UK five-year mortgage rates hit 6% as Kwarteng meets bank chiefs – business live | Business

Introduction: Fitch cuts outlook for UK rating to ‘negative’ from ‘stable’

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

A second rating agency has threatened to downgrade the UK’s credit rating, warning that the unfunded tax cuts in Kwasi Kwarteng’s mini-budget will drive up borrowing.

Fitch has cut the outlook on the UK’s AA- investment grade credit rating, to Negative from Stable, following a similar move from S&P.

Fitch warned that the “large and unfunded fiscal package” could lead to a significant increase in the government’s deficits over the medium term, and undermine the previous government’s fiscal consolidation strategy.

In a rather scathing verdict of Kwarteng and Liz Truss’s plans, Fitch says:

The large fiscal stimulus, announced without compensatory measures or an independent evaluation of the macroeconomic and public finances’ impact, and the inconsistency between fiscal and monetary policy stance given strong inflationary pressures, have in Fitch’s view, negatively impacted financial markets’ confidence and the credibility of the policy framework, a key long-standing rating strength.

Fitch also criticises Kwarteng for hinting that there could be more tax cuts, and fears the government’s politicial credibility, and the credibility of its fiscal policy, are both hurt.

Monday’s humiliating u-turn on abolishing the top rate of UK income tax didnt change Fitch’s wider assessment either:

Although the government reversed the elimination of the 45p top rate tax (expected to cost £2bn in FY22-2023), the reportedly negative impact of the tax package, and related financial market volatility, on public opinion and the government’s weakened political capital could further undermine the credibility of and support for the government’s fiscal strategy.

Fitch estimates that “without compensatory measures”, the general government deficit will remain elevated at 7.8% of GDP in 2022 and increase to 8.8% in 2023.

Borrowing will be pushed up by rising interest payments on inflation-linked bonds, household support packages, the energy price cap and tax cuts.

This would lift the UK government debt to 109% of GDP by 2024 from an estimated 101% in 2022, reflecting “both higher primary deficits and a weaker growth outlook”.

Also coming up today

National Grid is set to publish its outlook for both gas and electricity supplies this winter today, outlining how Britain’s power system will cope with harsh weather.

The report comes amid growing concern that factories could be forced to shut down as Vladimir Putin chokes Europe’s gas supplies.

We also find how UK, and eurozone, construction companies fared last month, and the Office for National Statistics releases its weekly economic insights.

The agenda

-

7am BST: German factory orders for August

-

8.30am BST: Eurozone construction PMI for September

-

9.30am BST: UK construction PMI for September

-

9.30am BST: ONS’s latest economic activity and business insights

-

12.30pm BST: European Central Bank’s Monetary Policy Meeting Accounts published

-

1.30pm BST: US weekly jobless claims

Key events

Filters BETA

Average five-year mortgage rate hits 6%

The average five-year fixed-rate mortgage on the market has breached 6% for the first time in 12 years, as the crisis in the lending market deepens.

Across all deposit sizes, two-year and five-year fixed rates now both stand at more than 6% on average, according to Moneyfacts.co.uk.

The average five-year fixed-rate mortgage rose to 6.02% this morning, Moneyfacts said, having crept up from 5.97% on Wednesday.

The last time average five-year fixed-rate mortgages were at 6% was in February 2010, when the typical rate was 6.00%.

The average two-year fixed-rate mortgage is now 6.11%, having breached the 6% mark on Wednesday, for the first time since November 2008.

NEW: The average five-year fixed-rate mortgage on the market has breached 6% for the first time in 12 years.

Across all deposit sizes, two-year and five-year fixed rates now both stand at more than 6% on average, according to https://t.co/1FhM7QLp2g.

— Vicky Shaw (@ThisIsVickyShaw) October 6, 2022

Surging mortgage rate will force more lenders into arrears, economists fear, and also push down house prices.

The Centre for Economics and Business Research warned this morning:

With average mortgage rates set to reach more than 20-year highs by mid-2023, and stagflationary pressures set to reduce real earnings further, affordability will worsen next year.

Accordingly, annual house price growth is expected to enter negative territory during the first half of 2023, with an overall annual contraction of 3.9% expected across the whole year.

