UK Economic Forecast: A Consumption and Confidence-Led Recession with the Potential for a Housing Crisis

Due to a series of factors – ranging from the long-term impacts of the pandemic to the ongoing effects of the conflict in Ukraine – the UK is currently exposed to a unique range of economic pressures.

For the first time in 30 years, the country is operating in a high-inflation environment, which, save for recent government intervention, would have seen rates as high as 16% in October 2022. For many consumers, this is the first time they have experienced a high-inflation environment. For those who have come of age and become homeowners in the last 15 years, it is also the first time they will have experienced significant interest rates.

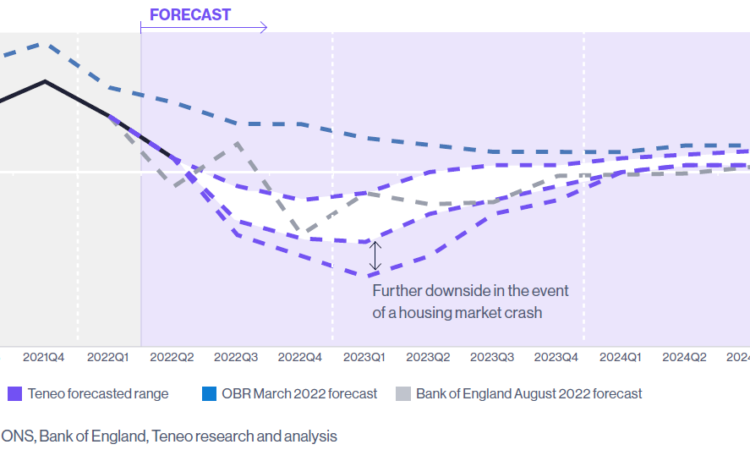

This paper outlines how through a chain reaction –starting with those economic pressures referenced above and ending with the inexorable ratchet in mortgage repayments – the UK economy is forecast to enter a recession (or, more likely, is already in one) that will last for an expected six quarters, at a likely range of negative 2 – 4% growth annually, wiping an estimated £100bn off the national GDP. While the causes are different, the effect is ominously similar to 2008: the potential for a mortgage crisis and house price decline driving the UK economy into a deep recession.

At the start of this chain sits a unique blend of factors that have all coalesced to drive inflation. Some, such as underlying demographic changes and cultural shifts in the workforce, were always likely to occur. Others, such as post-COVID behavioral changes and the unwinding of latent demand, are seen across all major economies. This statement is broadly true for events resulting from Russia-Ukraine, including rising oil, gas and commodity prices. However, there is a further set of factors that might be uncharitably defined as ‘self-inflicted’ and only serve to exacerbate the impact of inflation in the UK, including the country’s sub-optimal trading position with the rest of the world as a result of Brexit and the further suppression to the pound as a result of failed government intervention.

Real GDP Quarterly Growth Forecast, 2021Q3 – 2024Q4

Inflation currently sits at an estimated 12% in October 2022 and would have been over 16% without intervention on residential energy prices. Despite this policy, levels are still buoyed by fuel, food and wage-driven inflation and are expected to remain above 10% well into 2023. While wage rises are at near record levels, this over-indexes in high-income sectors and even then does not offset the impact of inflation. This is leading to reduced disposable income (which will continue to diverge well into the back of 2023) and levels of consumer confidence lower than during the Global Financial Crisis. This has resulted in significantly suppressed levels of consumption in higher income groups, with lower earners only consuming essential goods and services.

Consumer behavior is already changing to adjust to this new reality. The UK population is reducing significant individual expenditures (albeit after an Indian Summer of unwinding COVID demand for foreign holidays), further increasing working from home to save on commuting fees, reducing discretionary car journeys and ‘trading down’ to cheaper more value-led brands and services. These altered behaviors, movements and spending patterns will have disparate impacts across various UK business sectors but, combined with expected government spending reductions, will themselves reduce UK output sufficiently to drive a recessionary environment.

In addition, as the Bank of England (BoE) acts to curb inflation (and perhaps, more importantly, protect the pound’s value), it is already increasing interest rates, which currently sit at 2.25% but are expected to climb to at least 6% by 2023Q2. This typical mechanism used to suppress inflation has the potential to wreak havoc with a large portion of the UK population who have feasted on historically low levels of interest rates and do not know (or were programmed to expect) any different.

