’s pretty good going, with growth propped up by a combination of higher prices and an increased number of homes sold.

Operating at scale has afforded Horton enviable margins, right at the top end compared to peers. While that’s not guaranteed to continue indefinitely, it does show the group knows how to run a tight ship and that customers trust the brand.

Another aspect we like is that the group doesn’t pigeonhole itself to just one demographic of customers. It offers homes at various price points, targeted at first-time buyers, larger homes for growing families, as well as more expansive homes aimed towards luxury buyers. This diversification should help at a time when all types of buyers are struggling.

Being a homebuilder in this environment brings its own challenges. Building costs have been on the rise, putting downward pressure on profits. Affording a new mortgage has become much tougher, keeping the housing market tight. That’s not something we expect to change quickly.

However, with a track record of positive free cash flows and relatively low net debt levels, it’s something we think Horton can navigate.

The tight housing market has some benefits though.

It’s helped prop up house prices and will likely continue to do so in the near term. With a severe undersupply in the market, we could see government intervention to support home ownership – something Horton would likely benefit from. Although nothing is guaranteed.

While housebuilding’s typically a tough sector during economic uncertainty, Horton’s position in the US market is strong.

The group’s valuation is currently trading in line with peers on a price-to-book basis, which we view as relatively undemanding given its history of delivering higher-than-average returns. There’s no guarantee that continues and the housing market remains tight, so expect ups and downs along the way.

Find out more about D.R Horton shares including how to invest

Remember, before you can trade US shares, you need to complete and return a W-8BEN form.

Unless otherwise stated, estimates are a consensus of analyst forecasts provided by Refinitiv. These estimates aren’t a reliable indicator of future performance. Investments rise and fall in value so investors could make a loss.

This article is not advice or a recommendation to buy, sell or hold any investment. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. Non-independent research is not subject to FCA rules prohibiting dealing ahead of research, however HL has put controls in place (including dealing restrictions, physical and information barriers) to manage potential conflicts of interest presented by such dealing. Please see our full non-independent research disclosure for more information.

Share insight: our weekly email

Sign up to receive weekly shares content from HL.

Please correct the following errors before you continue:

Hargreaves Lansdown PLC group companies will usually send you further information by post and/or email about our products and services. If you would prefer not to receive this, please do let us know. We will not sell or trade your personal data.

What did you think of this article?