Between April and June this year, 80,150 borrowers were in significant arrears. This number will surge to 175,000 by the end of 2024 – close to the 216,400 recorded in 2009 @andrewishart https://t.co/wUknqRCNKw

— Emma Fildes (@emmafildes) October 6, 2022

UK banks to raise mortgage market fears in Kwarteng meeting

Kalyeena Makortoff

High street bank bosses will tell the chancellor, Kwasi Kwarteng, that they have growing concerns over the state of the UK’s mortgage market when they gather at Number 11 Downing Street today.

The meeting – which is expected to be attended by chief executives, including Alison Rose of NatWest, Charlie Nunn of Lloyds Banking Group, Mike Regnier at Santander and Robin Bulloch at TSB – comes amid mounting fears about the potential fallout from rapidly rising mortgage rates.

Executives are understood to be planning to raise concerns about rising borrowing costs, which surged last week after the government’s mini-budget sent UK financial markets into meltdown.

There are concerns that rising interest rates – while more lucrative for banks – will make it difficult for homeowners to repay their home loans.

Here’s the full story:

BoE’s Cunliffe: Pension funds must learn lessons from LDI near-meltdown

Pensions funds need to learn lessons from the panic in the UK bond market last week which forced the Bank of England to intervene, a deputy governor at the central bank has said.

Sir Jon Cunliffe has written to parliament’s Treasury Committee, explaining how the unprecedented slump in UK gilt prices forced its emergency bond-buying programme last week, to rescue pension funds from disaster.

Cunliffe’s letter lifts the lid on just how serious the situation became, as the plunge in the value of UK government debt after the mini-budget threatened financial instability.

Cunliffe explains that last Wednesday’s major invention, pledging to buy up to £65bn of long-dated gilts, was triggered by warnings that pension funds’ liability-driven investment (LDI) investments were under massive pressures.

Those LDI strategies try to match a fund’s long-term liabilities against its assets, Cunliffe tells MPs:

LDI strategies enable DB pension funds to use leverage (i.e. to borrow) to increase their exposure to long-term gilts, while also holding riskier and higher-yielding assets such as equities in order to boost their returns.

But the drop in bond prices (which pushes up yields) put increasing pressure on LDI schemes, forcing funds to put up more collateral – raised by selling their gilts.

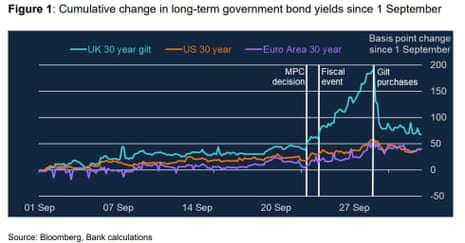

Cunliffe helpully shows MPs how the selloff in UK bonds was much worse than for US or eurozone bonds:

Last Monday (when the pound hit a record low) the Bank received market intelligence of increasing severity from a range of market participants, and in particular from LDI fund managers.

The situation worsened further last Tuesday (27th September), foring it to act, Cunliffe explains:

The Bank was informed by a number of LDI fund managers that, at the prevailing yields, multiple LDI funds were likely to fall into negative net asset value. As a result, it was likely that these funds would have to begin the process of winding up the following morning.

In that eventuality, a large quantity of gilts, held as collateral by banks that had lent to these LDI funds, was likely to be sold on the market, driving a potentially self-reinforcing spiral and threatening severe disruption of core funding markets and consequent widespread financial instability

Bank staff worked overnight on Tuesday to design an intervention to address the problem, Cunliffe says. That pledge, to buy up to £5bn of long-dated gilts each day, calmed the markets– and the Bank’s only had to buy under £4bn so far.

Cunliffe concludes by warning that the Bank, and City regulators, are closely monitoring LDI funds as they put their positions on a sustainable footing, and prepare better for future stresses.

While it might not be reasonable to expect market participants to insure against all extreme market outcomes, it is important that lessons are learned and appropriate levels of resilience ensured.

UK business inflation expectations rise in September

Fitch are right to be worried about inflation, judging by the latest data from the Bank of England.