From the time of publication to the end of 2023, there are an estimated 4.1m UK mortgages (55% of the total 8.3m UK mortgages) that are either already on a variable rate or are up for renewal. For the typical UK consumer, a modest (in relation to the possible downside) 4% rise in interest rate from 3% to 7% on a £200,000 mortgage could result in additional monthly payments of £466. If energy bills were the warm-up act to the cost of living crisis, then mortgage repayments are very much the main event. With a majority of landlords also exposed to variables of expiring mortgage deals and often highly leveraged, rental prices are equally sure to follow. Initial analysis (albeit in a do-nothing scenario) indicates the possibility of up to 30% house price reductions and over 20% of UK homes in negative equity in some scenarios.

Monthly Repayment Increase Based on Mortgage Rate Increase (% Increase in Repayments)

Noting the government had no choice but to act on energy bills, and the rises there pale in comparison to the potential household impact of mortgage rates, it seems inevitable that some intervention will be required. Whether that be a collaboration with the BoE to keep rates at reasonable levels, direct intervention on mortgage repayments or another mechanism, one fact is clear: There is an unnerving requirement for clear, decisive and unprecedented government policy, a commodity which feels even more scarce than those which helped to kick-start this crisis.

The Current Situation

The UK is Currently in a Period of Unprecedented Inflationary Challenge

A confluence of factors, including the aftermath of the COVID-19 pandemic, ongoing issues relating to Brexit, underlying demographic challenges and the ongoing impacts of the Russia-Ukraine conflict, have driven UK inflation to a 40-year high. Price increases are outpacing wage growth, resulting in a real wage decline for many individuals, leading to a ‘cost of living crisis’ that has squeezed consumer disposable income.

Consumer Price Index, 2021 – 2022

As household incomes have fallen in real terms and consumers have less money to spend, there is already evidence of both output and consumption declining in the UK. Both of these factors are linked to a slowdown in GDP, which has experienced declining growth since 2022Q2.

Consumer Confidence, 2021Q1 – 2022Q2

The Series of Events Leading to a Recession

The UK is Expected to Enter a Recession by 2023

The Input Events Impacting the UK Economy

The COVID-19 Pandemic, Issues Relating to Brexit and the Russia-Ukraine Conflict Have Manifested in an Acute Inflationary Environment

We have identified eleven different key input events which have been influencing the UK economy.

Inflation

Despite Significant Intervention, These Inputs are Expected to Drive Inflation to a Peak of 12%

The range of factors explored on the previous pages have all contributed to a high inflation environment. Inflation currently sits at 9.9% but is forecast to reach 12% by October and remain high going into 2023. The three most material contributors are utilities, transport, and food and non-alcoholic beverages.

UK Inflation Forecast, 2022 – 2023

While energy remains the most material contributor to inflation, the recent government intervention of a new energy price cap has reduced overall anticipatory inflation by around 4% in both 2022 and 2023.

Typical Annual Household Energy Bill1 Inclusive of Government Support, 2021 – 2024F (£)

Wage Growth and Employment

Rising Inflation Puts Pressure on Wages to Maintain Standards of Living

In response to high and rising inflation, workers have put pressure on earnings to rise, leading to a 6.1% increase in median wages over the last 12 months. This has been exacerbated by a low unemployment rate and high levels of vacancies, which has created upwards wage pressure, resulting in wage increases which are expected to continue.

A Low Unemployment Rate and High Demand for Workers has put Pressure on Wages

This Wage Growth has Helped Individuals Partially Cover the Cost of Rising Inflation. However, it Can Also be a Driver of Further Inflation

However, This Wage Growth is not Distributed Equally

Across the UK, wages are rising faster in certain sectors, particularly across higher income brackets.

Median Wage Growth by Industry, July 2021 –July 2022

Those industries that have seen higher levels of wage inflation in percentage terms have tended to be those with higher levels of pay in absolute terms, leading to greater levels of wage inflation (and lower levels of inflationary pressure) amongst higher earners.

Wage Growth by Income Brackets, July 2021 – July 2022

Real Wages and Disposable Income

Inflation Continues to Outpace Wage Growth, Resulting in Declining Real Disposable Income

Across all income groups, wage increases do not compensate for the full impact of inflation. This is negatively impacting real wage growth and real disposable income. As a result, individuals are feeling poorer than they did 12 months ago. Since 2022Q1, inflation has outpaced wage growth, reducing real income and disposable income. We forecast this dynamic to continue until at least the start of 2024, with individuals feeling progressively poorer and having reduced real income until this trend reverses.

