UK Landlords Brace for Mortgage Payment Increase in 2024

In 2024, an estimated 150,000 buy-to-let landlords in the UK are anticipated to face a considerable increase in mortgage payments as long-term fixed-rate mortgage agreements expire. Specifically, 144,000 landlords will see their five-year fixed contracts conclude and will probably need to refinance at rates ranging from 4.5% to 5%, a rise from the average of 3.5% in 2019. This could result in monthly payment increases of nearly £200 for a £150,000 interest-only loan.

The Knock-On Effects of Mortgage Rate Increases

Darryl Dhoffer from The Mortgage Expert predicts that some landlords may experience rate jumps of up to three percentage points upon refinancing. This could potentially add £450 to monthly costs. The situation is further complicated by the reductions in tax relief on buy-to-let mortgages, implemented between 2017 and 2020. These changes no longer permit landlords to deduct all mortgage interest as a business expense. This shift has led to reduced profit margins and may compel landlords to raise rents to cover the increased expenses.

Double Whammy for Landlords

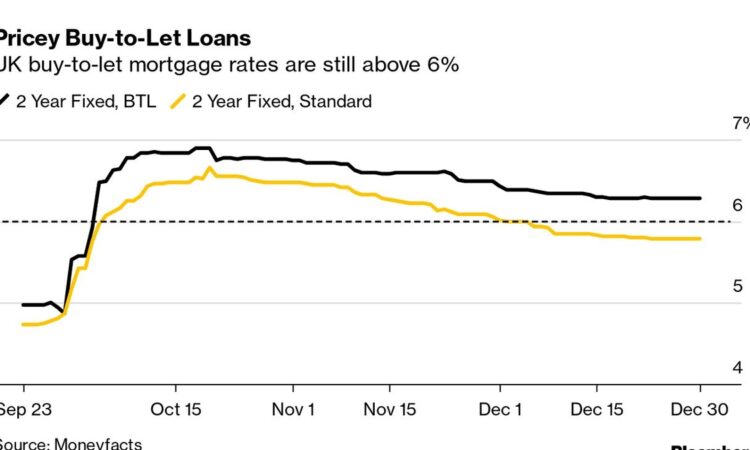

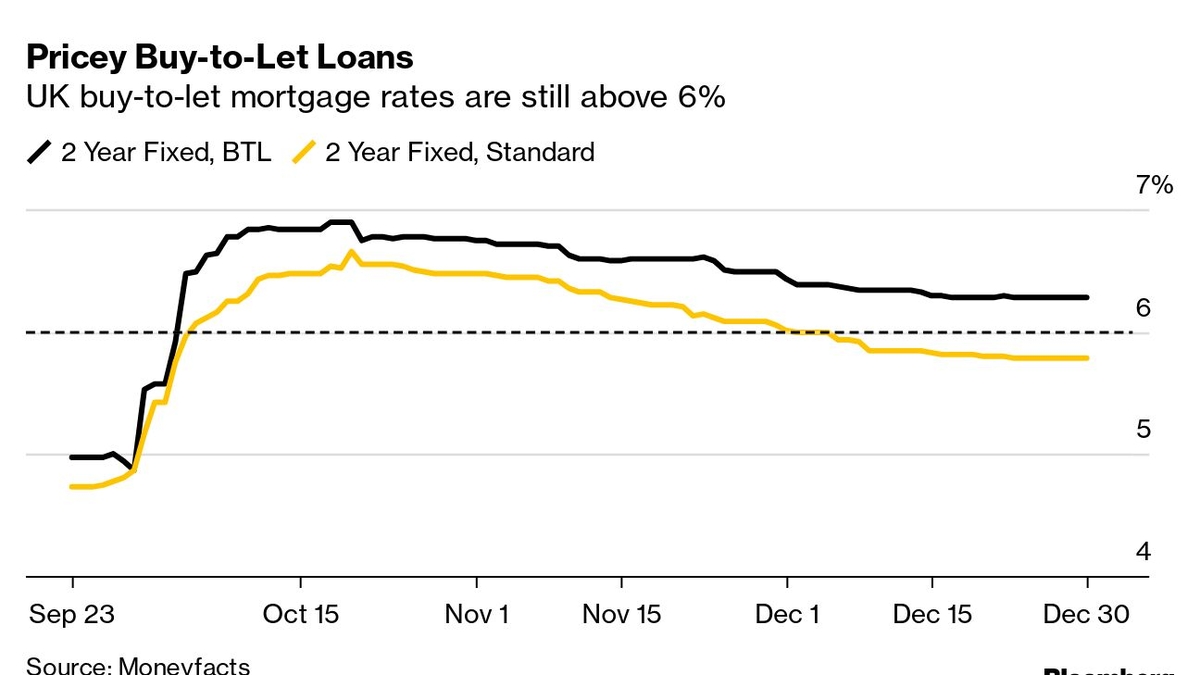

More than 35,000 landlords who opted for two-year fixed-rate deals in 2022, in anticipation of a decrease in rates by the time of renewal, will instead face a second increase in payments. The average rate on a two-year buy-to-let mortgage has dropped from a peak of nearly 7% to 5.95%, but remains higher than the sub-4% rates 18 months prior.

Future Predictions and Implications

Economists suggest that by the end of 2024, buy-to-let mortgage rates will fall below 4.5%, which will still be higher than the rates these landlords previously locked in. The impending escalation of mortgage payments paints a grim picture for landlords. However, it also underscores the importance of having a robust financial plan in place to navigate these potential challenges and ensure the sustainability of their property investments.