British businesses’ expectations for consumer price inflation in one year’s time rose to 9.5% last month, up from 8.4% in August, a BoE survey of chief financial officers shows.

Bosses also expect to keep raising prices – output prices are forecast to rise by 6.6% in the year ahead, up from expectations of 6.5% in August.

The survey was conducted in the first half of September, before the mini-budget, and will add to the BoE’s concerns that inflation expectations are rising.

BOE are concerned about expectations.

DMP members expected CPI inflation to be 9.5% one-year ahead, up

from 8.4% in the August survey, and 4.8% in three years’ time.— stewart hampton (@stewhampton) October 6, 2022

Fitch also warned that the UK faces the risk of “prolonged inflationary pressures”:

The agency forecasts that inflation will average 8.9% this year (it was 9.9% in August), before gradually declining to 4% in 2024.

This, they say, will spur the Bank of England to raise interest rates to 5% next year (from 2.25% at present.

Although the energy price cap will lead to a lower inflation peak, rising core inflation (6.3% in August) reflects strong pressures from domestic demand and a tight labour market.

A weaker GBP [the pound] could also feed price dynamics through higher import prices. We consider that these factors and the fiscal stimulus announced will lead the BoE to increase its policy rate to 5% in 2023 and maintain rates at 4% by end-2024.

Fitch’s threat to downgrade the UK’s credit rating shows the anxiety over the serious concerns about the government’s push for unfunded tax cuts, Interative Investor’s Victoria Scholar adds:

There are serious concerns about the government’s unfunded stimulus measures and what the increased levels of borrowing will spell for the UK’s inflationary conundrum as well as its debt levels down the line.

The UK is already dealing with historically high debt levels in the aftermath of the pandemic when billions were spent on expensive emergency programmes such as the furlough scheme, track and track and the vaccine roll-out.

Construction firms gloomier as recession worries grow

Activity among British construction companies improved unexpectedly last month, but builders were also hit by a fall in new business as the economic outlook deteriorated.

The Construction Purchasing Managers’ Index, which measures activity in the sector, rose to 52.3 in September from 49.2 in August – showing a return to growth, as supply chain problems eased.

But, business optimism hit the lowest since July 2020 as new orders stalled.

Housebuilders reported that activity rose, but civil engineering projects declined again.

Construction firms said clients were slow, or reluctant, to sign off projects due to inflation concerns, squeezed budgets and worries about economic outlook.

Tim Moore, economics director at S&P Global Market Intelligence, which compiles the survey, warned that the outlook is weak:

Forward-looking survey indicators took another turn for the worse in September, with new business volumes stalling and output growth expectations for the year ahead now the lowest since July 2020.

This reflected deepening concerns across the construction sector that rising interest rates, the energy crisis and UK recession risks are all set to dampen client demand in the coming months.”

Here’s our news story on Fitch’s cut to the UK’s credit rating outlook:

Energy news: Shell has warned that its profits this quarter will be hit by a drop in refining margins, and a squeeze on its chemicals division too.

Margins at Shell’s refining business – which turns crude oil into products such as petrol and diesel – are expected to fall to $15 a barrel, down from $28/barrel in the last quarter. This will knock up to $1.4bn off Shell’s adjusted underlying earnings.

Margins at its chemicals unit have tumbled dramatically too – to minus $27 per tonne, from $86 per tonne in the previous three months.

This suggests that Shell’s run of record profits could be ending, with Brent crude having dropped steadily since June.

Victoria Scholar, head of investment at interactive investor, explains:

In what is a notoriously cyclical business, Shell is grappling with a dysfunctional and volatile gas market as well as expectations of softening oil demand, particularly from China as the global economy cools.

Shell has been a major FTSE 100 winner this year amid the equity market turmoil, up by around 40% year-to-date.

This morning, though, Shell are down 3.7%, near the bottom of the FTSE 100 leaderboard.

Rather than clearing the crisis in-tray, problems keep piling up for the Truss administration, says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown:

Another threat of a ratings downgrade comes hard on the heels of mortgage rates shooting up to 14 year highs and the steep rise in oil prices, which threaten to keep fanning the fires of inflation.