Forecast Inflation (CPI,%) VS Forecast Wage Growth, 2021Q3 – 2023Q2

Lower-income individuals are most significantly impacted as they are receiving a ‘double hit.’ The inflation rate is higher amongst these groups (as they spend a greater proportion of their income on essential items like energy), but their wage growth is lower.

Household CPIH1 and Salary Percentile Growth, June 2022, %

Consumer Confidence and Consumption

Declining Real Disposable Income (RDI) Has Resulted in Significant Drops in Consumer Confidence

Real wage declines, combined with further inflationary rises and interest rate hikes, have severely damaged consumer confidence. Consumer confidence is at its lowest level since records began in 1974, lower even than during the 2008 Financial Crisis and the COVID-19 pandemic.

It is consumer confidence, combined with available disposable income, that dictates total consumption. Low levels of consumer confidence, combined with lower levels of disposable income, are having a knock-on impact on consumption. This is a key predictor of an economy entering a recession.

Anticipated Impact on Consumption

Higher Income Groups Will See Larger Declines in Consumption

- Perversely, larger drops in consumption are expected in groups less impacted by wage decline. Given they account for 90% of spend, this impact is significant.

- Even small declines in real wages impact confidence, and these groups have the ability to save in anticipation of further inflationary pressure.

- This dynamic will be particularly acute for high earners with large mortgages who will be anticipating significant interest rate rises.

- Interest rates could rise as high as 5% when the BoE reviews in November.

Lower Income Groups are Likely to Maintain Consumption to Cover Essential Spend

- Lower income groups are expected to continue to consume at the same rate and may even rely on credit, since they are unable to save in response.

- However, their spending is likely to shift heavily toward essential goods and services.

Consumer Spending and Behaviour Changes

As Consumption Declines, Significant Changes in Spending Behaviours are Expected

As consumers become and feel poorer, the most immediate change is in their prioritisation of spend. Evidence from the 2008 Financial Crisis is informative in terms of where consumers may cut back; however, today’s environment is different in many ways.

For instance, between 2006 and 2010, UK consumers materially adjusted their proportional household spend in order to prioritize certain goods and services over others.

% Change in the Budget Share Allocated Towards Each Category by Household, 2006 – 2010, UK

During the 2008 Financial Crisis, consumers reduced spend on large discretionary items such as cars, holidays and household improvements, whilst prioritising essential items such as energy and accommodation. They also prioritised smaller discretionary purchases such as restaurants and personal care. However, there are a number of factors which may see consumers prioritise in a different fashion during this crisis (see below).

Beyond reprioritisation of spending, there are a number of other behavioral changes likely to occur across the UK. One of these is consumers ‘trading down’ to cheaper, less-premium alternatives of goods and services in order to consume the same volume at a cheaper price. This behaviour set can apply to supermarkets, hospitality, holidays and a range of other services.

Trade-Down Behaviours for Supermarkets

Impact on UK Businesses

Suppressed Consumer Spending Will Have a Direct Impact on Business Impact

Consumer spending suppression flows through to actual reductions in GDP through their reduced spending at (or in the value chain of) UK businesses. The reduced revenues manifest in suppressed output and therefore aggregated reduced GDP, albeit with material variation between industries.

Future Outlook by Industry

Government Response

The Government Released its ‘Mini-Budget’ on 23rd September, Which Prior to Subsequent U-Turns, Represented One of the Most Significant Cuts to Tax in Recent History

Prior to a u-turn on 3rd October, the government’s 23rd September mini-budget outlined some of the most significant changes in taxation in recent history. These terms aimed to combat the forecast decline in consumer spending and overall confidence and consumption.

Tax Interventions

While the most material element of the tax package (the removal of the 45p tax rate) has since been reversed, it is important to consider both the strategy which sat behind the intervention and the long-term impact of its attempted introduction. Noting that over 20% of UK consumption comes from the top 1% of earners, increasing their spending power is, in theory, a potential strategy for supporting economic growth. However, as highlighted above, this cohort is unlikely to spend all increases to income, unlike middle-earners who would have a) more need for the increase and b) been more likely to dispose of this income to support economic growth. Despite the reversal of this policy, there are material residual negative impacts, including continued suppression to the value of the pound. This results in faster than anticipated interest rates rises and damaged consumer and investor confidence.

Interest Rates and the Housing Market

Significant Interest Rate Increases are Expected, Which Will Have a Knock-On Impact on Mortgage Repayments and the Housing Market

The BoE was already in the process of increasing interest rates to curb inflation and protect the value of the pound; however, recent moves by the government have heightened expectations of more material rate rises in the coming six months.