The Prime Minister’s speech yesterday had nothing new to reassure markets and with political divisions widening within her party of how to pay for big tax cut promises, ratings agencies are far from impressed. Fitch followed S&P to cut the outlook on the UK’s AA investment grade rating to negative from stable.

This matters because even without a downgrade the UK’s borrowing costs have risen sharply, and if the ‘stable’ rosette is ripped off, foreign creditors are going to demand even more money to fund the government’s growing debt pile. Moody’s has also warned that large unfunded tax cuts risks damaging the country’s debt affordability.

Bloomberg: Uninvestable’ UK market lost £300bn in Truss’s first month

At least £300bn has been wiped off the value of Britain’s stock and bond markets during Liz Truss’s first month in power.

Bloomberg has calculated that the market value of its UK gilt and inflation-linked gilt indexes has lost around £200bn since the Conservative Party chose their new leader in early September.

The FTSE 350 Index, which includes the blue-chip FTSE 100 and the domestically focused FTSE 250 — is down by about £77bn since the September 2 close.

The market value of Bloomberg’s gilt and inflation-linked gilt indexes (UK government bonds) has lost around £200bn. Company bond prices have also fallen.

A wild first month for Liz Truss’s government has seen at least £300 billion ($342 billion) erased from the combined value of the nation’s stock and bond markets. pic.twitter.com/AteaYNvekA

— Jean-Charles GAND (@jeancharlesgand) October 6, 2022

We should remember that financial markets globally also had a rocky September, hit by concerns of a world recession as central banks hike interest rates to battle inflation.

But UK bonds fell much more sharply than rivals after the mini-budget, while shares in property companies tumbled on fears of higher interest rates to cool the inflationary impact of unfunded tax cuts.

Investors have been spooked by Truss and Kwarteng’s plans, warns Liberum Capital strategist Joachim Klement.

Klement says:

“The feedback we get from investors is that they consider the UK uninvestable as long as there is such government chaos.”

Here’s Bloomberg’s full story: ‘Uninvestable’ UK Market Lost £300 Billion in Truss’s First Month

Quite the statement. “The feedback we get from investors is that they consider the UK uninvestable as long as there is such government chaos”. Cannot emphasise enough how this government has such a limited understanding of business. https://t.co/D3NnOqDGUh

— David Henig 🇺🇦 (@DavidHenigUK) October 6, 2022

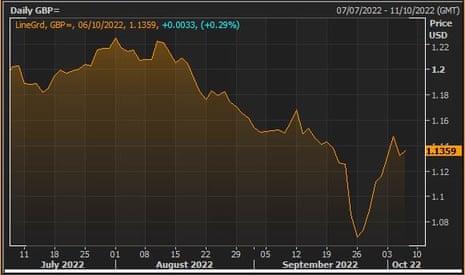

Sterling is a little higher against the US dollar this morning, after sliding back yesterday.

The pound has gained a third of a cent to $1.136, towards the two-week high near $1.15 early on Wednesday.

The US dollar had weakened a little recently, on hopes that weaker economic data might prompt the US Federal Reserve to slow its interest rate rises.

But Mark Haefele, chief investment officer at UBS Global Wealth Management, predicts the dollar will remain in demand.

“We expect the dollar, along with the Swiss franc, to remain supported by safe-haven flows amid uncertainty over the outlook for inflation, Fed policy, and the war in Ukraine.”

Although Fitch are the second ratings agency to cut the UK’s outlook (after S&P), Moody’s was also concerned about the mini-budget.

Moody’s warned last week that the large unfunded tax cuts were “credit negative”, and would lead to higher deficits. It is expected to give its verdict on the UK on 21st October.

UK bond prices are a little weaker this morning, which is pushing up the interest rate on government debt.

Benchmark 10-year government bond yields have risen to 4.08%, from just over 4% last night.

Before the mini-budget, these 10-year gilts were trading at a yield of 3.5%, before Kwasi Kwarteng’s plans for unfunded tax cuts alarmed markets.

They surged to 4.5% last week before the Bank of England pledged to buy up longer-dated bonds to stabilise the markets and protect the pensions industry.

The yield on 30-year gilts has risen to 4.26%, from 4.18%. They also rose yesterday after the Bank of England resisted buying any gilts through its emergency scheme, following the recovery in bond prices.

How to avoid a credit rating downgrade

Lowering the UK’s outlook to negative, from stable, could be the first step towards a full-blown downgrade by Fitch.

Fitch say there are several factors that could trigger a cut… or alternatively lead to an upgrade.

Factors that could, individually or collectively, lead to negative rating action/downgrade:

-

Public Finances: Failure to implement a credible fiscal strategy that restores market confidence and is consistent with government debt/GDP declining over the medium term.

-

Macro: Evidence that policy uncertainty and/or new trading arrangements with the EU will undermine the UK’s macroeconomic performance and financial stability over time.

-

-Structural: Political developments that lead to deterioration in governance indicators and/or undermine the territorial integrity of the UK.

Factors that could, individually or collectively, lead to positive rating action/upgrade:

-

Public Finances: Implementation of a credible fiscal strategy that is consistent with government debt / GDP declining over the medium term.

-

Macro: Reduces risks to macro-financial stability, for example, through sustained easing of inflationary pressures and improved market confidence in the government’s fiscal strategy.

The UK’s credit outlook was lowered to negative from stable by Fitch Ratings, which cited risk the government’s new growth plan could increase the nation’s fiscal deficit https://t.co/X0rXIfgiyh

— Bloomberg (@business) October 6, 2022

Some history: the UK lost its prized AAA credit rating with both Fitch and Moody’s back in 2013, while S&P followed suit after the EU referendum in 2016.

Fitch also downgraded the UK after the Brexit vote (from AA+ to AA), and then lowered the rating to AA- when the pandemic hit.

As the FT points out, the ratings agencies are still monitored by investors:

Credit rating agencies have lost some of their power since the 2008-09 financial crisis, when they failed to warn of the risk in many complex products they had given triple-A ratings.

But their sovereign ratings are still closely watched.

Political uncertainty is also weighing on the UK, Fitch adds.

The new government of Prime Minister Liz Truss has sought to assuage concerns regarding transparency and institutional independence after comments about potential revisions to the BoE’s mandate during the Conservative leadership contest and the roll-out of a large fiscal package without the involvement of the Office of Budget Responsibility.

Reduced popular support for the ruling Conservative Party, the social impact of the cost of living crisis and increased frequency of strikes could constrain the new Prime Minister’s room for manoeuvre.

Polling company YouGov showed yesterday that Truss’s popularity had deteriorated dramatically, while several polls have given Labour very large leads since mini-budget.

First time since 2019 GE that a majority expects a Labour Government.

If an election took place within six months, what do Britons think would be the most likely outcome? (2 Oct)

Labour Gov’t: 52% (+12)

Conservative Gov’t: 28% (-8)Changes +/- 25 Septhttps://t.co/z5wS2F35Lr pic.twitter.com/QLzXcpbzQP

— Redfield & Wilton Strategies (@RedfieldWilton) October 3, 2022

Fitch: UK economy to contract next year

Fitch has also warned that Britain’s economy will shrink next year, despite the mini-budget.

We forecast the economy to contract in 2023 despite the energy tariff support and the proposed tax cuts. In addition to the energy crisis and weaker external demand (including contraction in the eurozone), the likely tighter domestic financing conditions will lead to a contraction of 1.0% in 2023 before growth recovers to 1.8% in 2024.

Yesterday, Liz Truss claimed that an “anti-growth coalition” was holding the UK back – including opposition parties, unions, remainers and environmental campaigners (and quite possibly anyone who disagrees with the government).

Fitch, though, points out that Truss’s administration haven’t shown how their growth plan will actually improve the economy:

Although the government seeks to lift growth to 2.5% over the medium term, it has yet to fully outline how and in what timeframe it plans to directly address structural challenges related to low investment, labour supply and continued uncertainty over the implementation and evolution of the Trade Cooperation Agreement (TCA) with the EU.

There could be progress on that last point soon — Simon Coveney, the Irish foreign minister, is flying to London for talks with his UK counterpart, James Cleverly, today over Northern Ireland’s Brexit arrangements.