While still in the very early days of the government response, markets have responded poorly. This has resulted in reduced business and investor confidence in the UK and subsequent withdrawal in investment, pushing down the value of the pound. A weak pound has a number of knock-on implications, many of which can be further drivers of inflation.

The BoE can move to curb inflation through increasing interest rates and can also use the same mechanism to protect the value of the pound through making investment in government debt more attractive for investors. The recent moves by the government have led to increases in the expectations of the level of interest rate rises required to curb inflation and protect the value of the pound.

Bank of England Interest Rate Forecast, 2020 – 2023

Impact on Mortgage Rates and House Prices

These interest rate rises (while required) have the potential to have a devastating impact upon

homeowners across the UK. A rise in interest rates will, in turn, increase mortgage rates, which will have a detrimental impact on repayments. A 4ppt increase in repayment rate would result in monthly charges increasing by almost 50%.

Monthly Repayment Increase Based on Mortgage Rate Increase (% Increase in Repayments)

Those with flexible, standard rate or fixed rate mortgages due to expire in the coming months and years will see a material increase in monthly payments. This will put additional pressure on household budgets and have a detrimental impact on the housing market. By the end of 2023, half of mortgage holders will be paying considerably higher rates than today.

# of Mortgages Subject to Rate Increases

Mortgage Rate Increases of This Magnitude Risk a Crash to the Housing Market

With over 55% of mortgages seeing a material increase in repayments over the next 12-18 months, a number of significant events are likely.

1. Increases in repayments will leave some households unable to pay, and fewer people will enter the market.

2. This will lead to lower demand, and house prices will fall.

3. Decreasing home prices may lead to negative equity as house values becomes lower than mortgage values.

4. Decreasing home prices and negative equity can be a key recessionary driver, as seen in previous crashes.

Barriers to First-Time Buyers

For first-time buyers, an increase in mortgage rates will likely reduce the amount they can borrow. If the regulator is to retain the broad ratios between total household income, monthly payments and mortgage debt, increased monthly payments will likely result in a reduction in how much they can borrow. Indicatively, mortgage rates at 6% would lead to a 35% fall in the loan-to-income ratio, meaning the amount a provider would be willing to lend will be reduced by 35%.

While those with existing mortgages will be able to renew, the increase in payments is likely to have a significant impact on household budgets and may see existing mortgage holders looking to sell.

With new buyers limited in the amount they can borrow and existing borrowers looking to exit the housing market, this will likely reduce demand in the market, which could, in turn, lead to falling house prices and the increased likelihood of negative equity (covered right).

Negative Equity for Existing Mortgage Holders

Estimated % of Mortgages Falling Into Negative Equity if Average House Prices Were to Fall

Falling house prices and negative equity have two main impacts on consumer economics and behaviour. Firstly, the long-term impact on confidence that a consumer experiences when falling into negative equity cannot be overstated. Secondly, should mortgage holders see their payments become unaffordable and they find themselves in negative equity, a forced sale of their home will see their entire investment wiped out, forcing them from the housing market and further reducing demand and house prices and confidence.

The previous two house price crashes saw house price falls of close to 20%, with 18% of mortgages going into negative equity in the early 1990s recession. Price falls and negative equity can lead to further economic contraction and can increase the severity of a recession.

House Price Falls in Recent Property Crashes

GDP Forecast

This Recession has the Potential to Last for Six Quarters and a Likely Range of Between 2-4% Negative Growth Annually

Considering the impact the current macroeconomic environment is having on consumer confidence and consumption, GDP growth is expected to be negative in 2022Q3, and the country will enter a recession following 2022Q4. Negative growth is likely to persist throughout 2023 as the UK economy continues to grapple with energy pressures and high interest rates driving a slowdown of the economy, including a reduction in house prices. GDP growth is only likely to turn positive in 2024Q1/Q2. The potential for a housing market crash represents an even further downside to this forecast.

Real GDP Quarterly Growth Forecast, % 2021Q3 – 2024Q4

Actual GDP Growth is Likely to be Dictated by a Small Number of Key Factors

Actual GDP growth will likely be dictated by a small number of key factors, specifically the government’s commitment to tax cuts set out in the mini-budget and the timing and strength of the fiscal measures the BoE chooses to pursue in response. Any large rises in interest rates are expected to damage consumer confidence, significantly impacting consumption.

Key Contributors to the Economic Outlook

How Does This Compare to Other Recessions?

There are Striking Differences Between this Recession and Previous Ones

When compared to previous recessions that affected the UK, the currently forecasted recession is likely to differ on a number of levels.

The recession that is forecast to impact the UK is likely to affect a wider range of households, particularly the middle class, homeowners and families.

Key Differences Today

1. The current tight labour market makes it unlikely that unemployment will rise substantially

2. The UK is a considerably larger net importer than during previous runs on the pound, leading to greater inward inflationary pressure

3. While interest rates have risen higher in the past, the relative scale of increase that will be required this time (rate of 0.1% in Dec2021) is significantly greater than at any time in history

Taken together, these factors could mean the recession has the potential to be longer, with widespread inflation challenging to unwind. However, with no significant job losses or other substantial losses of income, its overall profile is expected to be shallower.

Real GDP Growth, Indexed to Q1 Before the Start of the Recession

How Does the UK Compare to Other Countries

While Inflationary Pressures Remain a Global Challenge, the Degree to Which they are Forecast to Impact Specific Countries Varies

Inflation Impact on % of Consumer Baskets Around the Globe

How Inflation Pressure Compares Across the World

Inflation Pressure Persist Across the Globe

- Due to global supply chain issues and rising energy prices, inflation remains high globally

- In the US, inflation has surpassed 9% in 2022, while in Australia, it is close to 7%, and in Brazil it peaked at over 12%

Challenges are Most Acute in Europe

- Moving into winter, European countries are most likely to be significantly affected due to the continent’s reliance on Russian gas and the predicted increase in global demand driving prices up further

Germany is Particularly at Risk Due to a Reliance on Cheap Energy

- The German economy is most at risk, due to the high amount of energy it imports, its reliance on exports (of which its competitiveness will fall with higher prices) and the limited control it has over its monetary policy as a Eurozone member

The Situation in the UK is Among the Worst

- The UK remains in a more precarious position than most due to its weakened trade ties with Europe and falling net inward migration following Brexit, and

- The recent mini-budget that has been poorly received by investors and led to a run on the pound

What Does This All Mean?

Addressing Consumer Confidence and the Pain Felt Within Low-Income Groups is Key to Increasing Consumption and Easing the Recession; However, the Threat to the Housing Market Represents a Significant Risk

The Prospect of Raising Interest Rates May Prolong the Recession

The UK is heading into a recession driven by high inflation. The traditional mechanism employed to manage high inflation is high-interest rates, while the traditional mechanism employed to support an economy in recession is to set low-interest rates.

The prospect of raising interest rates in a recessionary environment risks lengthening and increasing the severity of this recession.

There is a Significant Threat to the Housing Market

Large increases in mortgage rates could have a significant knock-on impact to house prices, resulting in widespread negative equity and individuals defaulting as they become unable to afford to renew mortagages.

Encouraging Spending is Likely the Quickest Way Out

Individuals in high-income groups have money to spend; however, low levels of consumer confidence mean they are choosing to save instead. Further interest rate rises are likely to further exacerbate this trend as homeowners become increasingly worried about interest payments.

Government Intervention Needs to be Targeted

While the tax cuts outlined in the mini-budget can be seen as the government attempting to invigorate the economy and encourage spending, these efforts may fall short. Tax cuts to high-income groups, without increasing consumer confidence, are unlikely to result in spending. The government should therefore focus on consumer confidence in this group, not increasing total income.

Within lower income groups, tax cuts and/or additional support are likely to be much more effective and immediately translate into spending.

Some intervention may be required to support the housing market. This could include collaboration with the BoE to keep rates lower or direct intervention on repayments.

Low-Income Groups are Likely Hardest Hit

Low-income groups are expected to be incredibly hard hit by this recession, experiencing the highest levels of inflation coupled with the lowest levels of wage rises. This group will continue spending, as they will have no opportunity to save. Any windfall provided to these groups is likely to be funneled immediately back into the economy and spent in order to cover living costs.

Businesses Selling Discretionary Goods and Services are Most Vulnerable

Higher cost discretionary goods and services are likely to be particularly vulnerable. Businesses will need to focus on value for money and strong engagement and promotional strategies in order to capture spend. Low-cost essential goods providers (e.g. discount supermarkets) are likely to see strong growth.

The views and opinions in these articles are solely of the authors and do not necessarily reflect those of Teneo. They are offered to stimulate thought and discussion and not as legal, financial, accounting, tax or other professional advice or counsel.