Chancellor to hold crisis talks with high street banks over rising mortgage rates

Fitch’s warning comes as Chancellor Kwasi Kwarteng prepares to meet high street bank bosses to discuss the crisis in the mortgage market following the mini-budget.

The talks comes as homeowners face the biggest increase in mortgage costs for 14 years, with the average rate on a new two-year fixed mortgage rising above 6%.

These soaring rates mean some homeowners’ monthly payments are increasing by hundreds of pounds a month when they remorgage, and are also pricing new home-buyers out of the market.

My colleague Rupert Jones explains:

Moneyfacts, a financial data provider, said the average new two-year fixed rate had risen again and broken through 6% on Wednesday. It went up to 5.97% on Tuesday, having already risen to 5.75% on Monday.

The average two-year fix has increased from an average of 4.74% on 23 September, the day of the mini-budget. At the start of December last year the average was 2.34%.

You’ll have seen a lot of charts in the past few weeks.

But this one REALLY matters.

The mortgage burden – the % we spend on our repayments – is heading for the highest level since the late 80s.

Last time it hit these levels it preceded the biggest housing crash in modern history pic.twitter.com/6gVHXpXxi0— Ed Conway (@EdConwaySky) October 5, 2022

Mortgage costs surged as the money markets dramatically lifted their forecasts for UK interest rates after the mini-budget.

This morning, the money markets suggest the Bank of England will have hiked base rate to 5.5% by next summer, from 2.25% today.

Introduction: Fitch cuts outlook for UK rating to ‘negative’ from ‘stable’

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

A second rating agency has threatened to downgrade the UK’s credit rating, warning that the unfunded tax cuts in Kwasi Kwarteng’s mini-budget will drive up borrowing.

Fitch has cut the outlook on the UK’s AA- investment grade credit rating, to Negative from Stable, following a similar move from S&P.

Fitch warned that the “large and unfunded fiscal package” could lead to a significant increase in the government’s deficits over the medium term, and undermine the previous government’s fiscal consolidation strategy.

In a rather scathing verdict of Kwarteng and Liz Truss’s plans, Fitch says:

The large fiscal stimulus, announced without compensatory measures or an independent evaluation of the macroeconomic and public finances’ impact, and the inconsistency between fiscal and monetary policy stance given strong inflationary pressures, have in Fitch’s view, negatively impacted financial markets’ confidence and the credibility of the policy framework, a key long-standing rating strength.

Fitch also criticises Kwarteng for hinting that there could be more tax cuts, and fears the government’s politicial credibility, and the credibility of its fiscal policy, are both hurt.

Monday’s humiliating u-turn on abolishing the top rate of UK income tax didnt change Fitch’s wider assessment either:

Although the government reversed the elimination of the 45p top rate tax (expected to cost £2bn in FY22-2023), the reportedly negative impact of the tax package, and related financial market volatility, on public opinion and the government’s weakened political capital could further undermine the credibility of and support for the government’s fiscal strategy.

Fitch estimates that “without compensatory measures”, the general government deficit will remain elevated at 7.8% of GDP in 2022 and increase to 8.8% in 2023.

Borrowing will be pushed up by rising interest payments on inflation-linked bonds, household support packages, the energy price cap and tax cuts.

This would lift the UK government debt to 109% of GDP by 2024 from an estimated 101% in 2022, reflecting “both higher primary deficits and a weaker growth outlook”.

Also coming up today

National Grid is set to publish its outlook for both gas and electricity supplies this winter today, outlining how Britain’s power system will cope with harsh weather.

The report comes amid growing concern that factories could be forced to shut down as Vladimir Putin chokes Europe’s gas supplies.

We also find how UK, and eurozone, construction companies fared last month, and the Office for National Statistics releases its weekly economic insights.

The agenda

-

7am BST: German factory orders for August

-

8.30am BST: Eurozone construction PMI for September

-

9.30am BST: UK construction PMI for September

-

9.30am BST: ONS’s latest economic activity and business insights

-

12.30pm BST: European Central Bank’s Monetary Policy Meeting Accounts published

-

1.30pm BST: US weekly jobless claims